*There will be no video today (1/5/2023) or tomorrow (1/6/2023). Videos will resume Monday (1/9/2023).

The near-term trends look to be giving way, as per QQQ -1.84% ’s breakdown to new multi-day lows as of Thursday’s close. While SPX has not officially broken 3800, it won’t take much for SPX to also join suit, and could usher in a tough couple weeks of losses before markets bottom out coinciding with the 80-day trading day cycle in late January. As discussed yesterday, it’s tough having too much bullish conviction with big market percentage constituents like AAPL -0.03% and MSFT -1.94% hitting new weekly lows. While Discretionary and Communication Services have held up quite well in recent weeks, a break of SPX 3794 should lead down to 3700 and slightly below into late January. DXY and ^TNX have both shown some evidence of turning back higher, and the combination of these moving up is thought to be a negative given current correlation trends. Any break of December lows 259 in QQQ likely brings about a retest of October lows near 254.

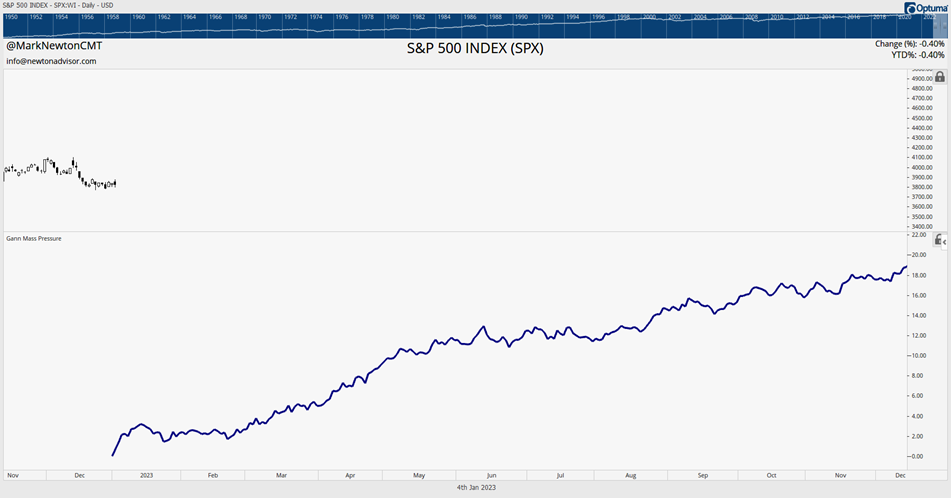

Gann’s Mass Pressure Index shows a much better year

Not everything looks negative when looking at the year as a whole! While it’s early to have any real conviction on whether the traditional decennial year tendencies will materialize similar to last year’s decline, this year is likely to be far more positive, if historical cycles are any guide.

Gann’s Mass Pressure index worked quite well last year in forecasting a decline into June and double dip into October before a rally attempt into end of year. However, as we know, 2022 more closely approximated 1962 with the more severe pullback into October than the Mass Pressure index composite suggested. Also, the subsequent rally from October lows turned out to be far more muted, and not nearly as robust as what occurred following mid-term elections in prior years.

This composite below is thought to be just “one piece of the puzzle” and I’ve loaded several important prior years into a composite which could aid in forecasting this year. As shown below, weakness into late January should turn out to be a buying opportunity, and I suspect that if this composite is any guide, then 2023 could turn out to be far more bullish than many strategists are forecasting. ( I’ll be providing further details in my own 2023 Annual Outlook on 1/24/23.

While the composite below is certainly more optimistic than the other weekly cycle composites I’ve shown in the past, I’m willing to bet that at a minimum, the back half of the year should prove far better than what was seen in 2022. The first half of the year should largely depend on Technology starting to act better, and the US Dollar and Treasury yields starting to turn down more sharply as the FOMC puts its foot on the brakes on hiking rates. I’ll be monitoring this as the year progresses, but it’s worth mentioning that a liftoff in February into March would directly coincide with the bullish seasonality typically seen during 1st Quarter of Pre-election years.

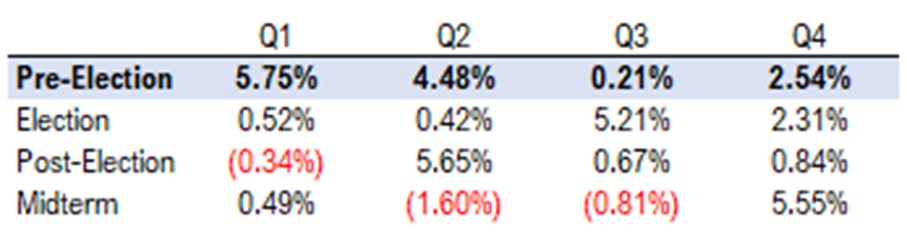

The Pre-Election year stats show the 1st Quarter performance being the best of all 16 quarters in the Presidential cycle

The performance of the first few days of January haven’t given investors much reason to cheer the new year just yet, but if history is any guide, this quarter could prove to be far better than many suspect.

Pre-election year performance on SPX going back since 1927 shows Q1 performance averaging +5.75%, the best of any of the 16 quarters of the four-year Presidential cycle.

This gives some reason for hope for the Bulls, and might make dip buying attractive once the 80-day trading cycle shows evidence of bottoming in late January. At present, as discussed initially, trends don’t look particularly bullish and could be turning back lower to kick off a further decline to the pullback which got underway back in mid-December.

It’s particularly interesting to see these stats below, however, which run contrary to the consensus call being made around Wall Street of a weaker first Half, followed by a rebound, at least with regards to economic performance. These stats seem to suggest the opposite.

Natural Gas decline to yearly lows means buying dips here is also likely premature

The decline in the notoriously volatile Natural gas contracts might not come as much surprise to those in the Northeast which have experienced much warmer temperatures than January typically brings about.

US Henry Hub Natural Gas is now trading at a substantial discount to European Natural Gas.

As the front month Natural Gas (NG -0.51% ) contracts show below, the break of $5.50 represented a violation of a huge Head and Shoulders formation. This has resulted in a big downward acceleration in prices, and as of 1/5 front month NG closed down under $3.80, a decline of more than 10% Thursday alone, and down nearly 50% just from the peak in late November.

Interestingly enough, the wave structure still shows this decline from late November as having unfolded in three waves. Thus, when prices get sufficiently oversold, there could be a minor bounce before additional weakness gets underway.

Bottom line, Natural gas remains extraordinarily volatile, and even on a small bounce, further weakness looks likely into late January/February before any bottom materializes.