Daily Technical Strategy Video (6/20/25)

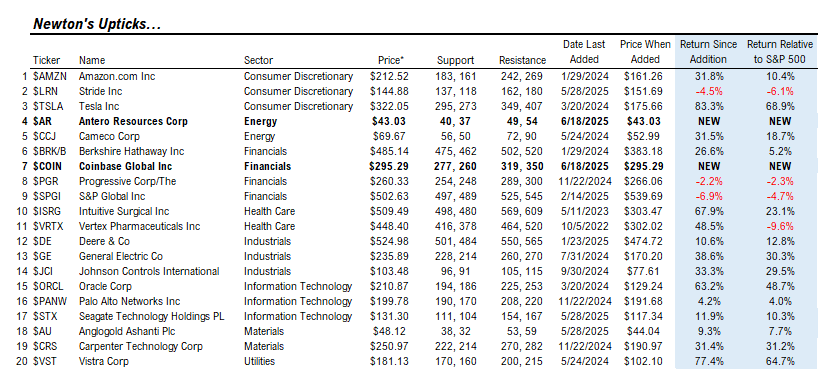

Upticks – Newton’s Law

Upticks Additions

- Antero Resources (AR 1.37% – $43.03)

- Coinbase Global (COIN 6.56% – $295.29)

Upticks Deletions

- Kratos Defense & Security Solutions, Inc. (KTOS 7.19% – $42.16)

- Axon Enterprise, Inc. (AXON 0.50% – $770.38)

- Alibaba (BABA 5.21% – $113.49)

- Super Micro Computer (SMCI 3.70% – $44.47)

- Palantir (PLTR 5.27% - $139.96)

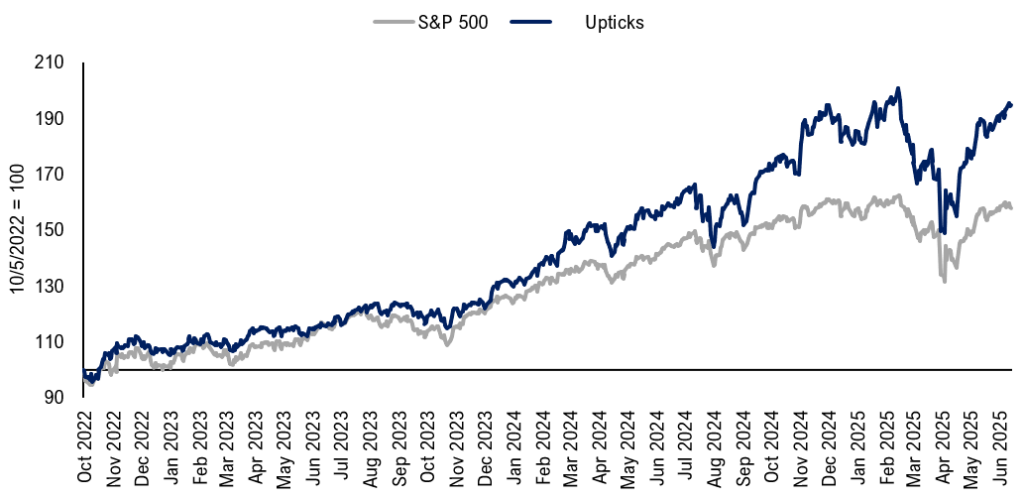

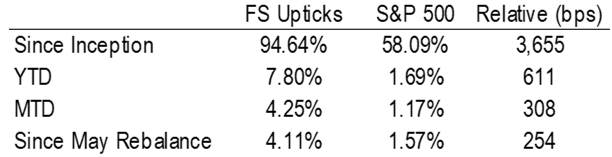

UPTICKS Total Return vs. SPY, Year to Date

UPTICKS Return vs. S&P 500, Since Inception

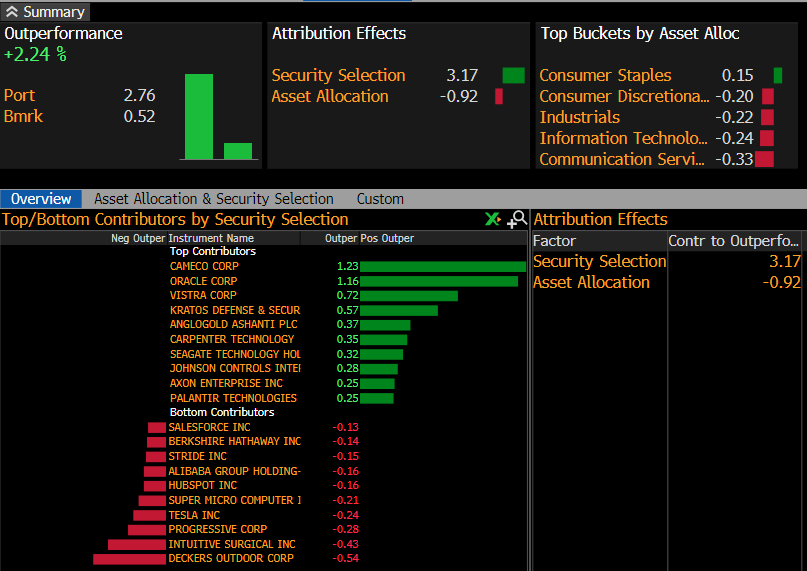

Upticks One Month Contribution to Performance Relative to SPY (May 16 to June 18)

Upticks Additions Commentary

Antero Resources (AR 1.37% - $43.03) – Breakout bodes well for follow-through back to new all-time highs

Support- $41, $39, Resistance- $48.80, $60

- AR 1.37% has proven to be one of the stronger Exploration and Production stocks within Energy in 2025, returning over 22% through 6/18/25, the 5th strongest out of 54 names that make up XOP 0.84% , the SPDR S&P Oil and Exploration Index.

- Oil has shown signs of trying to bottom out after a dismal first half of 2025. While Energy requires a bit more technical improvement to Overweight, it looks right to start favoring select names within the sector to diversify portfolios for 2H 2025.

- Ongoing geopolitical tension doesn’t seem close to waning just yet, making it possible that WTI Crude will climb higher and Energy stocks might outperform.

- AR 1.37% just exceeded a reverse Head and Shoulders pattern since January, which bodes well for upside continuation to test three-year highs at $48.80 initially.

- Further upside progress looks likely, and dips aren’t likely to prove too severe nor long-lasting before additional upside progress, technically speaking.

Coinbase Global (COIN 6.56% - $295.29)-Breakout bodes well for a continued rally to test and exceed December 2024 peaks

Support- $268, $260, Resistance- $350, $430

- COIN 6.56% breakout bodes well for continued gains to challenge and eventually exceed last December’s peaks near $350.

- Its low-to-high range from last week on heavy volume is technically appealing to consider owning COIN 6.56% at current levels and using dips to buy.

- While current entry points are admittedly not ideal for short-term traders, my technical analysis suggests dips should prove brief ahead of continued upside progress to new highs for 2025.

- Given the rally in cryptocurrencies has begun to gain traction in recent months, this bodes well for COIN 6.56% to show further upside progress in the months to come.

Upticks Deletions Commentary

Kratos Defense & Security Solutions, Inc.- (KTOS 7.19% -$42.16) Breakout has gotten too extended, making KTOS vulnerable in the months ahead

Support- $35, $32.85- Resistance – $46

- Breakout has helped KTOS 7.19% extend gains at a time of geopolitical conflict, but momentum has gotten too stretched for my liking in recent weeks as the stock has neared resistance.

- Combination of daily and weekly DeMark-based exhaustion signals are now present on KTOS 7.19% , making this stock vulnerable to possible correction in the months ahead.

- While technical trends remain quite bullish, I’m anticipating a possible short-term peak in July/August and pullback to the mid-$30’s where KTOS 7.19% would become more attractive again.

Axon Enterprise, Inc. (AXON 0.50% - $770.38) Breakout has now neared levels of possible resistance

Support- $715, 670 Resistance- $800, 921

- Similar to KTOS 7.19% , AXON 0.50% has rallied sharply into a time of heightened geopolitical conflict, and now has begun to stall out.

- Counter-trend exhaustion DeMark-based signals are present on both daily and weekly basis, while monthly TD Combo signals might appear within two months’ time.

- Negative momentum divergence is present on both a weekly and monthly basis, while daily momentum has begun to wane given its stalling out in recent weeks.

- The risk/reward has worsened in the short run, and I favor removing AXON 0.50% technically at current levels despite its ongoing technical uptrend being intact. Following some consolidation in the months ahead, this stock would be attractive on a pullback under $700 into the Fall.

Alibaba (BABA 5.21% - $113.49) Recent technical deterioration suggests possible further weakness in the month ahead

- BABA 5.21% ’s recent technical deterioration has made an immediate rally somewhat unlikely in the next month. Specifically, the pullback in May at a time of rising global Equity prices is seen as a negative.

- Moreover, BABA 5.21% ’s deep retracement to levels just above late May lows looks problematic in the short-run, technically speaking. This bearish triangle pattern appears likely to suffer a downside break, which could result in BABA 5.21% pulling back to $101, or potentially lower to $95.

- While FXI 1.68% , the Large-cap China ETF has gained appeal as the US Dollar has weakened, BABA 5.21% has not proven to be a leader in the Chinese Equity space.

- Upon evidence of this pulling back to $101, or strengthening back over $125, it might be time to revisit BABA 5.21% . At present, I anticipate additional underperformance, and am removing this from UPTICKS.

Super Micro Computer (SMCI 3.70% - $44.47) SMCI 3.70% ’s inability to extend gains is a technical concern

Support- $40, 28, Resistance- $48, 55

- SMCI 3.70% has proven disappointing in recent months, following a failed breakout on above-average volume in May. The stock has retreated and has been unable to climb back above the mid-$40’s despite a stellar move in Technology.

- While SMCI 3.70% ’s rally might take patience in the months to come, it appears to be not an ideal candidate given that it lies so far below 52-week highs.

- On any dip in Technology in the months ahead, SMCI 3.70% is likely to underperform given its weak intermediate-term structure.

- On evidence of strengthening in the months ahead, I might revisit SMCI 3.70% , but at present, this looks right to remove from UPTICKS given its disappointing performance of late.

Palantir (PLTR 5.27% - $139.96) PLTR 5.27% looks to be nearing the final part of its rally off the April lows

Support- $119, $107 Resistance- $145, $150

- PLTR 5.27% ’s near-term risk/reward looks unattractive given the extent of its rally in recent months.

- While technical trends remain in good shape, the stock’s momentum has begun to wane in recent months, and shows negative momentum divergence on a weekly and also monthly basis.

- While many analysts point to PLTR 5.27% being overpriced, it’s right to point out that its monthly Relative Strength index (RSI) has exceeded 93, signaling very stretched momentum on a monthly basis.

- Pullbacks in the months to come would be looked upon favorably as a chance to buy weakness into this coming Fall.

- DeMark indicators have lined up to show TD Combo monthly 13 Countdown” exhaustion, coupled with a completed 9-13-9 weekly pattern which just signaled a TD Sell Setup two weeks ago. Notably, PLTR 5.27% also shows a quarterly TD Sell Setup at current levels using these same tools.

- Overall, while I would eagerly buy PLTR 5.27% on weakness, I feel the combination of stretched and diverging momentum at a time that Technology has begun to stall out makes this a poor technical risk/reward.