The minor stalling out above ^SPX-4100 might require a final push up to test June peaks near 4177, but the majority of this initial move higher off last week’s lows looks to be complete. Interestingly enough, some evidence of the US Dollar and also Treasury yields turning higher should be watched carefully for those looking for positioning in risk assets, as ^SPX largely fell as Yields and Dollar pushed higher. While my 6-week forecast calls for 4200 to be exceeded on its way to 4230 and then 4369, this move likely does not materialize in a straight line following a 12+% gain over the past six weeks. Near-term, upside looks limited, and I’m expecting a stalling out/trend reversal which could take risk assets lower over the next two weeks.

Treasury yields down to near key support. Bounce likely over next few weeks

–After nearly 100 bps in weakness in yields over the last six weeks, support looks near.

-Treasury rally (yield weakness) looks more extreme than warranted given no evidence just yet of job losses and Friday’s NFP report might prove to be the catalyst for a jump in yields.

-Pattern looks similar to a fourth wave consolidation from June peaks. While a larger pullback in yields might materialize from late September into year end, the next few weeks looks positive for yields, and a retest of June peaks looks possible with resistance at 3.50-3.60%.

-Maximum near-term weakness would take yields to 2.35%, but anticipating that yields are already in a short-term bottoming process and should start to work higher next week.

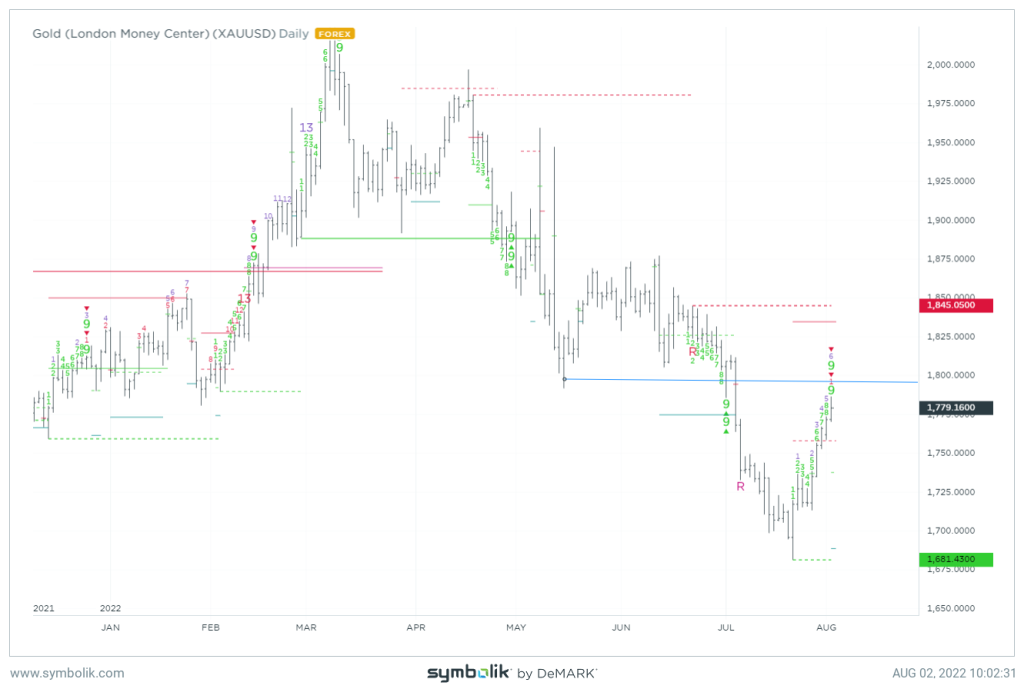

Gold has hit first resistance, and might weaken back to lows on US Dollar and Yield strength

Interestingly enough, the recent rally in Gold directly coincided with yields and the US Dollar pulling back. These look to be counter-trend corrective moves, and both could rally to test highs in the weeks to come.

Precious metals look close to bottoming, but wave structure suggests a retest and break of June lows would create a more meaningful low in prices.

Given the US Dollar stabilization at the 50-day moving average for DXY while yields are also nearing support, Gold is likely to stall after this bounce and turn back lower.

Seasonal strength looks to be near with prices in a bullish seasonal time for precious metals. Yet, for those with a short-term trading perspective, prices have not achieved enough off the lows to think a meaningful low is in place.

Commercial hedging activity per CFTC data shows longs ramping up, while non-commercial Futures positioning (Hedge funds) has plummeted. From a contrarian perspective, this suggests that lows in Gold are near.

China breakdown needs to be watched carefully

Following a failed breakout attempt into late June, Chinese Equities are increasingly showing signs of turning back lower.

China’s Ishares Large-Cap ETF (FXI -0.05% ) broke down under near-term trendline support, and FXI has now been down the last four of the last six weeks.

Given that the US Dollar held support near its 50-day moving average (m.a.) and reversed sharply back higher on Tuesday, it looks close to bottoming out and rallies back to new highs look likely.

Any rally in DXY likely results in weakness in Emerging markets, and China comprises over 25% of EEM 0.11% at present.

The ratcheting up in geopolitical tension is thought to be a negative, from a non-technical standpoint. China’s FXI -0.05% having broken trends over the last few months is thought to be something that likely continues lower in the weeks ahead.

For those looking at buying dips, the area near May lows looks initially important, while violations of that level likely lead down to June to March lows.

China’s prior relative strength vs. US looks to have reversed over the last month and now is taking the lead in weakening. Overall, additional weakness looks likely for FXI between now and early October before a constructive bottoming process gets underway. At present, buying dips here looks premature for investors with a time frame of more than a few weeks.

For my 8/2/2022 CNBC appearance see HERE.