The S&P 500 has closed out its third consecutive down week, and stocks were already under pressure before the week began, with shrinking expectations for rate cuts from the Fed and a recent CPI print that came in hot. Then on Sunday (April 14), Iran launched an attack of unprecedented scale against Israel, launching 300 drones and missiles – although nearly all were successfully intercepted.

As the week began, the S&P 500 was already below its 20-day moving average (20 dma), and right around its 50 dma. Fundstrat Head of Research Tom Lee described the instinct for investors to de-risk after the attack as both “knee-jerk” and “reasonable,” and although the pullback in markets have created an attractive longer-term opportunity in his view, the surge in the VIX – a key index of market volatility – makes Lee markedly cautious right now.

He observed that as long as the immediate risk of escalation evaporates, as we obviously hope it will, markets will eventually get comfortable with the idea of a simmering conflict. “That’s an unpleasant and uncomfortable thing to say,” he acknowledged, “but it is reality. This is what happened with the Russia-Ukraine war.” However, “The VIX is telling us that we need to take this extra slowly, that there’s still more de-risking ahead,” he said, repeating the word “slowly” for added emphasis. Ultimately, and looking tentatively at a time frame of two weeks to a month from now, Lee would like to see VIX make a sustainable move back below 18, with oil prices remaining subdued. And of course, for many reasons, “we want to see further escalation avoided,” he said.

From a strictly technical perspective, Head of Technical Strategy Mark Newton is not particularly worried about recent market movements. For him, “the most important catalyst from a technical perspective to watch for in the weeks ahead concerns a turn back lower in the US Dollar and Treasury yields. It’s thought that when cycles start to project lower for yields between late April and August, that indices should respond positively.

Head of Digital Asset Strategy Sean Farrell is in agreement on yields pulling back some time after May, albeit for different reasons. Post-April 15, some projections suggest that federal tax receipts could approach record highs this year, and if so, “We could see [Treasury Secretary Janet] Yellen come out and overweight issuance for the rest of this quarter and next quarter towards bills [shorter-term debt] so that she can reduce the coupon issuance [longer-term debt].” With less longer-term debt being issued than perhaps the market is currently pricing in, this could “bring yields down and smooth out volatility, a good setup for crypto and equities.”

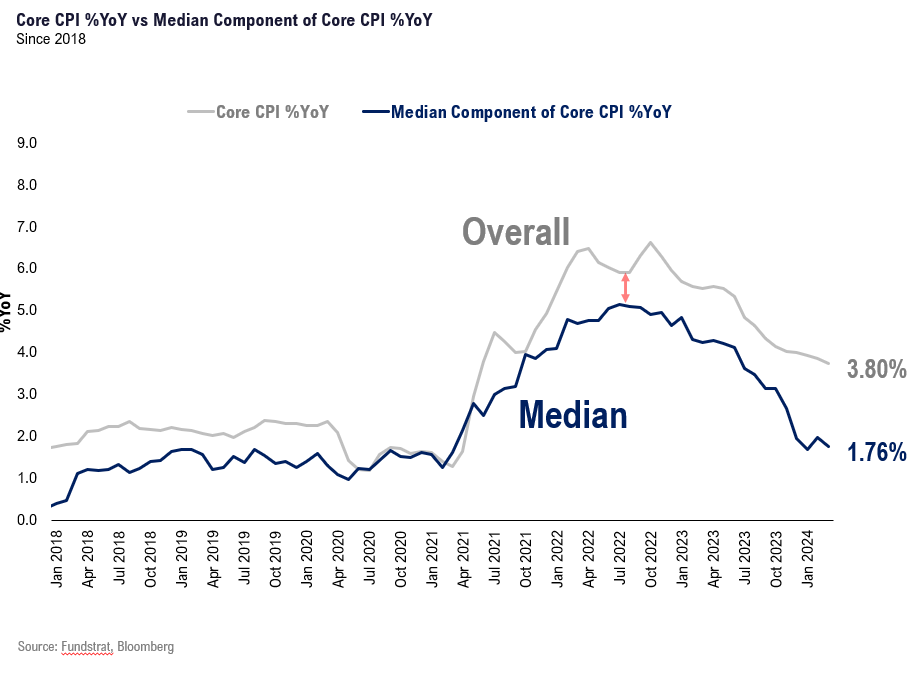

Chart of the Week

Fundstrat Head of Research Tom Lee believes that the Fed will be more dovish that consensus expects. Despite a hotter-than-expected headline CPI number in March, the internals of the latest CPI release confirm inflation continuing to fall. As our Chart of the Week shows, the median inflation rate for all of the various components that make up CPI continues to fall and is at 1.76%. The gap between the median component and the headline number has widened over the past year and is further evidence that only two components – housing and auto insurance – are keeping the overall CPI elevated while the rest of inflation declines. Lee believes the Fed will recognize this.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

4/15 8:30 am ET: Apr Empire Manufacturing SurveyTame4/15 8:30 am ET: Mar Retail Sales DataMixed4/15 10:00 am ET: Apr NAHB Housing Market IndexTame4/16 8:30 am ET: Apr New York Fed Business Activity SurveyTame4/17 9:00 am ET: Apr Mid-Month Manheim Used Vehicle IndexTame4/17 2:00 pm ET: Fed Releases Beige BookTame4/18 8:30 am ET: Apr Philly Fed Business Outlook SurveyTame- 4/22 8:30 am ET: Mar Chicago Fed Nat Activity Survey

- 4/23 9:45 am ET: Apr P S&P Global PMI

- 4/25 8:30 am ET: 1QA 2024 GDP

- 4/26 8:30 am ET: Mar PCE

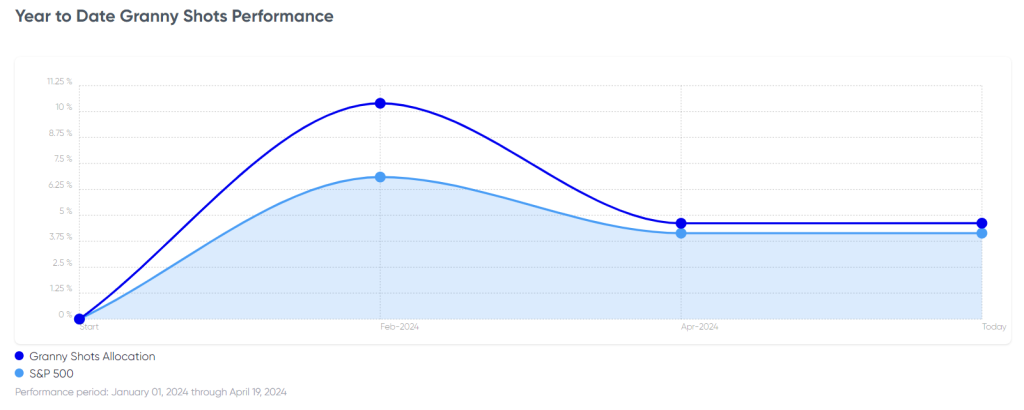

Stock List Performance

In the News

[fsi-in-the-news]