The third quarter ended last Tuesday with the S&P 500 having hit 23 records as it climbed 7.8%. The broad-based index then proceeded to set fresh records on Thursday and brush up against yet another record on Friday before settling slightly to close the week in the green, at 6,715.79.

Head of Technical Strategy Mark Newton said that the S&P 500’s new records have positive technical implications for stocks. “This sets up for a push up to 6,749 in the short run, and potentially near 6,800 in mid-October before some consolidation starts to get underway.” He reiterated, “It looks technically right to trust that this rally has more to go.”

Yet perhaps the biggest headline this week was the federal government shutdown, which began at 12:01 a.m. right as Wednesday began. As Fundstrat’s Washington Policy Strategist Tom Block and Head of Data Science Ken Xuan noted, history suggests that government shutdowns do not tend to have lasting negative effects on the financial markets, even though some limited, short-term panic selling can take place at first.

That does not mean there’s no impact for investors, however. Friday was supposed to be the day the Bureau of Labor Statistics released the Nonfarm Payrolls numbers (aka the jobs report) for September. Thanks to the shutdown, this didn’t happen.

Fundstrat Head of Research Tom Lee suggested that if the shutdown continues past the next Federal Open Market Committee meeting on Oct.29 (the last shutdown in 2018 went on for 35 days), the lack of BLS jobs data could end up pushing the Fed in a dovish direction, which arguably would be good for stocks. Without any new jobs data, “the Fed most likely would have to rely on the August jobs report (weak),” and this would arguably require them to act with caution, he suggested. Another dovish consideration is that “the economy suffers from a shutdown, from lost activity,” Lee wrote, and the Fed is likely to take this into account as well.

In summation, Lee wrote: “I would not lean ‘bearish’ because of shutdowns. […] Shutdowns have rarely created lasting impacts on equities. There is a strong seasonal tailwind underway, and the upside is higher given the Fed is dovish.”

Chart of the Week

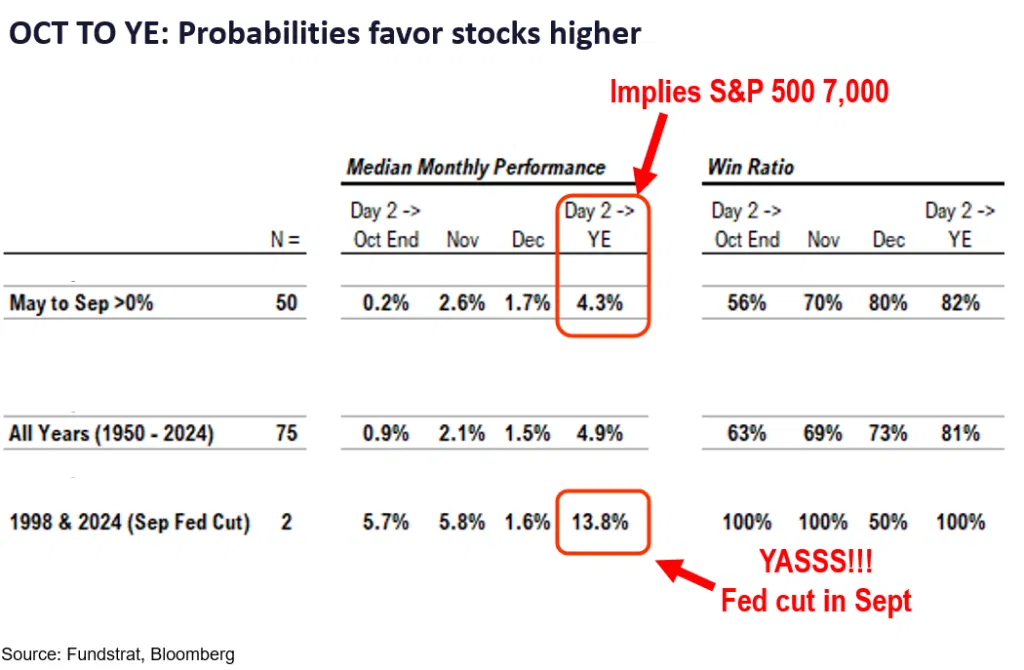

Amidst a rousing start to the fourth quarter, Fundstrat Head of Research Tom Lee noted that Q4 has historically been a strong period for stocks. Since 1950, stocks have notched a median gain of 4.9% in the period from October through December, with a win ratio of 81%. Two historical instances are particularly noteworthy: In both 1998 and 2024, the Federal Reserve cut rates in September after having been on pause since the beginning of the year – just as we’ve seen this year. The average Q4 gains in those precedent years is 13.8%. Details can be found in our Chart of the Week above.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

9/29 10:30 AM ET: Sep Dallas Fed Manuf. Activity SurveyTame9/30 10:00 AM ET: Sep Conference Board Consumer ConfidenceTame9/30 10:00 AM ET: Aug JOLTS Job OpeningsTame10/1 9:45 AM ET: Sep F S&P Global Manufacturing PMITame10/1 10:00 AM ET: Sep ISM Manufacturing PMITame10/2 10:00 AM ET: Aug F Durable Goods Orders MoMDelayed due to Shutdown10/3 8:30 AM ET: Sep Non-farm PayrollsDelayed due to Shutdown10/3 9:45 AM ET: Sep F S&P Global Services PMITame10/3 10:00 AM ET: Sep ISM Services PMITame- 10/7 8:30 AM ET: Aug Trade Balance

- 10/7 9:00 AM ET: Sep F Manheim Used Vehicle Index

- 10/7 11:00 AM ET: Sep NYFed 1yr Inf Exp

- 10/8 2:00 PM ET: Sep FOMC Meeting Minutes

- 10/10 10:00 AM ET: Oct P U. Mich. 1yr Inf Exp

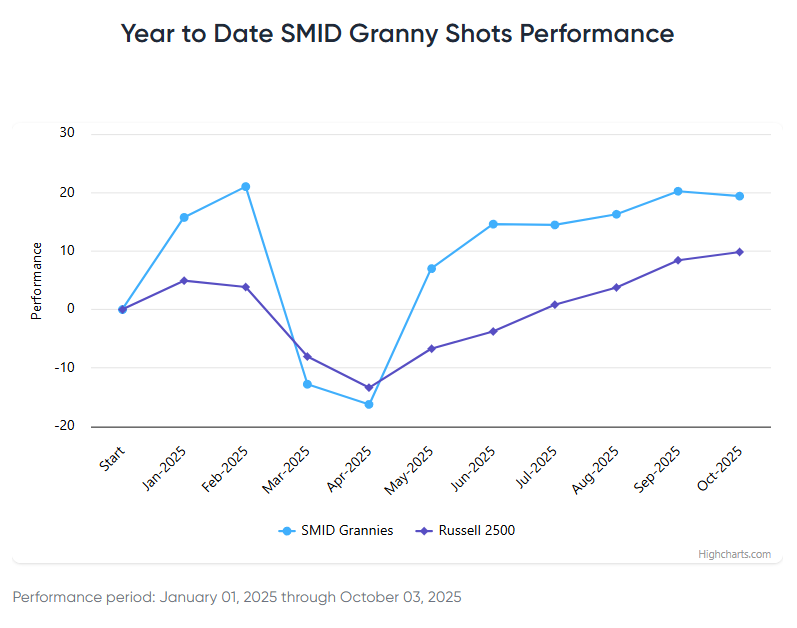

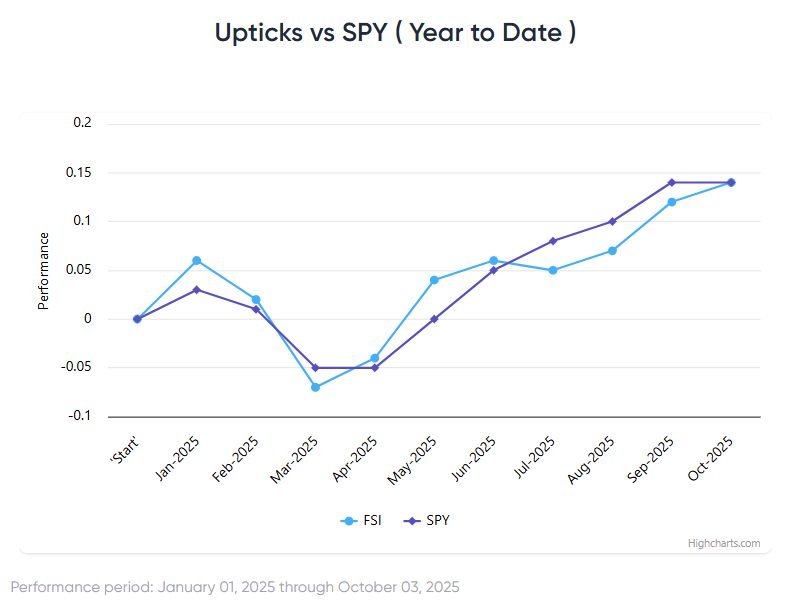

Stock List Performance

In the News

| More News Appearances |