I’d like to wish a Happy Thanksgiving and/or Holiday period to all. Have a happy, healthy and fantastic time with family, friends and/or relatives. I’ll be away until next Monday. There will be no technical publications nor videos after today until next Monday, 12/2/24.

Equity trends from August remain bullish, but yet there’s been some noticeable divergence that’s cropped up when viewing QQQ vs. the Equal-weighted SPX in recent weeks. Monday brought about some cross-asset volatility in Interest rates, commodities, and also Currencies, which makes keeping a close eye on the Equity trends important this week, given recent divergences. Key Technology stocks like NVDA broke down on Monday under $137, and the divergences in stocks like NVDA, AAPL, MSFT, and GOOGL vs. the regular market look to be important to watch carefully. Thus far, none of the underperformance from large-cap Technology has adversely affected SPX or QQQ, though Overall, I’m expecting a coming trend reversal, but it doesn’t look proper to emphasize this until prices begin to show some technical damage. Weakness in early December lines up with cyclical composites, but until trends are violated, it makes sense just to keep a close eye on the existing uptrend.

SPX should find ample resistance near channel highs near 6100

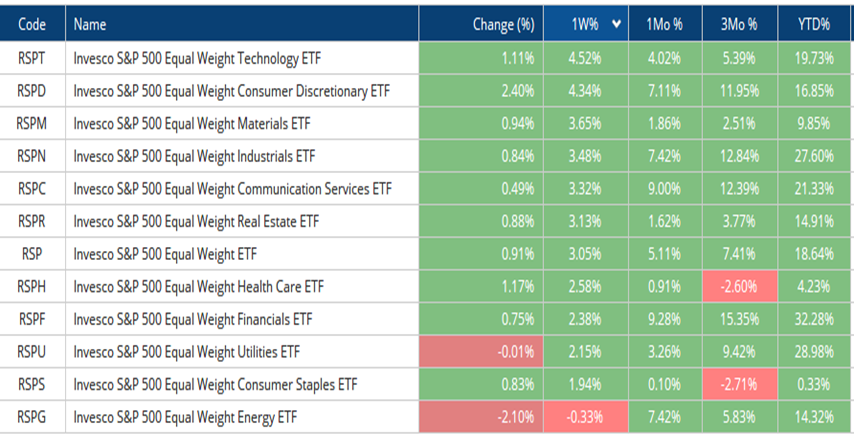

SPX has successfully pushed back to new all-time highs as of today, 11/26/24, and now joins the Equal-weighted SPX back at new highs. This is certainly encouraging as breadth has rebounded this past week, and there is good strength out of Equal-weighted Technology, which has led all other 10 sectors this past week and is higher by more than +4.00%.

However, Large-cap Technology(based on XLK 2.38% ) has underperformed RSPT 1.86% sharply by nearly 300 bps this past week, and laggards like NVDA 2.29% , QCOM 1.08% , MPWR 2.36% , and AMD 5.53% are all down more than 1%.

None of the breadth weakness seen from mid-November has mattered thus far to price, but yet multiple breadth gauges are lower now than in mid-November, while price is now higher. Overall, this won’t matter until it does.

The key area to concentrate on for those who care on risk management lies near 5853 and can’t be broken without expecting a pullback to challenge and undercut November lows. If this doesn’t happen into mid-December, then I suspect it happens to a larger degree in January as this would result in the cycle “doubling down” given that it skipped a bear in December.

For now, it is just important to realize that despite some of the breadth erosion, prices have not broken down, despite some very key constituents having weakened and some change in trend in Interest rates along with USDJPY. Some might not wish to concentrate on this, but it does matter when NVDA is lower by more than 6.5% over the past week.

At present, there won’t be much to make of any technical damage until/unless SPX-5853 is undercut. For now, there should be ample resistance on Wednesday and Friday of this week, right near 6100, before at least a minor consolidation.

S&P 500 Index

Performance shows a comeback in Equal-weighted Tech and Materials over the past week

I think this performance data has actually been quite constructive in helping Tech to stage a minor rebound. While QQQ is not at new highs and SOX remains nearly 13% down from July peaks, it’s important to recognize that Technology has shown good recent performance, despite it lagging over the last month and over the last three months.

The key question, of course, is that given the sideways nature of Technology in relative terms to SPX over the last few months, can Financials and Industrials continue to outperform if their weekly RSI has exceeded 80? What other sectors outside of Consumer Discretionary can help to take the lead?

Invesco S&P 500 Equal Weight ETF

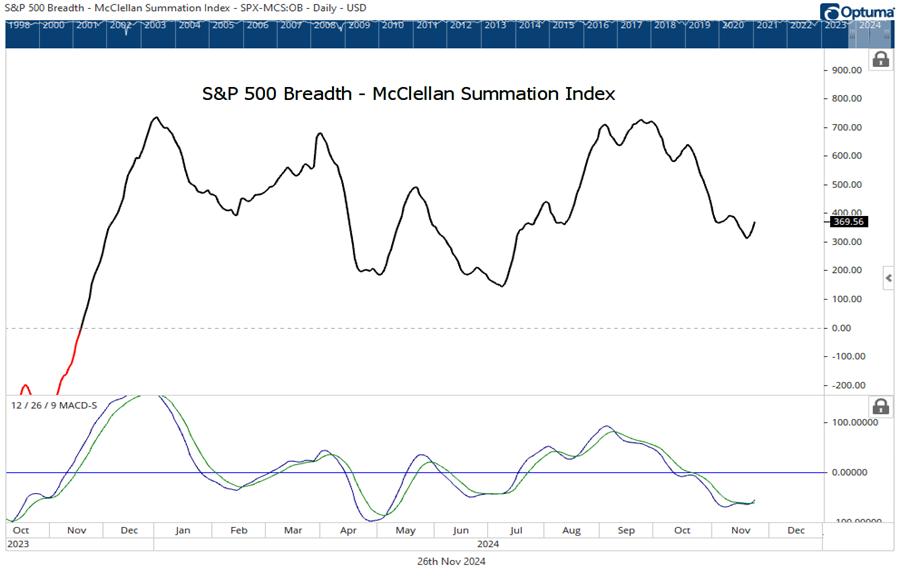

McClellan’s Summation index trying to bottom from low

This smoothed version of breadth normally nosedives when stock indices begin to show downside volatility. As shown below, the Summation index has been trending down over the last month and is approaching similar levels seen in August and April of 2024.

However, this time around, there’s been no material Index deterioration.

Normally, it’s not wise to say that indices are “out of the woods,” so to speak, on a possible correction, until MACD begins to turn back higher above 0 after having crossed the signal line.

Thus far, no such achievement has occurred, and the following breadth gauges still lie below mid-November lows despite prices having just pushed back to all-time highs in SPX today:

-Coppock curve MACD remains down-sloping.

The percentage of SPX names within 20% of 12-month highs has been trending down over the last month.

-SPX stocks which show RSI levels above 70% is lower than mid-November.

-SPX’s new 1-month highs are also below mid-November.

-The percentage of SPX names at new all-time highs spiked this week but also lies under mid-November peaks.

Below Is the Summation index from McClellan, something which I find helpful towards discussing breadth conditions for the major index gauges.

S&P 500 Breadth – McClellan Summation Index

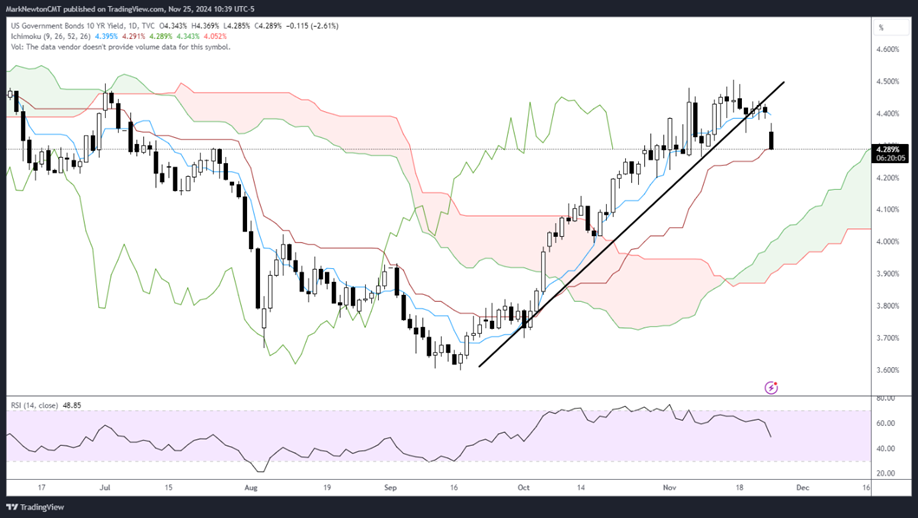

US 10-year Yields and the US Dollar look to be wavering, and Yields have begun to plunge

Technically, this pullback in yields was something many doubted could happen given the media’s narrative that Trump’s tariffs were inflationary.

As I discussed, short-term cycles start to turn lower into December for both TNX and also DXY and I suspect both start to move lower in the weeks ahead.

Overall, while the trend from September in both TNX and DXY might have some early 2025 strength, it’s more likely that TNX retraces at least 38%, if not 50% of its rise from early September.

I expect that a decline to 4.06% can happen in TNX in the weeks to come before stabilizing and then beginning to bounce into January. At present, TLT 0.60% looks appealing technically and I expect that yields across the curve begin to fall in the weeks to come.

US Government Bonds 10 YR Yield