A dovish stance from the Federal Reserve and blockbuster earnings from Meta Platforms and Apple helped the S&P 500 inch higher this week, reversing some of the declines seen over the past two consecutive weeks.

The index added 0.3% this week to 6,939.03 points, bringing its 2026 annual advance to 1.4%.

Responsible for the broad-based index’s advance were Big Tech stocks, which made a much-welcomed move after their monthslong sideways trading. Their previous lack of participation had raised many questions about whether the broadening rally in the stock market could continue to hit records. The laggards of last year, like the energy, materials, and industrials sectors, are still among the top performers this year, up 14%, 8.6%, and 6.6%, respectively.

“Technology was largely out of favor from July of last year until November, and then it really started to rip back and lately we’ve seen exactly the opposite where this big broad-based rally has given way to tech just in the last week,” said Fundstrat Head of Technical Strategy Mark Newton during our weekly huddle.

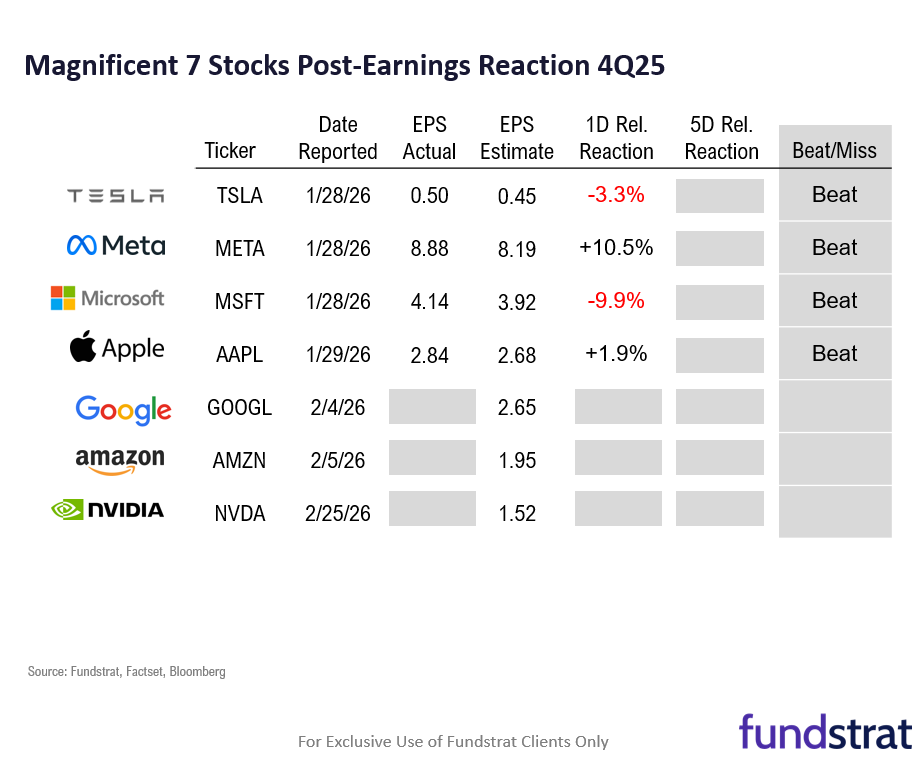

Earnings releases from four of the Magnificent Seven this week were in the spotlight, as they’re the face of the AI revolution. Microsoft, Meta, and Tesla reported on Wednesday, followed by Apple on Thursday. All four of them beat earnings expectations.

All eyes were also on the Federal Reserve’s meeting on Wednesday. In a widely expected move, the board voted to keep rates steady between 3.5% and 3.75%. Head of Research Tom Lee said in his Macro Minute videos that Chair Jerome Powell has not been contemplating hikes, and the outgoing Fed Chair reiterated this point at the latest meeting. In Lee’s view, this strongly suggests that the pace of cuts is now dependent on the evolution of the jobs market, which in turn arguably means there’s a put on the economy and a put on stocks.

Lee said that “the downside risk is less and the upside risk is lower.”

“I think on balance it’s still dovish,” he added.

The president also unveiled Kevin Warsh as the pick for the next Fed chair on Friday. All three major indexes declined on Friday.

Warsh has served on the board before and has criticized the central bank publicly. He’s known for being an inflation hawk, making him an interesting choice for the president, given his loud demands for lower interest rates.

The precious metals market, too, was full of action this week. On Friday, gold fell 11% and silver lost 31.35%, — with both noting the largest one-day dollar declines on record.

“Gold and silver have gotten truly parabolic,” Newton said. “They’re, sort of at the end of their move in my view, but I still like being long if you own it and you just simply have to use a trailing stop. It’s still early to sell, but they have gotten very, very overbought.”

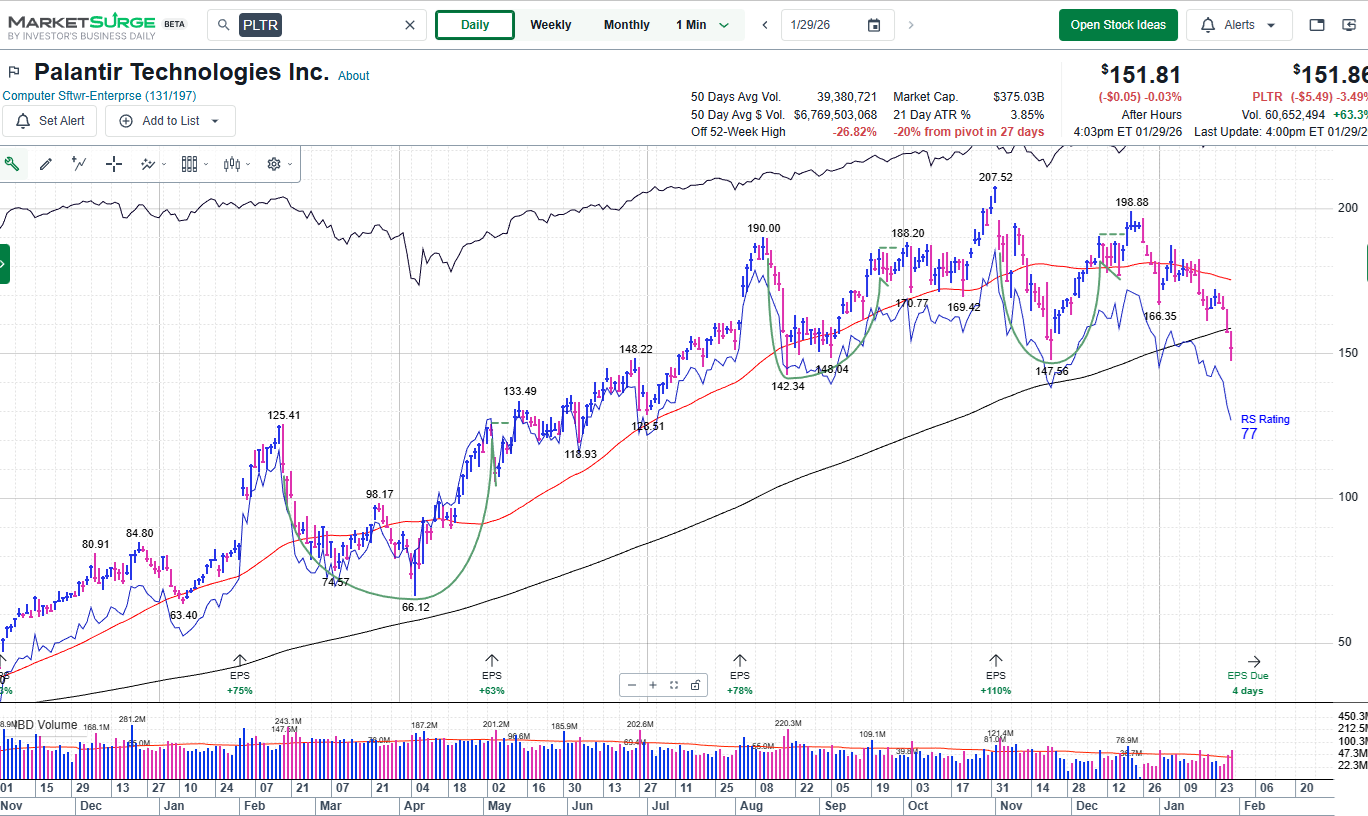

Chart of the Week

For Fundstrat Head of Technical Strategy Mark Newton, the beats by the Magnificent Seven still mean that “the Mag Seven have come back to life.” “I think in general, outside of Microsoft, it’s a pretty good sign,” he added. Our Chart of the Week has more details. Microsoft reported higher-than-expected capex on AI and slowing cloud growth. Shares fell 10% the next day, weighing heavily on the broader tech sector and highlighting just how much pressure software stocks are under right now. But the hit from that was somewhat softened by gangbusters earnings from Meta and Apple. The former has been able to use investments into AI to increase revenue growth. Meta’s stock rose 10% the next day. The latter, Apple, reported better-than-expected iPhone sales and profits but also rising costs perhaps limited their upside – though shares nevertheless added 0.5% the next day. Investors’ reaction for Tesla was much more muted. Tesla dropped 3.5% after earnings because it continues to lose its edge – at least in EV sales.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

1/26 8:30 AM ET: Nov P Durable Goods Orders MoMTame1/26 10:30 AM ET: Jan Dallas Fed Manuf. Activity SurveyTame1/27 9:00 AM ET: Nov S&P Cotality CS 20-City MoM SAMixed1/27 10:00 AM ET: Jan Conference Board Consumer ConfidenceTame1/27 10:00 AM ET: Jan Richmond Fed Manufacturing SurveyTame1/28 2:00 PM ET: Jan FOMC DecisionDovish1/29 8:30 AM ET: Nov Trade BalanceTame1/29 8:30 AM ET: 3Q F Unit Labor CostsTame1/29 8:30 AM ET: 3Q F Nonfarm Productivity QoQTame1/29 10:00 AM ET: Nov F Durable Goods Orders MoMTame1/30 8:30 AM ET: Dec Core PPI MoMHot- 2/2 9:45 AM ET: Jan F S&P Global Manufacturing PMI

- 2/2 10:00 AM ET: Jan ISM Manufacturing PMI

- 2/3 10:00 AM ET: Dec JOLTS Job Openings

- 2/4 9:45 AM ET: Jan F S&P Global Services PMI

- 2/4 10:00 AM ET: Jan ISM Services PMI

- 2/6 8:30 AM ET: Jan Non-farm Payrolls

- 2/6 10:00 AM ET: Feb P U. Mich. 1yr Inf Exp

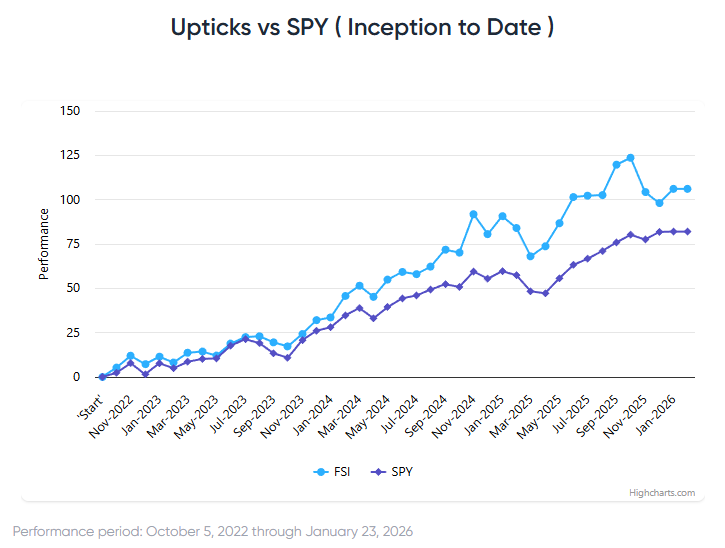

Stock List Performance

In the News

| More News Appearances |