The S&P 500 edged higher to start a seasonally strong December. The broad-based index rallied 0.3% this week, while the Nasdaq Composite increased 0.9%. They’re off 0.3% and 1.6% from all-time highs, respectively.

Fundstrat Head of Research Tom Lee says that investors shouldn’t worry about a shaky start to December, as this is how November started, too, yet the index added 0.1% last month. “I think December is going to do even better than that,” Lee said in his Macro Minute videos.

Lee expects the S&P 500 will close out the year between 7,000 to 7,300 points. He pointed to data going back to 1950 suggesting that when stocks finish flat or down in November, then in all four instances you have a stronger December performance, with a median gain of 3.5%.

There’s six other reasons why he believes stocks will gain in December. First is because the Fed’s likely going to cut interest rates in December. Futures prices imply that there’s an 87% chance of a quarter-percentage point rate cut at next week’s meeting, up from 62% a month ago, according to the CME’s FedWatch tool.

Lee pointed out that the Fed is done with shrinking its balance sheet, also known as quantitative tightening. “That’s not only positive but quite dovish for stocks,” Lee said.

Second, the U.S. economy remains healthy and ISM continues to come below 50, suggesting that there is still pent up demand bubbling beneath the surface.

Fresh economic data released this week showed that the labor market strength deteriorated in November. Private employers lost 32,000 jobs, according to ADP, which was below expectations for a 40,000 increase. Meanwhile, on the inflation front, the Fed’s preferred inflation gauge rose 0.3% from a month ago, while the core number increased 0.2%. Both were in line with expectations.

Third, the government shutdown is now over, restoring visibility after a blackout period for economic data.

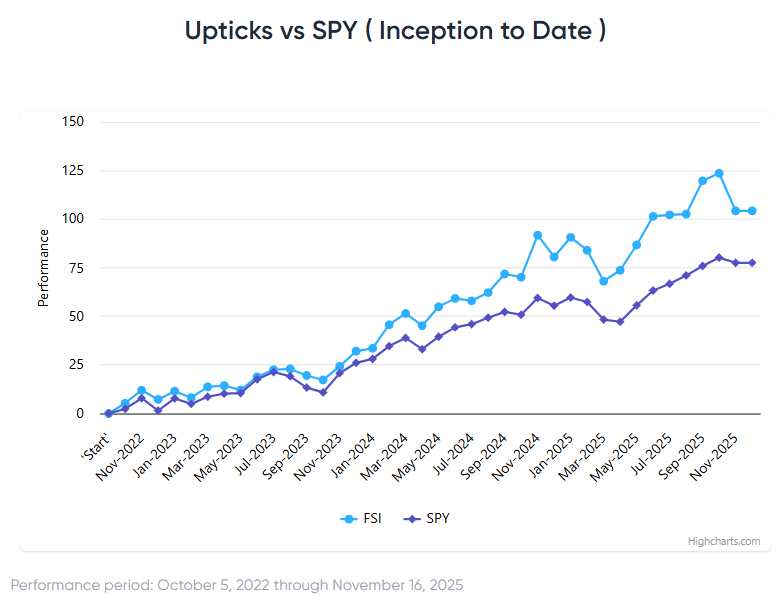

Fourth, many investors were on the offside during the earlier part of November when stocks were lagging. As it is, 2025 is turning out to be the worst year for fund manager performance with 78% trailing their benchmarks. That’s why Lee thinks there’s going to be “performance chasing” as the year wraps up.

Fifth, equities got oversold in November, with RSI falling to the lowest level since April’s Liberation Day-driven low when stocks bottomed.

Sixth, Lee pointed to strong December seasonals for why investors should expect a rally by the year-end.

Head of Technical Strategy Mark Newton has a similar view. While all-time highs from this past October could serve as resistance initially heading into the FOMC meeting, he acknowledged that it has been an excellent recovery after a difficult November.

He likes that various measures of broad-based market action based on the equal-weighted S&P 500, along with industrials, financials, and discretionary are all helping stocks “act a bit better.”

Chart of the Week

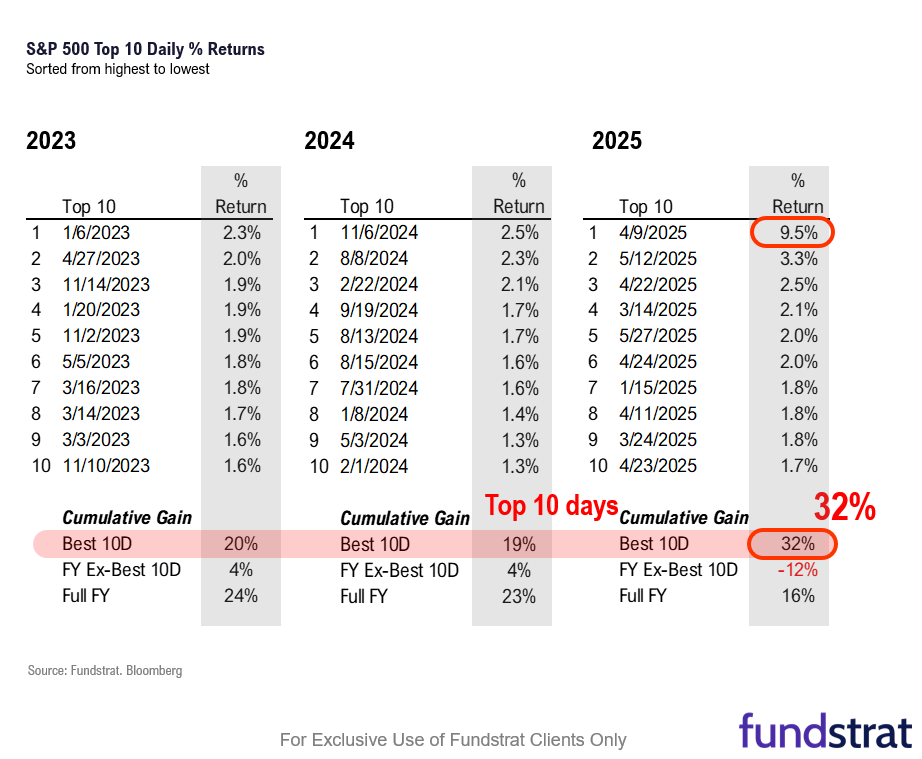

Fundstrat Head of Research Tom Lee cautioned investors against timing the market, referencing back to his 10 best days chart. Since 1928, the S&P 500 is up 8% a year, but if you exclude the 10 best days, then the index is down 13%. Putting that same stat in the context of this year, the 10 best days in 2025 are a cumulative gain of 32%, which is much bigger than 2024’s 19% and 2023’s 20% gain. Our Chart of the Week has more details. If you missed out on the 10 best days this year, then you’d be down 12%, which is why so many investors have been bearish this year. “It’s a reminder not to time the market,” Lee said. He added that “a lot of [10 best days] happened at the end of the year.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

12/1 9:45 AM ET: Nov F S&P Global Manufacturing PMITame12/1 10:00 AM ET: Nov ISM Manufacturing PMITame12/3 9:45 AM ET: Nov F S&P Global Services PMITame12/3 10:00 AM ET: Nov ISM Services PMITame12/5 9:00 AM ET: Nov F Manheim Used Vehicle IndexTame12/5 10:00 AM ET: Dec P U. Mich. 1yr Inf ExpTame12/5 10:00 AM ET: Sep Core PCE MoMTame- 12/8 11:00 AM ET: Nov NYFed 1yr Inf Exp

- 12/9 6:00 AM ET: Nov Small Business Optimism Survey

- 12/9 10:00 AM ET: Oct JOLTS Job Openings

- 12/10 8:30 AM ET: 3Q ECI QoQ

- 12/10 2:00 PM ET: Dec FOMC Decision

Stock List Performance

In the News

| More News Appearances |