Stocks set multiple new all-time highs last week, including on Friday when the S&P 500 closed at 6,388.64. Despite the broader index’s recent advances, sentiment remains restrained. Fundstrat Head of Research Tom Lee noted that anecdotally, “at Fundstrat, the feedback continues to be that many investors are skeptical of gains.”

Head of Technical Strategy Mark Newton concurred. “If you look at the overall levels of sentiment, it’s still pretty subdued,” he noted at our weekly research huddle. “We’re certainly not bearish anymore,” he acknowledged, “but we’re pretty much in neutral. We haven’t really gone to bullish territory yet, and we’re not really all that speculative.”

Even disregarding the new records set by the broader index, “the market continues to trade very well,” in Newton’s view. “In the last week, we’ve seen really good performance out of many of these groups that have not shown performance in quite some time. In general, this is a broadening out of the rally,” he said. Notably, “on an equal-weighted basis, tech actually hasn’t done as well as the others. There are other sectors that have actually started to outperform tech, which I think is a positive.”

We are about a third of the way into earnings season, and perhaps two of the most watched earnings reports last week were Alphabet (GOOG 1.24% ) and Tesla (TSLA -1.50% ). Tesla, of course, had faced some challenges since the beginning of the year, and many investors appeared to interpret Elon Musk’s remarks as subdued. From a technical perspective, however, Newton noted that “despite the gap down the day after its earnings report, I see the stock being a good intermediate-term risk/reward for the second half of this year.” As a caveat, he warned that a break of July lows at $288.77 might temporarily affect his current constructive view of the stock, but “at present, I don’t expect this to happen.”

As for Alphabet, the tech giant surged after reporting a 14% increase in second-quarter revenue. Investors appeared to find much to like in chief executive Sundar Pichai’s remarks, which included upbeat views about AI supporting the company’s cornerstone search-engine revenues and a $10 billion increase in its 2025 capex forecast to $85 billion.

That’s consistent with Lee’s continued view that AI demand remains strong, and AI itself is a multi-decade story. After attending a Hill & Valley Forum co-hosted by the All-In podcast (where President Trump on Wednesday signed three executive orders regarding AI), Lee also noted that, “To me, the key takeaway is that there are many instances of AI helping existing workers multiply their skills, so perhaps AI will not replace as many jobs as feared.” Looking into next week, with the release of June PCE data, a rate decision from the Federal Open Market Committee, and 163 earnings reports on deck, Lee “[expects] equities to end July on a high note. We do not think the final weeks of July are a concern.”

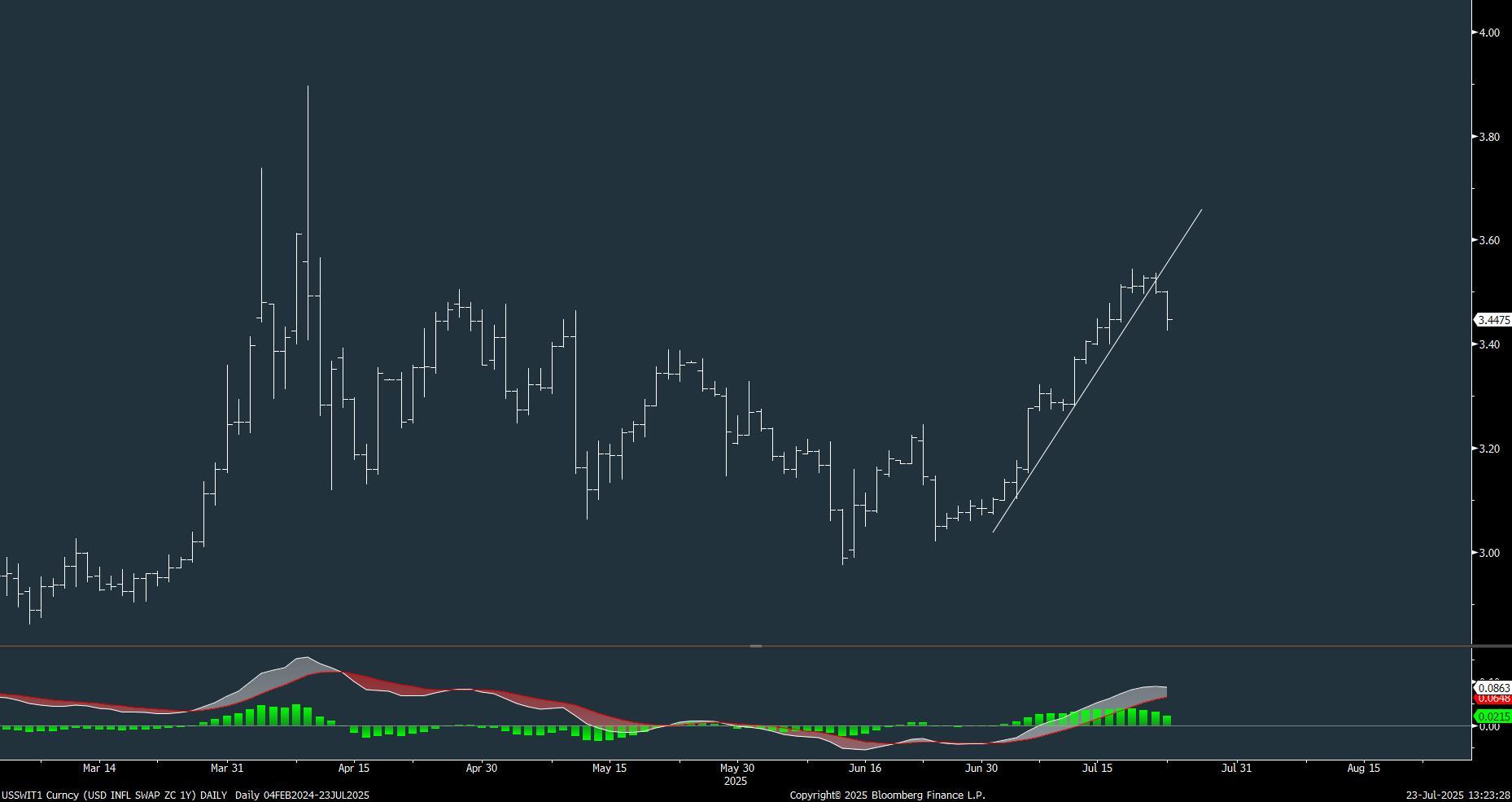

Chart of the Week

Although it was a relatively light week for fresh macroeconomic data, markets were buoyed by the announcement of three trade deals — Indonesia, the Philippines, and Japan, as seen in our Chart of the Week.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

7/22 10:00 AM ET: Jul Richmond Fed Manufacturing SurveyTame7/23 10:00 AM ET: Jun Existing Home SalesTame7/24 8:30 AM ET: Jun Chicago Fed Nat Activity IndexTame7/24 9:45 AM ET: Jul P S&P Global Services PMITame7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMITame7/24 10:00 AM ET: Jun New Home SalesTame7/24 11:00 AM ET: Jul Kansas City Fed Manufacturing SurveyTame- 7/25 8:30 AM ET: Jun P Durable Goods Orders MoM

- 7/28 10:30 AM ET: Jul Dallas Fed Manuf. Activity Survey

- 7/29 9:00 AM ET: May S&P CS home price 20-City MoM

- 7/29 10:00 AM ET: Jul Conference Board Consumer Confidence

- 7/29 10:00 AM ET: Jun JOLTS Job Openings

- 7/30 8:30 AM ET: 2Q A GDP QoQ

- 7/30 2:00 PM ET: Jul FOMC Decision

- 7/31 8:30 AM ET: Jun Core PCE MoM

- 7/31 8:30 AM ET: 2Q ECI QoQ

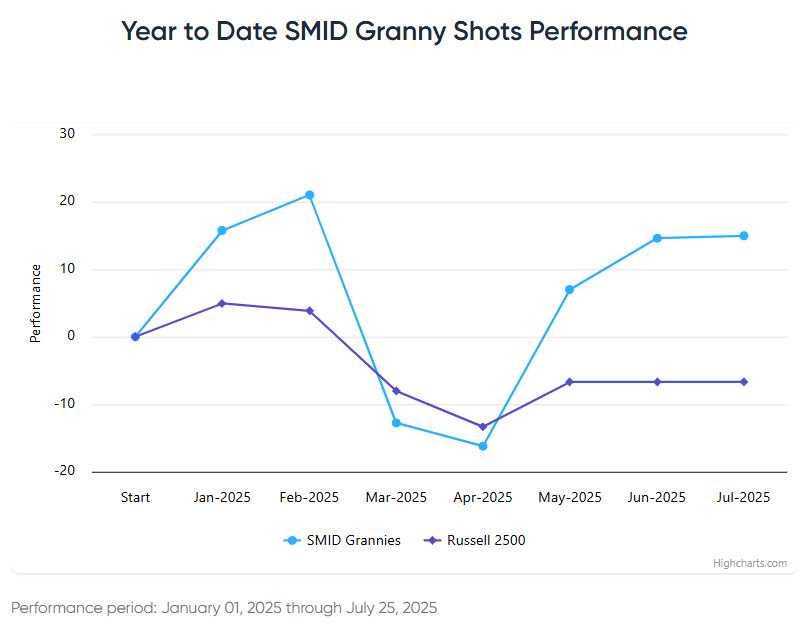

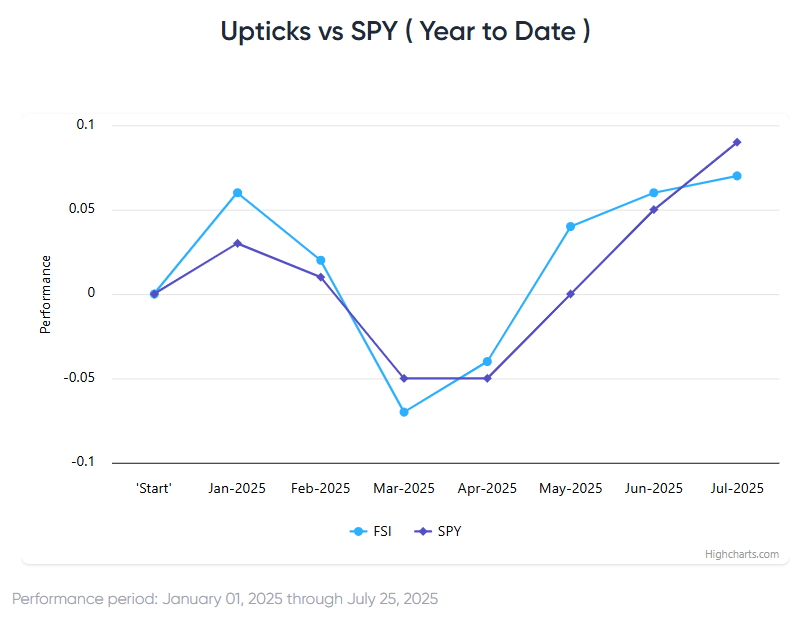

Stock List Performance

In the News

| More News Appearances |