We hope our U.S. readers had a happy Thanksgiving. Trading for the month of November has now concluded, and in our view, the story this month was one of resilience. The S&P 500 showed choppiness, and at one point, stocks were down as much as 6% from their October highs. Yet with the broad-based large-cap index surging 4.75% during the abbreviated final trading week of the month, we ended the month with stocks eking out a 0.39% gain.

November’s volatility caused some discomfort. Retail investor sentiment, as measured by the American Association of Individual Investors (AAII), remains net bearish at negative 10.7%. Nevertheless, Lee does not view November’s developments as disrupting his constructive expectations for December.

Among the reasons for his constructive view are strong seasonality and the growing likelihood of another rate cut from the Federal Reserve in December, with odds (as implied by Fed funds futures trading) rising to 86.9%. Lee also sees momentum as on the side of the bulls, noting that in the past 100 years, there have been six times in which stocks have been up six months in a row in October. In those historical precedents, “November and December rallied five out of six times, with a median gain of 5%,” he pointed out.

Much of the pain in November had to do with the travails of technology. The tech sector (XLK 0.56% ) sank more than 4.72% this month, led by big tech – though the month’s 2.92% decline of equal-weighted tech (RSPT 0.49% ) showed that it wasn’t just the Magnificent Seven that struggled.

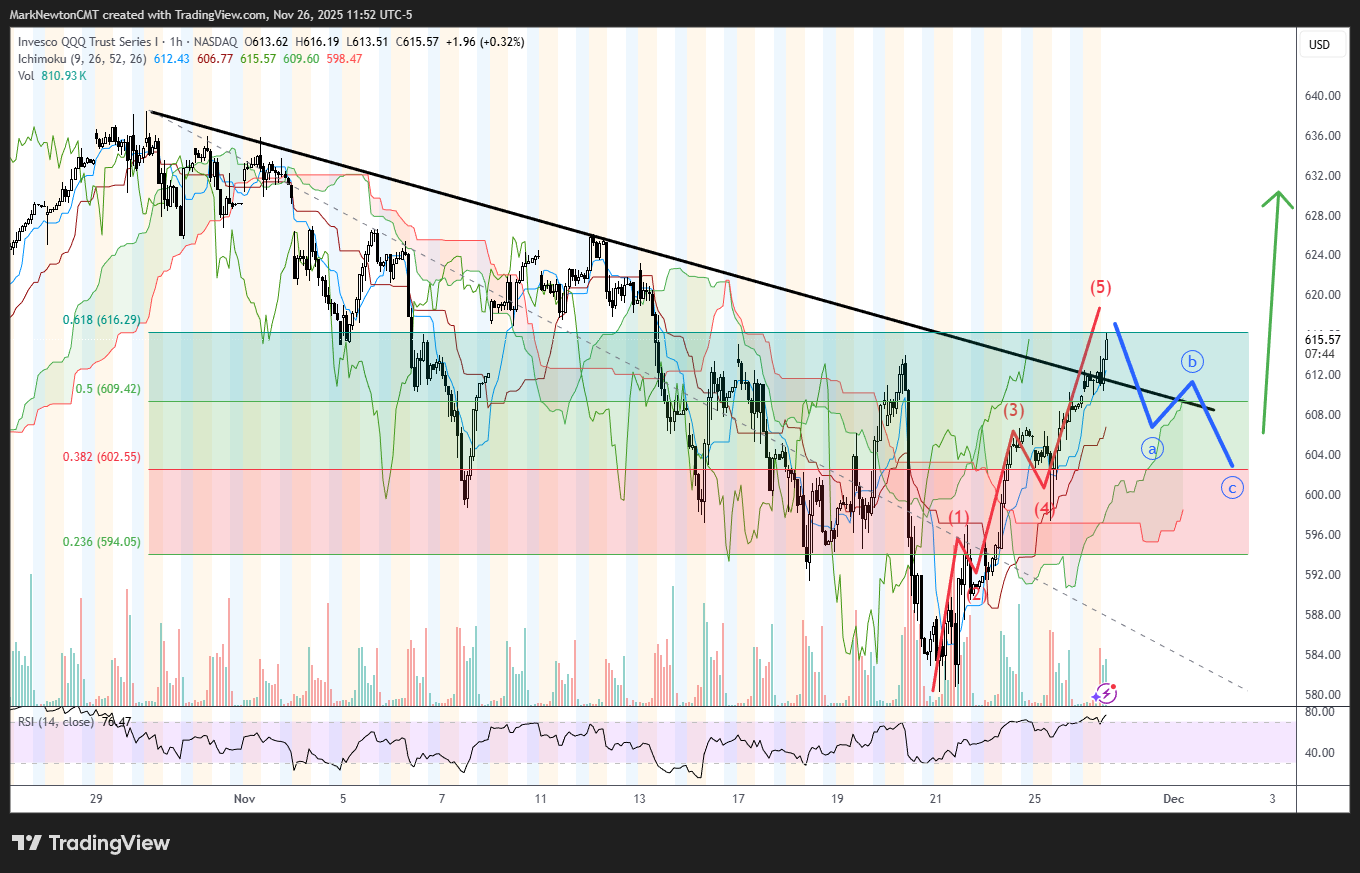

Yet there is arguably a silver lining to be seen. For months now, Head of Technical Strategy Mark Newton has repeated his concerns about deteriorating breadth, noting that gains by heavyweights like Nvidia were masking lackluster action in other sectors. With Nvidia stumbling despite beating expectations in its most recent earnings report this month (NVDA 1.03% fell 12.76% in November), other parts of the market stepped up – especially this week. “This week’s sharp rally is certainly helpful, as many different parts of the market participated in this move,” he told us.

Notably, Newton noted that market breadth “began to rebound […] in sectors like consumer discretionary, industrials, and financials.” With this in mind, Newton’s technical work leads him to suggest that “some broad-based rallying could be likely into year-end,” a view consistent with Lee’s outlook.

Chart of the Week

November’s choppiness included a temporary correction that worried investors, but as Fundstrat’s Tom Lee pointed out, such corrections have not been unusual this year. In fact, this is the seventh correction of at least 3% that markets have seen in 2025, as seen in our Chart of the Week. Lee maintains his constructive outlook for December, including a year-end target of 7,000 for the S&P 500.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

11/24 10:30 AM ET: Nov Dallas Fed Manuf. Activity SurveyTame11/25 9:00 AM ET: Sep S&P Cotality CS 20-City MoM SATame11/25 10:00 AM ET: Nov Conference Board Consumer ConfidenceTame11/25 10:00 AM ET: Nov Richmond Fed Manufacturing SurveyTame11/26 8:30 AM ET: Sep P Durable Goods Orders MoMTame11/26 8:30 AM ET: Oct P Durable Goods Orders MoMDelayed due to Shutdown11/26 8:30 AM ET: 3Q S GDP QoQDelayed due to Shutdown11/26 10:00 AM ET: Oct Core PCE MoMDelayed due to Shutdown11/26 10:00 AM ET: Oct New Home SalesDelayed due to Shutdown11/26 2:00 PM ET: Fed Releases Beige BookMixed- 12/1 9:45 AM ET: Nov F S&P Global Manufacturing PMI

- 12/1 10:00 AM ET: Nov ISM Manufacturing PMI

- 12/3 9:45 AM ET: Nov F S&P Global Services PMI

- 12/3 10:00 AM ET: Nov ISM Services PMI

- 12/4 8:30 AM ET: Oct Trade Balance

- 12/5 9:00 AM ET: Nov F Manheim Used Vehicle Index

- 12/5 10:00 AM ET: Dec P U. Mich. 1yr Inf Exp

Stock List Performance

In the News

| More News Appearances |