Near-term and intermediate-term technical trends remain bullish for US Equities, and Treasuries have also begun to trend higher on the long end of the curve following a recent breakout on the short end. However, the dropoff in Technology strength could pose a short-term problem for US Equity markets just as indices near a time window where weakness could be possible starting next week through the FOMC meeting. Market breadth has proved a bit skittish in recent days, and momentum has rolled over a bit, which warrants some close scrutiny in the days ahead. Moreover, cryptocurrencies have begun to show some near-term weakness, which should be watched carefully given their recent leading tendency for Equities. Despite the lack of price weakness, I suspect the next 2-3 weeks might prove difficult before a rally materializes to carry SPX back to new highs into early October. Bottom line, I suspect that 6500-6550 might serve as strong near-term resistance for SPX, while 6250-6300 could mark support on pullbacks in the weeks to come. Following a minor drop in September, my expectation is for SPX to rally back to new highs.

Friday’s decline likely could prove to be a “Shot across the Bow” for momentum, but the late day comeback prevented any short-term sell signal from materializing after the early day setback.

While I expect upside to prove limited between now and this month’s FOMC meeting, trends are still in good shape and have not shown any damage despite momentum having trailed off in recent weeks. My ideal scenario would involve a short-term peak in price early next week, followed by a swift but shallow decline over the next two weeks before ^SPX bottoms and begins to turn back higher into October. I don’t expect to see August lows taken out in September, but I do feel there’s an above-average chance of weakness this month, which likely provides a buying opportunity.

As shown below, hourly charts show the strong area of resistance where ^SPX approached in Friday’s trading before making the About-face that resulted in early day weakness. This directly coincided with Treasuries extending gains after Thursday’s breakout, while the US Dollar also began to roll over.

My short-term technical thoughts remain largely unchanged from Thursday’s discussion. However, the late day snapback on Friday could allow for a brief attempt to exceed SPX-6532 before failing and dropping back down to test the mid-August lows.

As written yesterday in the 9/4/25 report, “Any daily close down under SPX 6416 could likely coincide with short-term weakness which might break the lows from mid-to-late August before stabilizing and pushing higher into October. Thus, I think it’s wise to be on the lookout for a technical reversal and weakness down to challenge 6300 or slightly under, which could materialize into next week. However, even in this scenario, I’m highly skeptical that August lows from 8/1/25 of 6212.25 are broken.”

S&P 500 Index

Energy is being downgraded to Underweight again due to the good likelihood of Crude decline

While I had upgraded Energy to a Neutral to allow for a bounce, this past week’s decline in WTI Crude looks likely to extend lower into late September/early October.

It’s been reported that Saudi Arabia is pushing for another supply hike this weekend at OPEC + meeting, and WTI Crude has been pulling back sharply of late.

Technically, I expect Crude oil to pull back to possibly test May lows in the next month which likely should result in sharp underperformance for Energy as a sector. Thus, it’s right to expect some further lagging in Energy as this decline from June likely follows through lower over the next 1-2 months before bottoming and turning higher.

Light Crude Oil Futures

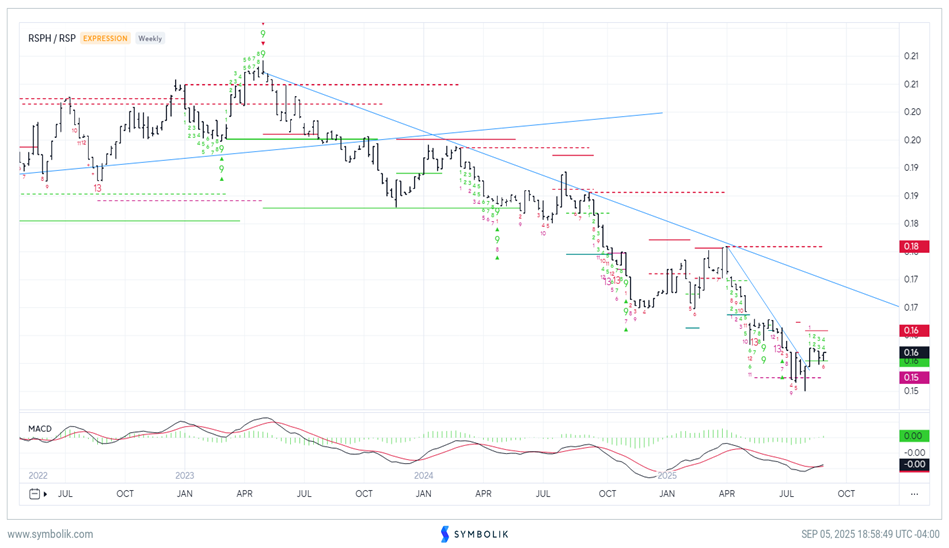

Energy relative to the S&P 500 in relative terms remains quite weak

This relative chart of Energy in Equal-weighted terms (based on Invesco ETF (RYE 1.76% )) remains trending down sharply for Energy.

This downtrend started nearly two years ago and still shows an excellent likelihood of pulling back more before it starts to stabilize.

While the last few months have shown some minor stabilization in Energy, I expect that any decision to hike output again should result in Energy weakening to its lowest levels since 2022.

Overall, the monthly relative chart below (RSPG vs. RSP) supports an Underweight view for Energy as a sector.

RSPG/RSP

Communication Services is being raised to Overweight

Following several months of range-bound trading, relatively speaking, this past month’s outperformance looks too important to ignore.

Stocks like PSKY, GOOGL -0.87% , TKO 0.79% , MTCH -0.80% , and FOXA -0.92% have all risen more than 10% in the past month, and have helped Comm. Svcs. to reach the highest levels vs. S&P 500 since June.

This is very close to hitting the highest levels since 2022 and appears like a legitimate breakout which likely can make further progress between now and year-end.

As seen monthly DeMark counts lie on a 10 count, per TD Combo and 5 count based on TD Sequential, with a 13-count necessary for any type of exhaustion.

Thus, I expect that outperformance in Comm. Svcs. might last until year-end and this strength warrants Overweighting this sector.

RSPC/RSP

Healthcare is being raised to Neutral

While I harbor intermediate-term doubts on Healthcare, it has recently sprung back to life and has outperformed at a time of above-average sector rotation within the S&P 500.

As shown below, Equal-weighted Healthcare ETF (RSPH -0.96% - Invesco) has broken out of a four-month downtrend, as sub-sectors like Biotechnology have come to life.

Although I anticipate that recent Healthcare strength should prove to be a tactical bounce only, it could persist in the next few months, given the possibility of market volatility this Fall as Defensive sectors like Healthcare outperform.

I am expecting this sector to deserve a Neutral ranking technically, as it could rally in the next few months, but remains broadly under pressure.

However, I am skeptical that it underperforms between now and November, making a Neutral ranking seem prudent.

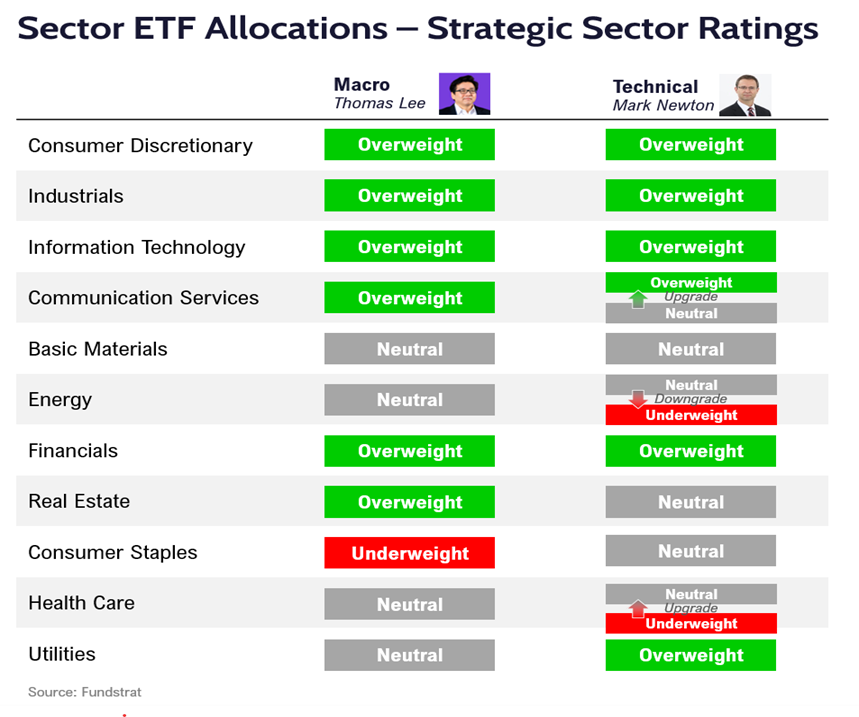

Technical Sector rankings shown below

Overall, I am making three changes for the month of September:

- Healthcare is being raised to Neutral

- Energy is being lowered to Underweight

- Communication Services is being raised to Overweight

The table for how my rankings stack up against Tom Lee’s rankings is shown below.