FOMC Day has come and gone, and the Federal Reserve has put an official end to one of the most aggressive hiking cycles in Fed history. Before the Federal Open Market Committee concluded its meeting on Wednesday, market participants debated whether the Fed would decide on a cut of 25 bp or 50 bp. Ultimately, the FOMC opted to cut 50 bps, setting a target range of 4.75% – 5.00%.

For Fundstrat Head of Research Tom Lee, the decision and Fed Chair Jerome Powell’s post-meeting press conference were decidedly positive for markets. “Chair Powell mentioned ‘recalibration’ multiple times,” he pointed out. “To me, this indicates that the Fed has shifted its focus to the other part of its dual mandate, keeping the job market strong. With inflation softening, it seems clear that the Fed wants to keep the economic expansion healthy.” Expanding on that, he explained, “This should arguably act as an implicit ‘put’ on the equity market, as falling asset prices would threaten to weaken labor markets.”

“All of this is arguably most supportive for small-caps and cyclicals,” he noted. Yet Lee warns clients to expect “noise” in trading activity in the near term, over the weeks to come. This is in large part because markets are in the historically challenging eight-week period before Election Day, particularly when the contest is close, as is currently the case.

Head of Technical Strategy Mark Newton is somewhat in agreement. He acknowledged that late September, particularly in election years, has historically been “a tricky time for the equity markets.” However, with stocks having notched all-time closing highs on Thursday, “the market clearly shifted to the upside, despite having dipped on Wednesday afternoon after the FOMC.” To Newton, this might lead to “a FOMO type of catch-up period where investors are going to climb aboard. We could, in fact, rally into the middle part of October.”

However, “mid-October is when you’re going to want to watch carefully,” he warned. Furthermore, “if sentiment starts to get real giddy in the next month, I think that’ll be your sell signal. Going forward, I think we’re still in for an interesting time,” he concluded.

Chart of the Week

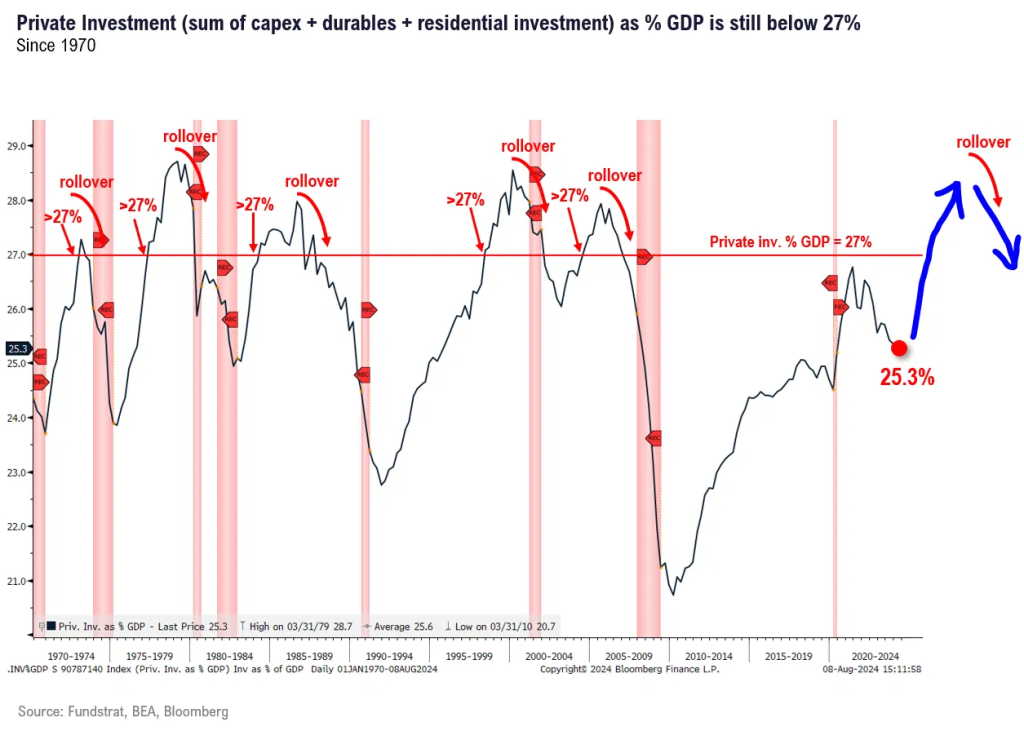

Many investors wonder if the economy is late cycle. But as Fundstrat Head of Research Tom Lee points out, businesses became cautious about over-expanding in early 2022, when the Fed began signaling intentions to raise interest rates sharply. They have remained cautious ever since. “The private investment-to-GDP ratio sits at 25%, below the long-term average of 27%, and with the exception of the pandemic, no major recession has started since 1970 without this figure exceeding 28%,” he told us this week. Our Chart of the Week illustrates this.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

9/16 8:30 AM ET: Sep Empire Manufacturing SurveyTame9/17 8:30 AM ET: Aug Retail Sales DataTame9/17 9:00 AM ET: Sep M Manheim Used vehicle indexTame9/17 10:00 AM ET: Sep NAHB Housing Market IndexTame9/18 2:00 PM ET: Sep FOMC DecisionTame9/18 4:00 PM ET: Jul Net TIC FlowsTame9/19 8:30 AM ET: Sep Philly Fed Business OutlookTame9/19 10:00 AM ET: Aug Existing Home SalesTame- 9/23 8:30 AM ET: Aug Chicago Fed Nat Activity Index

- 9/23 9:45 AM ET: Sep P S&P Global Manufacturing PMI

- 9/23 9:45 AM ET: Sep P S&P Global Services PMI

- 9/24 9:00 AM ET: Jul S&P CoreLogic CS home price

- 9/24 10:00 AM ET: Sep Conference Board Consumer Confidence

- 9/25 10:00 AM ET: Aug New Home Sales

- 9/26 8:30 AM ET: 2Q T 2024 GDP

- 9/26 10:00 AM ET: Aug P Durable Goods Orders

- 9/27 8:30 AM ET: Aug PCE Deflator

- 9/27 10:00 AM ET: Sep F U. Mich. Sentiment and Inflation Expectation

Stock List Performance

In the News

[fsi-in-the-news]