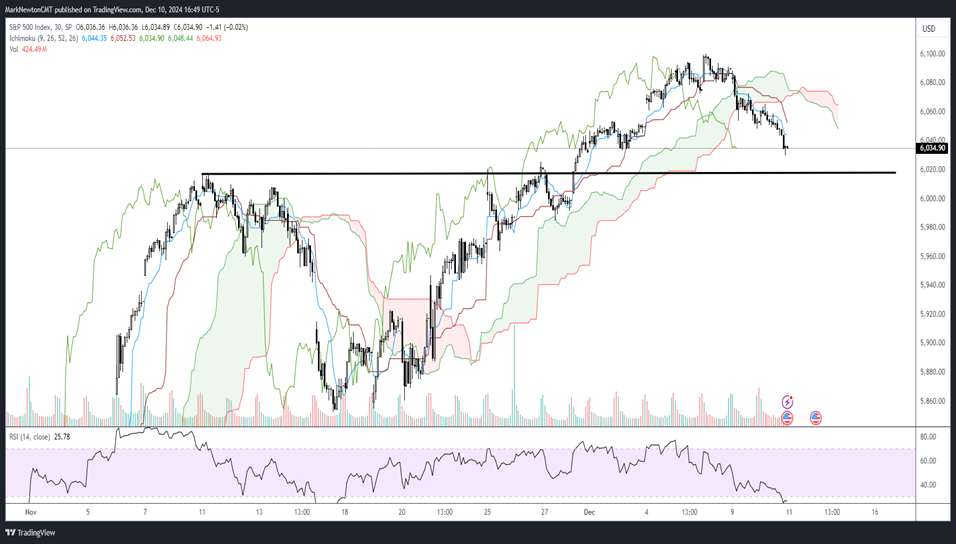

A minor US Equity pullback is underway but arguably should be complete by next week’s FOMC meeting at the latest and potentially as early as tomorrow. As discussed, trends from mid-November and August remain quite constructive, and it remains tough to be too bearish in December. Multiple days of negative market breadth gave ample warning signs into early December that consolidation could be possible and this directly fits into the normal seasonality trend for middle December following gains of 25%+ into this month. However, broader trends remain quite positive, and until/unless SPX and QQQ break the uptrend in early November (near 6006), pullbacks should likely prove buyable. Initial support for SPX lies near 6017.

Tuesday’s breadth was more in-line with what might be expected on a -0.30% “Down day” as nine sectors out of 11 fell in trading while Technology, Materials and REITS all led to the downside.

While there were a plethora of cyclical and breadth-related reasons to think SPX might require consolidation into mid-December, the weakness largely occurred in the Equal-weighted indices up until Monday of this week. The last couple of days of weakness have resulted in more broad-based weakness out of most sectors, but still remains short-term consolidation as part of existing uptrends.

Heading into CPI, S&P now shows hourly oversold readings with price having pulled back to within striking distance of the first target at 6017. I’m reluctant to try to forecast any immediate rebound without proof given last night’s confirmation of TD Combo “13 countdown” signals on daily charts. However, weakness should prove mild in the days to come and might cease tomorrow before the start of a push back higher.

Breaks of 6006, if they occur post-CPI report on Wednesday, would lead to ample technical support down at 5950-75. At present, it’s difficult to make the case for an extended selloff, given the strength in stocks like AAPL -0.44% and GOOGL -1.99% which are largely ignoring this recent Technology weakness.

S&P 500 Index

SOX weakness remains a concern for Technology, but for now, it is Neutral, not bullish nor bearish

As shown below, the Philadelphia Semiconductor index (SOX) has been grinding sideways in a neutral Triangle consolidation since the month of July.

At present, Tuesday’s closing price of 4894.71 represents a 17% decline in SOX since the mid-July peaks.

Tuesday’s move to multi-day lows does look indicative of a bit more downside volatility.

However, I don’t suspect that 4770 should be violated on this current decline. The next 2-3 days should bring about ample support which then allows for rallies to take hold into mid-January 2025.

Given that price is nearing the apex of this triangle pattern, it’s certainly getting closer to a time when a larger move might get underway. These types of patterns normally show constrictive price action into the apex of this pattern before a breakout ensues.

Given the bullish intermediate-term charts of SOX outperformers like NVDA 0.53% , AVGO -1.43% , and TSM -0.94% , which are my favorite technical stock patterns within the Semiconductor sector, I’m inclined to expect a bottom in Semiconductor issues, and a possible bounce getting away by next week at the latest.

However, it’s proper to allow the price to show ample stabilization before attempting to buy dips, and for now, the Software and Hardware sub-sectors are both more favorable within Technology than many Software issues.

SOX chart is shown below with its triangle formation. For investors who favor looking at SMH -0.75% the VanEck Semiconductor ETF, I expect a short-term bottom is found near 234 before moving higher.

PHLX Semiconductor

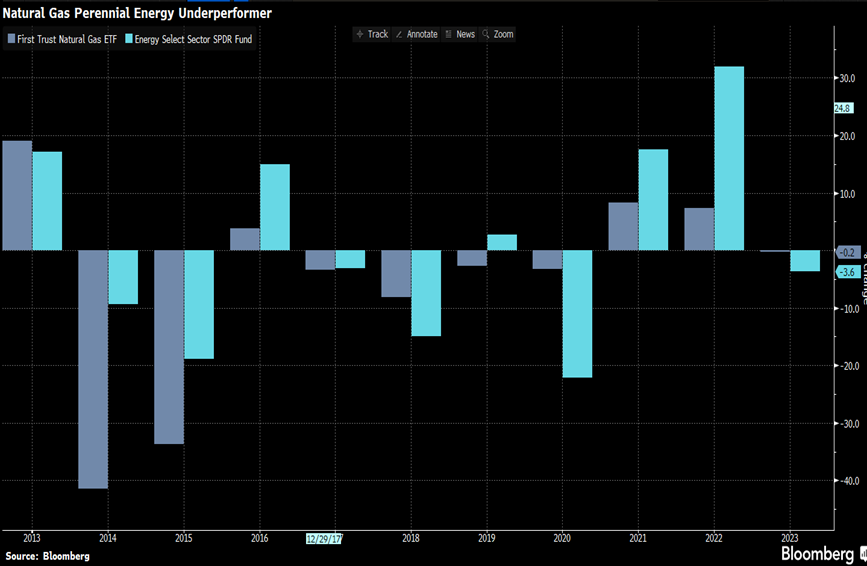

Natural Gas stocks are a preferred way to play Energy

Interestingly enough, the First Trust Natural Gas ETF (FCG 2.39% ) has seen nine straight weeks of Fund inflows, which is the largest stretch since 2021.

Normally, natural gas stocks have struggled to match the performance of traditional Crude oil-based Equities, but this might be getting ready to change.

The chart below highlights the performance of FCG vs. XLE which has been a chronic underperformer over the years.

However, given expectations of an oversupplied oil market while LNG exports might benefit the Natural Gas-based names, I expect 2025 might prove to be a better name for Natural Gas stocks.

Technically, many of these look quite positive as names like EQT 2.97% , CRK 5.60% , GPORT all look much better structurally than many Oil-based names.

Given that my Natural Gas cycles show strength into next Spring while WTI Crude might face weakness to $50 or below, I like following the strength seen in some of the technically more attractive Gas names than oil.

Natural Gas Perennial Energy Underperformer