A rally from the previous extended into the early part of last week before sputtering out, dragged by auto tariffs and a slide in consumer confidence. The declines accelerated Friday after the release of weakened consumer sentiment data. Though this week ultimately ended with the S&P 500 down 1.56%, Fundstrat Head of Research Tom Lee believes that equities bottomed on March 13. To be sure, there appears to be some degree of market uncertainty ahead of April 2, aka “Tariff Liberation Day,” but Lee sees parallels between the market’s reaction to Trump 2.0’s tariff regime and the tariffs of Trump 1.0.

In 2018, Trump made remarks about tariffs at Davos on Jan. 26, triggering a plunge until Feb. 19, when the VIX surged and equities bottomed, with the S&P 500 retreating to support above the 200-day moving average. Investor sentiment measures showed bearishness continuing well after that bottom. “If we fast-forward to 2025, a similar pattern appears to be unfolding,” Lee noted, so “if the 2018 comparison holds, equities could be poised for sustained upside.”

If so, Lee suggested that the market recovery might “evolve into a V-shaped recovery – a so-called ‘face ripper,’ especially after April 2.” He noted that further support for the risk-on thesis could emerge as investors recall the possibility of pro-growth tax cuts and lower regulatory costs as Trump’s term continues.

Head of Technical Strategy Mark Newton holds a similar – if not precisely identical – view. From his perspective, the market is on a “two-steps forward, one-step backward” trajectory, and the week’s pullbacks “[haven’t] proven damaging to this recovery effort,” noting that the S&P 500 remains nearly 200 points above the point at which he views it as having bottomed two weeks ago. Newton also notes a potential near-term bullish tailwind from the likely pension rebalance as the end of the month and first quarter approach.

U.S. exceptionalism

Of late, international equity markets have outperformed the U.S. stock market. Our Head of Technical Strategy acknowledged recent underperformance by the S&P 500 relative to the All-Country World Index (ACWI -0.07% ), but he believes that recent enthusiasm for international equities “might be an overreaction.” Newton noted that when viewed as a ratio, SPY -0.24% versus ACWI -0.07% “has not violated long-term uptrends going back more than a dozen years.” He added, “Overall, I like overweighting U.S. stocks vs. ACWI for 2025. My view is that the U.S. dollar decline won’t persist into 2026 and that tariffs likely won’t prove as damaging to the U.S. economy and by extension, the U.S. stock market as many are suggesting.”

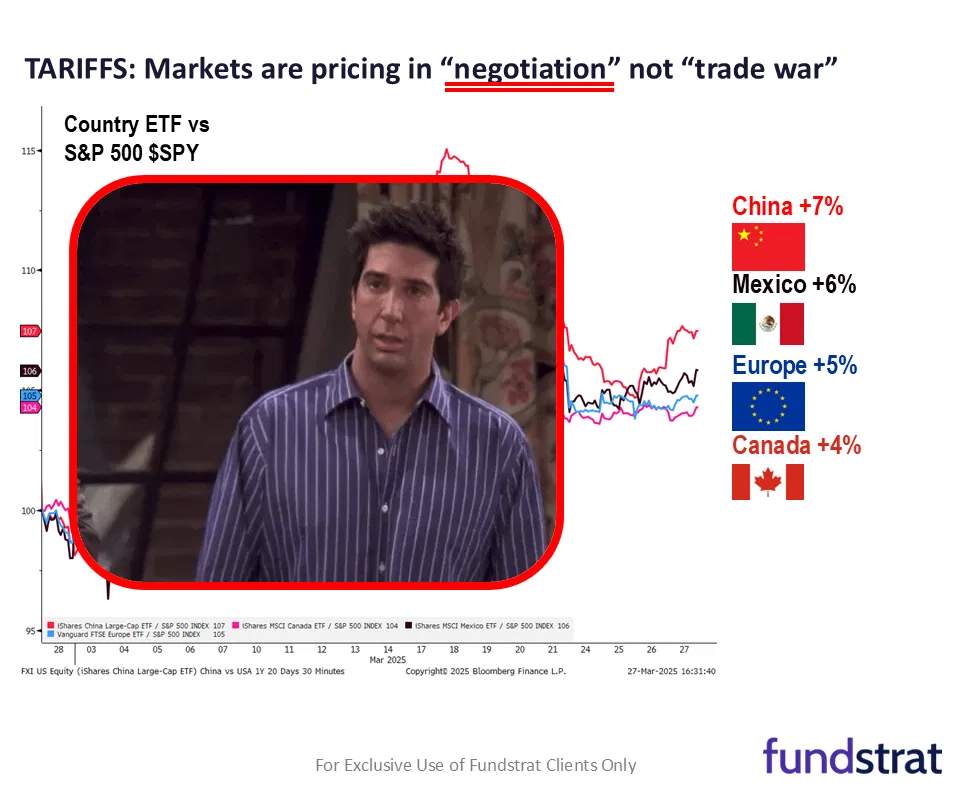

Chart of the Week

Fundstrat’s Tom Lee sees possible signals about economic policy in recent non-U.S. outperformance. Last week, he suggested this could be viewed as “optimism around tariff negotiations” among investors abroad – a view that Trump’s tariff rhetoric is possibly more of a negotiation strategy rather than an actual desire to start a trade war. We see this illustrated in our Chart of the Week. For now, all eyes are on April 2.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

3/24 8:30 AM ET: Feb Chicago Fed Nat Activity IndexTame3/24 9:45 AM ET: Mar P S&P Global Manufacturing PMITame3/24 9:45 AM ET: Mar P S&P Global Services PMITame3/25 9:00 AM ET: Jan S&P CoreLogic CS home priceTame3/25 10:00 AM ET: Mar Conference Board Consumer ConfidenceTame3/25 10:00 AM ET: Feb New Home SalesTame3/26 10:00 AM ET: Feb p Durable Goods OrdersTame3/27 8:30 AM ET: 4Q T GDPTame3/28 8:30 AM ET: Feb PCE DeflatorMixed3/28 10:00 AM ET: Mar F U. Mich. Sentiment and Inflation ExpectationHot- 3/31 10:30 AM ET: Mar Dallas Fed Manuf. Activity Survey

- 4/1 9:45 AM ET: Mar F S&P Global Manufacturing PMI

- 4/1 10:00 AM ET: Mar ISM Manufacturing PMI

- 4/1 10:00 AM ET: Feb JOLTS Job Openings

- 4/2 10:00 AM ET: Feb F Durable Goods Orders MoM

- 4/3 8:30 AM ET: Feb Trade Balance

- 4/3 9:45 AM ET: Mar F S&P Global Services PMI

- 4/3 10:00 AM ET: Mar ISM Services PMI

- 4/4 8:30 AM ET: Mar Non-farm Payrolls

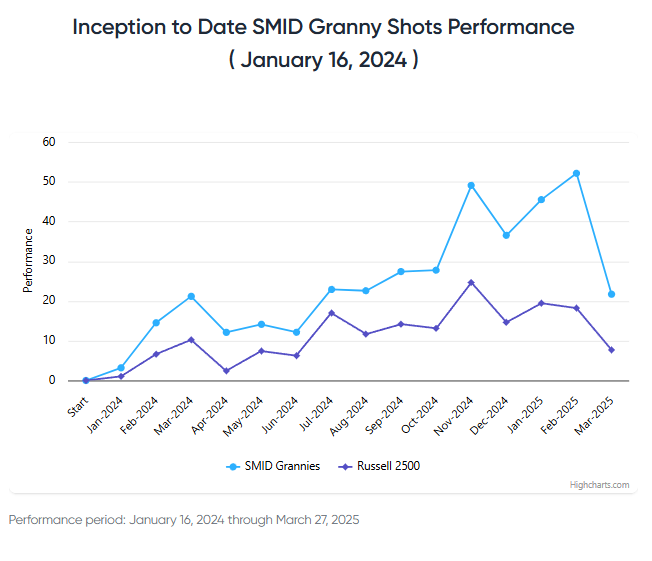

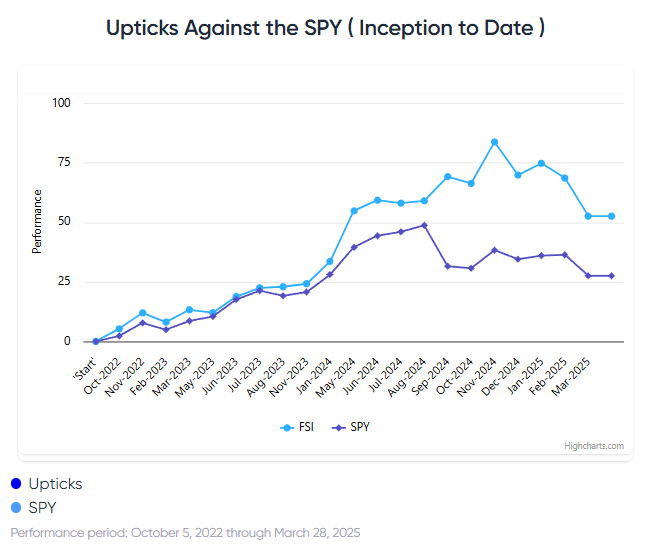

Stock List Performance