For close to half a year, Fundstrat Head of Research Tom Lee has been referring to the V-shaped rally we’ve experienced since April as one of the “most hated” in his memory. Last week, we saw some evidence that the “hate” was subsiding ever-so-slightly (see our Chart of the Week below).

Then on Friday, U.S.-China trade tensions intensified, with President Trump’s unambiguous response to China’s latest decision to intensify export restrictions on rare-earth materials. This was followed by a significant dip in both the S&P 500 and Nasdaq Composite that led both indices to finish the week in the red. The S&P 500 suffered its biggest one-day decline since April 21.

“I don’t want to be glib and say ‘hey this is nothing,'” Lee remarked on CNBC, but he remains largely unfazed. As he noted, the structural tailwinds that form the basis for his intermediate- and long-term constructivism are unlikely to be affected by a rare-earth dispute with China, and dips in 2025 have tended to be bought. Absent any structural change, Lee does not see why this time needs to be different. That doesn’t mean markets necessarily bottomed on Friday, but to Lee, “this pullback is a buying opportunity.”

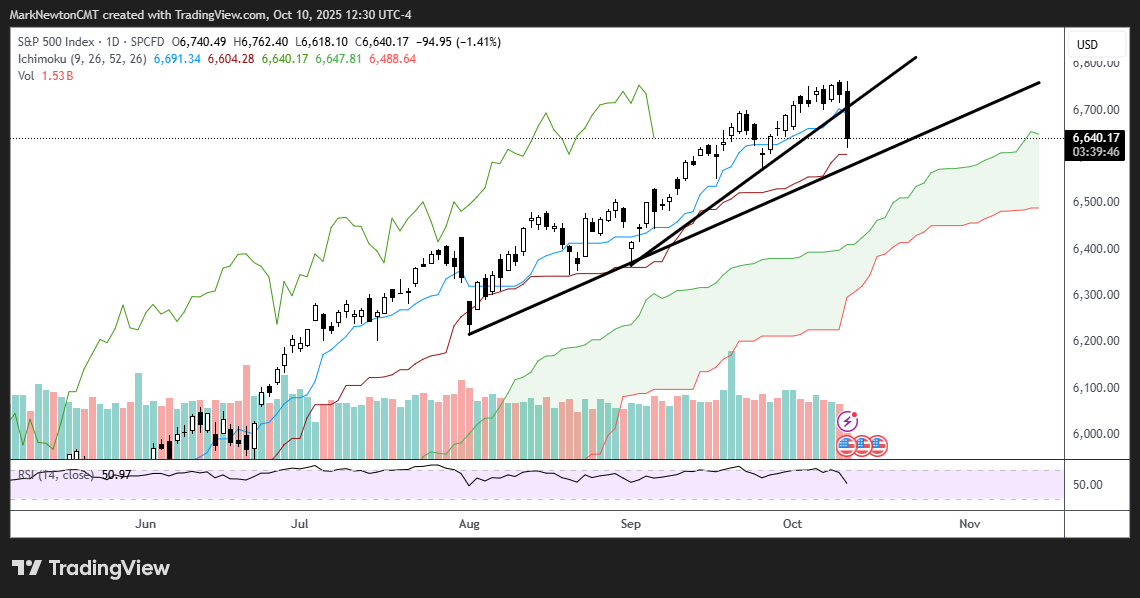

For his part, Head of Technical Strategy Mark Newton suggested the possibility that Friday’s break of 6569, which technically violates late September lows along with the ongoing uptrend, might signify that a Fall correction had gotten underway, though this is still unconfirmed at the moment. Even if so, however, “I believe that a pullback […] should be healthy for U.S. equities ahead of a further push higher into year-end,” he wrote.

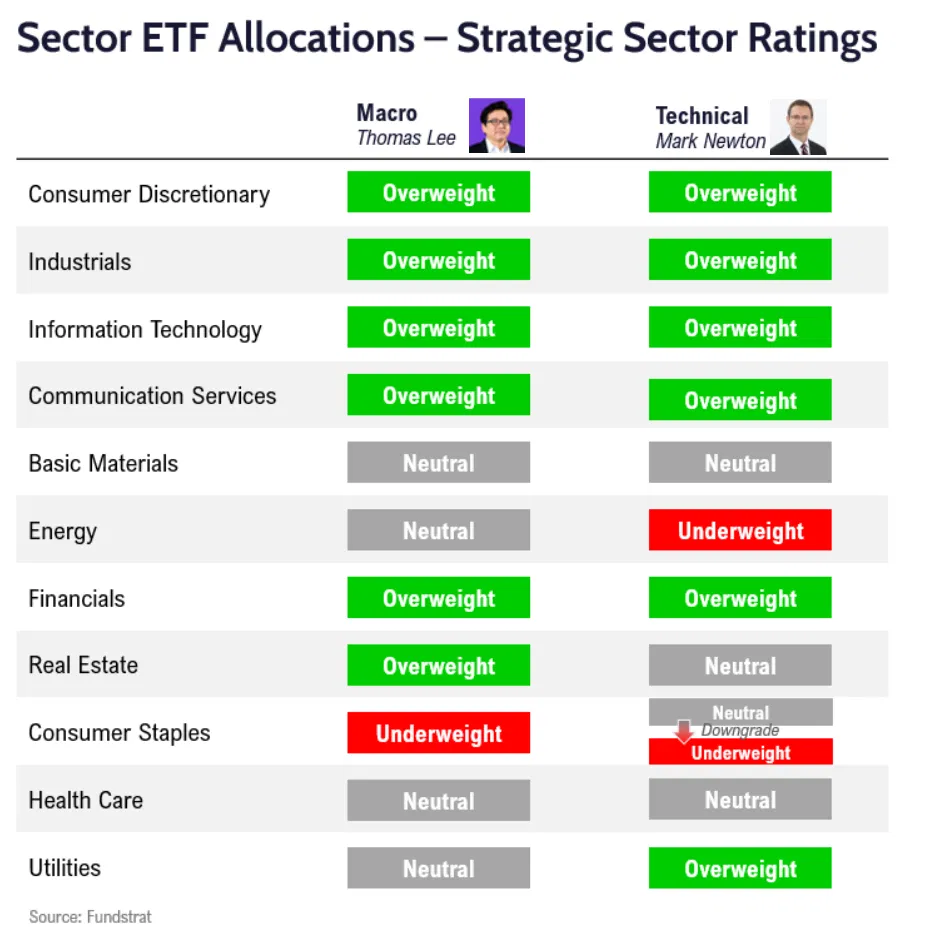

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the October 2025 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

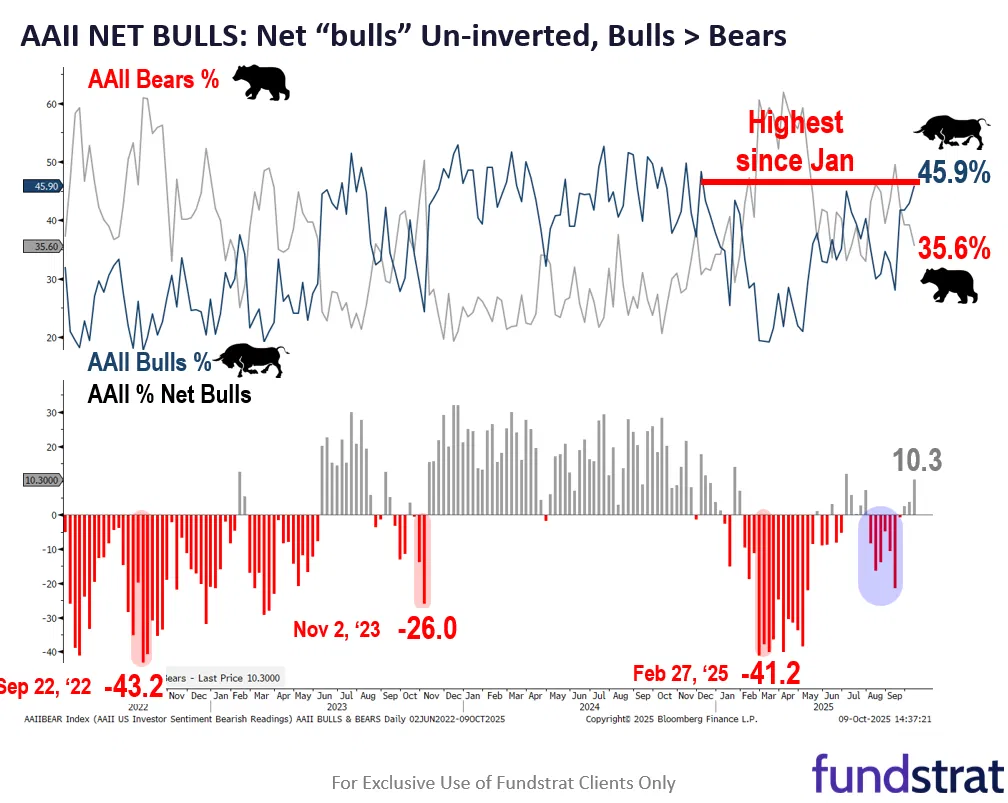

Chart of the Week

The latest American Association of Individual Investors (AAII) survey showed sentiment uninverting: The bullish reading rose to 45.9%, the highest since January, flipping the sentiment metric net bearish to net bullish (+10.3%). For those inclined toward contrarianism, however, Lee remarked, “I don’t see the flip to positive as that consequential.” As shown by our Chart of the Week, the extent of net bullishness is still at or below even levels seen for much of 2024, a year in which the S&P 500 rose 23%. In any case, the re-intensified trade tensions between the U.S. and China that emerged on Friday also call into question whether this uninversion will endure.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

10/7 8:30 AM ET: Aug Trade BalanceDelayed due to Shutdown10/7 9:00 AM ET: Sep F Manheim Used Vehicle IndexTame10/7 11:00 AM ET: Sep NYFed 1yr Inf ExpTame10/8 2:00 PM ET: Sep FOMC Meeting MinutesMixed10/10 10:00 AM ET: Oct P U. Mich. 1yr Inf ExpTame- 10/14 6:00 AM ET: Sep Small Business Optimism Survey

10/15 Wed 8:30 AM ET: Sep Core CPI MoM 0.32%eDelayed due to Shutdown- 10/15 8:30 AM ET: Oct Empire Manufacturing Survey

- 10/15 2:00 PM ET: Fed Releases Beige Book

- 10/16 8:30 AM ET: Oct Philly Fed Business Outlook

10/16 8:30 AM ET: Sep Core PPI MoMDelayed due to Shutdown10/16 8:30 AM ET: Sep Retail SalesDelayed due to Shutdown- 10/16 10:00 AM ET: Oct NAHB Housing Market Index

- 10/17 9:00 AM ET: Oct M Manheim Used Vehicle Index

10/17 4:00 PM ET: Aug Net TIC FlowsDelayed due to Shutdown

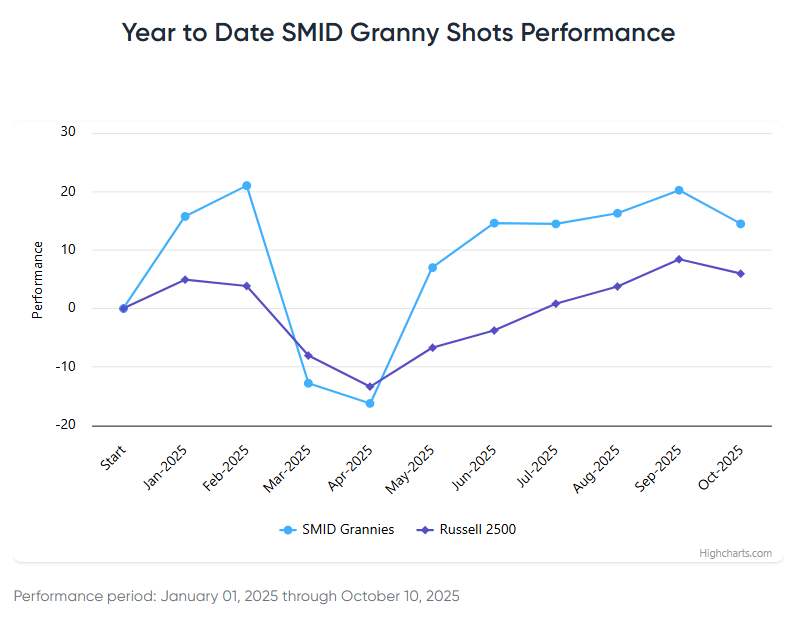

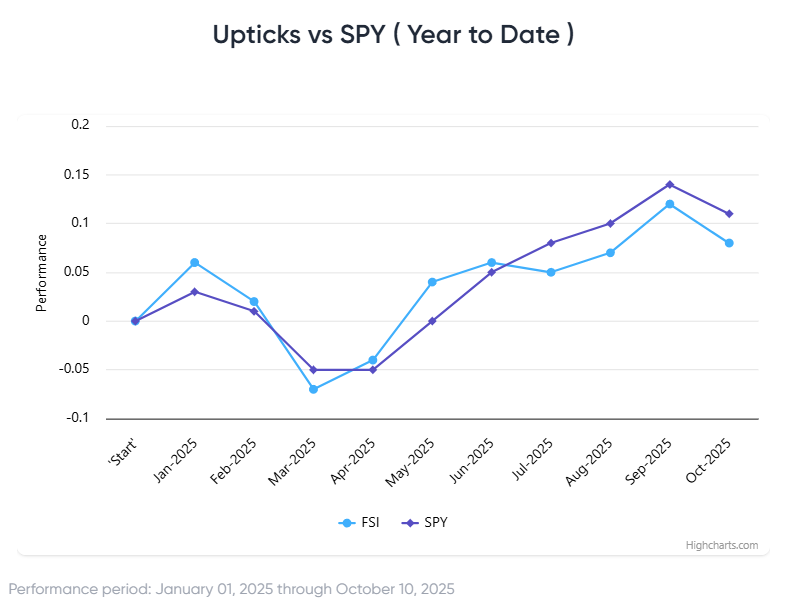

Stock List Performance

In the News

| Start Your 30-Day Free Trial Now! More News Appearances |