“My dear graduates, let me be frank, the best years are very much ahead of you. And they can be whatever you want them to be … You’re going to continue to evolve in unforeseen ways. What defines you now will be mere shades and hues of a more vibrant you over the next five, 10, 50 years. Honestly, I can’t think of anything more liberating than that, knowing that life will look differently than you think it will.”

~ Actress Octavia Spencer, Commencement Speech for Kent State University Class of 2017

We are coming up on the tail end of another graduation season, with another set of young adults going into the world – to strive and to build, to work and to spend. This will be the first half of a series about the youngest generation of adults, focusing on their generalized approach toward money matters and what companies are poised to benefit from them.

This year’s high-school graduates fall just past the midpoint of the birth years that demographers use to define Generation Z (1997-2010). More than half of Gen Z are now legally adults. The generation ranges in age from 13 to 26.

Demographics are destiny – that’s what our Head of Research, Tom Lee, constantly repeats as a mantra. This forms part of the foundation for his perennially outperforming Granny Shots stock list. Demographics are why Lee looks for companies involved in AI and automation, and demographics are why Lee looks for companies poised to benefit from the rise of Millennials.

The Pew Research Center defines Millennials as people born between 1981 and 1996. That means the oldest Millennials are now in their 40s, entering their peak earnings years. They will remain influential for decades to come. But Gen Z is the future. Over the next two decades, they will follow in the footsteps of their predecessors, growing their income and spending power. With a size comparable to that of Millennials, Gen Z is about to play an increasingly prominent role in driving the U.S. and global economies.

Gen Z differs from previous generations in one key respect: its members wield more influence on their parents (typically Generation X) than previous generations did with their parents. Between their growing impact on the market and their already significant influence on Generation X, it makes sense to examine what our youngest adults think, how they might change society (hopefully for the better), and which companies are poised to benefit.

“Give me a child until he is 7, and I will show you the man.” ~ Aristotle

People change throughout their lives, but many thought patterns and instincts are formed in youth. So what experiences shaped Gen Z when they were children? Regarding views on money and spending, most of Gen Z have early memories of their parents dealing with the Global Financial Crisis – job losses, budgetary constraints, and even loss of homes. At a young age, the members of Gen Z were made keenly aware that economic security was by no means a guarantee and that good times could be transitory.

As they entered their teen years, they also saw the prosperity that followed the GFC, entering their high school and university years with a sense of optimism. That optimism crashed into the global pandemic, then skidded on a global surge in inflation.

Caution is advised when making blanket statements about an entire generation – especially one that, depending on the cutoff years used, might match Millennials in size while exceeding it significantly in diversity. Nevertheless, it is reasonable to anticipate that Gen Z is entering adulthood with contradictory mindsets – guarded and insecure about the future, yet simultaneously willing to spend on personal enjoyment and satisfaction.

On the one hand, Gen Zers tend to have a long-term view of their financial futures. They strive to be financially disciplined, determined to achieve their ambitious goals. About 54% of this generation already holds some investments, whether through traditional instruments such as mutual funds, ETFs, and stocks, or digital assets such as cryptocurrencies and NFTs. This actually puts them ahead of Boomers (43%) and nearly at par with their Gen X parents.

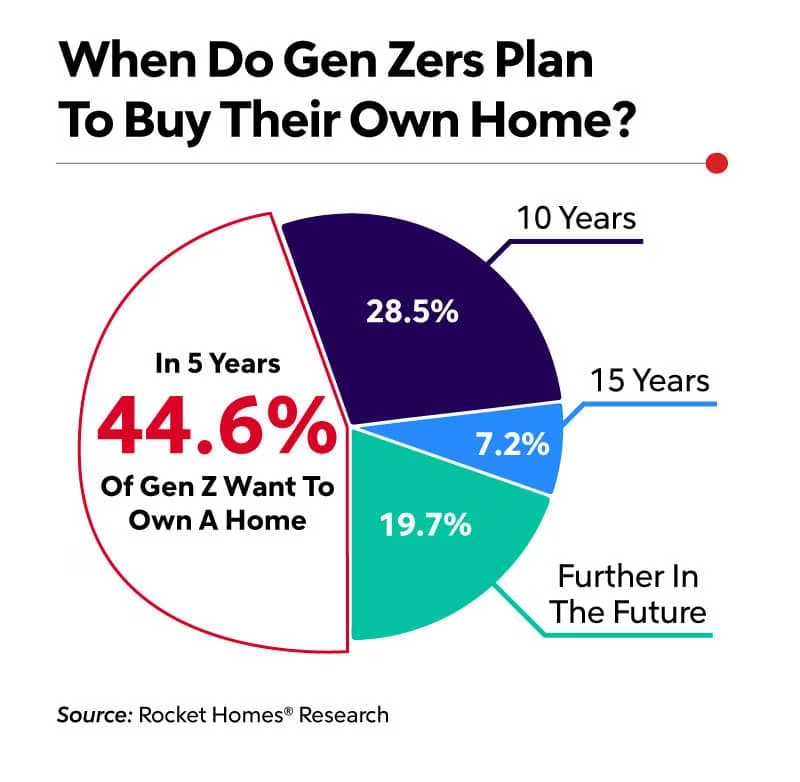

Zoomers are also ahead of earlier generations when it comes to home ownership. According to Redfin (RDFN), 30% of Zoomers are already homeowners by age 25 – which puts them ahead of Millennials and Xers at that age (28% and 27%, respectively). Rocket Homes (RKT) research shows that nearly 45% plan to buy a house in the next five years, and another 28.5% plan to do so within 10 years.

One thing improving their chances: many Zoomers continue to live with their parents even after completing school – 48%, a level not seen since the early 1940s during the Great Depression. Much of that might have been due to the pandemic, but a significant number chose this option specifically to save money for a down payment on a house.

Some of Gen Z’s other spending tendencies enhance the potential benefits of this kind of decision-making. This cohort has adopted some sensible views on shopping, often favoring Big Box stores that older generations might have viewed as uncool. It’s is no accident that Walmart (WMT) is one of the most popular brands for this demographic, just ahead of Target (TGT).

Coincidentally, Walmart and Target are also poised to take advantage of this potential surge in new homeowners – customers likely to have just bought older houses that need to be fixed and furnished. More specialized retailers could also benefit, such as DIY chain Home Depot (HD) and home-furnishings retailer Wayfair (W).

Yet it is not all grit and pragmatism with the Zoomers. There is no evidence that this cohort is particularly interested in the lifestyle of an ascetic monk. As noted in a previous Signal From Noise, Gen Zers still have a taste for luxury – an appreciation for life’s finer things that they developed at a precocious average age of 15. (In comparison, the average Millennial was between 18 and 20 the first time they bought a luxury brand.)

One obvious question arises: Just how are Zoomers able to afford expensive luxury items at such a young age? A number of explanations come to mind. First, recall that many adult Zoomers still live with their parents. Discretionary funds swell when living rent-free, and it is unrealistic to expect them to put all of those savings toward a down payment for a house.

A second reason is the growing number of online second-hand luxury marketplaces. The Realreal (REAL) is just one of numerous companies vying to do their part to bring expensive purses, designer shoes, and haute couture closer within reach.

And a third way in which Gen Z – even those in the lower income brackets – can afford all of this is by going into debt. Admittedly, this is not conducive to their goals of imminent home ownership and financial security, but like their elders, the members of Gen Z are full of human contradictions.

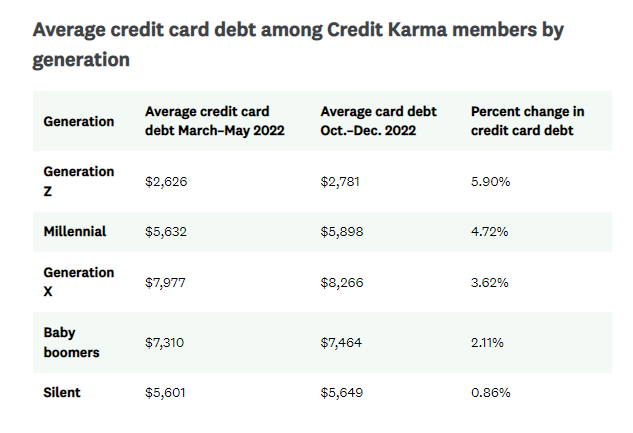

One obvious source of spending is credit cards. The 2009 Credit Card Accountability Responsibility and Disclosure Act (CARD Act) restricted on-campus marketing of credit cards to college students, but cards remain a popular and easy way for young adults to spend – and go into debt. Gen Z saw the biggest percentage increase in credit-card debt in 2022 – nearly 6%.

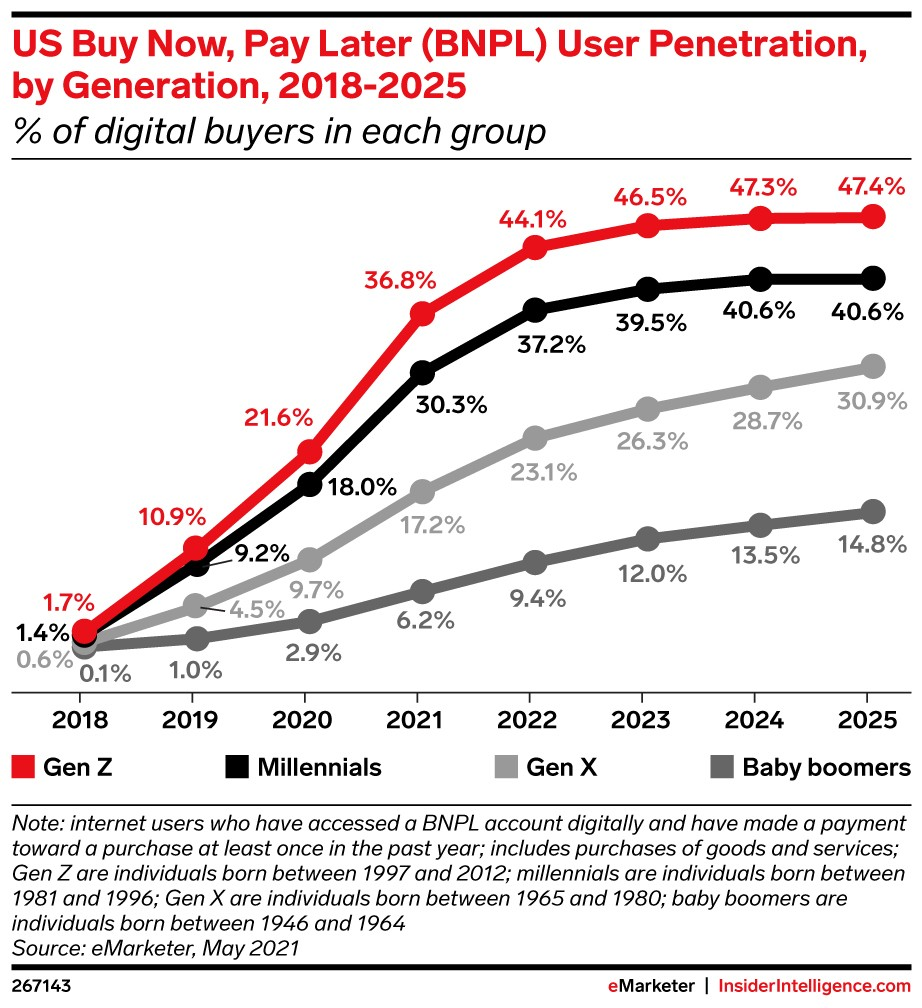

But it is not just about credit cards. Gen Z is the most enthusiastic adopter of recently introduced Buy Now Pay Later (BNPL) options, partly because their less rigorous credit checks and looser requirements are more accessible to customers with imperfect or less established credit histories.

Nearly 48% of this cohort have made at least one purchase using BNPL in the past year, and that number is only expected to grow. Fintech companies such as Paypal (PYPL) and Block (SQ) have been eager to meet this demand. However, the market has so much potential that even less obvious players such as Granny Shot Apple (AAPL) have also joined in.

Final thoughts

By dint of their youth, size, and potential, Gen Z is poised to make its mark on the world. Just like every other generation, members of this cohort will face various challenges – some not of their making, and some that arise from their tendencies and choices. The companies mentioned above have the intent and potential to benefit from both, but it must be stressed that no investment decision should be made solely on the basis of one thematic idea. Despite their potential, some of the names in this piece have struggled recently and might well continue to do so. We recommend that readers use these suggestions only as a starting point for further research.

Next month, we will look at this generation’s lifestyle tastes and preferences, diving a little deeper into how they decide what to spend money on, and which companies seem able to provide what they desire.

In the meantime, we encourage you to explore our full Signal From Noise library, where you’ll find ideas about investing to benefit from the growing demand for luxury goods and the need for solutions to the ever-increasing global water crisis. You will also find interviews with respected investors and bestselling authors Morgan Housel and Robert Hagstrom.

Your feedback is welcome and appreciated. What do you want to see more of in this column? Let us know. We read everything our members send and make every effort to write back. Thank you.