________________________________________________

- Updating our list of 5 Super and 5 Sleeper Grannies

- SMID Grannies May Quarterly rebalance today

- Updating 5 Super and 5 Sleeper SMID Grannies

- Chartbook linked below

- See below for SMID Grannies adds and deletes

To download the slide deck for our Market Update Webinar, please click HERE.

VIDEO: Stocks are 3% from all-time highs, yet this is one of the “most hated” rallies as investors are looking for reasons for stocks to fall, rather than upside. This is a good sign. And we see firepower to drive an all-time high in equities

Please click below to view our Macro Minute (duration: 5:33).

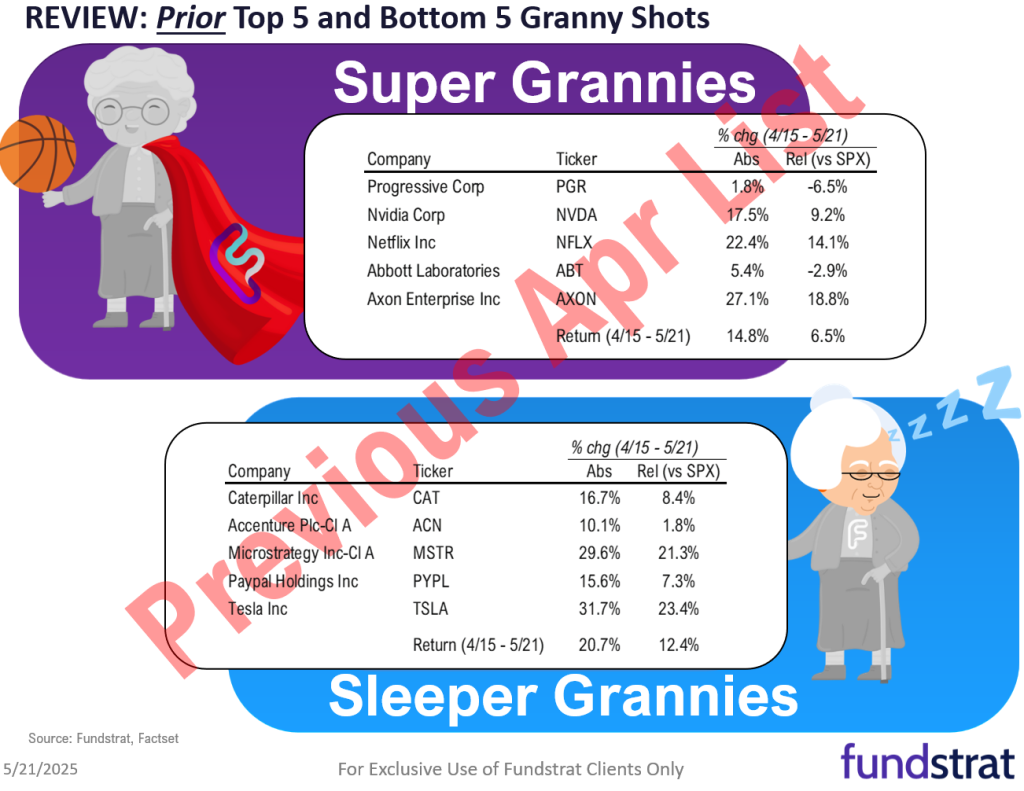

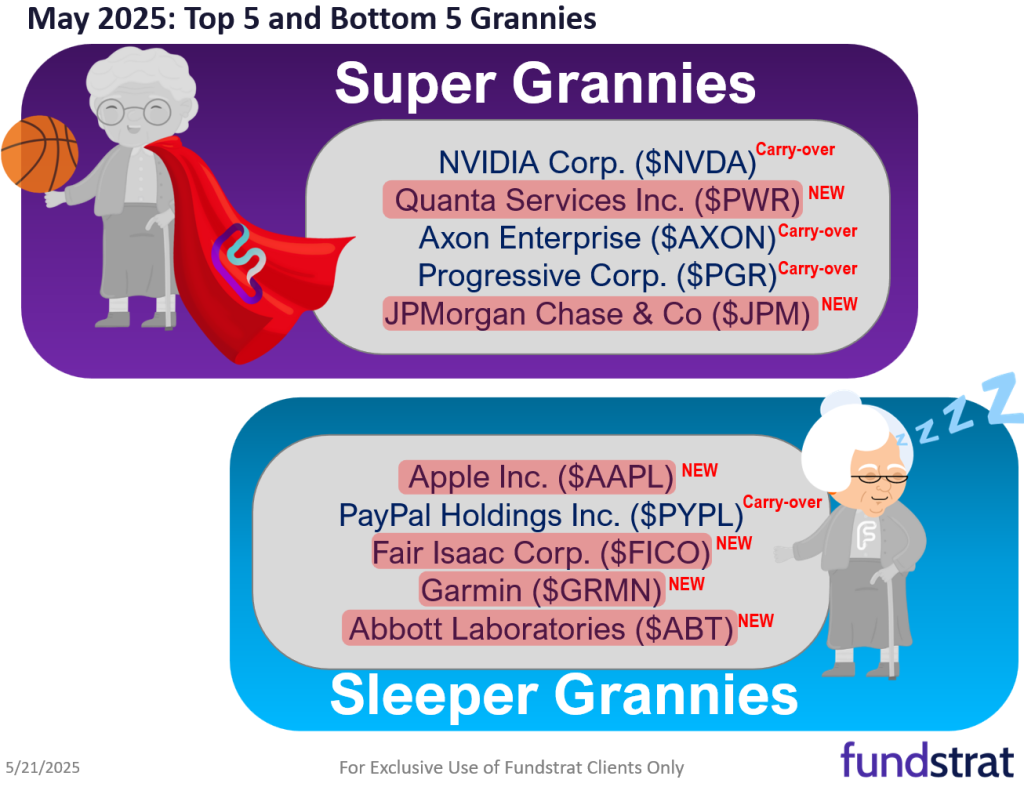

SUPER GRANNIES: 5 Super and 5 Sleeper

Back by popular demand, we are re-introducing our “Super Grannies” (most timely) and “Sleeper Grannies” large-cap stock ideas.

- The rationale is many clients ask us to narrow our recommendations down to a list of “fresh money” ideas.

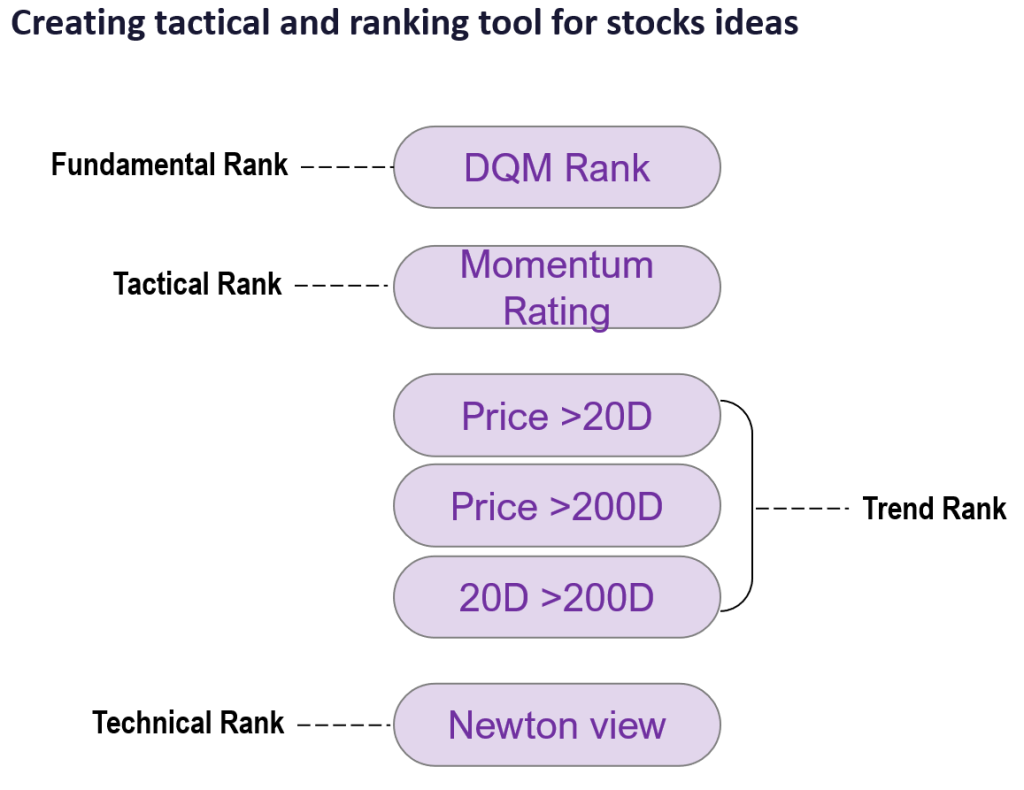

- We established a criteria of 4 factors to narrow the list to tactical buys:

– fundamentals using DQM model managed by “tireless Ken”

– IBD momentum rating

– technical strength measured by Price >20 DMA, 20 DMA vs 200 DMA and combos

– Mark Newton’s judgement on technical outlook

- We have 5 tactical buys aka “Super Grannies”

– NVIDIA Corp. (NVDA -2.82% ) <– carry over

– Quanta Services Inc. (PWR 1.69% )

– Axon Enterprise (AXON 0.82% ) <– carry over

– Progressive Corp. (PGR 0.79% ) <– carry over

– JPMorgan Chase & Co (JPM 1.66% ) - The bottom 5 “Sleeper Grannies” are:

– Apple Inc. (AAPL 0.38% )

– PayPal Holdings Inc. (PYPL 1.22% ) <– carry over

– Fair Isaac Corp. (FICO 3.53% )

– Garmin (GRMN 0.28% )

– Abbott Laboratories (ABT 0.68% )

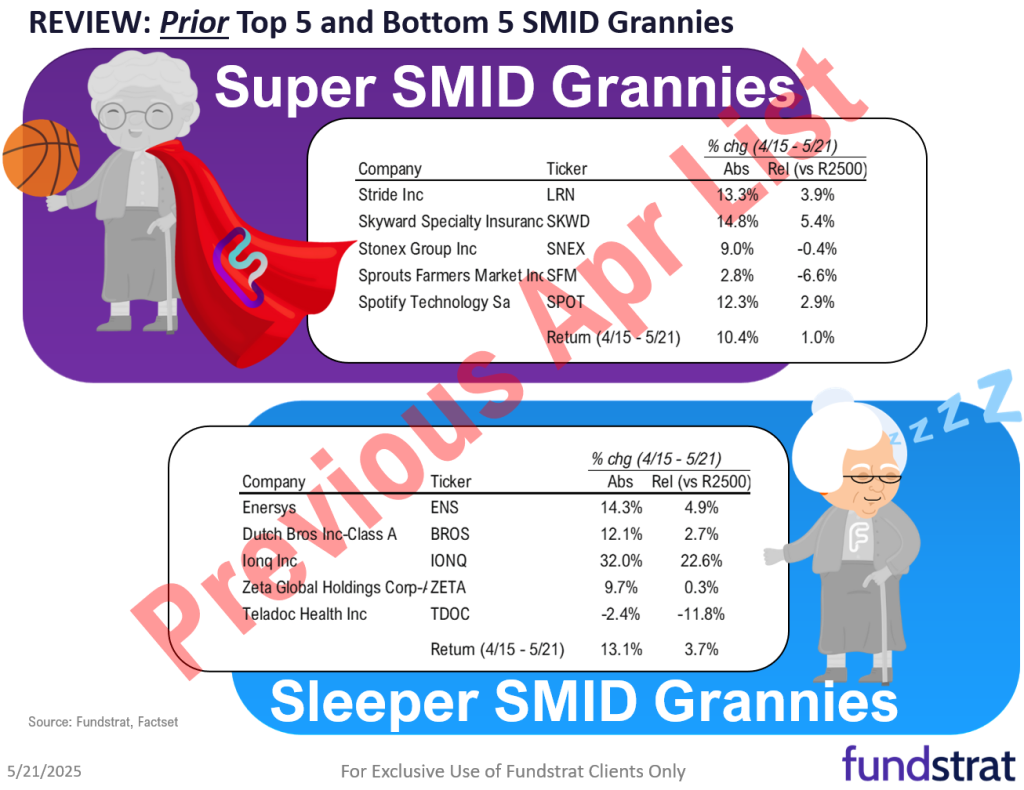

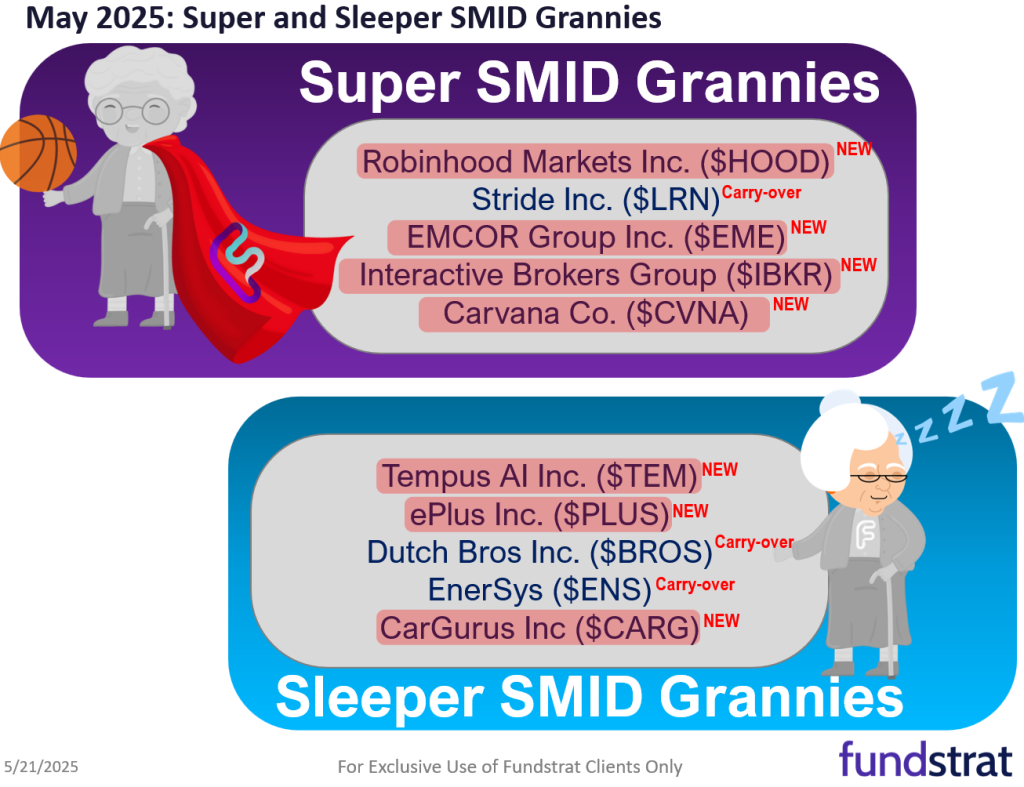

REBALANCE SMID GRANNIES: +11 adds, (-11 deletes). YTD outperformance +412 bps

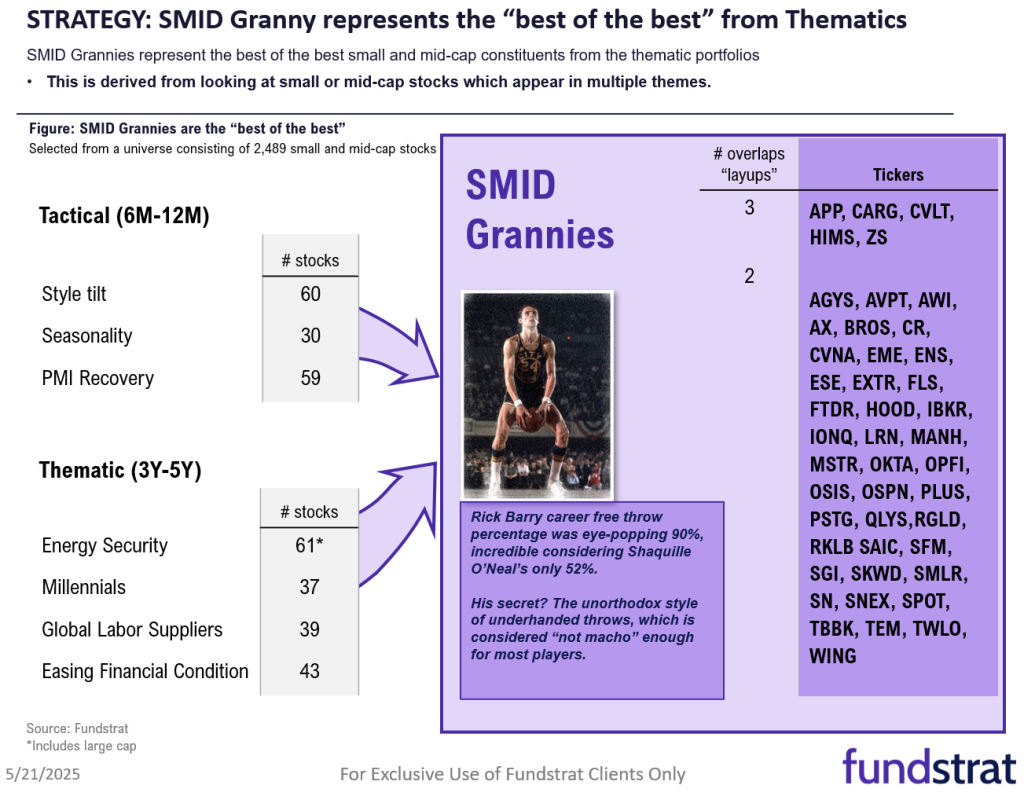

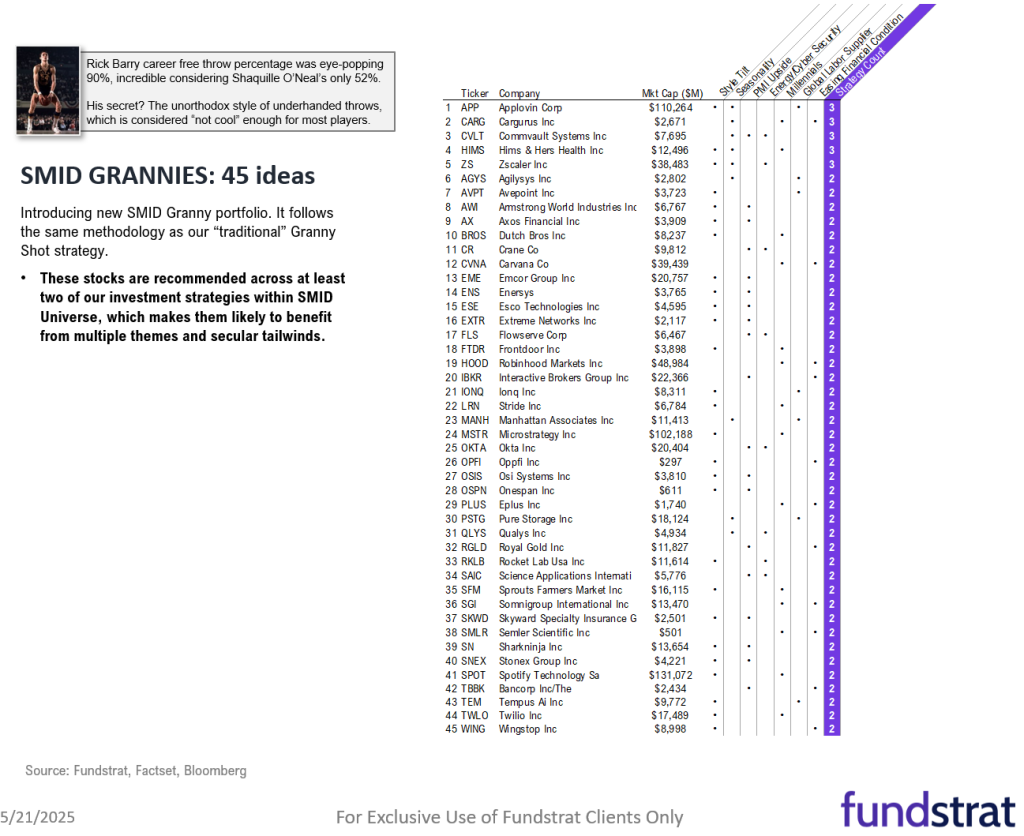

Last December, we maintained Small-caps as one of our #1 recommendations in our 2025 year-ahead outlook. We also created the SMID Granny portfolio strategy last year as many of our clients asked us for our Top SMID stock picks.

- We believe the SMID Grannies could benefit from the multiple themes and secular tailwinds

- SMID Grannies were selected from a universe consisting of 2,489 small and mid-cap stocks.

- From the SMID Granny portfolio, we employed the same framework mentioned above to identify the 5 most timely ideas and 5 least timely ideas within the SMID Granny portfolio.

11 rebalance additions are:

- Financials: AX 3.18% , HOOD 0.72% , OPFI 3.89%

- Healthcare: TEM 0.76%

- Industrials: EME 0.46% , SAIC 0.69%

- Materials: RGLD 0.79%

- Technology: AGYS 4.11% , EXTR 2.28% , MANH 3.03% , QLYS 0.90%

11 rebalance deletions are:

- Discretionary: WSM 3.37% (Added to large-cap universe)

- Financials: ATLC 4.77% , ENVA 3.36% , GCMG 2.30%

- Healthcare: DOCS 2.24% , GMED 4.02% , TDOC 2.76%

- Technology: DOCN -0.35% , HCKT 1.25% , TEAM 1.77% , ZETA 3.15%

SUPER SMID GRANNIES: 5 Super and 5 Sleeper

“Super SMID Grannies” (long) and “Sleeper SMID Grannies” are derived from our SMID stock list of 45 ideas called “SMID Granny Shots”

- We have 5 tactical buys aka “Super SMID Grannies”

– Robinhood Markets Inc. (HOOD 0.72% )

– Stride Inc. (LRN -0.33% ) <– carry over

– EMCOR Group Inc. (EME 0.46% )

– Interactive Brokers Group Inc. (IBKR 1.39% )

– Carvana Co. (CVNA 6.01% ) - The bottom 5 “Sleeper SMID Grannies” are:

– Tempus AI Inc. (TEM 0.76% )

– ePlus Inc. (PLUS -0.25% )

– Dutch Bros Inc. (BROS 7.55% ) <– carry over

– EnerSys (ENS 0.39% ) <– carry over

– CarGurus Inc (CARG 2.36% )

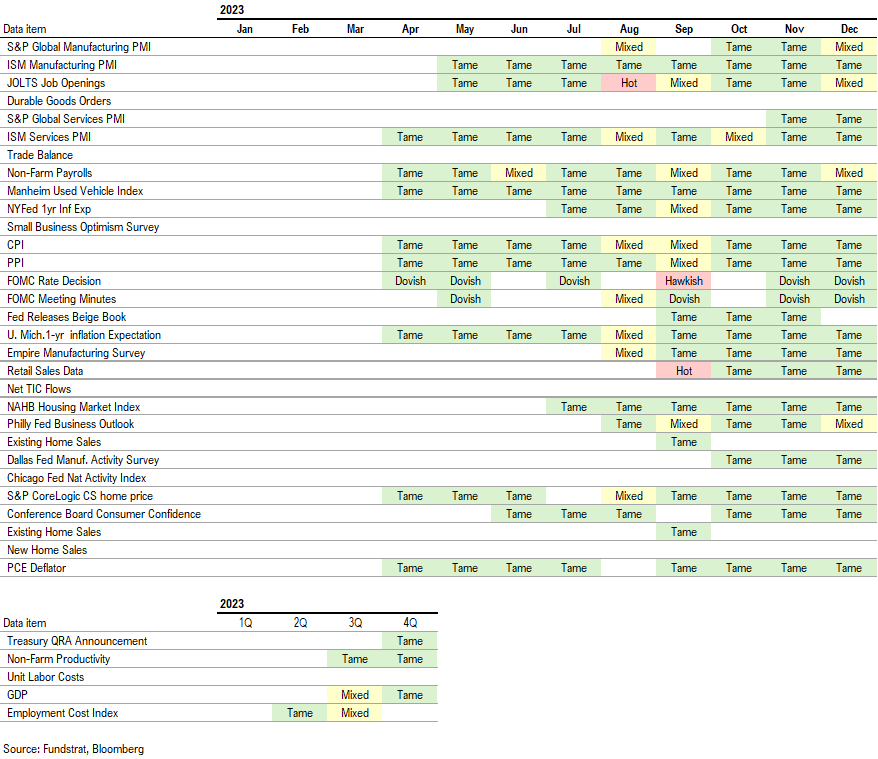

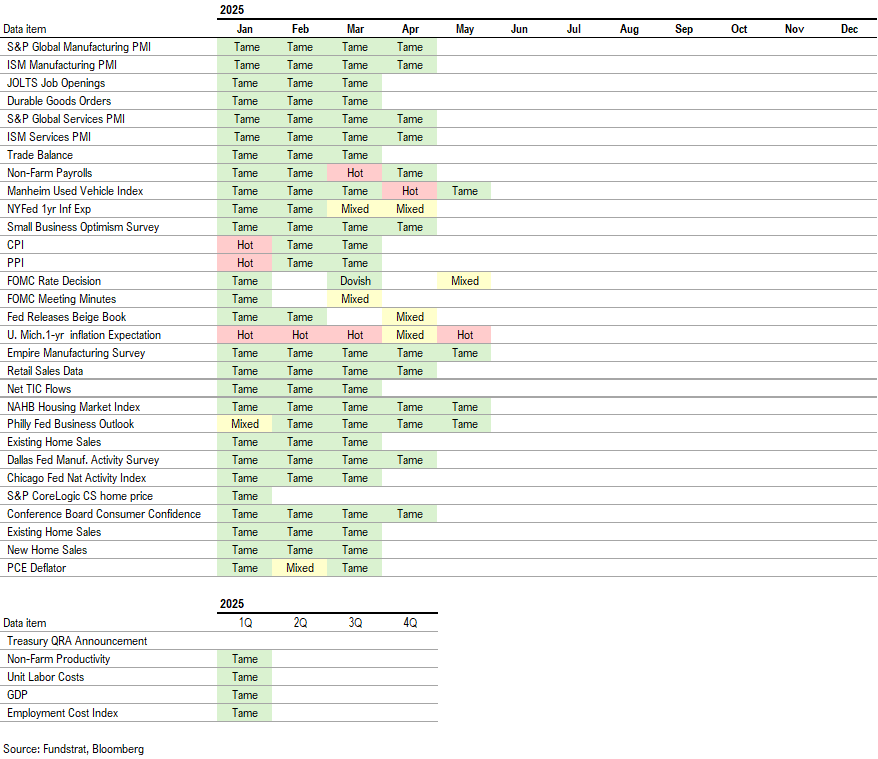

Key Incoming Data May:

5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/2 8:30 AM ET: Apr Non-Farm PayrollsTame5/2 10:00 AM ET: Mar F Durable Goods Orders MoMTame5/5 9:45 AM ET: Apr F S&P Global Services PMITame5/5 10:00 AM ET: Apr ISM Services PMITame5/6 8:30 AM ET: Mar Trade BalanceTame5/7 9:00 AM ET: Apr F Manheim Used Vehicle IndexHot5/7 2:00 PM ET: May FOMC DecisionMixed5/8 8:30 AM ET: 1Q P Unit Labor CostsTame5/8 8:30 AM ET: 1Q P Non-Farm Productivity QoQTame5/8 11:00 AM ET: Apr NY Fed 1yr Inf ExpMixed5/13 6:00 AM ET: Apr Small Business Optimism SurveyTame5/13 8:30 AM ET: Apr Core CPI MoMTame5/15 8:30 AM ET: May Philly Fed Business OutlookTame5/15 8:30 AM ET: Apr Core PPI MoMTame5/15 8:30 AM ET: May Empire Manufacturing SurveyTame5/15 8:30 AM ET: Apr Retail SalesTame5/15 10:00 AM ET: May NAHB Housing Market IndexTame5/16 10:00 AM ET: May P U. Mich. Sentiment and Inflation ExpectationHot5/16 4:00 PM ET: Mar Net TIC FlowsTame5/19 9:00 AM ET: May M Manheim Used Vehicle IndexTame- 5/22 8:30 AM ET: Apr Chicago Fed Nat Activity Index

- 5/22 9:45 AM ET: May P S&P Global Services PMI

- 5/22 9:45 AM ET: May P S&P Global Manufacturing PMI

- 5/22 10:00 AM ET: Apr Existing Home Sales

- 5/22 11:00 AM ET: May Kansas City Fed Manufacturing Survey

- 5/23 10:00 AM ET: Apr New Home Sales

- 5/27 8:30 AM ET: Apr P Durable Goods Orders MoM

- 5/27 9:00 AM ET: Mar S&P CoreLogic CS home price

- 5/27 10:00 AM ET: May Conference Board Consumer Confidence

- 5/27 10:30 AM ET: May Dallas Fed Manuf. Activity Survey

- 5/28 10:00 AM ET: May Richmond Fed Manufacturing Survey

- 5/28 2:00 PM ET: May FOMC Meeting Minutes

- 5/29 8:30 AM ET: 1Q S GDP QoQ

- 5/30 8:30 AM ET: Apr Core PCE Deflator MoM

- 5/30 10:00 AM ET: May F U. Mich. Sentiment and Inflation Expectation

Economic Data Performance Tracker 2025:

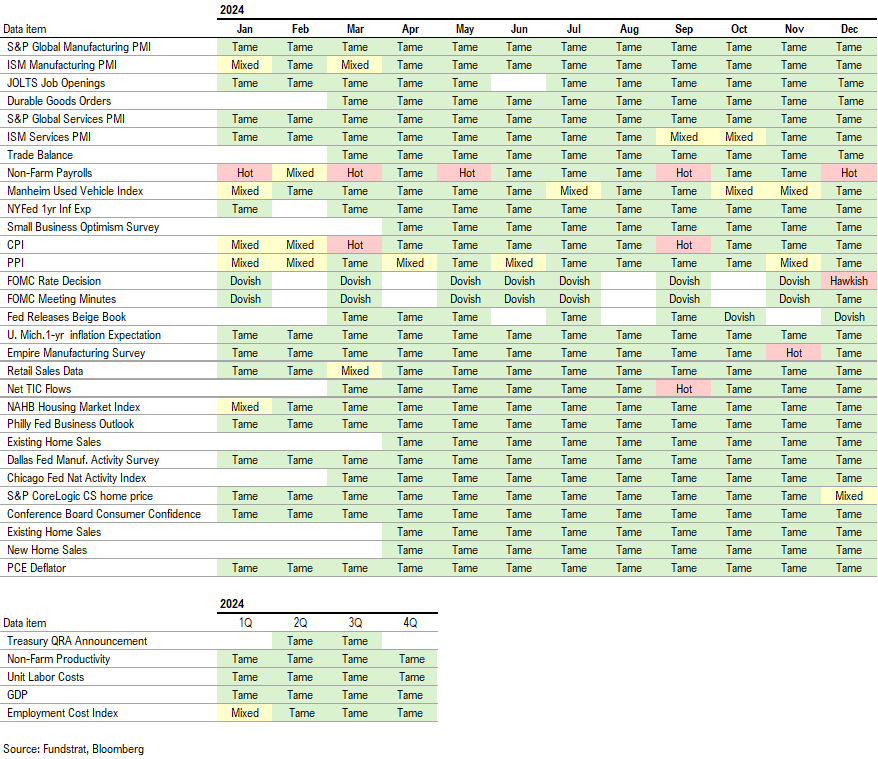

Economic Data Performance Tracker 2024:

Economic Data Performance Tracker 2023: