The S&P 500 slipped 1.39% this week, and the Nasdaq Composite fell still further, ending the week down 2.10%. Software stocks helped lead the indexes lower, as worries over whether AI would render many forms of software redundant maintained their presence on investors’ wall of worry.

As Fundstrat Head of Research Tom Lee put it, the story of “software eating the world,” which we read repeatedly from 1980-2025, is now becoming one of “AI eating software.” Yet this shift, to Lee, signals that AI is productive and has a payoff. “To us, [the carnage in software] argues that AI’s biggest impact in the U.S. is ultimately less inflation. Because if there are fewer workers, less software and services spend, but the same output, this is both productivity-enhancing and disinflationary.”

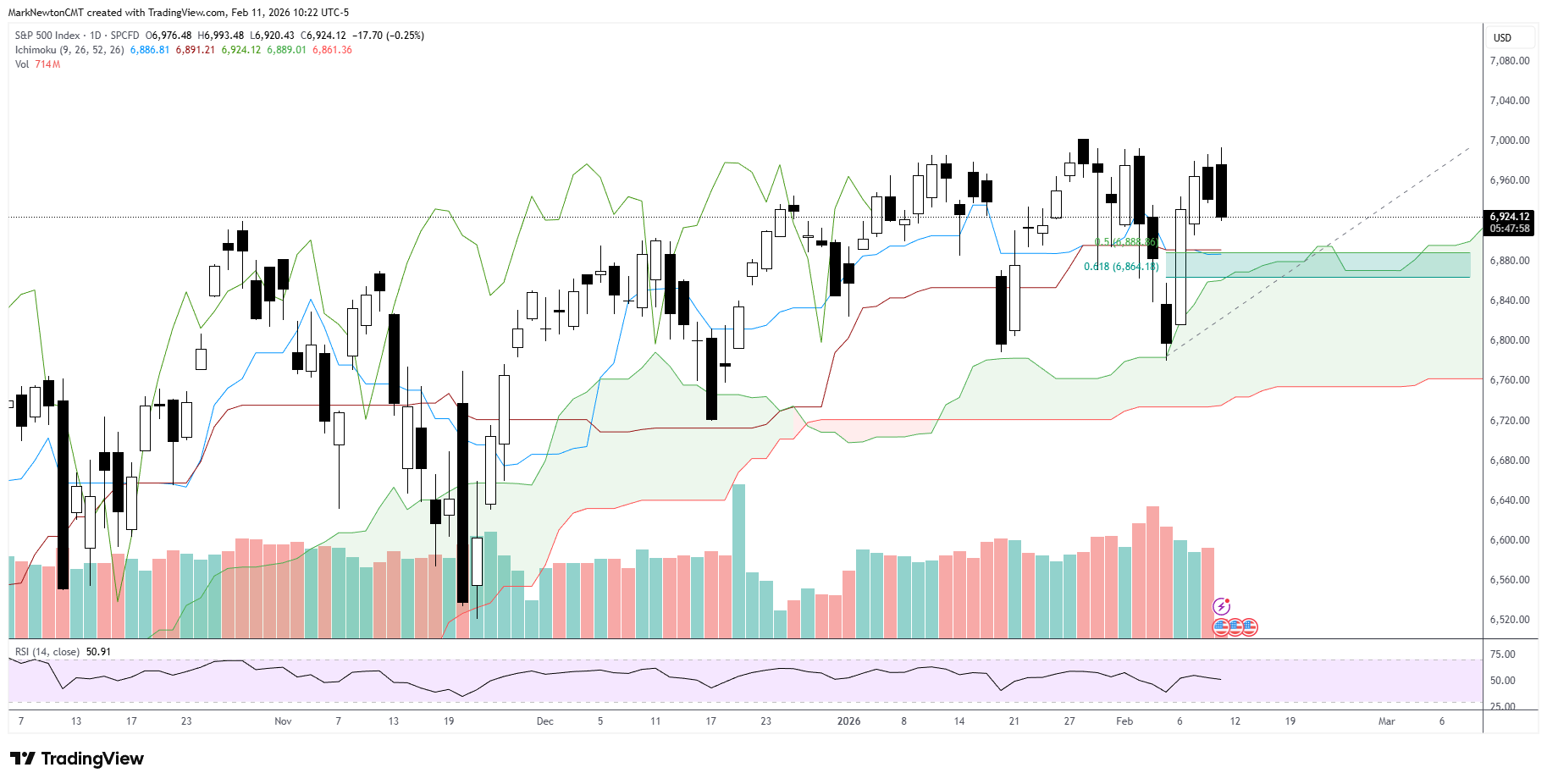

From a technical analysis perspective, Head of Technical Strategy Mark Newton acknowledged that “software has struggled to stabilize and find a bottom, [and] they look like they’re going straight down in the short run.” Going forward, Newton told us that “I don’t sense it’s going to be an area to overweight within technology.”

As he told us during our weekly huddle, however, the situation does not necessarily look so dire for those with more of an intermediate-term timeframe. “The intermediate-term charts help to put this deterioration into perspective,” he suggested, and “I do sense that this group can bounce.”

Regardless of one’s views on Kevin Warsh, President Trump’s choice to succeed Jerome Powell as chair of the Federal Reserve, Newton noted this that the changeover to a new Fed chair has historically tended to be followed by market uncertainty and short-term drawdowns. Newton also sees a seasonality challenge. “The second year of a second term of a president has tended to coincide with challenging years for stock investors,” he pointed out, a pattern that has largely held true going as far back as Harry S. Truman’s second term.

For the most part, this independently coincides with Lee’s view. As he reiterated this week, Lee said, “We still think markets have enough tailwinds to get to 7,300, and then we do think there’s likely to be a drawdown that feels like a bear market this year. And then year-end we do finish stronger, in my view.”

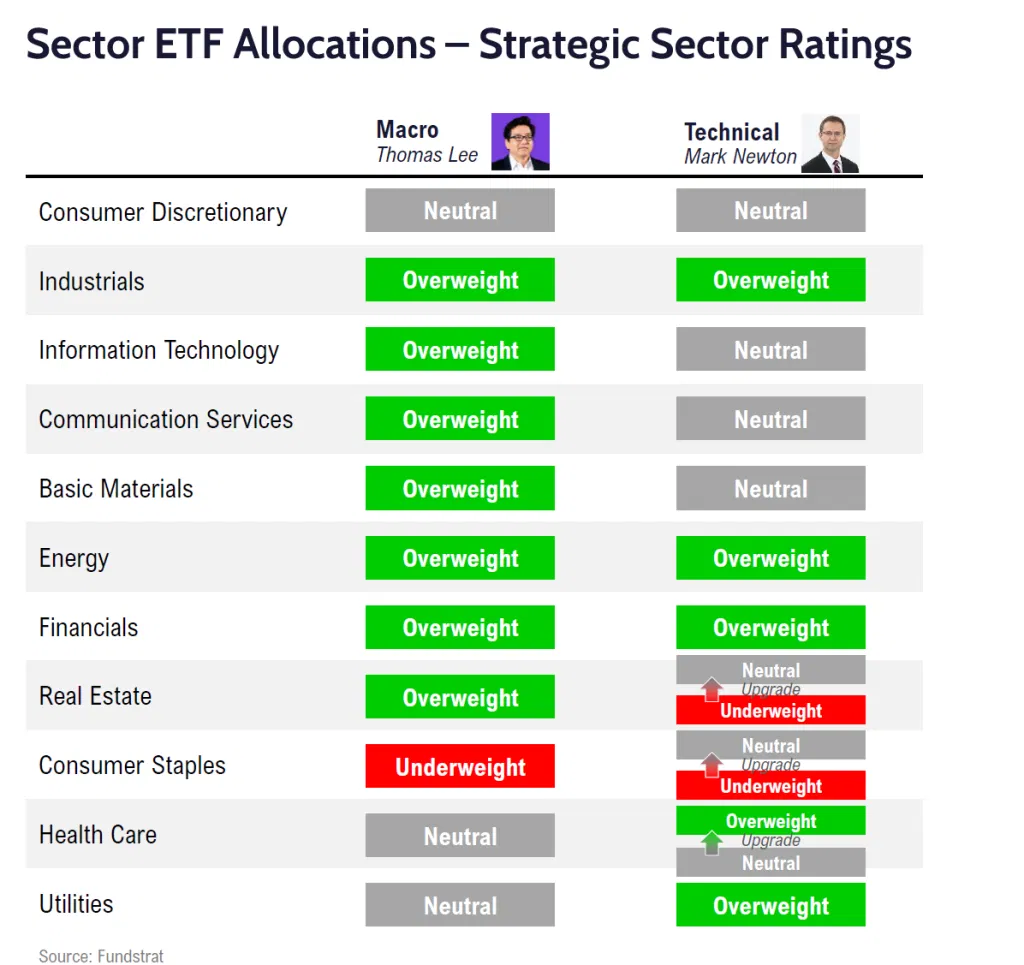

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the February 2026 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

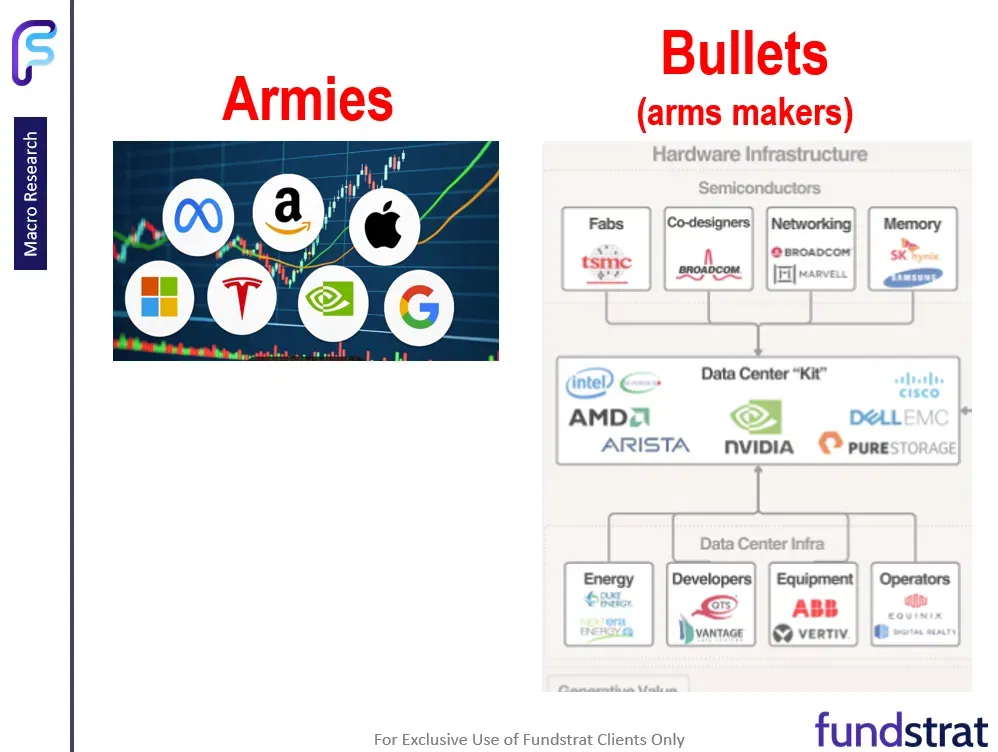

Fundstrat’s Tom Lee views current mood of the market as also related to the current rotation within the AI trade, away from the Magnificent Seven and toward companies in processors, chips, energy, and infrastructure. Taking a look at market history, Lee sees a similarity between the current scenario and the situation with the initial building of nationwide wireless networks in the late 1990s. In those days, investor appetite shifted back and forth between buying carriers and buying infrastructure and handset makers. “Back then, we’d call this ‘buying the armies or buying the bullets,'” he told us. In a modern context and as illustrated in our Chart of the Week, the current AI activity can be seen similarly, shifting between the Magnificent Seven as the “armies” and those companies that make “bullets” – processor and memory-chip makers and those in the business of building out data centers, such as energy companies. To Lee, this current shift does not necessarily mean underweighting or divesting from the “armies” of the Magnificent Seven. “At some point, this rotation will arguably shift again to Mag7,” he told us.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

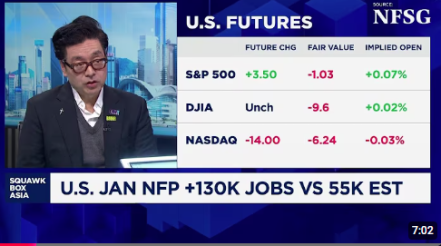

2/9 11:00 AM ET: Jan NYFed 1yr Inf ExpTame2/10 6:00 AM ET: Jan Small Business Optimism SurveyTame2/10 8:30 AM ET: Dec Retail SalesTame2/10 8:30 AM ET: 4Q ECI QoQTame2/11 8:30 AM ET: Jan Non-farm PayrollsHot2/12 10:00 AM ET: Jan Existing Home SalesTame2/13 8:30 AM ET: Jan Core CPI MoMTame- 2/17 8:30 AM ET: Jan Retail Sales

- 2/17 8:30 AM ET: Feb Empire Manufacturing Survey

- 2/17 10:00 AM ET: Feb NAHB Housing Market Index

- 2/18 8:30 AM ET: Dec P Durable Goods Orders MoM

- 2/18 2:00 PM ET: Jan FOMC Meeting Minutes

- 2/18 4:00 PM ET: Dec Net TIC Flows

- 2/19 8:30 AM ET: Dec Trade Balance

- 2/19 8:30 AM ET: Feb Philly Fed Business Outlook

- 2/20 8:30 AM ET: 4Q A GDP QoQ

- 2/20 8:30 AM ET: Dec Core PCE MoM

- 2/20 9:45 AM ET: Feb P S&P Global Services PMI

- 2/20 9:45 AM ET: Feb P S&P Global Manufacturing PMI

- 2/20 10:00 AM ET: Feb F U. Mich. 1yr Inf Exp

- 2/20 10:00 AM ET: Dec New Home Sales

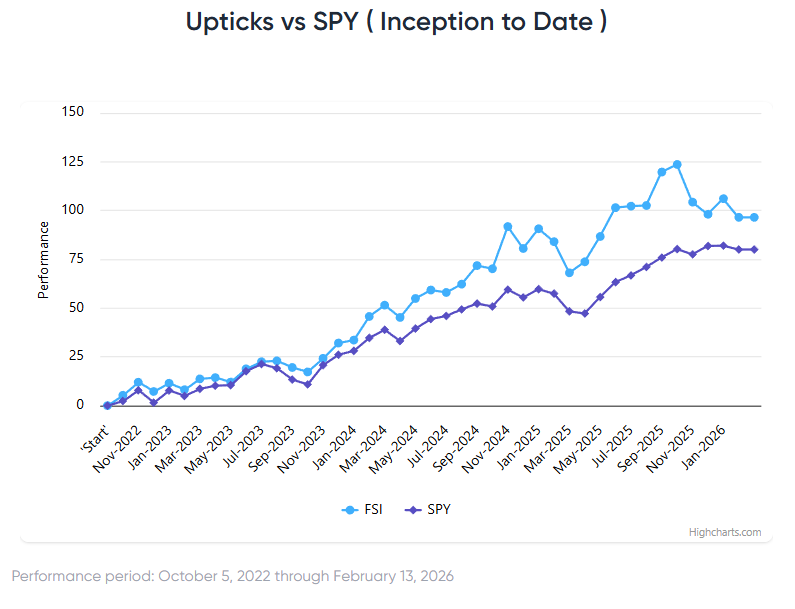

Stock List Performance

In the News

| More News Appearances |