It was the second consecutive down week for the S&P 500, with much of the pressure on stocks this week originating from a hotter-than-expected CPI print, released on Wednesday. Core CPI came in hotter than Fundstrat’s expectations, as well as the Street’s. The MoM reading came in at +0.36%, the same as it was in February.

As Head of Data Science “Tireless” Ken Xuan noted during our weekly research huddle, “If you look at the details of this hot CPI print, the primary culprit is still car insurance, which is still surging at a 22% year-over-year rate, and as we’ve said before, that’s a lagging function of increases in auto prices.” In Xuan’s view, however, inflation is still tanking. “One number does not make a change in the trajectory of inflation,” he asserted.

That sparked a question from Head of Technical Strategy Mark Newton: “We are still seeing auto insurance boosting the numbers, but what about the other components?”

Fundstrat Head of Research Tom Lee had an answer for that. He and his team took a deeper look at the data behind the latest CPI numbers, and while he acknowledged that “we didn’t get the CPI number we wanted,” he found that “the forces of disinflation are still strong. Right now we are seeing the highest share of CPI components with inflation of less than 3% YoY since 2021, and that share is expanding,” he told us this week.

Although the indices ended the week down, Newton said that “technically, we have seen a little bit of a short-term break in the market after a pretty sustained uptrend. I don’t sense that this is going to be a big deal. My own thinking is that it’s very short-term in nature.”

For Newton’s technical perspective on the markets, “The bigger deal is that interest rates and the dollar have spiked pretty dramatically in the last few days, and stocks are taking their cues from this. But my work suggests that the bigger move in yields is still likely going to be to the downside, and I personally expect to see a pretty rapid decline in yields between the latter part of April until August [2024].”

Chart of the Week

After hotter-than-expected CPI reports in December, January, and February, the markets sold off – just like they did last Wednesday. But Our Chart of the Week shows that all three times, the weakness was short-lived and the markets went on to rally after a day or two. To Fundstrat’s Head of Research Tom Lee, this means that the market reaction after last Wednesday’s CPI release was a dip that is buyable.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

4/10 8:30 am ET: Mar CPIHot4/10 2pm ET: Mar FOMC Meeting MinutesTame4/11 8:30 am ET: Mar PPITame4/12 10:00 am ET: Apr P U. Mich. Sentiment and Inflation ExpectationTame- 4/15 8:30 am ET: Apr Empire Manufacturing Survey

- 4/15 8:30 am ET: Mar Retail Sales Data

- 4/15 10:00 am ET: Apr NAHB Housing Market Index

- 4/16 8:30 am ET: Apr New York Fed Business Activity Survey

- 4/17 9:00 am ET: Apr Mid-Month Manheim Used Vehicle Index

- 4/17 2:00 pm ET: Fed Releases Beige Book

- 4/18 8:30 am ET: Apr Philly Fed Business Outlook Survey

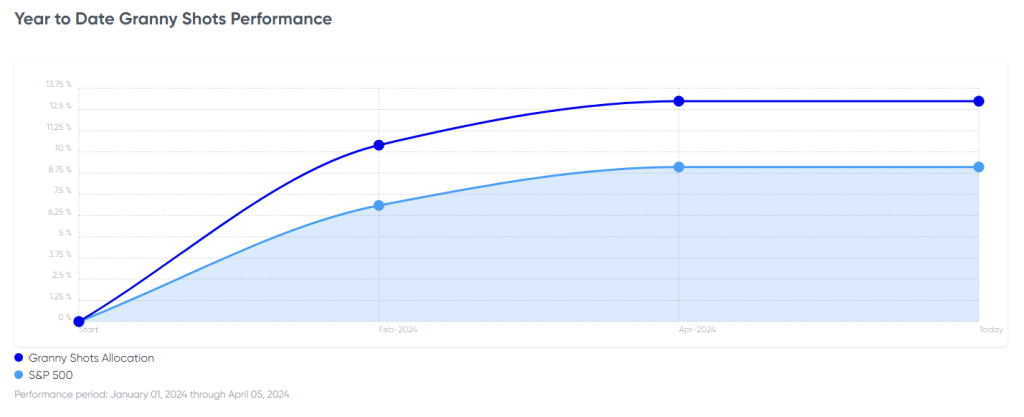

Stock List Performance

In the News

[fsi-in-the-news]