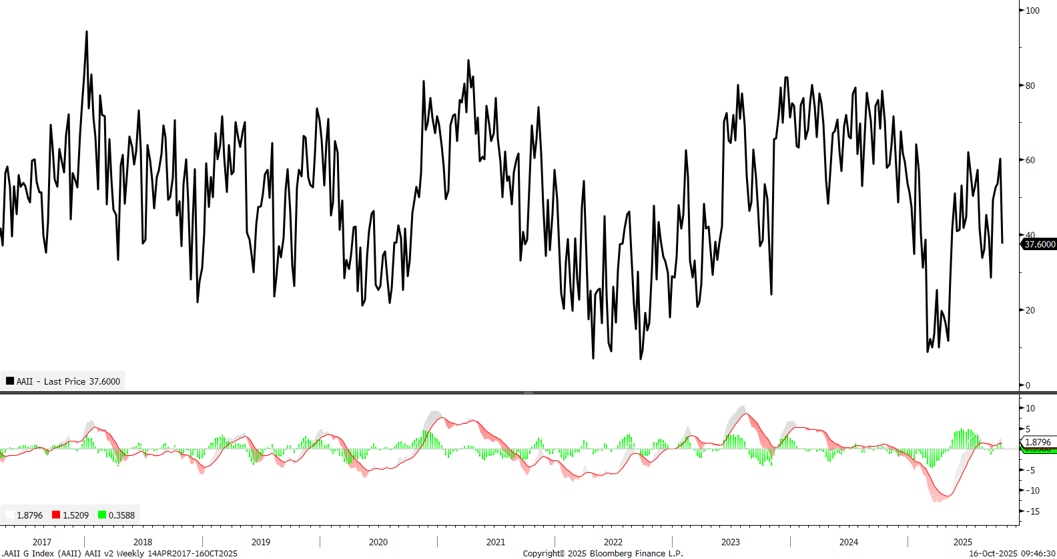

Elevated trade tensions between the U.S. and China continued to occupy investors’ attention last week. Sentiment, as measured by the American Association of Individual Investors (AAII) weekly survey, had previously begun to look at least slightly bullish, only to revert back to net bearish last week. Fundstrat Head of Technology Tom Lee and Head of Technical Strategy Mark Newton agree that this is good for stock investors. “I view this as contrarian positive,” Lee wrote, pointing out that “if conviction wavers easily, that is a sign that sentiment is not ebullient.”

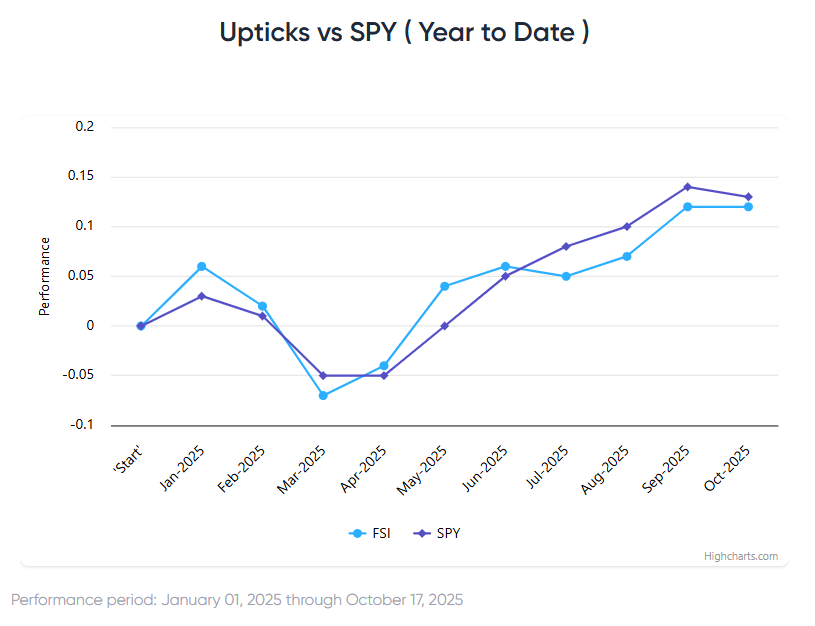

Further supporting Lee’s bullish view for the final quarter of the year is the underperformance of active fund managers during the first three quarters of the year, with only 22% of them beating their benchmarks, according to data compiled by Jefferies. This represents some of the worst performance by this group in decades. That means “there’s pressure for funds to outperform into year end,” Lee observed. For underperforming managers to do that, they will likely need to move cash off the sidelines and put it to work, and that’s arguably constructive for the markets.

Small Caps

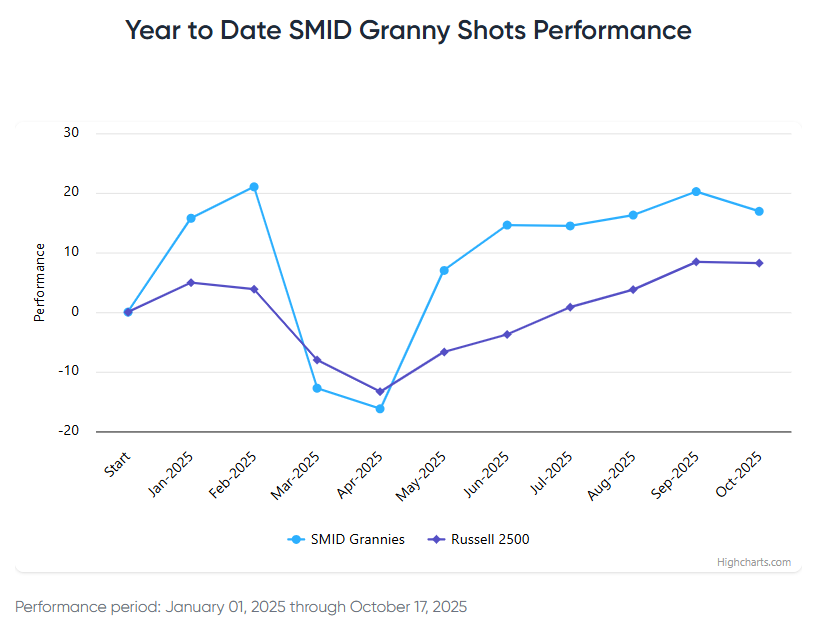

As followers of our work know, Lee has long been overweight small caps, seeing the sector as both undervalued and especially well-positioned to benefit from a Fed rate-cut cycle that now looks to have begun. Fed Chair Jerome Powell on Tuesday made remarks supportive of that thesis, reiterating the message that inflation remained largely under control while “downside risks to employment” had risen.

As Mark Newton observed at our weekly huddle last week, “small caps officially have broken out,” pushing through to new all-time highs on Wednesday before settling back slightly on Friday. As a sector, small caps (IWM 0.74% ) had a good week on an absolute basis, advancing 2.38% to close on Friday at 243.45. Yet the sector’s relative performance has been impressive as well. While small-caps have outperformed equal-weighted S&P 500 (RSP 0.52% ) for the last six months, as Newton observed, “what many people haven’t realized is that when you look at the larger ratios of IWM versus SPY, we’ve now broken out of the entire four-year downtrend since 2021.” On a month-to-date basis, small caps are now also outperforming both the S&P 500 and the Mag Seven.

To be sure, some of that outperformance has resulted from recent underperformance of Mag Seven stocks like Meta, Microsoft, and even Nvidia. Nevertheless, Newton views this week’s small-cap action as intermediate-term bullish. “I think this persists into the year-end,” he said. Aligning with Lee’s outlook on the sector, Newton said: “It’s right to be long small caps. It’s right to overweight small caps versus large caps.”

Chart of the Week

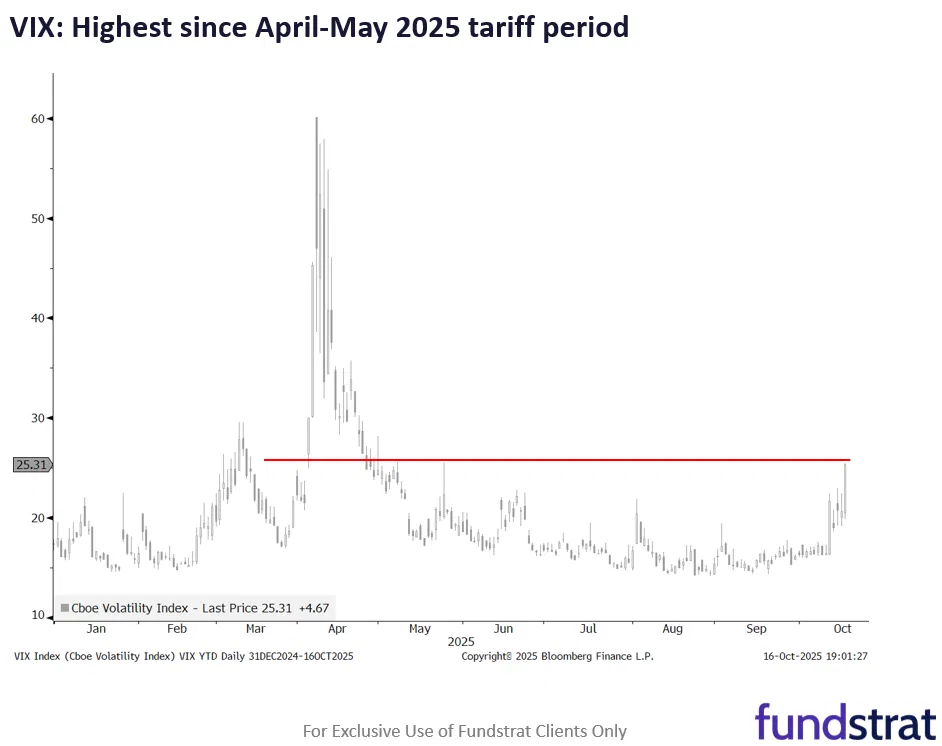

Volatility, which spiked after President Trump’s truculent response to China’s intensified rare-earth export restrictions, continued to rise this week as China reacted in turn. Worries over the state of U.S. credit markets after the collapses of First Brands and Tricolor also contributed to uncertainty As our Chart of the Week shows, VIX is now at its highest level since President Trump launched his tariff broadside in April and May – though still significantly lower than its springtime peak. Still, history shows that VIX surges greater than 30%, as we saw on Oct. 10, are often a sign of a local bottom, with media gains for the S&P 500 one month later at 2.8%. This week’s higher volatility does not change Lee’s view.

Recent ⚡ FlashInsights

- this means there was “cash raising” into today

- with this pressure behind us, stocks can lift

FS Insight Video: Weekly Highlight

Key incoming data

10/14 6:00 AM ET: Sep Small Business Optimism SurveyTame10/15 8:30 AM ET: Oct Empire Manufacturing SurveyTame10/15 2:00 PM ET: Fed Releases Beige BookMixed10/16 8:30 AM ET: Oct Philly Fed Business OutlookTame10/16 8:30 AM ET: Sep Core PPI MoMDelayed due to Shutdown10/16 8:30 AM ET: Sep Retail SalesDelayed due to Shutdown10/16 10:00 AM ET: Oct NAHB Housing Market IndexTame10/17 9:00 AM ET: Oct M Manheim Used Vehicle IndexTame10/17 4:00 PM ET: Aug Net TIC FlowsDelayed due to Shutdown- 10/23 8:30 AM ET: Sep Chicago Fed Nat Activity Index

- 10/23 10:00 AM ET: Sep Existing Home Sales

- 10/23 11:00 AM ET: Oct Kansas City Fed Manufacturing Survey

- 10/24 8:30 AM ET: Sep Core CPI MoM

- 10/24 9:45 AM ET: Oct P S&P Global Services PMI

- 10/24 9:45 AM ET: Oct P S&P Global Manufacturing PMI

- 10/24 10:00 AM ET: Oct F U. Mich. 1yr Inf Exp

- 10/24 10:00 AM ET: Sep New Home Sales

Stock List Performance

In the News

| More News Appearances |