As last week began, Fundstrat Head of Research Tom Lee pointed out signs investors had de-risked to such an extent in April that they now needed to re-risk. Lee further argued that the week’s macroeconomic data releases could serve as a catalyst for further gains in stocks.

This week, the Nasdaq and the S&P 500 hit new all-time high closes, and the Dow breached the 40,000 milestone for the first time (closing the week at 40,003.59). Arguably the biggest driver of this week’s rally was what Lee had described as “one of the most important data releases of 2024” – April CPI. Ahead of the data release, Fundstrat Head of Data Science Ken Xuan’s model saw Core CPI MoM coming in at 0.29%, ever-so slightly below Street expectations of 0.30%. In response, Lee said, “Anything below 0.30 would be a huge break in trend” and “positive for stocks.”

Xuan and Lee were both correct. Furthermore, a deeper analysis by Lee and his team had them concluding that “the right components [are] showing a slowdown.” Shelter slowed modestly to +0.38% MoM vs +0.42% last month, while auto insurance slowed to +1.76% vs +2.58% last month. These two components are 1.87% of the excess YoY inflation, so any further slowing would help pull down CPI.

Fundstrat Head of Technical Strategy Mark Newton agreed that “we saw very good action following the CPI report. We’ve seen a pretty steady decline in Treasury yields, along with the US dollar. Both of those are constructive for risk assets. “I think we’re in a sweet spot of about three months where we can actually do very, very well even if in the short run, we don’t immediately accelerate.”

Sean Farrell, Fundstrat’s Head of Digital Asset Strategy, concurred. “Our view since May has been that the macro environment has been working. Rates have continued to roll, and the dollar as well. We just needed that CPI print on Wednesday to bring capital back to the market, and it came back in full force. We saw flows come back to the [BTC] ETF market, and the Coinbase premium is back.”

During a recent appearance on CNBC, Lee was asked for his thoughts on the re-emergence of meme-stock trading. “I don’t have a view on Gamestop or AMC,” he responded, but with regard to the meme-stock craze, “I think it’s healthy. It highlights a segment of retail investors who are learning about the stock market. I think speculation is healthy, and they’re not employing a lot of leverage, so to me it’s a sign that stocks have a revival potentially coming.”

Chart of the Week

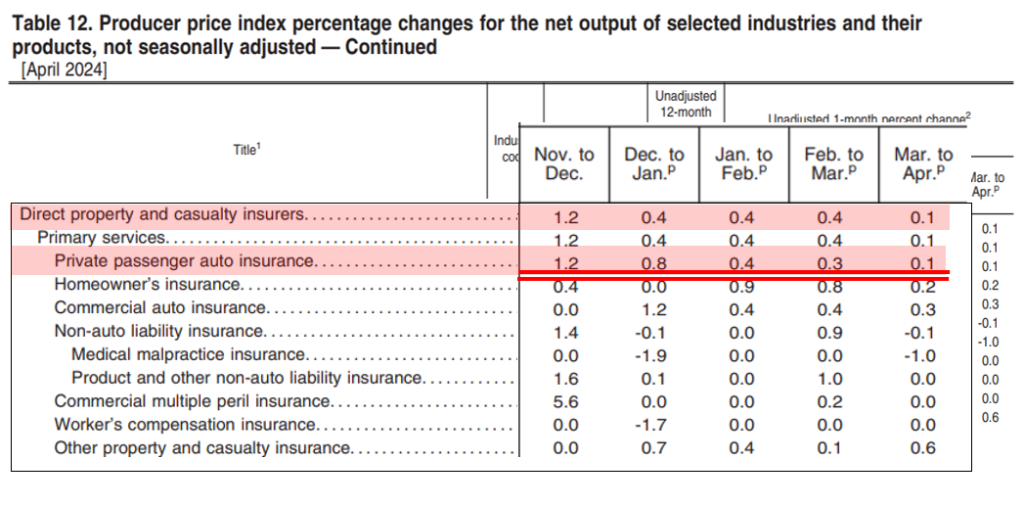

Tuesday’s PPI data release showed the PPI property and casualty insurance (auto and home) component declining to 0.1% MoM, compared to 0.4% in January, February, and March. “This is a huge slowing,” Lee said, with the auto-insurance sub-component also cooling, as shown in our Chart of the Week. PPI tends to be a leading indicator of CPI, and auto insurance represents a significant share of excess YoY CPI inflation. Thus, this plunge in PPI auto insurance suggests potentially significant declines in future CPI readings.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

5/13 11:00 AM ET: Apr NYFed 1yr Inf ExpTame5/14 6:00 AM ET: Apr Small Business Optimisim SurveyTame5/14 8:30 AM ET: Apr PPIMixed5/15 8:30 AM ET: Apr CPITame5/15 8:30 AM ET: Apr Retail Sales DataTame5/15 8:30 AM ET: May Empire Manufacturing SurveyTame5/15 10:00 AM ET: May NAHB Housing Market IndexTame5/15 4:00 PM ET: Mar Net TIC FlowsTame5/16 8:30 AM ET: May Philly Fed Business OutlookTame5/17 10:00 AM ET: May M Manheim Used vehicle indexTame- 5/22 10:00 AM ET: Apr Existing Home Sales

- 5/22 2:00 PM ET: May FOMC Meeting Minutes

- 5/23 8:30 AM ET: Apr Chicago Fed Nat Activity Index

- 5/23 9:45 AM ET: Apr F S&P Global Manufacturing PMI

- 5/23 9:45 AM ET: Apr F S&P Global Services PMI

- 5/23 10:00 AM ET: Apr New Home Sales

- 5/24 8:30 AM ET: Apr P Durable Goods Orders

- 5/24 10:00 AM ET: May F U. Mich. Sentiment and Inflation Expectation

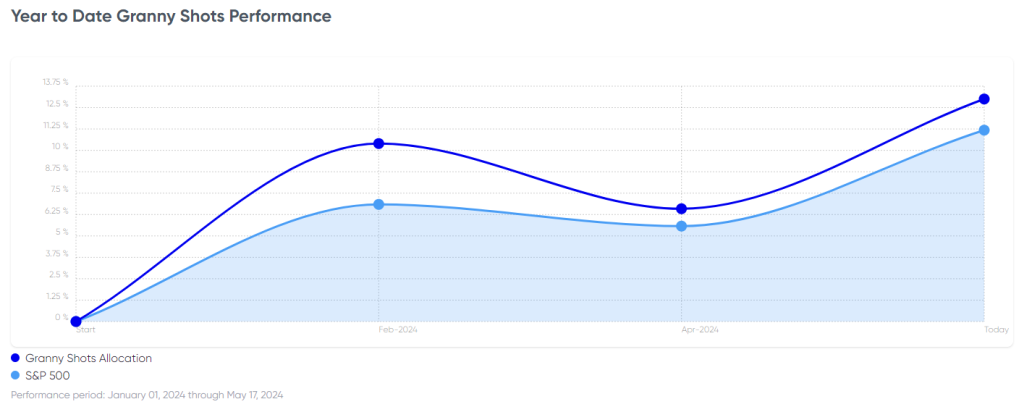

Stock List Performance

In the News

[fsi-in-the-news]