“Just get through August.” That’s what Fundstrat Head of Research Tom Lee has been telling clients for the past month, and we are now most of the way there. Since 1928, the most common month for a summer bottom has been August, and the most common week for it has been the first week of August. Evidence continues to suggest that 2024 is following that pattern, with markets having now fully recovered from Tokyo Black Monday (August 5) as we are about to enter the last week of the month.

Mark Newton, our Head of Technical Strategy, agreed that “we’ve managed to snap back in very good fashion. I agree with what Tom wrote this week, when he said markets could push back to new all-time-highs as we approach Labor Day [September 2]. Based on current trends, I expect that we are en route to 5700-5750.”

Newton did sound a cautionary note at our weekly research huddle, however. “The road after that is likely going to get tougher, and I suspect that we are getting closer to a time when stocks will consolidate – though I also think any consolidation will prove to be short-lived. Still, there are some warning signs that are starting to creep up on the horizon that weren’t present before. So, from Labor Day until the election in November, I want to emphasize that I don’t think it’s going to be a straight shot. I think it’s going to be a lot choppier.”

The week’s most significant macro event was Federal Reserve Chair Jerome Powell’s speech at the annual Jackson Hole Economic Symposium. Lee anticipated dovish remarks. “‘Real’ interest rates – measured by taking Fed Funds and subtracting Core PCE YoY – are just too high” in his view, and significantly higher than they were ahead of his dovish remarks at the 2023 Jackson Hole symposium. “Real rates have never been this restrictive at a time when inflationary pressures are ebbing and when labor markets are softening,” he noted.

On Friday, Powell was, as Newton put it, “perhaps more dovish than anyone might have expected. The real key statement for me from Powell came when he said, ‘The time has come for policy to adjust,’” Powell even lightly alluded to the possibility of a larger 50 bp cut in September when he said, “The timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

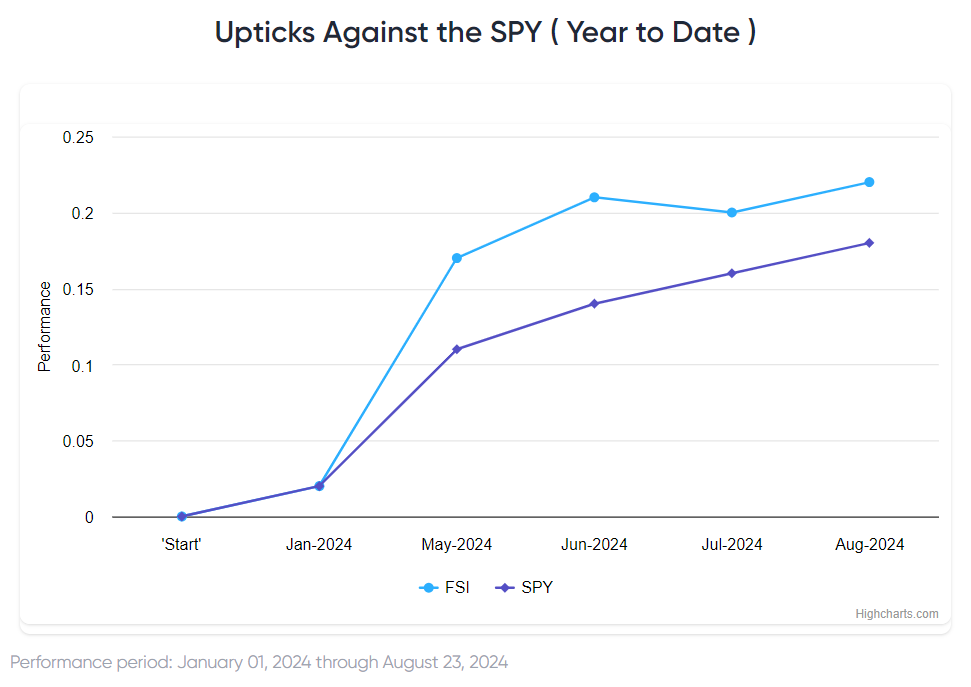

Chart of the Week

Lee’s constructive market outlook is also supported by investors’ inflation expectations. “Market-based inflation expectations 12 months from now, as measured by OIS inflation forward 1Y-1Y, are currently at 3.2%, their lowest levels in four years. There were three prior similar nadirs in this OIS forward metric – in July 2022, May 2023, and January 2024. Three out of three times, we saw equities rally strongly after the nadir.” We see this in our Chart of the Week. “If you’re wondering why this happens, we think it’s because such nadirs mark points at which inflation fears ebbed and investors therefore responded by going ‘risk on,’” he noted.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

8/19 9:00 AM ET: Aug M Manheim Used vehicle indexTame8/21 2:00 PM ET: Jul FOMC Meeting MinutesDovish8/22 8:30 AM ET: Jul Chicago Fed Nat Activity IndexTame8/22 9:45 AM ET: Aug P S&P Global Manufacturing PMITame8/22 9:45 AM ET: Aug P S&P Global Services PMITame8/22 10:00 AM ET: Jul Existing Home SalesTame8/23 10:00 AM ET: Jul New Home SalesTame- 8/26 10:00 AM ET: Jul P Durable Goods Orders

- 8/26 10:30 AM ET: Aug Dallas Fed Manuf. Activity Survey

- 8/27 9:00 AM ET: Jun S&P CoreLogic CS home price

- 8/27 10:00 AM ET: Aug Conference Board Consumer Confidence

- 8/29 8:30 AM ET: 2Q S 2024 GDP

- 8/30 8:30 AM ET: Jul PCE Deflator

- 8/30 10:00 AM ET: Aug F U. Mich. Sentiment and Inflation Expectation

Stock List Performance

In the News

[fsi-in-the-news]