Ahead of the meeting of the Federal Open Markets Committee on May 1, recent inflation prints had some speculating that Fed Chair Jerome Powell might signal a future hawkish pivot and hint at possible rate hikes soon. Fundstrat Head of Research Tom Lee saw it differently.

After the meeting, the Fed left rates unchanged and announced its intentions to slow its quantitative tightening (QT). Powell also reiterated the central bank’s overall confidence and its base view that inflation is going to fall throughout the year. That led Lee to conclude: “The hawks were wrong. The Fed remains dovish.”

For Fundstrat Washington Policy Strategist Tom Block, a key moment came when Powell was asked about the possibility of rate hikes: “I think it is unlikely the next move will be an increase,” Powell said. To Block, a Beltway veteran of many press conferences, “Powell and his staff anticipated such a question. It was clear that his response had been well-rehearsed and intended to pre-empt that line of questioning.”

Powell also told reporters that strong labor markets do not preclude the possibility of rate cuts. “I just want to be careful that we don’t target wage growth or the labor market,” he said, hinting that the Fed might consider easing if the labor market weakens. On the heels of soft job numbers on Friday, those remarks could take on added significance. In Lee’s view, soft jobs numbers could inject confidence into the markets, pull forward the odds of a cut, and break the market’s current pattern of “two steps forward, one step back.”

On Apple

Head of Technical Strategy Mark Newton has observed that “Since the latter part of December, Apple has fallen from almost 200 down to 160.” That has affected not just its shareholders, but the market as a whole, given that Apple (AAPL -2.47% ) is roughly 8% of the S&P 500 and almost 12% of the QQQ 0.13% . On Friday, Apple finally broke its downtrend, moving above $180 in response to a post-close Thursday earnings report which the Cupertino company beat estimates and announced a $110 billion share buyback program and dividend increase. The “confirmed breakout” puts Technology and equities in general on “much better footing,” in Newton’s view.

FSI Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the May 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

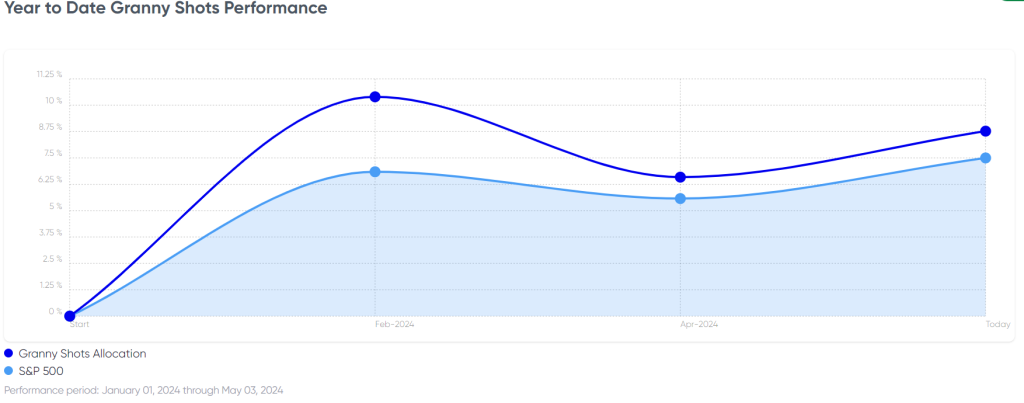

For stocks, April was the worst month of the year so far, ending 4% down from its levels on April 1. It was the first down month for all three major indices since October 2023. Much of that pain was inflicted in the first half of the month, and the second half of the month saw equities enter what Fundstrat Head of Research Tom Lee describes as our current “two steps forward, one step back” market, rising though choppy trading as illustrated by our Chart of the Week. Lee sees the possibility that Friday’s soft job numbers could break this pattern.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

4/29 10:30 am ET: Apr Dallas Fed Manufacturing Activity SurveyTame5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/1 10:00 AM ET: Mar JOLTS Job OpeningsTame5/1 2:00 PM ET: May FOMC DecisionDovish5/2 8:30 AM ET: 1Q P Nonfarm ProductivityTame5/2 8:30 AM ET: Mar Trade BalanceTame5/2 8:30 AM ET: 1Q P Unit Labor CostsMixed5/2 8:30 AM ET: Mar F Durable Goods OrdersTame5/3 8:30 AM ET: Apr Jobs ReportTame5/3 9:45 AM ET: Apr F S&P Global Services PMITame5/3 10:00 AM ET: Apr ISM Services PMITame- 5/7 10:00 AM ET: Apr F Manheim Used vehicle index

- 5/10 10:00 AM ET: May P U. Mich. Sentiment and Inflation Expectation

Stock List Performance

In the News

[fsi-in-the-news]