This week, Nvidia (NVDA 0.76% ) released quarterly results that arguably blew away everyone’s expectations. Fundstrat Head of Research Tom Lee has been a vocal advocate for the company’s potential and importance since 2019, when he put the stock on our Granny Shots stock list. He remains enthused about the stock, but it was Nvidia’s impact on the rest of the market that had his attention this week.

The euphoria caused by Nvidia’s earnings report didn’t just drive the S&P 500 and Nasdaq to record highs, but also buoyed Japan’s Nikkei 225 and the pan-Europe Stoxx 600 index to record levels as well. But does Nvidia really matter for stocks outside of Big Tech or AI? Yes, Lee told us. Ahead of its earnings report, Lee observed, “It seems as if the question on everybody’s minds is: Are we reaching, or have we already reached, the top for the first half of 2024?” Part of the answer, he suggested, would depend on the response to Nvidia’s report. “How equities react will help to tell us how much firepower is left in the market.”

Lee disclosed that in his conversations with investors and clients, he picked up on expectations of selling after good news from Nvidia, by those hoping to lock in profits. This would be a variant of stocks falling on good news, and it would also suggest that buying power is starting to flag. To Lee, those are both signals of a near-term top. But this week, that didn’t happen, and given the spike in share prices after Nvidia released its results, Lee said, “If you ask me, I think there’s still some gas left in the tank.”

Commenting on the broader market, Head of Technical Strategy Mark Newton said, “U.S. Equities remain extraordinarily strong, and even the minor churning of the past couple of weeks has now been resolved by a push back to new all-time highs for SPX, led by Technology, which largely takes away any serious near-term threat. At some point we’re probably going to see some type of a minor pullback, but this is a very strong move right now and it’s really proper not to be too cute and attempt to sell out of it. And for those who have asked about when the market will really start to broaden out, I think you’re starting to see that. We’ve started to see Industrials, Financials, and Healthcare all come back, and that’s a good sign.”

Chart of the Week

In our Chart of the Week, Fundstrat’s Tom Lee looks to recent history to further assess whether we’ve reached a near-term top. Since the market bottomed in October 2022, we have had two other rallies. The first lasted 16 weeks and resulted in a 20% rise before pulling back, and the second one gave us 21% over 19 weeks. “The current rally has gone on for 17 weeks,” Lee observed, “and in rough terms, I think this one should go on a little longer, maybe 19 to 21 weeks – so, basically, maybe a few more weeks. But I’d say we’re in a mature rally and it’s getting a little trickier.”

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

2/19 9am ET Manheim Used Vehicle Index February Mid-MonthTame2/21 2pm ET January FOMC Meeting MinutesTame2/22 9:45am ET S&P Global PMI February PrelimTame- 2/26 9:30am ET February Dallas Fed Manufacturing Activity Survey

- 2/27 9am ET February S&P CoreLogic CS home price

- 2/27 10am ET February Conference Board Consumer Confidence

- 2/28 8:30am ET 4QS 2023 GDP

- 2/29 8:30am ET January PCE

- 3/01 10:00am ET Feb (final) U Mich Inflation Expectations

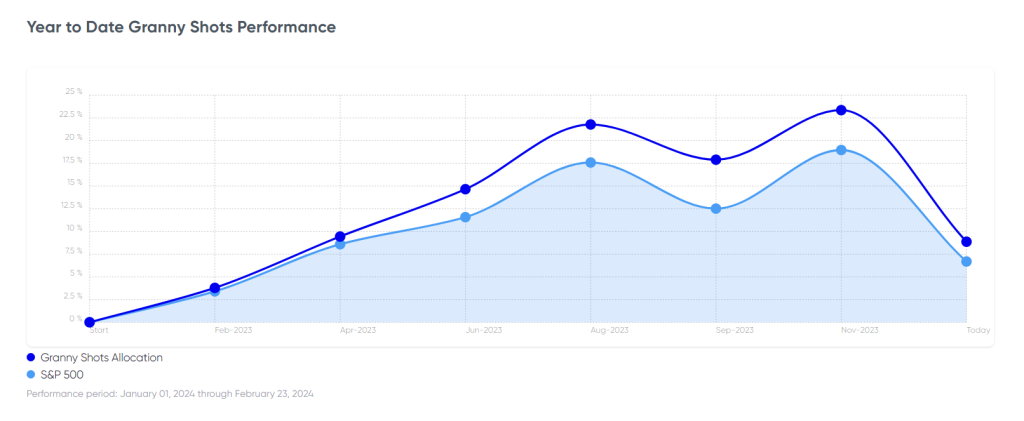

Stock List Performance

In the News

[fsi-in-the-news]