S&P 500 Ends Week at All-Time High Despite Mid-Week Turmoil

In this strategy briefing…

The S&P 500 closed at an ATH of 4,232.60 which was up from 4,181.17 last Friday. The big news on Friday was a pretty massive miss on non-farm payrolls. It ... – The Wall Street Debrief –

Read more

In the United States a steady and persistent decline in cases continues. The 7D delta has been negative in the past 23 days. In the past few days, the &D delta has also been accelerating to ... – Tom Lee's Equity Strategy –

Read more

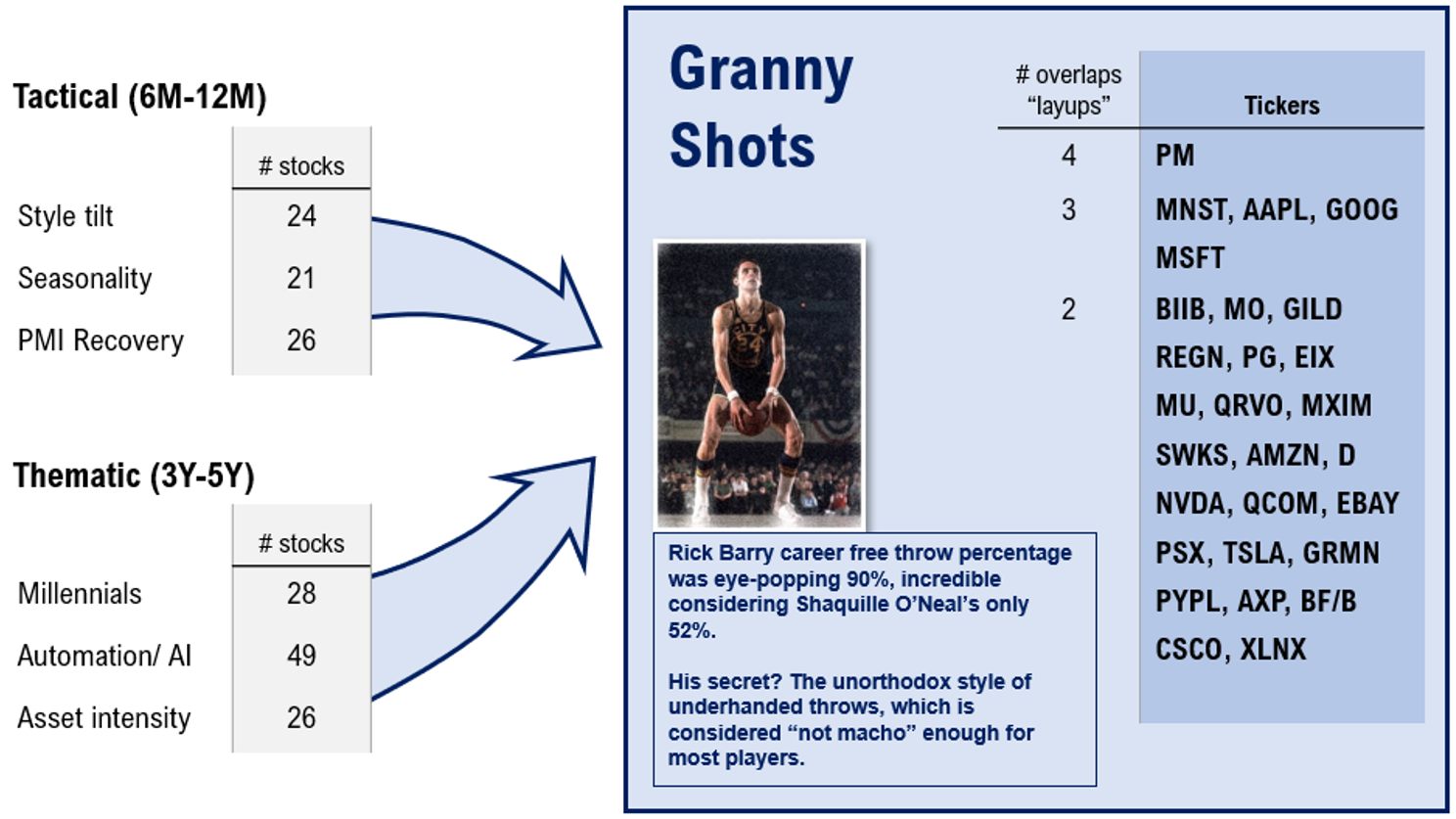

Below we’ve highlighted stocks that we recommend across at least two of our investment strategies for 2021. These companies could benefit from multiple themes and secular tailwinds – clear picks in our view. Figure: Granny Shots are ... – Granny Shots –

Read more

|

FS Insight Investment Views

|

The Wall Street Debrief

S&P 500 Ends Week at All-Time High Despite Mid-Week Turmoil

The S&P 500 closed at an ATH of 4,232.60 which was up from 4,181.17 last Friday. The big news on Friday was a pretty massive miss on non-farm payrolls. It came it significantly below expectations but markets shrugged it off and understandably so given that it takes a lot of pressure off the Fed to begin ‘thinking about thinking about’ Tapering. Jay Powell’s life was probably made significantly easier by this morning’s miss, particularly after Janet Yellen talked out of school on rates recently.

That being said, we think this number is usually prone to noise in normal circumstances and even more so in the anomalous times we live in. Normal markets are like the blues; steady, relatively repeatable, and predictable progressions. If you’re a musician you know that you can jam with anyone as long as you both know the 12 bar blues and your scales. This is not the case with jazz. In environments like this (blues-like or markets dominated by endogenous cycles) Wall Street that has a special advantage in a more normal environment as computing power and math are particularly valuable in these tamer cycles in making sense of data.

The markets we’re living in today in the hopefully soon-to-be post-COVID-19 reality are much more like jazz. Staggered, changing tempos and things just happening when you might not expect it. The smooth consonance and steady back-beat of the blues stands in stark contrast to the sometimes dissonance or some might even say shrillness that can instantly grab your attention in an unexpected

and pleasant way as the more erratic and random character of Jazz tunes are prone to rapid, sometimes uneven changes. We see this as an imperfect but useful metaphor in today’s markets. It should come as know surprise that dislocations in the labor market are occurring. Labor dislocations have happened in the wake of plagues since before the Black Death. Similarly, inflation in commodities has regularly occurred. The prices of lumber, steel, and many food items are surging.

Another unique event where the Entertainment Industry and Wall Street are converging this week is the much-anticipated episode of Saturday Night Live which is featuring Tesla and Space-X CEO Elon Musk as the host along with Miley Cyrus as the musical guest and will air on May 8th. The price of some more speculative crypto assets may partially be surging in anticipation that Mr. Musk may give some shout out to the legions of retail investors who idolize him.

The initial ad featured him and Miley Cyrus capitalizing on their somewhat mutually shared image as rebels and iconoclasts. However, as this video demonstrates of Ms. Cyrus, beyond all the hype and image she is an incredibly talented singer. You can take the girl out of Nashville but you can’t take the Nashville out of the girl. We think despite the hype of this Episode it will likely be two very talented people putting on an entertaining episode. We certainly don’t see it as anything more or less.

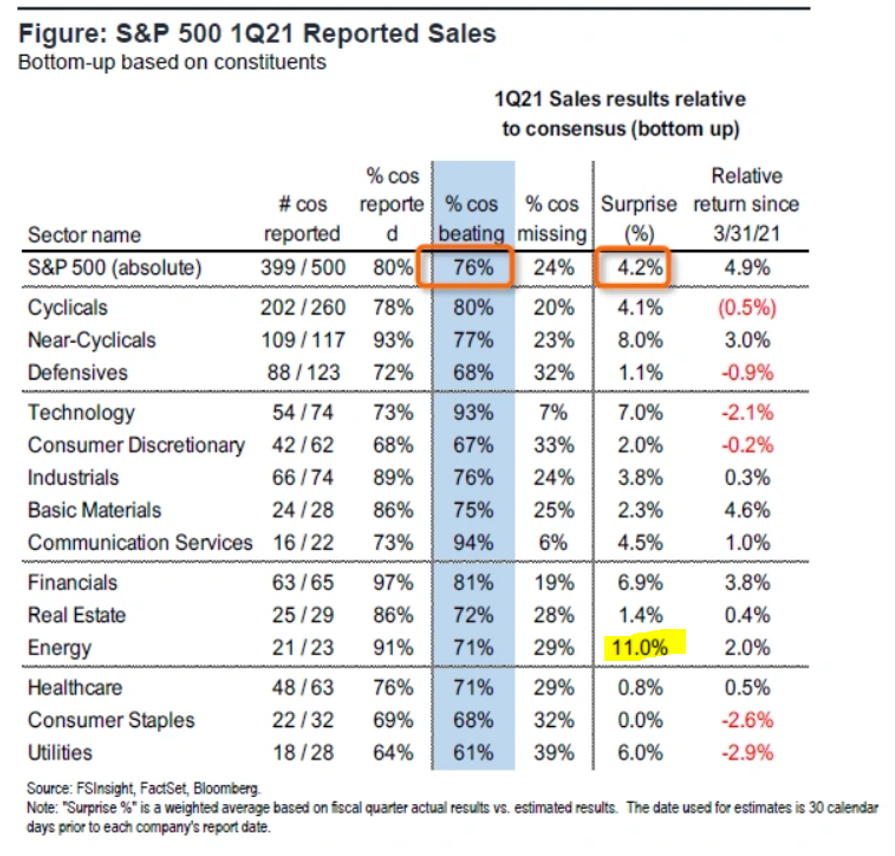

This earnings season has been incredibly strong, so why have there been such lackluster performance in so many names that shatter expectations? My colleague Tom Lee will answer this delicate question below. Despite some stocks not moving as investors might like, strong earnings are strong earnings. Sell-side analysts are repeatedly upgrading earnings for the S&P 500. 87% of companies outperformed expectations which is significantly above the historical average of 65%. Energy lead in sales outperformance and was the only sector to have double digit surprise in the area.

We held a webinar this week in which Tom Lee and Tom Block discussed how the re-opening of the world’s largest economy should affect stocks and which sectors should benefit most. The replay is available here. We want to thank our family of loyal and inquisitive subscribers for tuning into this event in droves. The whole team is honored by your support.

The re-opening is here. Hilton’s CEO noted that “April bookings for the summer are exceeding 2019 peak levels by 10% in the US.” Folks are beginning to offices and retail properties are filling up again.

This SNL episode is not a shoeshine boy moment but it does suggest Lorne Michaels might also being paying attention to on of our favorite investing themes which is the economic rise of millennials. Like Mr. Michael’s ratings, we are the stock market benefits from this rise and from the looks of it that is already occurring. Stock holdings are now 41% of household levels, the highest level on record. We think this is the beginning of a longer-term bullish trend for equities. Millennials don’t like bonds. They like crypto and stocks and as they inherit trillions of dollars they will increase holdings.

Of 431 companies that have reported so far (88% of the S&P 500), 85% are beating earnings estimates by a median of 16%. On the top line, 77% are beating by an average of 7%.

Tom Lee's Equity Strategy

Earnings Comps Distort Picture, Energy CAPEX Shortfall

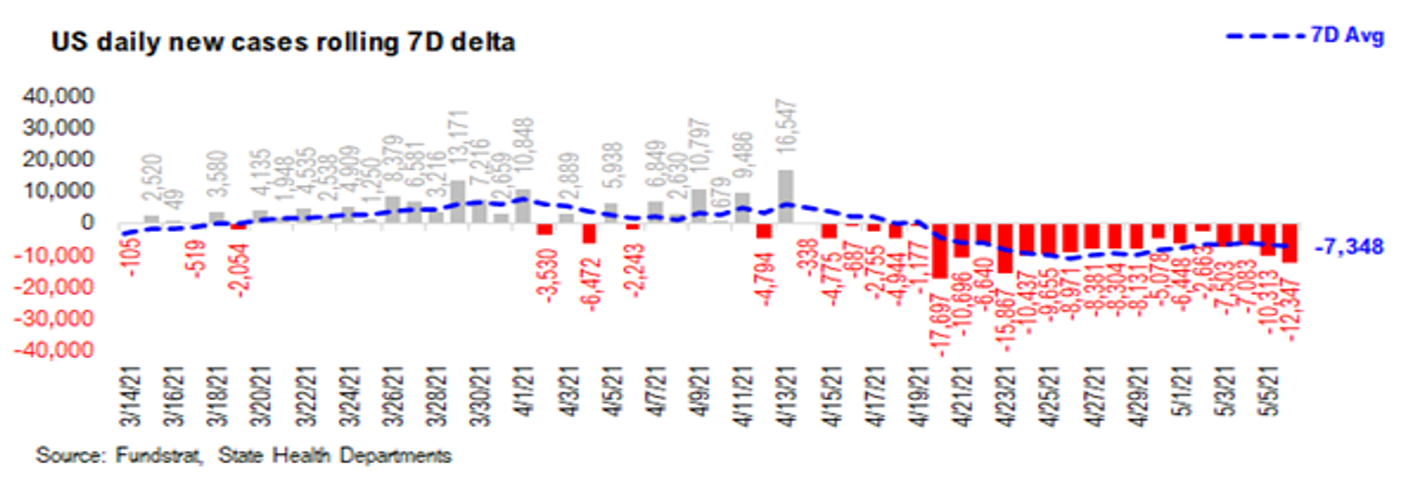

In the United States a steady and persistent decline in cases continues. The 7D delta has been negative in the past 23 days. In the past few days, the &D delta has also been accelerating to the downside again. If the speed of this decline continues at its current pace then we could the daily cases drop below 20k by mid-May. As we wrote before, at this stage of the pandemic, as long as vaccinations work (evidence overwhelmingly suggests they do), eventually the successful rollout will lead to a persistent decline in cases. Based on the recent data, we think that decline has arrived.

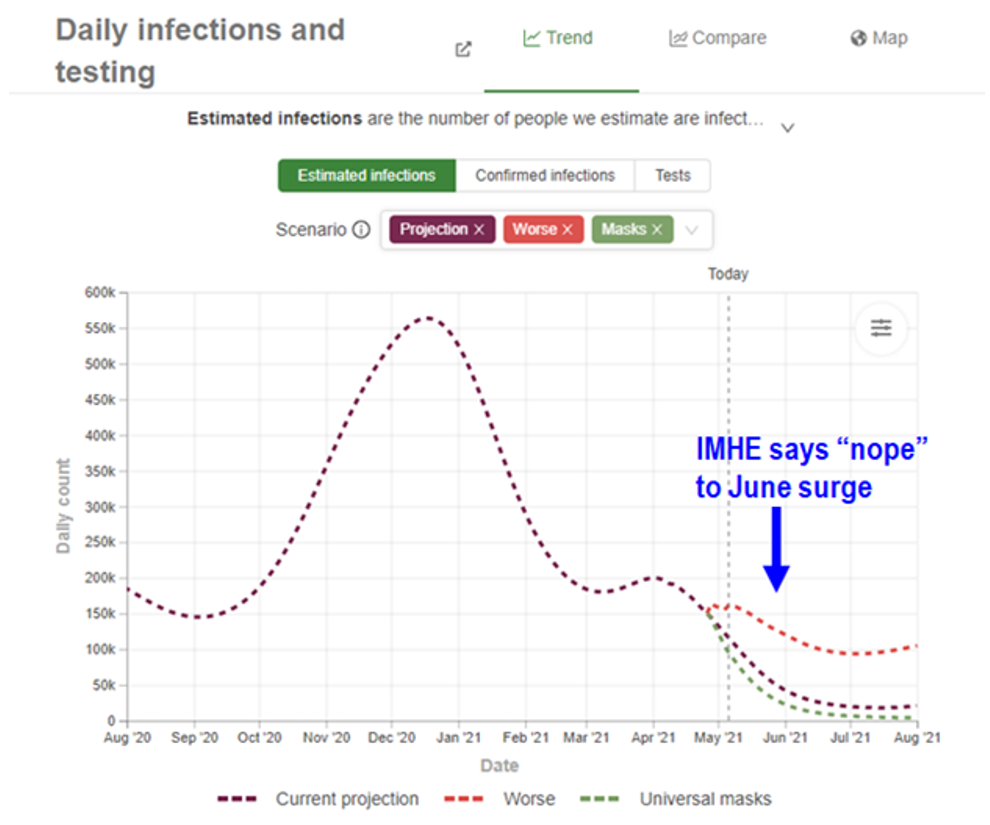

Despite what is clearly playing out in the data and the undisputable fact that with the dramatically increased immunity, particularly amongst the most vulnerable cadre, there is simply less places for the virus to go the CDC has provided a pretty strange forecast for a major spike from May to June. Their forecast is apparently due to the spread of dangerous variants that elude the immunity provided by the vaccines. However, our preferred forecaster for COVID-19 data the IHME shows no such rise. The CDC has been generally slow to lift recommendations. They are allowing sports and indoor dining but not cruises with all vaccinated passengers. Dr. Scott Gottlieb also pointed out that they were wrong on the science surrounding outdoor transmission.

So, we are taking the CDC forecast with a grain of salt, while accepting that it is certainly possible that it could occur. If they are right it would be a headwind for markets. In mu opinion, and only my opinion, the CDC’s latest forecast seems to be borderline ludicrous. The IHME baseline is a continued collapse in US cases. If the IHME forecast is correct than Epicenter will rally.

STRATEGY: 1Q2021 Earnings “Don’t Matter’ as Comps Not Realistic- 2Q2021, 3Q2021 Matter Way More

Many clients are concerned that stocks are peaking, because stocks are not reacting to ‘strong EPS’ results, and in fact, are often selling off. I can think of at least 7 reasons that stocks do not have to react to ‘great results’- of which, only 2 are actually bad signs.

But in my opinion, the main reason stocks are not ‘reacting to 1Q2021 results’ is that the year ago comparison is to March 2020 when the economy was six weeks into an unprecedented economic depression caused by a synchronized shutdown. Do comparisons vs the ‘first stage’ of the pandemic collapse, when revenues were often near zero, matter? We don’t think they matter all that much. Realistically I think the YoY vs 1Q2020 is simply going to look mental. So I would not place much weight on the results. And to me, it seems like equity markets are reacting as such. The next two quarters are more important than comps to the heights of COVID induced economic devastation.

If you were wondering what the fuller list of possible reasons of why stocks do not react to EPS, here it is. Two potential bad reasons are that 1) good news is already priced in and that 2) no shorts have to cover. Two medium reasons could be 3) incremental buyer doesn’t care for earnings and thus doesn’t react and 40 market is trying to process hairs of inflation. Three good reasons for why stocks aren’t booming on good earnings could be that 5) people aren’t chasing earnings 6) which could mean retail is getting smarter and not gambling on earnings calls or 7) nobody cares about comparison to March 2020.

1Q2021 EPS had been beating estimates by 19% which would be considered extraordinary under normal circumstances. The upside has been strongest in Cyclicals (+27%) and Near-Cyclicals (+41%) as compared with Defensive (only +8%). The beats by even Defensives, let alone the others, would be considered very outstanding in normal years.

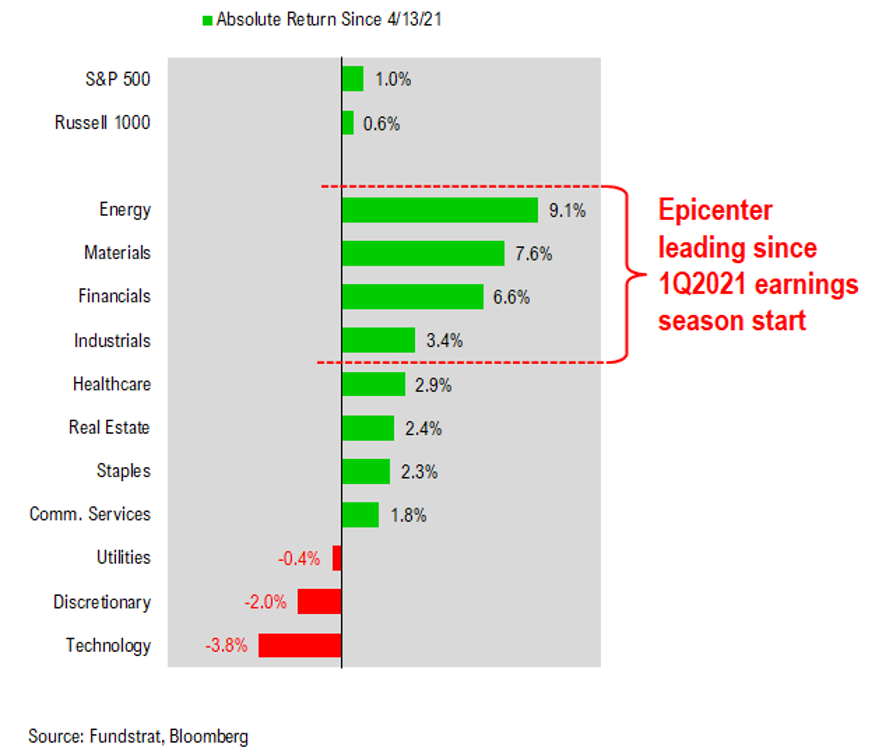

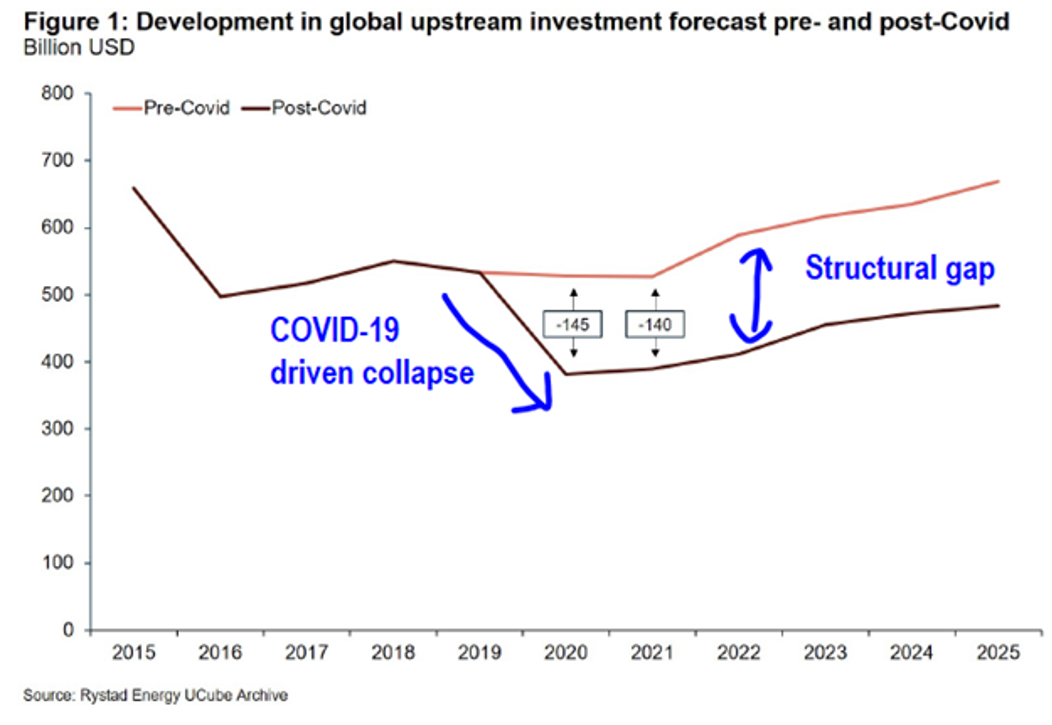

STRATEGY: Structural Tailwind for Energy. Per Rystad, $300 bn of Oil Capex Taken Out Since 2020

This is one of the reasons why we continue to be so bullish on Energy. Epicenter is leading and performing very strongly. In fact, for the first time in nearly 6 months of being bullish on Energy we are finding institutional investors developing incremental curiosity about the sector. And as many readers know, Energy is a sector investors have largely ignored for the past decade and this was even more true since the beginning of the pandemic.

Rystad Energy (rystadenergy.com) is an independent Energy research boutique, headed by Jarand Rystad, published a report today that points the E&P sector has cut investment (capex) by $300 bn since pandemic started. This will have lasting impact in their words. There is quite a lot of good material in this report and we hope to do a joint webinar with Rystad in coming weeks, so we can more fully explore their views an analysis.

The dramatic cuts will result in a structural gap that can only be corrected by setting capex higher. North American oil production is set to fall by 3.0mbpd by 2022 alone. An additional 1mpbd will be taken off as well. That is a level on par with the annual oil production of Iraq and exceeds Iran’s and Kuwait’s production. This is a pretty stark deficit and would be hard to dismiss. This goes further to support our recently reiterated bullish call on the Energy sector.

Bottom Line: Despite the diminished importance of 1Q2021 earnings due to anomalous comps, Epicenter is leading in terms of beating expectations. Energy is looking particularly appealing and has the best of alignment of supply/demand dynamics developing for a decade or more. We continue to recommend Energy and think it will be among the best, if not the best, performing sectors of 2021.

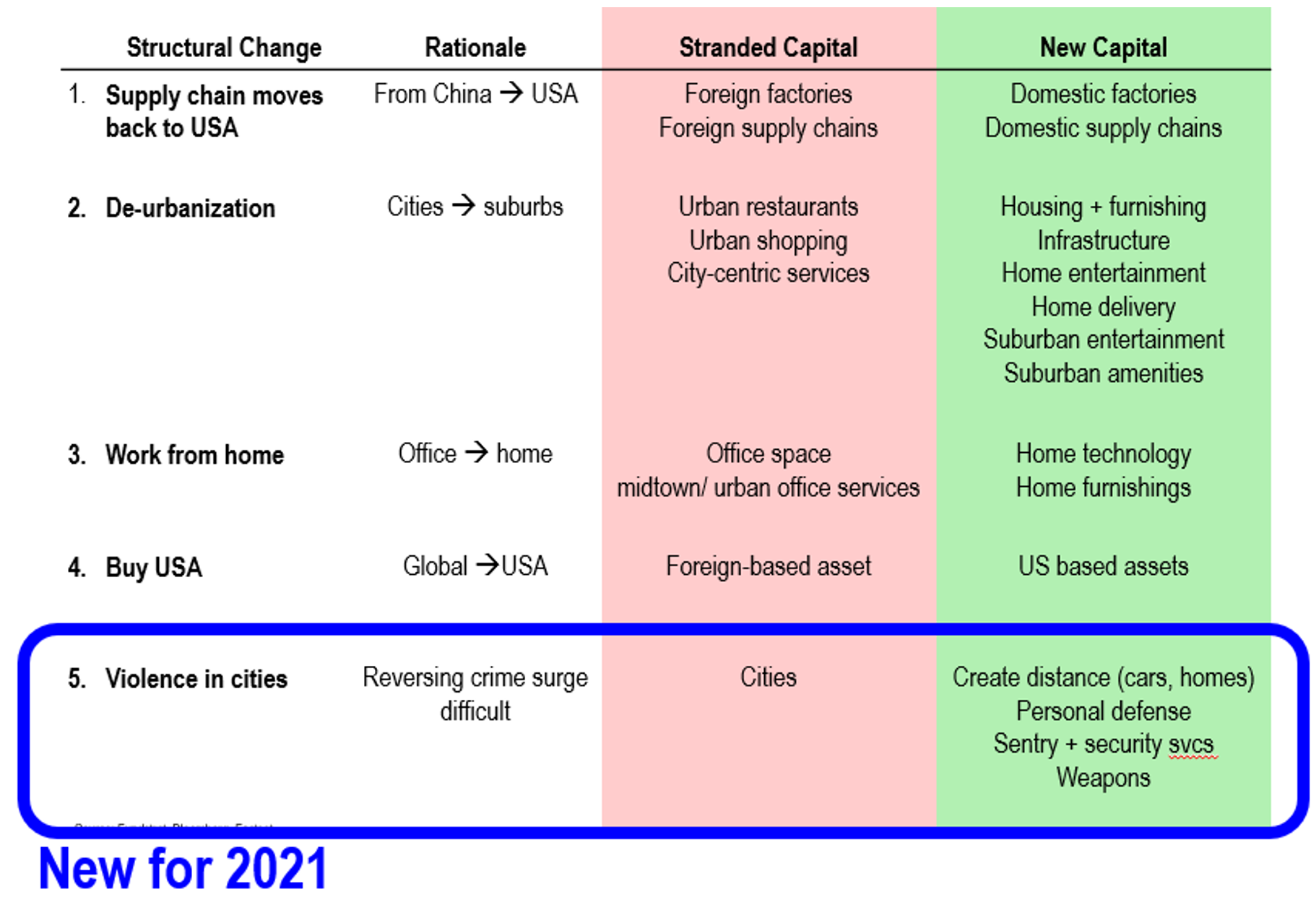

Figure: Way forward ➜ What changes after COVID-19

Per FSInsight

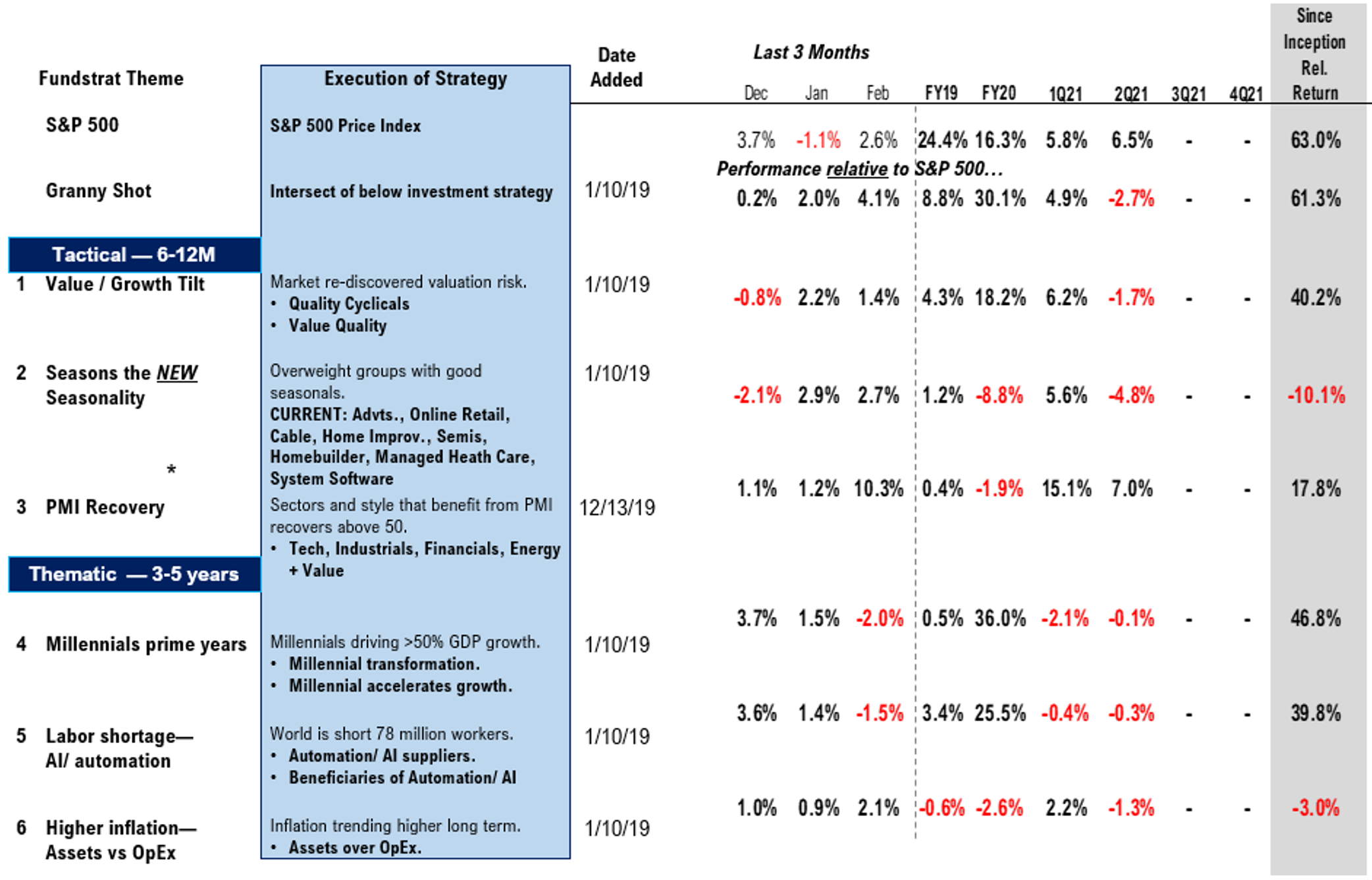

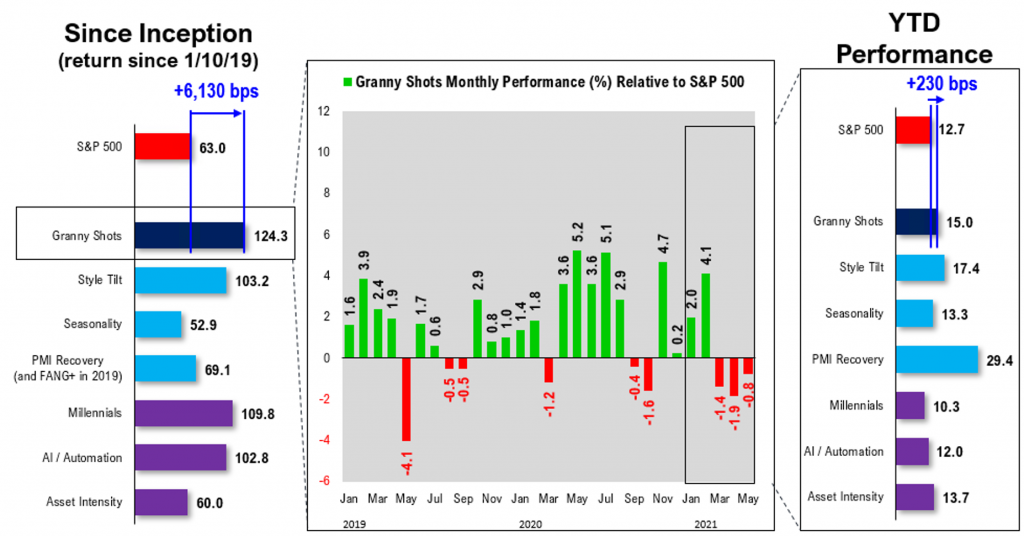

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

GRANNY SHOTS: Best bets in 2021

GRANNY SHOTS: Best bets in 2021 - Week 18

Below we’ve highlighted stocks that we recommend across at least two of our investment strategies for 2021. These companies could benefit from multiple themes and secular tailwinds – clear picks in our view.

Figure: Granny Shots are the “best of the best”

Stocks which appear in multiple themes. Source: FSInsight

Figure: Granny Shots Portfolio Performance

Monthly. Source: FSInsight. FactSet as of 04/30/21

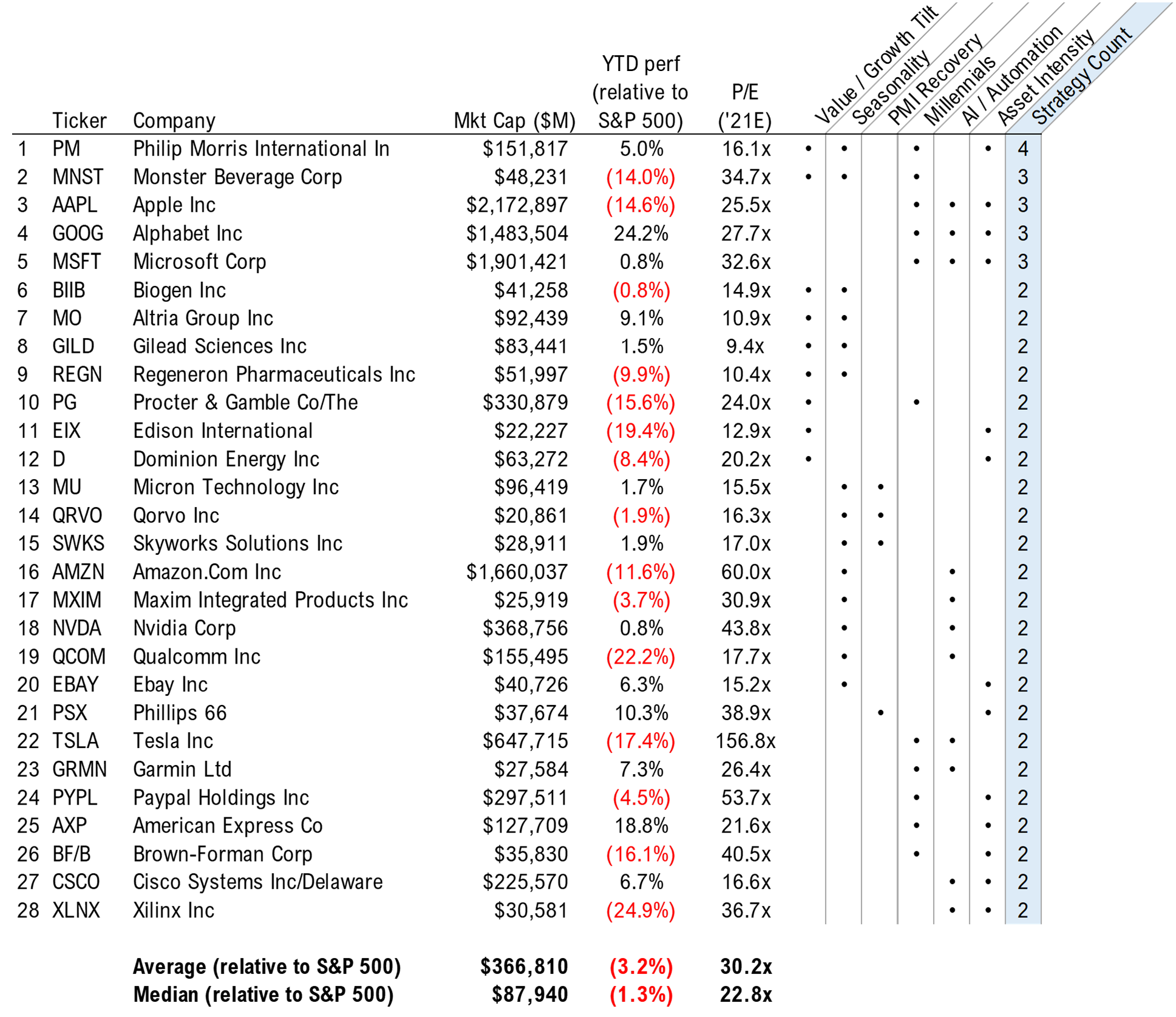

Figure: Intersection of investment recommendations by strategy

As of 04/30/21, Source: FSInsight, FactSet

The stocks in the Granny Shots portfolio collectively outperformed the S&P 500 by 6,130 bps since its inception (S&P 500 is up 63.0% during the same period).

US Policy

Infrastructure Debate Continues, Biden Intellectual Property Decision

Senate Republican Leader Mitch McConnell proclaimed in Kentucky this past week that his mission was to stop the socialist agenda of President Biden; while the White House looks for a bipartisan agreement on infrastructure.

The President and his White House team continue to talk to a handful of Republicans who have put forward a $600B infrastructure bill that moves ahead with traditional projects such as roads, bridges, airports etc. Democrats are split with some supporting Biden’s outreach to Republicans and others committed to “going big” with only Democratic votes. In my view there is a chance that Congress may move forward on a two-track approach with a bipartisan traditional infrastructure bill, and a second program passed exclusively with Democratic votes under Budget Reconciliation rules.

If there is going to be a bipartisan bill a stumbling block could be paying for the program. The Biden Administration has proposed using an increase in the corporate tax as the “pay-for.” Increasing the corporate tax is a non-starter for Republicans. The reduction of the corporate tax rate from 35% to 21% was the centerpiece of the Trump tax cuts. Prior to the Trump/Republican cut the US had one of the highest corporate tax rates in the world. President Trump and Congressional Republicans argued that the lower rate made American companies more competitive with global rivals and played a significant role in the robust economy pre-pandemic. Republicans will not support any bill that reverses this accomplishment.

While increasing the corporate tax may be off the table for a bipartisan infrastructure bill it is possible that Republicans could support an increase in the gas tax, a user tax. The gas tax hasn’t been increased since 1993 and is only $.18.4 a gallon. As autos have become more efficient the tax has brought in less and less revenue, and an increase might make sense to pay for roads and bridges.

A related issue is what to do about the expected increase in electric cars, EVs, which avoid the gas tax altogether. Republicans could expand that gas user tax in some form to capture revenue from EVs.

A third possible bipartisan tax might be an initiative to give the IRS more money for audits to collect from tax cheats. It’s estimated that the US may be missing $1T in uncollected taxes. Republican controlled Congress have cut IRS funding, but as part of an infrastructure bill compliance might be an acceptable way to raise revenue. The White House is reportedly ready to give the bipartisan talks another month but at some point they will reach a decision to fish or cut bait. I continue to believe that there is a 75% chance that an infrastructure bill will pass by the fall; if there is no bipartisan bill infrastructure will pass using Reconciliation.

West Virginia Democratic Senator Joe Manchin has expressed a preference to have a bipartisan bill; but West Virginia is a poor state that needs federal infrastructure dollars, it is my view that at some point he will agree to a Democrats only reconciliation approach. If it is a Democrats only bill increasing the corporate tax is back in play. Manchin, and a few others, have said they believe that the 28% rate proposed by the White House is too high; but there is support for a lower number such as 25%. Indeed when the Trump White House pushed for the lower corporate tax rate many thought the final figure would be 25%, and there was some surprise it ended up as low as 21%.

There is considerable Democratic support for giving the IRS more money to go after tax cheats and this could become part of a Democrats only reconciliation bill.

In any event I expect parts of the Biden infrastructure proposal to pass by fall

Intellectual Property (IP)

This past week the Biden Administration indicated that it would support an effort to waive the intellectual property protection given to the Covid 19 vaccine. I will be writing more about this in coming weeks; but as a former adviser to the US Government on trade issues it is my view that this is a mistake.

Protecting IP is a cornerstone of US trade policy and to waive the protection undermines the government’s negotiating position. From negotiations with China to WTO the US has stood with the EU and others to insist on the protection of private sector breakthroughs. To blink and waive the protection for the vaccine is a mistake. There are other alternatives to ensure that the vaccine gets to poor nations and it can be done with the full cooperation of the vaccine manufacturers.

Fed Watch

Fed Financial Stability Report Highlights Risks

Federal Reserve Chairman Jay Powell ironically probably felt a tinge of relief upon seeing the non-farm payrolls number. Why? Because it gives him cover to continue the course the Fed has been pursuing of near-zero rates and copious asset purchases Minneapolis Governor and PIMCO veteran Neel Kashkari commented in the wake of the jobs number that now was absolutely not the time to be raising rates. He also poignantly added that he has ‘zero sympathy’ for Wall Street critics of the Fed. We sincerely hope from the bottom of our hearts that he didn’t hurt any of your feelings or dash your expectations for sympathy.

This is all pretty well and good for the Fed given that by many other signs other than today’s jobs report the Economy is well within the stride of re-opening. First quarter productivity rose 5.4% which blew away the expectations of only 4.3%. US junk-bond yields dropped to an all-time low of 3.88% on Monday. Spreads hit their tightest level in well over a decade at (+289 bps). While the Fed got an immediate reprieve because of the jobs report, inflation expectations and bond vigilantes are unlikely to make the Central Bank’s life easy over the coming quarters as the economy continues to get red hot.

The strong rally in credit continues across all buckets. Issuance is on track to be the busiest first half ever on record. Currently we are only $5 billion short of the $211 billion record and there’s two full months to go. Bullish indicators are so plentiful many had speculated the Fed would be forced to begin talking about raising rates. Secretary Yellen even said something to the effect, which was probably unwelcome uptown at the Fed.

The Fed’s Financial Stability Report also showed an overwhelmingly strong picture in many respects. Banks remain very, very well capitalized. Leverage levels are very low among broker dealers. Household debt is manageable and loans are generally being paid back by households and businesses at historically high rates. The consumer balance sheet is very strong, buoyed by government stimulus.

The Fed issued a report on Thursday that warned of the risks of rising asset prices, including the boom in stock prices. In a statement that seems rather obvious to us, the Central Bank stated that “Asset prices may be vulnerable to significant declines should risk appetite fall. The semi-annual Financial Stability Report shouldn’t be taken with too much alarm. The job of the regulatory agencies that compile this report is to assess potential threats to financial stability from multiple vantage points but also well in advance. The report of course also cited COVID-19 and the potential for the spread of variants as a major potential risk.

Another strong point in the Financial Stability Report noted that many efforts have been taken to prevent contagion like occurred from the ABS market in 2008 from repeating itself. The Fed specifically mentioned that assets which may be considered speculative, like cryptocurrency, do not pose a significant risk to financial stability, outside the individuals who choose to take risk investing in this area.

Asset purchases continued at a pace of $40 billion a month for MBS and $80 billion a month for Treasuries. The benchmark yield on the 10 year is 1.579%.