Last week saw the final meeting of the Federal Open Markets Committee (FOMC) of the year, and the market response was positive – the S&P 500 ended Dec. 10 up 0.8% after the meeting. A Friday decline, sparked once again by the possibility of an AI bubble, led to the S&P 500 closing out the week ever-so-slightly lower, down by 0.4%. The Nasdaq Composite saw a sharper decline, down 1.4%.

The Fed’s 25 bps interest-rate cut (the third and final cut of 2025) was widely anticipated, so investors were primarily reacting to the post-meeting press conference by Fed Chair Jerome Powell, as well as the FOMC’s Summary of Economic Projections (SEP). The positive market response to both was arguably due to less hawkishness than many had feared.

Chair Powell’s current term is scheduled to end in May. It seems inconceivable that President Trump will nominate anyone who isn’t dovish to replace Powell, and that forms just a part of the constructive outlook for 2026 that Fundstrat Head of Research Tom Lee presented at his live webinar on Thursday. “There is a Fed put in place,” he told viewers.

As Lee elaborated, in 2023 and 2024, the S&P 500 notched gains of 20% or more. If stocks rally through the end of the year to the extent that Lee anticipates, we will get a third. Such gains over the past three years have fueled skepticism that stocks can rise yet another year in 2026, but as Lee reminded investors of what Art Cashin said: “Remember, bull markets don’t die of old age, they get killed by the Fed.” The likelihood is that next year will feature “a Fed that doesn’t want the bull market to end” rather than one intent on emulating a matador, in Lee’s view.

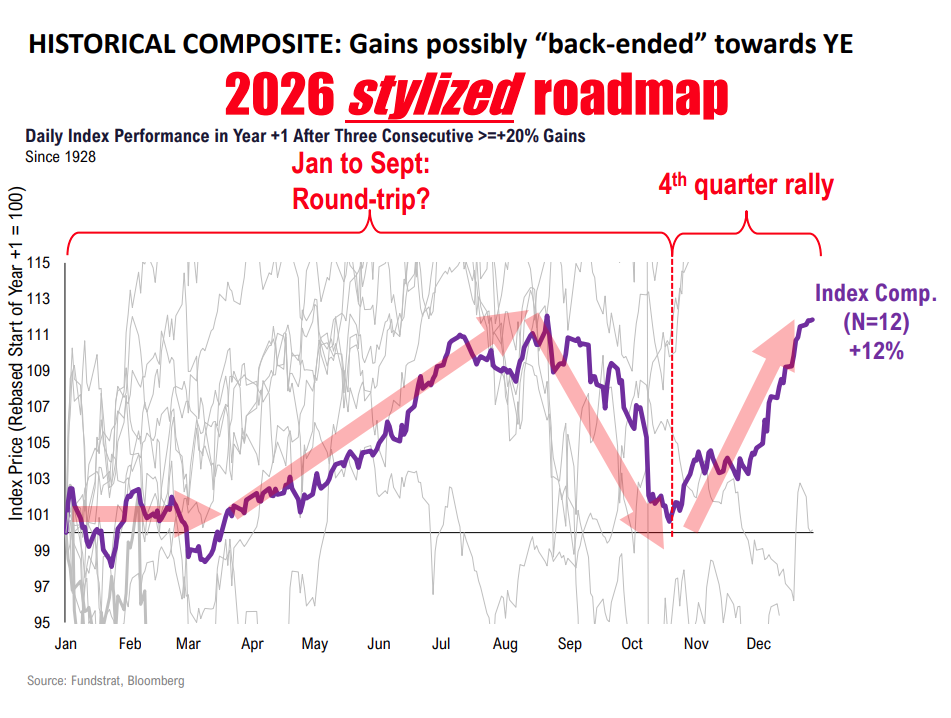

Lee’s base-case thesis addresses valuations, historical precedents, sentiment, and likely outcomes for economic and Federal Reserve policies. Ultimately, he sees the likelihood of another up year of gains in 2026 – but not necessarily smooth sailing. With a growing wall of uncertainty, including the ultimate fate of Trump’s tariff policies at the Supreme Court, several periods of 2026 could be challenging for investors. Nevertheless, Lee’s analysis sees the likelihood of the S&P 500 ultimately ending 2026 at 7,700.

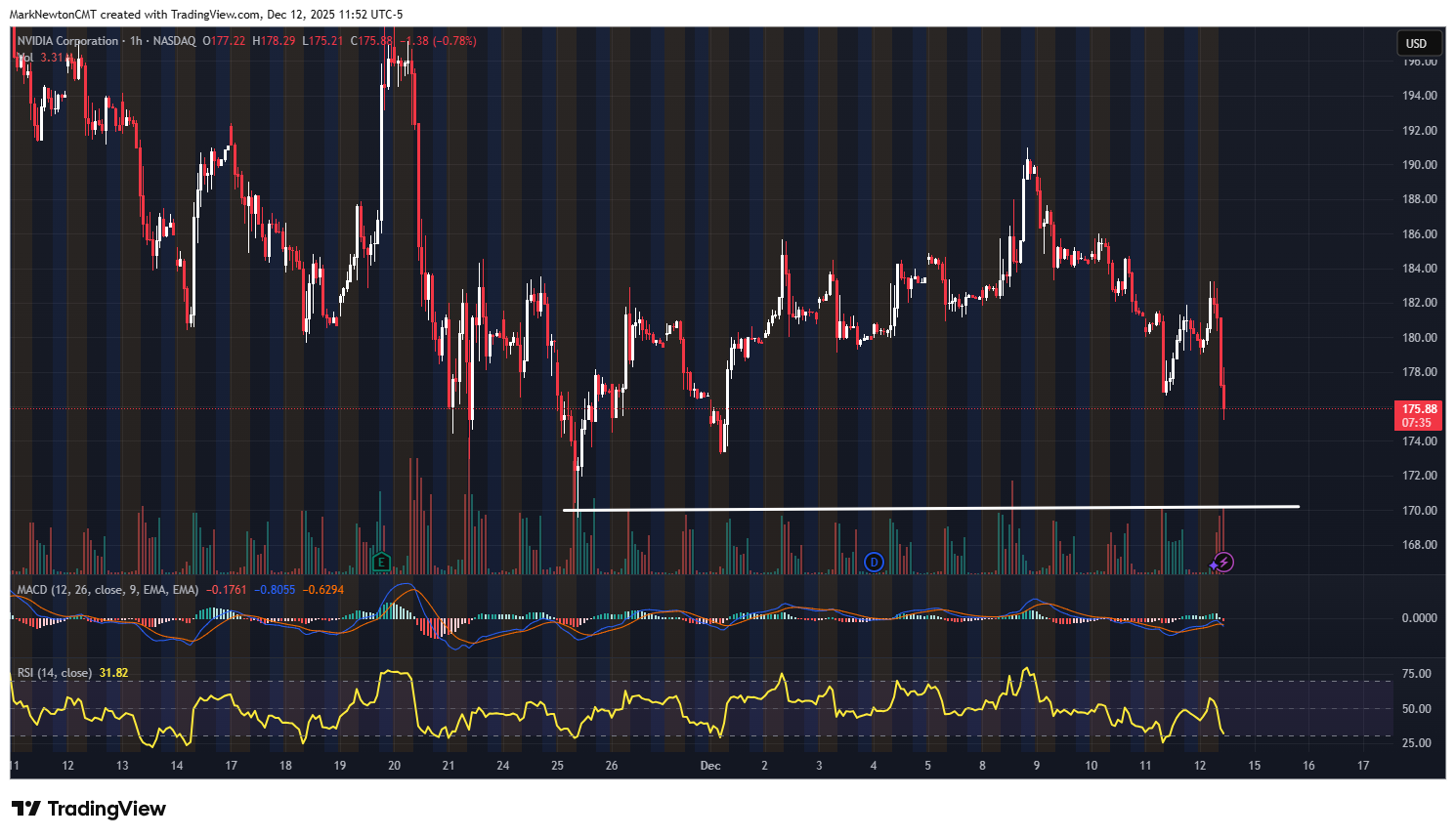

As for Head of Technical Strategy Mark Newton, he told us at our weekly research huddle that “I think that we will finish out the year on a good note.” He added, “my basic takeaway right now is that markets have improved in momentum and breadth in the last few weeks. It’s been a good rally since Nov. 20,” citing advances by industrials, financials, and small caps. “Those are all very big positives.” Newton is scheduled to present his 2026 outlook on Monday.

Chart of the Week

Despite a growing wall of worries, a multitude of factors has Fundstrat Head of Research Tom Lee seeing the likelihood of the S&P 500 ultimately ending 2026 at 7,700. Our Chart of the Week summarizes a possible path for 2026, in Lee’s view.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

12/8 11:00 AM ET: Nov NYFed 1yr Inf ExpTame12/9 6:00 AM ET: Nov Small Business Optimism SurveyTame12/9 10:00 AM ET: Oct JOLTS Job OpeningsMixed12/10 8:30 AM ET: 3Q ECI QoQTame12/10 2:00 PM ET: Dec FOMC DecisionMixed- 12/15 8:30 AM ET: Dec Empire Manufacturing Survey

- 12/15 10:00 AM ET: Dec NAHB Housing Market Index

- 12/16 8:30 AM ET: Nov Non-farm Payrolls

- 12/16 9:45 AM ET: Dec P S&P Global Services PMI

- 12/16 9:45 AM ET: Dec P S&P Global Manufacturing PMI

- 12/17 9:00 AM ET: Dec M Manheim Used Vehicle Index

- 12/18 8:30 AM ET: Dec Philly Fed Business Outlook

- 12/18 8:30 AM ET: Nov Core CPI MoM

- 12/18 11:00 AM ET: Dec Kansas City Fed Manufacturing Survey

- 12/18 4:00 PM ET: Oct Net TIC Flows

- 12/19 10:00 AM ET: Dec F U. Mich. 1yr Inf Exp

- 12/19 10:00 AM ET: Nov Existing Home Sales

Stock List Performance

In the News

| More News Appearances |