Short-term trends in US Equities remain bullish and, following last week’s breakout, now lie within striking distance of all-time highs. While a rally over February peaks should happen this Summer, my thoughts are the next week could prove choppy and allow for some consolidation ahead of a move back to all-time highs. This would gel with weak seasonality trends for June, while breadth and momentum have slowed in recent weeks. Meanwhile, the US Dollar has begun to move sharply lower, while Treasury yields have stabilized in the short run. Additionally, precious metals, Emerging markets, and commodities are all areas of near-term focus and can likely work well in the weeks/months ahead, given a falling US Dollar. Overall, a push up to between 6050-6150 is likely for SPX, while QQQ should rally to 540 before some minor stalling out.

It’s fair to say that when good news fails to carry markets higher following a time when this normally has been the case, then it’s worth paying a bit more attention.

Wednesday’s About-face failed to result in any real technical damage to the ongoing trend. However, it does fall into the time-based window of when this could occur between now and early next week.

Despite only two sectors having pushed higher to show positive performance Wednesday (out of a possible 11), breadth still finished positive on the session, and no trend damage occurred to the uptrend from April lows. The daily upsloping 9-day moving average for SPX lies at 5978, and until this is broken, and/or the minor uptrend from late May is violated, it will pay to adhere to the uptrend, expecting an even further push higher.

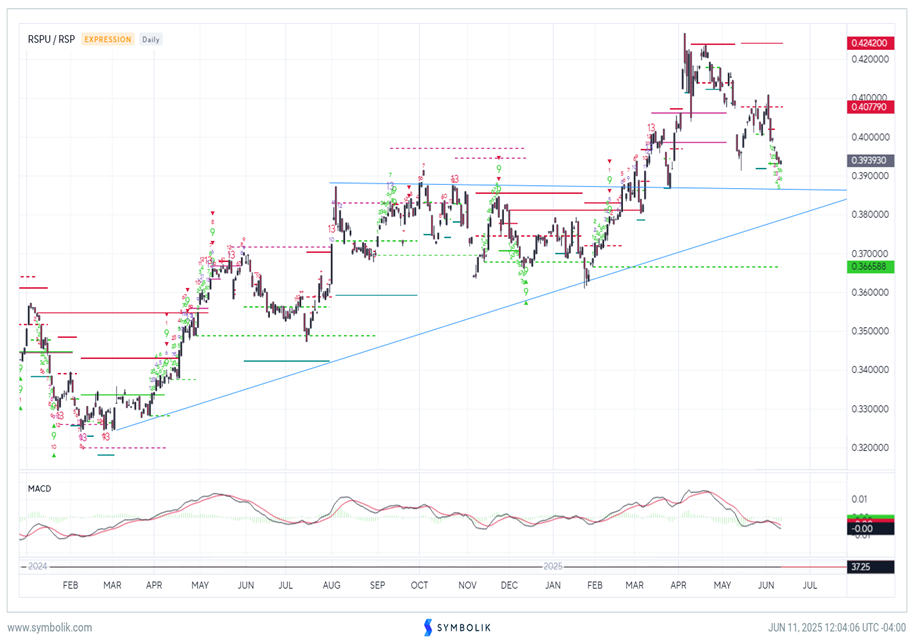

The chart below looks interesting which highlights the Equal-weighted SPX on a daily chart since mid-2024. As illustrated below, RSP has not yet moved above mid-May peaks, and has shown some negative divergence to the SPX.

This isn’t bearish per se, but would be more positive if the Equal-weighted S&P 500, along with DJIA and DJ Transports, were to join SPX and QQQ in pushing up to test (and eventually) break back out to new all-time high territory.

I sense this will take time, but I do feel that Technology might briefly stall out after this recent period of outperformance, and that RSP should push higher in the weeks ahead at a bit faster pace. This is based on wave structure and the patterns of sectors like Financials and Utilities, which both look to be at support after recent consolidation.

Overall, I don’t anticipate that Technology will peak out just yet, but might just consolidate in a way that allows for some near-term relative strength out of RSP.

Invesco S&P 500 Equal Weight ETF

Overall, my technical opinion is that any weakness next week should be completed into June expiration before some strong cyclical push higher into August gets underway. Thus, any selloff is running on a limited time and might not prove to be too damaging.

My two zones for possible downside volatility in the months ahead lie between 6/13-6/23 and then 8/9 into late September/Early October. However, it’s anticipated that any consolidation that occurs between late this week and June expiration will likely prove short-lived and not too damaging ahead of a sharp rally up through July into August.

Magnificent 7 is close to generating the same signals that marked prior turns in April, as well as this past January

While Wednesday’s minor reversal failed to show much evidence of technical damage, it’s also important to note that price pushed up to produce its first DeMark-based TD Sequential “13 Countdown” exhaustion signal since the early April low for Equities.

While this hasn’t been confirmed yet, and TD Combo signals might also crop up on a minor push up into early next week, it’s worth paying close attention at this stage of the rally.

Prior signals of this sort did coincide with peaks in price back in mid-January, while a similar but opposite TD Sequential 13 Countdown buy signal” happened at the April 7, 2025 lows.

My thinking is that Technology is growing closer to a minor peak. However, until the uptrend gives way, and/or this recent DeMark signal can be confirmed, one can’t rule out further gains. Resistance lies near $55.25 while a break of $52.42 on daily charts would seem important and negative in my view.

Roundhill Magnificent Seven ETF – MAGS

Financials have largely been neutral since last November, showing no meaningful deterioration, nor outperformance

While Technology has managed to push higher in a strong enough fashion to record the best performance of any of the 11 Equal-weighted sectors that make up S&P 500 in the last three months, any similar movement in Financials has been conspicuously absent.

Technology has returned +13.29% on a rolling three-month basis, while Financials have been higher by merely +3.99%.

This neutral consolidation in the Financials sector is seen as a positive in my view, as Financials never showed the kind of severe drawdown seen in other sectors from February into April. While Financials showed a minor pullback in late March into early April, it was immediately recouped and no real damage occurred to the relative chart.

Thus, this sector looks well-positioned to begin showing strength at a time when it might play catch-up to Technology.

I remain Overweight Financials from a technical perspective and expect outperformance in the months ahead.

RSPF/RSP

Utilities drawdown likely could reverse as rates start to peak

Utilities lost some of their strength in the last month, turning in the worst performance of any of the 11 sectors that make up S&P 500. However, Utilities remain the second-best performing sector on a Year-to-Date basis, higher by +7.49% in Equal-weighted terms.

This relative chart below highlighting Utilities vs. S&P 500 (Both in Equal-weighted terms), or (RYU -0.01% vs. RSP 0.24% ) shows why abandoning this sector now is likely the wrong call.

Uptrends remain very much intact, showing that this minor period of underperformance by Utilities has done little to no damage to the broader trend. Furthermore, the relative ratio now looks to be within 1 week of bottoming out.

Overall, Utilities is an appealing sector in my view. This sector remains my technical favorite of the defensive sectors and outperformance is likely in the months to come if/when interest rates start to fall.

RSPU/RSP