Technical Strategy Video (Recorded Tuesday, October 19th):

Key Takeaways

- Outperformance in Biotech, Services, Medical Devices and Pharma bodes well for Healthcare to “kick into gear” after a difficult month of underperformance

- Automotive (Retail) and Trucking (Transports) are two key groups to favor which are entering bullish periods of positive 6M seasonality

- Copper’s spike to multi-week highs keeps this bullish for a continued rally

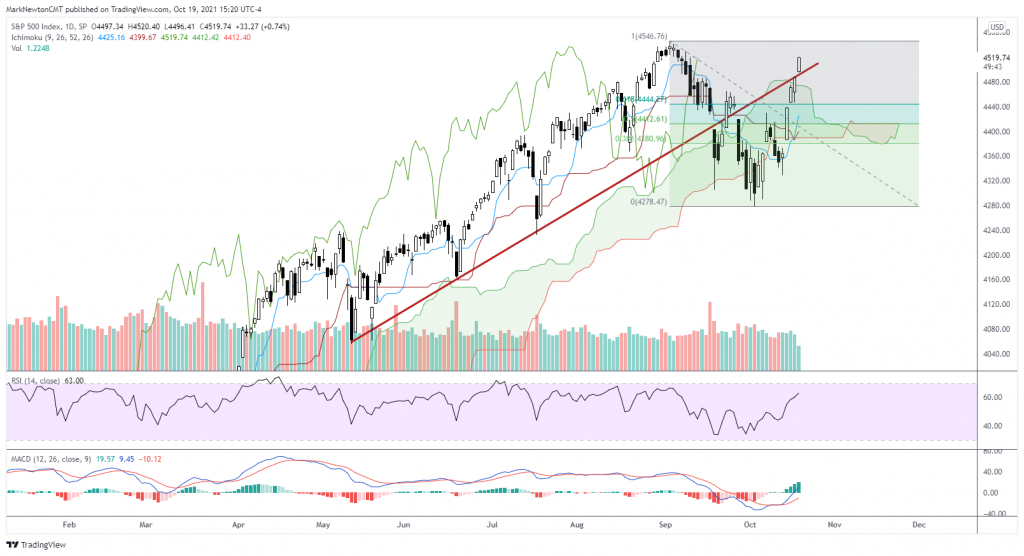

First, when looking at Equities, SPX upside follow-through has now come within 16 ticks of closing at new all-time highs. Momentum is stretched on an hourly basis and showing negative divergence. However, daily momentum is positive and not overbought. Overall, trends are bullish, and while minor pullbacks could happen, prices should not undercut 4430 (10/7 peak) before pushing back to highs

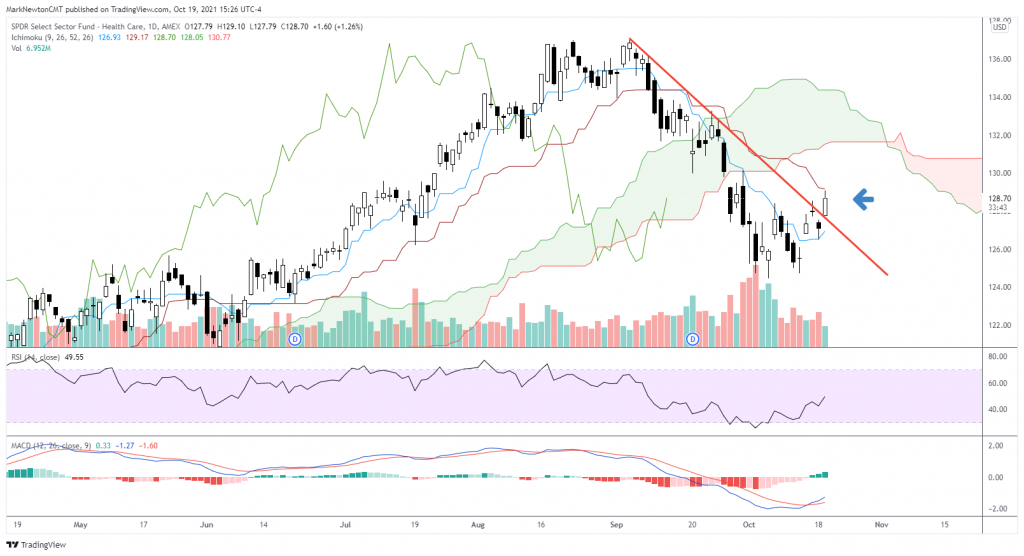

Healthcare showing real evidence of turning back higher

- Tuesday showed S&P Sector SPDR Healthcare ETF (XLV) and the Invesco Equal-weighted Healthcare ETF (RYH) exceeding the downtrend from September along with making a minor breakout to new multi-week highs. This is a bullish technical development

- Even after Tuesday’s gains, Healthcare remains lower by -3.23% on a rolling one-month basis, the worst of any of the S&P GICS Level 1 groups, shown by Sector SPDR ETF’s. Tuesday’s gains now suggest an oversold bounce is developing

- Healthcare remains an important sector, given this is the 2nd largest constituent of SPX by market capitalization. Thus, healthcare turning higher should provide a tailwind for SPX.

- Medical Devices remain the strongest part of this group. However, Healthcare Services, Pharma and Biotech names are participating in strengthening on Tuesday, adding to importance

- Preferred stocks to favor technically that are making important moves, which should allow these to continue higher: ISRG, EW, BSX, JNJ, MRK, STE, ABT

- Pharmaceuticals have been outperforming Biotech in recent weeks, and still important to be selective within Biotech. Many of the hardest hit names on a three-month basis, like AMGN, and BIIB look to be near support and should stabilize and turn higher. INCY, ILMN, VRTX are tougher to own technically.

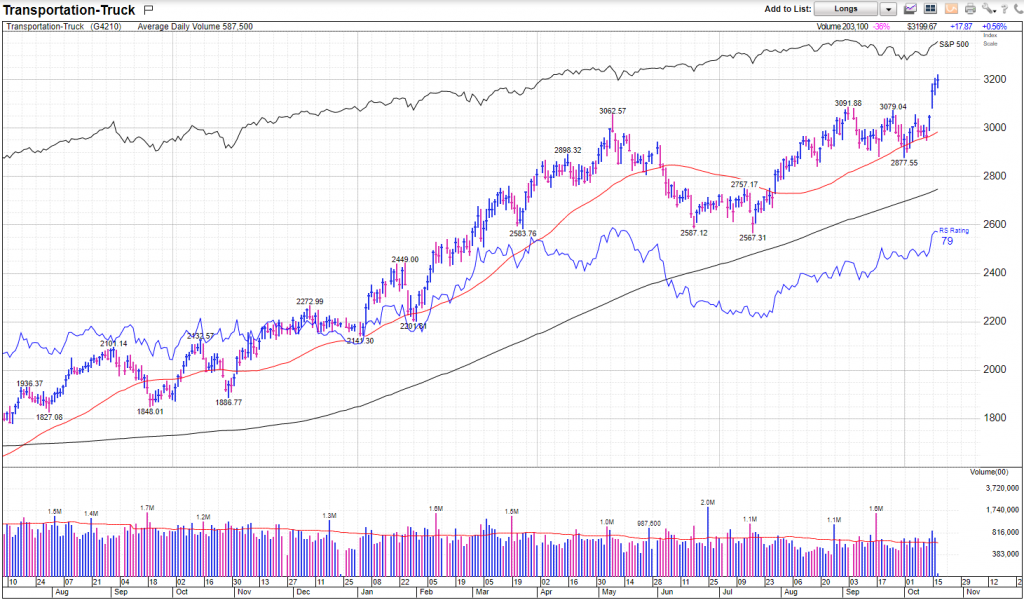

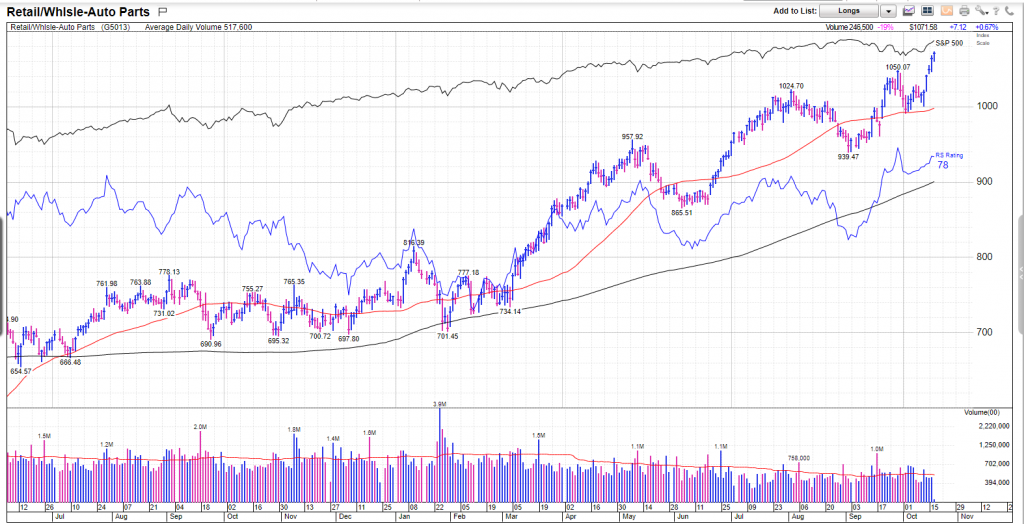

Two sectors which have started to show meaningful technical strength lately that make them attractive are the Trucking sub-sector within Transports and the Auto Parts group within Retailing.

As shown below, composites of Trucking broke out of a multi-month Cup and Handle pattern going back since May of this year. While DJ Transports remains down nearly 600 points from its May peaks, groups like Trucking have fared much better and have moved back to new highs. Stocks like SAIA, ODFL, JBHT, TFII, and LSTR look best within this space.

Autos have also come back with a vengeance, and coinciding with this rally, Auto Parts stocks within the Retailing group are quite bullish here technically. Many of this group have strengthened back to new highs and names like AAP, AZO, ORLY, GPC and CPRT are some of the better stocks to consider in this group.

Looking at commodities, Copper’s rally last week back to near May peaks is very constructive towards thinking this should push back to new 2021 highs. While prices look to be stalling near-term, any weakness in the days/weeks ahead should constitute an excellent buying opportunity technically, and should be used to buy dips. Stocks like FCX successfully broke out of multi—month downtrends from May peaks and are attractive to buy on weakness into late October. We expect that FCX should move back to new all-time highs into December 2021.