-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Why Getting Sentiment-al Isn’t Such a Bad Idea

“A contrarian, Newton also approvingly cites the currently bearish sentiment as a reason for optimism. ‘It’s taken almost two and a half months, but we’ve dropped from very bullish levels in July,‘ he observed recently. ‘Now we’re extremely bearish on Fear and Greed. AAII is also now bearish by 13 percentage points.‘ ~ FS Insight Weekly Roadmap, March 31, 2023

At Fundstrat, we pride ourselves on delivering evidence-based research that delivers insights ahead of consensus. Or, to put it another way, we seek to help investors position themselves ahead of where sentiment is about to be. Indeed, though they approach markets from different perspectives, you will often see Fundstrat Research Heads Tom Lee, Mark Newton, and Sean Farrell discussing sentiment. That’s because in order to position oneself ahead of sentiment, one first needs to understand where current sentiment is and where it’s likely to go.

When Lee, Newton, and Farrell are talking about sentiment, they are discussing how traders and investors aggregately feel about the current state of the market, and where they expect it to be. Why is this important?

Lee and his team examine a plethora of data and comb through numerous industry reports in order to deliver insights derived from economic, industry, and company fundamentals. However, Lee also frequently reminds us that “confidence drives markets” and that “confidence changes faster than fundamentals.” To reiterate why that is important, Lee is also fond of telling investors, “Don’t shout at the market.” The market does not care about any individual investor’s opinion.

Speaking generally, market sentiment can help identify three things:

- Potential shifts in market trends. Sentiment is one attribute to examine when trying to determine whether the market is likely to continue heading in the direction it has been headed.

- Overvalued and undervalued risk assets. Sentiment is also useful when trying to identify undervalued companies, which by definition have potential for growth. Conversely, sentiment can also be used to help identify overvalued and overbought companies – one way to decide whether to enter into or exit a position.

- Personal bias. When sentiment reaches extremes, this presents an opportunity for investors to gauge their own views on the market, to determine whether they are being overly ebullient or pessimistic, whether . This can help them avoid emotional decision-making.

How is sentiment measured?

There are softer ways of measuring sentiment – by reading or listening to news media, through conversations with other investors, for instance. While such methods are vulnerable to personal subjectivity and sampling error, they can be useful when paired with more concrete measures of sentiment.

Technical Indicators and metrics such as –

The Put/Call Ratio. As the name suggests, this is a measure of the trading volume of put options (bearish sentiment) to call options (bullish sentiments).

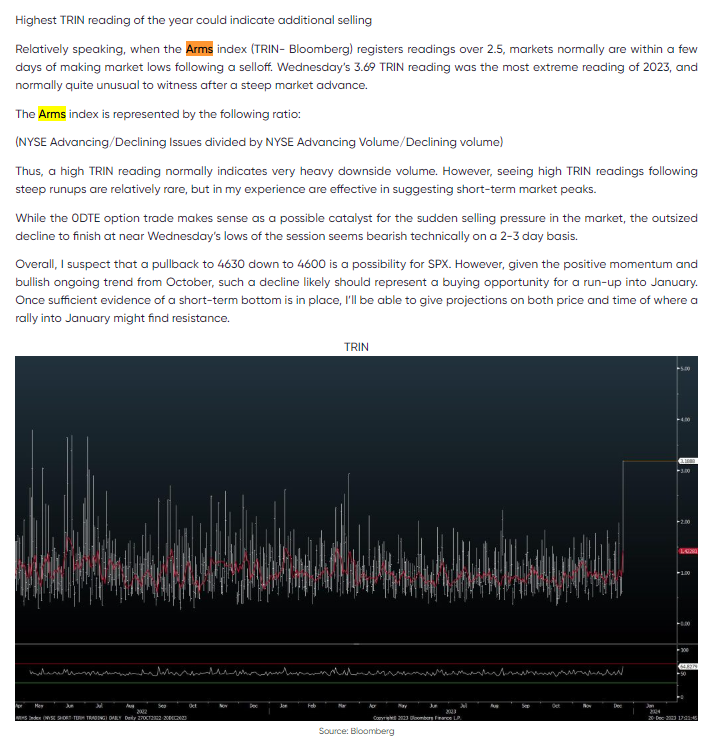

Arms Index. Also known as the Short-term Trading Index, the Arms Index compares the advancing issues to declining issues on a volume-weighted basis. Specifically, the ratio of advancing issues to declining issues is divided by the ratio of advancing volume to declining volume.

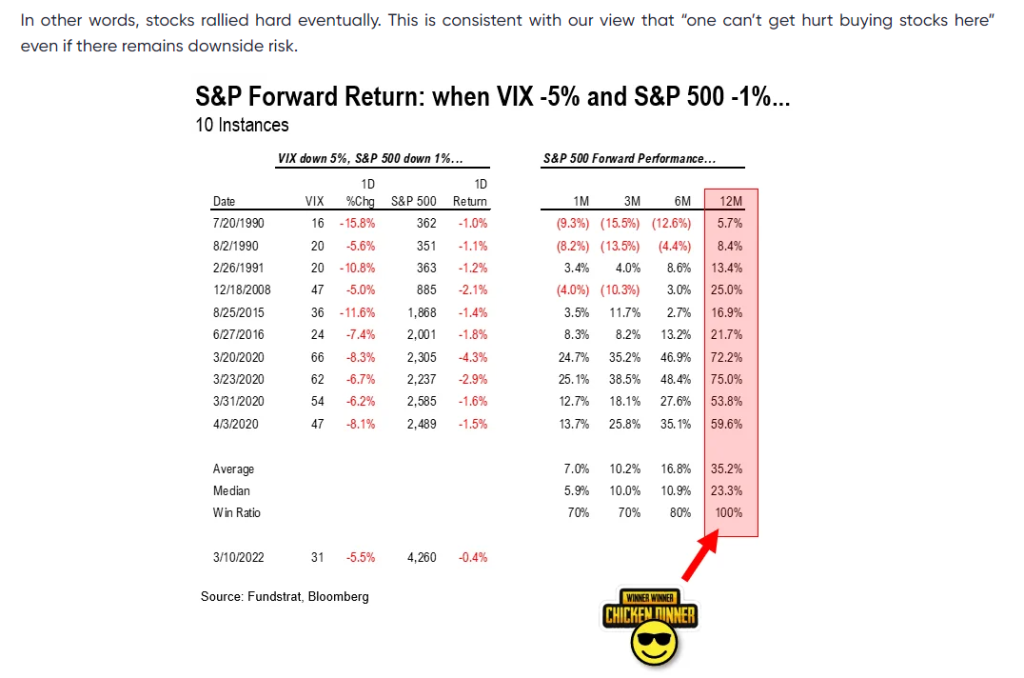

VIX. Also known as the CBOE (Chicago Board Options Exchange) Volatility index, the index measures implied market expectations of short-term volatility based on the prices of a variety of S&P 500 stock options. Speaking generally, higher VIX is associated with higher market risk. Below, Tom Lee and his team provide a more nuanced usage of this indicator. [Note: We discuss VIX in more detail in a separate FSI Academy series.]

Fund flows. Fund flows into and out of equities (including equity funds) are an indication of investor sentiment. In early 2024, Lee frequently cited cash on the sidelines and fund flows out of equities to argue that investors were not overly bullish at the time. (Overly bullish sentiment can signal a short-term top and thus, an imminent pullback.)

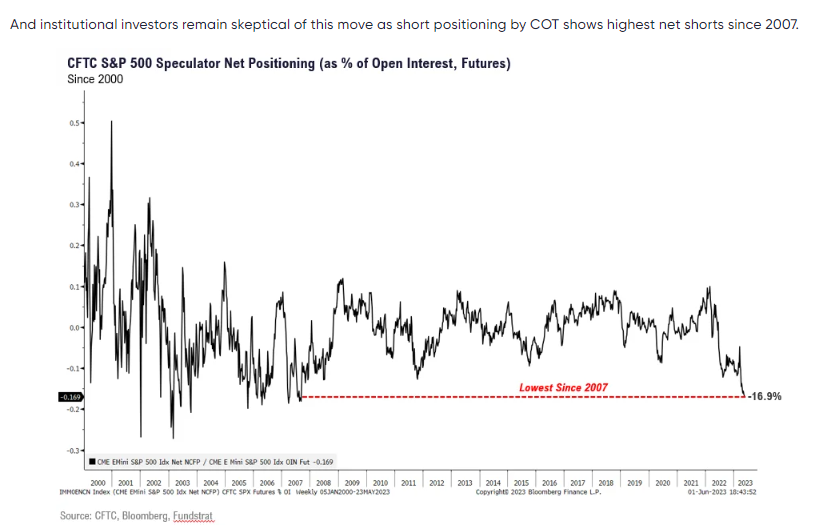

COT (Commitment of Traders) Report. A weekly report published by the Commodity Futures Trading Commission (CFTC) that summarizes the positions held by different types of investors and traders, including commercial traders (hedgers), speculators, and small traders.

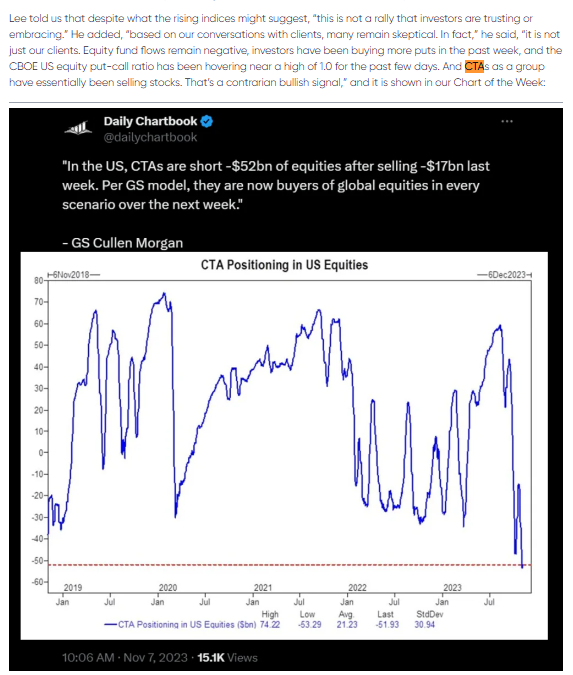

CTA Positioning. Another CFTC report, this one measures the positioning or exposure of Commodity Trading Advisors (CTAs) in various futures markets.

Investor surveys such as –

Fear & Greed. A proprietary index developed by CNN that combines momentum, strength, put/call ratio, junk bond demand, and market volatility to assess market sentiment on a scale from 0 to 100 (with lower numbers indicating more fear and higher numbers suggesting more greed).

AAII. Based on a weekly survey conducted by the American Association of Individual Investors that asks respondents whether they are bullish, bearish, or neutral for the next six months.

Investors Intelligence Bull/Bear. Another survey-based indicator, this one is based on the opinions of market professionals such as investment advisors. Conducted weekly by Investors Intelligence, the survey asks respondents whether they are bullish, bearish, or neutral. The index is expressed as a ratio in which anything above 1.0 indicates bullish sentiment, and anything under 1.0 suggests bearish sentiment.

Related Guides

-

Series of 3~5 minutesLast updated1 month ago

Series of 3~5 minutesLast updated1 month agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 4~7 minutesLast updated3 months ago

Series of 4~7 minutesLast updated3 months agoWhy The Mysterious R-Star Should Be on Your Radar

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated11 months ago

Series of 3~9 minutesLast updated11 months agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis