October began choppily, with the S&P 500 slipping 1.5% in the first three days of the month. FS Insight Head of Technical Strategy Mark Newton remained calm afterwards: “The little bit of consolidation we saw at the beginning of the week was almost a non-event,” in his view. “Look at the S&P 500,” he said. “We’re less than 1% from all-time highs. In my view, breadth has proven solid in recent weeks, and momentum and technical structure are in good shape,” he said.

Ultimately, stocks climbed back on Friday to close slightly up for the week after the September jobs report came in well above consensus estimates – +254,000 versus +150,000 expectations. “This was a clean beat driven by restaurants [which added 69,000 jobs],” FS Insight Head of Research Tom Lee noted. The positive surprise on the unemployment rate, which fell to 4.1%, “shows that the job market remains resilient,” in Lee’s view.

Investors were also reassured on Friday after the dockworkers strike at U.S. East Coast and Gulf Coast ports, which began Tuesday at midnight, resolved with a tentative agreement on Thursday evening. This resolved fears of supply chain disruptions and thus, potential upward pressure on inflation.

Yet seasonality remains a concern. The Fundstrat Data Science team looked at previous instances in which stocks notched strong gains in the first three quarters of the year. This year’s “first three quarters” performance of the S&P 500 was the ninth best since 1950. Looking at the other strong “first three quarters,” in the top 10, the team discovered that stocks declined in October seven out of nine times. The median decline was around 2%.

As Newton pointed out, election-year Octobers also present challenging seasonality: “A lot of people talk about September being difficult for stocks, but in election years, it’s actually October that has a far worse median rate of return,” he observed.

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the October 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

Fundstrat Head of Research Tom Lee is constructive for the rest of 2024, but in the immediate-term, election uncertainty and October seasonality leave him uncertain that Friday’s advances mean a “broader greenlight for stocks.” Lee is looking at stock-market volatility, as measured by VIX, for clues as to when that greenlight might emerge. As our Chart of the Week shows, spot VIX was trading around 19 on Friday afternoon, higher than the 17 level he would prefer. Furthermore, the VIX futures term structure remained inverted, “signaling that we are still in the midst of the ‘iffy October’ period,” Lee explained. An “un-inverting” would signal a possible bottoming for the S&P 500.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

10/1 9:45 AM ET: Sep F S&P Global Manufacturing PMITame10/1 10:00 AM ET: Sep ISM Manufacturing PMITame10/1 10:00 AM ET: Aug JOLTS Job OpeningsTame10/3 9:45 AM ET: Sep F S&P Global Services PMITame10/3 10:00 AM ET: Sep ISM Services PMIMixed10/3 10:00 AM ET: Aug F Durable Goods OrdersTame10/4 8:30 AM ET: Sep Non-Farm PayrollsHot- 10/7 9:00 AM ET: Aug F Manheim Used Vehicle Index

- 10/8 6:00 AM ET: Sep Small Business Optimism Survey

- 10/8 8:30 AM ET: Aug Trade Balance

- 10/9 2:00 PM ET: Sep 18 FOMC Meeting Minutes

- 10/10 8:30 AM ET: Sep CPI

- 10/11 8:30 AM ET: Sep PPI

- 10/11 10:00 AM ET: Oct P U. Mich. Sentiment and Inflation Expectation

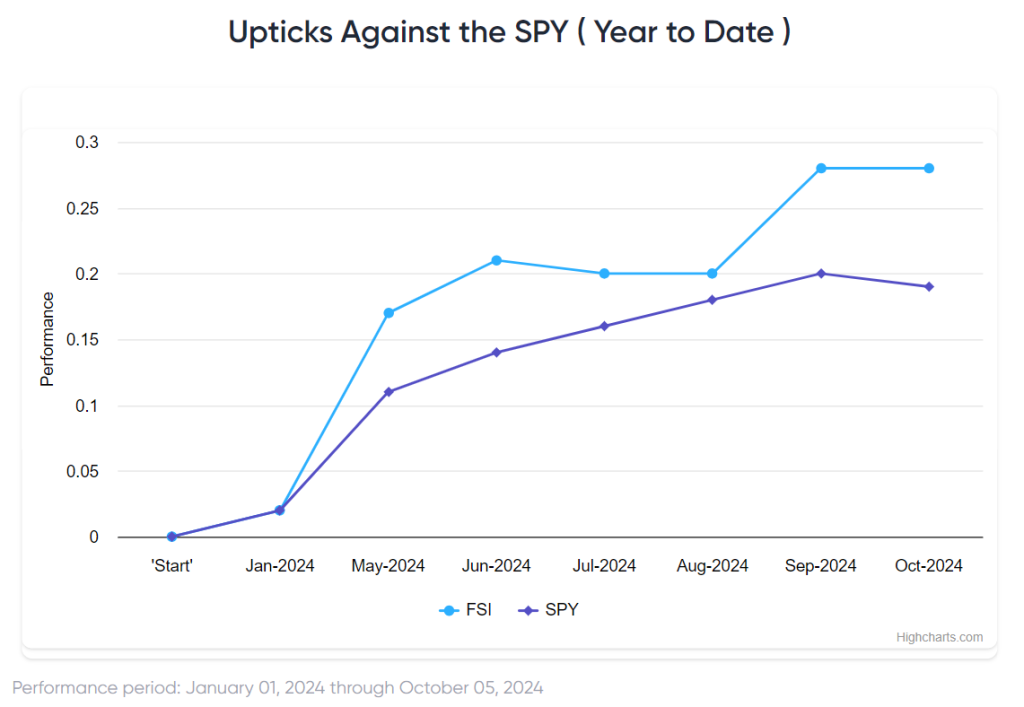

Stock List Performance

In the News

[fsi-in-the-news]