-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

Keep Calm and Carry on Investing part 1

This year has been far from easy.

After capping two consecutive years of over 20% gains, the S&P 500 has tumbled 3.4% in 2025. The tech-heavy Nasdaq Composite has been hit even harder, down 7%.

Many investors have had to build up their mental resolve to stay invested and not miss out on the opportunity to build generational wealth. But even when they know it’s the right thing to do, it’s hard to not let emotions take control when it’s your kid’s college tuition or your retirement income on the line.

We try to tell investors to take the emotion out of investing. But how do you stay disciplined when every bone in your body is telling you to sell it all so you don’t lock in even greater losses? We have five suggestions.

#1 Don’t waste time trying to time the market.

We’ve all been there. Thinking that we know better and will be somehow able to correctly predict selling at the top and timing our purchases to right before stocks rally. Don’t let this overconfidence bias fool you.

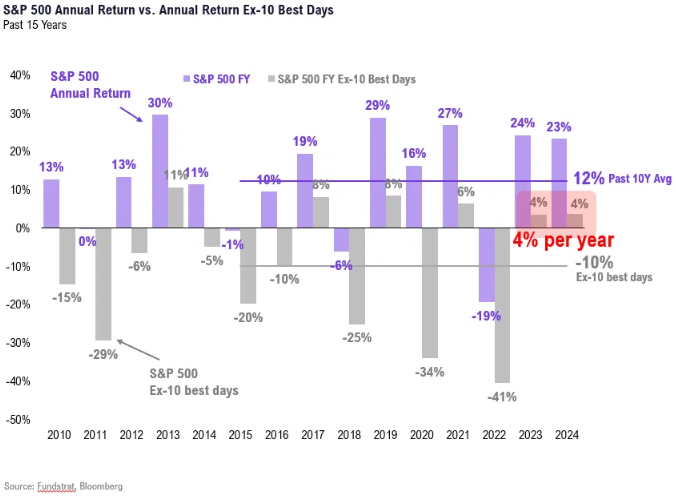

We’d like to remind investors about time in the market versus timing the market as highlighted by Head of Research Tom Lee through the rule of 10 best days. Keep it in mind, it’s literally impossible to know when those 10 days are coming.

The stock market makes most of its gains in 10 trading days in any single year. There are 252 trading days in a year.

The 10 best days adage has held true for the past 90 years and especially true in the past 10 years, according to our data team’s research.

For example, the S&P 500 has posted average annual gains of 8% since 1928. If you remove the 10 best days from it, the annual performance is a decline of 13%. Since 2015, the pain of missing those 10 best days is felt even more acutely. The S&P 500 has returned an average of 12%, but without those, the index has declined 10%.

Let’s put that into context. A $1,000.00 invested in the S&P 500 from 2015 to 2024 could hypothetically grow to $2,856.69. That same number would be $284.16 if excluding the 10 best days. That is a staggering difference of about 90%.

No one has a crystal ball on when the best 10 days might come, so it’s best to continue investing in the markets at regular intervals, rather than tactically trying to time entry and exit points.

Related Guides

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated11 months ago

Series of 3~9 minutesLast updated11 months agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis

-

Series of 4~10 minutesLast updated2 years ago

Series of 4~10 minutesLast updated2 years agoCommodities 100

An introduction to commodities for novice investors.