Last week, stocks recovered partially from the rather unpleasant declines from the week before. It was a light week for macroeconomic data, which arguably resulted in even greater focus on Nvidia’s earnings report. Although expectations were high, the chipmaker easily beat both top- and bottom-line estimates. Nvidia shares moved higher only slightly the next day, but Fundstrat Head of Research Tom Lee nevertheless viewed this as a good sign – both for the company and for markets in general. To him, the company’s outlook “reinforces our view that the AI demand story remains intact. In this context, Nvidia trading up slightly post-earnings suggests there is still more upside for Nvidia’s share price near term.” Perhaps just as importantly, “the release of the earnings is likely to clear some of the uncertainty that has been acting as a headwind for markets as a whole.”

Yet from his technical perspective, Head of Technical Strategy Mark Newton expressed near-term concern about the reaction to Nvidia’s results and forward guidance. “NVDA -3.27% was set to move up 8% potentially after its earnings report, but it has been pretty much range-bound,” he pointed out. This is meaningful for equity investors, because in his view, “as Nvidia goes, so goes the market.” As Newton reminded us, “Nvidia is now the largest stock within the S&P 500, so it’s important to keep track of where Nvidia is going at all times,” even for those who don’t have a stake in the company.

“The key level for Nvidia is going to be 137,” Newton said. To him, “a move under 137 means we’re likely to have a stock market correction in the weeks to come, possibly to the tune of about 5%. Now that’s not happening yet, and it might not,” he reassured us. “But it is something to keep an eye on.” In the immediate term, Newton noted that his work “seems to show the possibility of a rally into Thanksgiving,” and in this, he and Lee are in agreement. (Lee’s Thanksgiving-rally view is illustrated in our Chart of the Week below.)

Look further out, however, and Newton is slightly less sanguine. “You know, it could be setting up to be a more interesting December and year end than many people expect, only because the markets have already run up 15% in the last three months. So we’ve already sort of predated our so-called Santa Claus rally,” he suggested.

Lee suggested, however, that with sentiment not yet at peak bullishness, there could be enough upside potential to sustain markets until the end of the year. “As we all know, when sentiment reaches a ‘bullish extreme,’ that’s when we see equities priced to ‘perfection.’ By several measures, including FINRA margin debt and AAII’s net bulls percentage, we are not there at that point yet.”

The FS Insight team wishes all members of our community a Happy Thanksgiving.

Chart of the Week

As shown in our Chart of the Week, Fundstrat’s Tom Lee sees the likelihood that equities will rally into Thanksgiving. To him, stocks still have upside potential based on sentiment indicators showing that bullishness is not yet at extremes. In addition the Federal Reserve that remains dovish, acting as a “put” on markets. “Even if the pace at which the rate cuts arrive slows down, this would still be a dovish Fed,” he told us this week.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

1/18 10:00 AM ET: Nov NAHB Housing Market IndexTame11/18 4:00 PM ET: Sep Net TIC FlowsHot11/19 9:00 AM ET: Oct M Manheim Used vehicle indexMixed11/21 8:30 AM ET: Nov Philly Fed Business OutlookTame11/21 10:00 AM ET: Oct Existing Home SalesTame11/22 9:45 AM ET: Nov P S&P Global Manufacturing PMITame11/22 9:45 AM ET: Nov P S&P Global Services PMITame11/22 10:00 AM ET: Nov F U. Mich. Sentiment and Inflation ExpectationTame- 11/25 8:30 AM ET: Oct Chicago Fed Nat Activity Index

- 11/25 10:30 AM ET: Nov Dallas Fed Manuf. Activity Survey

- 11/26 9:00 AM ET: Sep S&P CoreLogic CS home price

- 11/26 10:00 AM ET: Nov Conference Board Consumer Confidence

- 11/26 10:00 AM ET: Oct New Home Sales

- 11/26 2:00 PM ET: Nov FOMC Meeting Minutes

- 11/27 8:30 AM ET: Oct PCE Deflator

- 11/27 8:30 AM ET: 3Q S 2024 GDP

- 11/27 10:00 AM ET: Oct P Durable Goods Orders

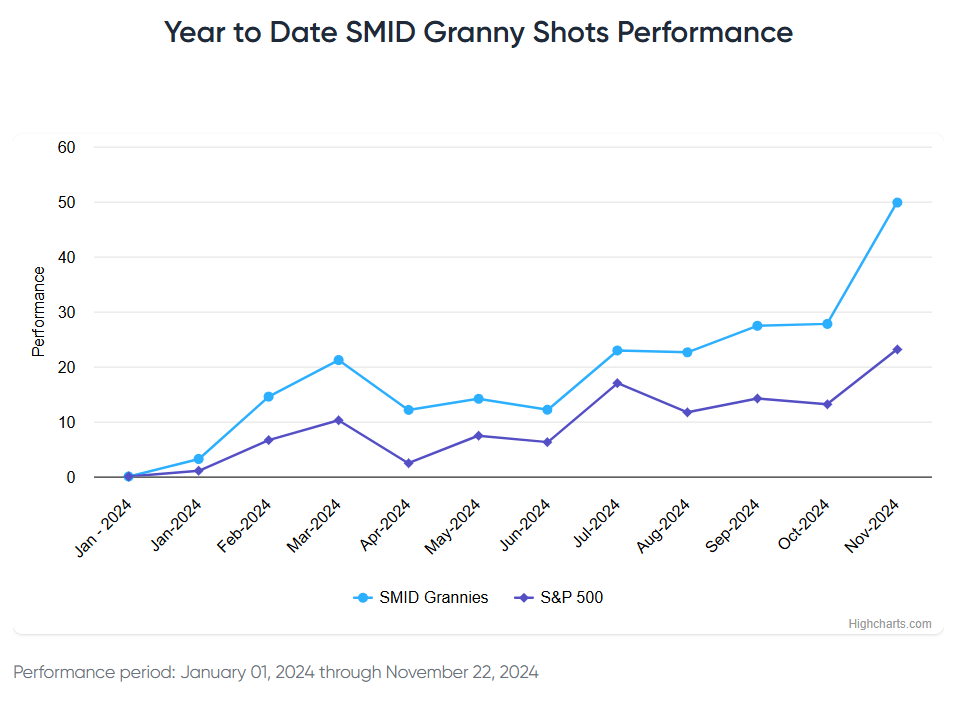

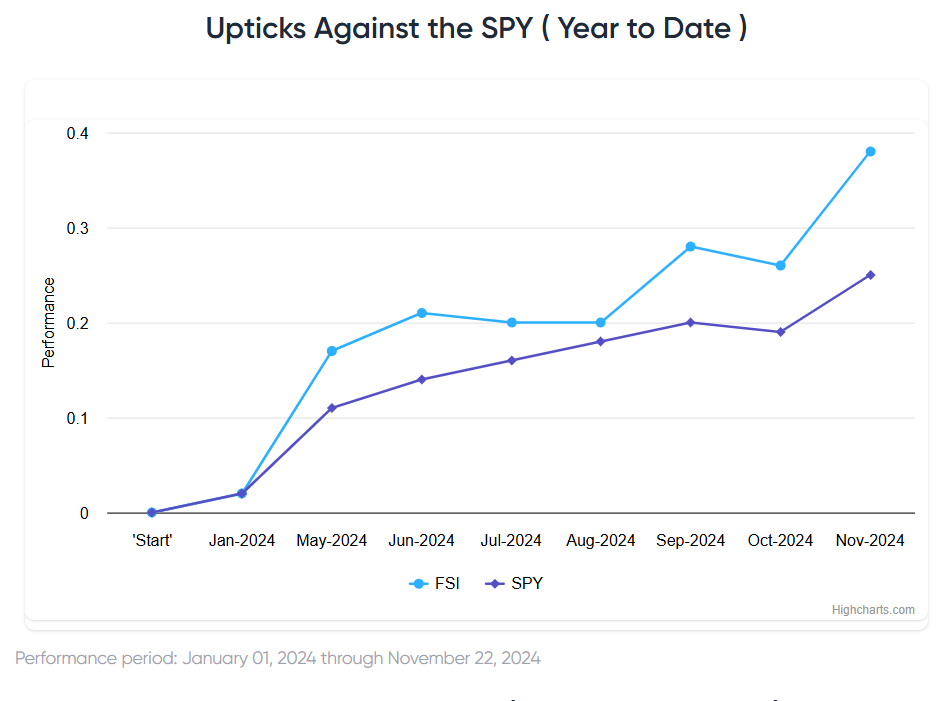

Stock List Performance

In the News

| More News Appearances |

- NVDA -3.18% earnings reported

- Whether market happy or sad

- It’s behind us

- Meaning it’s a “clearing event”

Please BUY THE DIP (if there is one) IWM 1.98% QQQ 0.27% SMLR -4.18% MSTR 7.81% KRE 2.86%