Investors have been nervous and uncertain in the past two weeks. At our weekly research huddle, Fundstrat Head of Data Science Ken Xuan suggested that this was an indirect result of the federal government shutdown, which has largely cut off the flow of macroeconomic data. “As time goes by, the more time we go, the more uncertainty we feel. That’s because we just don’t have data to know where we are,” he said.

It could be argued that Friday morning’s release of September CPI data removed much of that uncertainty, though it must have helped that the numbers came in dovish – lower than consensus expectations. That bolstered expectations of another rate cut when the Federal Open Market Committee meets next Wednesday, and the results could be seen in a range of indices – the S&P 500, the Nasdaq Composite, and the DJIA, as well as the small-cap Russell 2000. All four posted positive weeks, with the Russell 2000 leading the way with a 2.5% weekly gain.

Yet not all of the choppiness from the past two weeks has been due to the lack of fresh data. Fundstrat’s Head of Research Tom Lee attributes much of the rangebound action to a sort of PTSD (post-traumatic stress disorder). U.S.-China trade tensions remained elevated this week as the U.S. threatened to ban exports to China of any products that contain or were made with U.S. software. As Lee suggested, this gave investors “PTSD from earlier this year” when the trade war began.

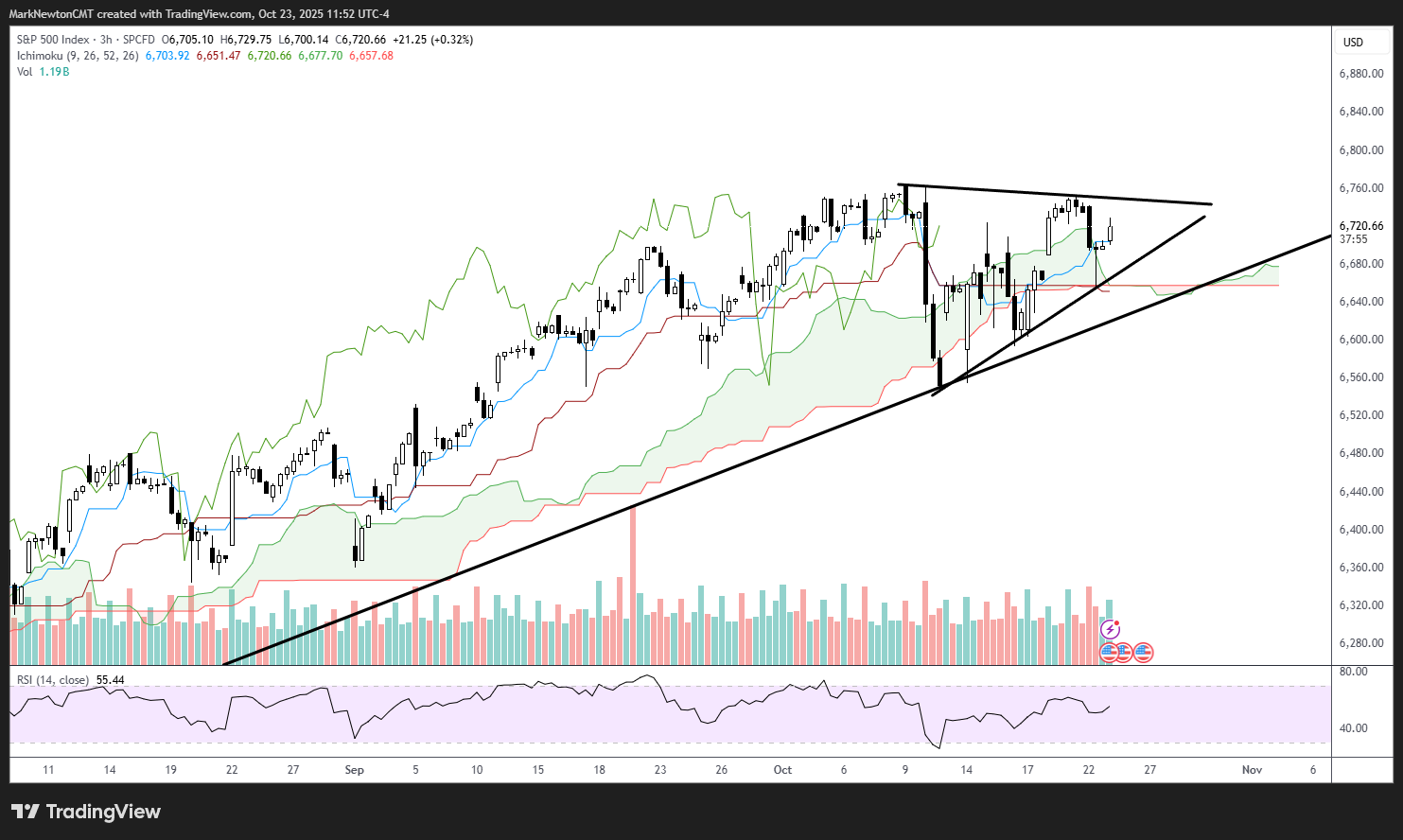

Head of Technical Strategy Mark Newton remains constructive. Asked to comment on the press speculation that we are currently in a market or AI bubble, he said, “I’ve heard the term ‘bubble’ so much in the last couple weeks, and it’s a very action-oriented word that makes us all pay attention. But honestly, technical trends haven’t really given us any reason to be concerned.”

The same goes for recent choppiness in markets. “I don’t care if the market’s been sort of choppy and range-bound. In my view, despite the choppy short-term trends, longer-term trends are intact. And with sentiment remaining subdued, it seems to me that the path of least resistance remains to the upside over the next couple weeks.”

What about valuations, Newton was asked during our weekly research huddle. “Yes, everybody’s saying things are expensive. Well, compared to what? How do we know how to value AI?” he asked rhetorically. For him, metrics like the number of stocks near 12-month highs matters more. It could be bearish, he suggested, “if that percentage starts to roll over sharply,” but as of right now, it isn’t.

Lee concurs. The case for a rate cut from the FOMC arguably strengthened this week, and the confirmation that President Trump and China’s Xi Jinping will meet next week on Thursday alleviates yet another concern that has been bothering markets. Thus, Lee continues to view any dips that might emerge as buyable.

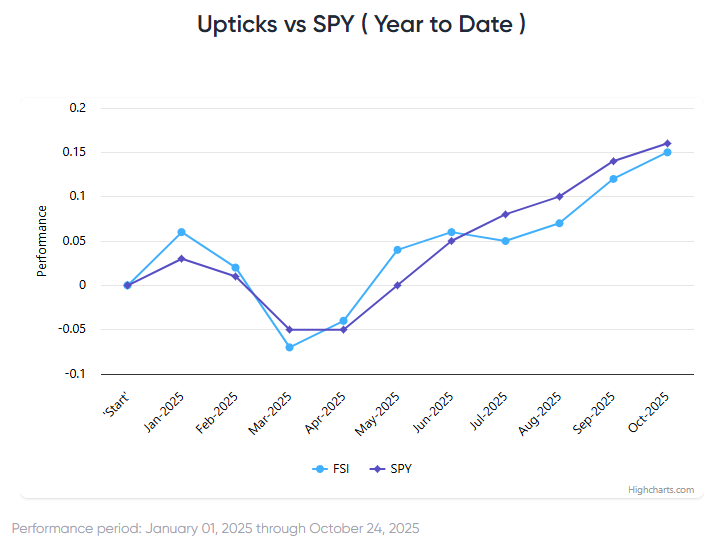

Chart of the Week

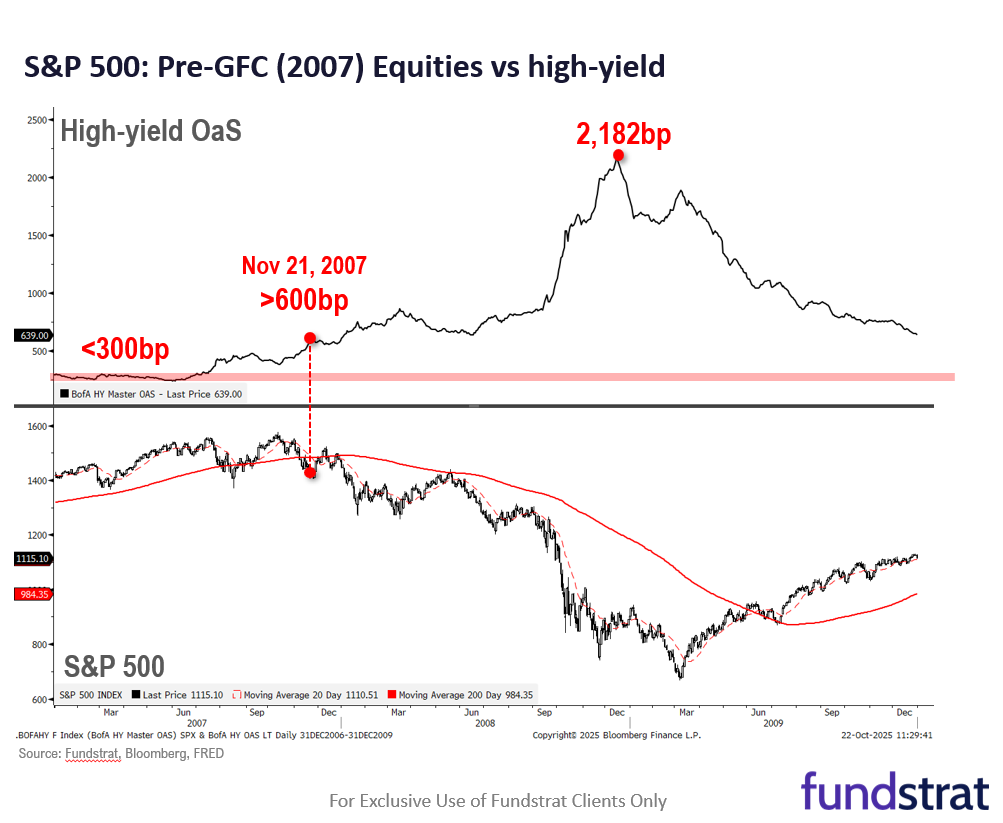

In the wake of the Tricolor and First Brands collapses as well as reports of losses by lenders like Western Alliance and Zions Bank, some market participants have developed flashbacks to the 2008 global financial crisis (GFC). As Bank of England Governor Andrew Bailey told MPs, “If you were involved [as a regulator] before the [GFC] and during it,” recent events had set off “alarm bells.” Fundstrat’s Tom Lee remains largely unworried on that front. As he highlighted again this week, “if there are credit problems brewing, we should see it in high-yield spreads, but it’s hardly budged.” As he reminded us and as we see in our Chart of the Week, before the market topped in 2007, high-yield spreads were just under 300 bps, just about where they are today. On Nov. 21, 2007, about a month after the market topped, spreads doubled to 600. To Lee, that rapid doubling in the high-yield spread back in 2007 “was a warning sign,” so those worried about a possible GFC redux might wish to keep an eye out for a similar doubling re-emerging.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

10/23 8:30 AM ET: Sep Chicago Fed Nat Activity IndexDelayed due to Shutdown10/23 10:00 AM ET: Sep Existing Home SalesTame10/23 11:00 AM ET: Oct Kansas City Fed Manufacturing SurveyTame10/24 8:30 AM ET: Sep Core CPI MoMTame10/24 9:45 AM ET: Oct P S&P Global Services PMITame10/24 9:45 AM ET: Oct P S&P Global Manufacturing PMITame10/24 10:00 AM ET: Oct F U. Mich. 1yr Inf ExpTame10/24 10:00 AM ET: Sep New Home SalesDelayed due to Shutdown- 10/27 8:30 AM ET: Sep P Durable Goods Orders MoM Likely delayed due to Shutdown

- 10/27 10:30 AM ET: Oct Dallas Fed Manuf. Activity Survey

- 10/28 9:00 AM ET: Aug S&P CS home price 20-City MoM

- 10/28 10:00 AM ET: Oct Conference Board Consumer Confidence

- 10/28 10:00 AM ET: Oct Richmond Fed Manufacturing Survey

- 10/29 2:00 PM ET: Oct FOMC Decision

- 10/30 8:30 AM ET: 3Q A GDP QoQ Likely delayed due to Shutdown

- 10/31 8:30 AM ET: 3Q ECI QoQ Likely delayed due to Shutdown

- 10/31 8:30 AM ET: Sep Core PCE MoM Likely delayed due to Shutdown

Stock List Performance

In the News

| More News Appearances |