This was an important week for markets, with a myriad of macroeconomic catalysts. “We learned a lot this week,” Fundstrat Head of Research Tom Lee told us, “but the primary takeaway is that 2024 will be a challenging year, but ultimately positive — just as January had zig-zags but ended up positive.”

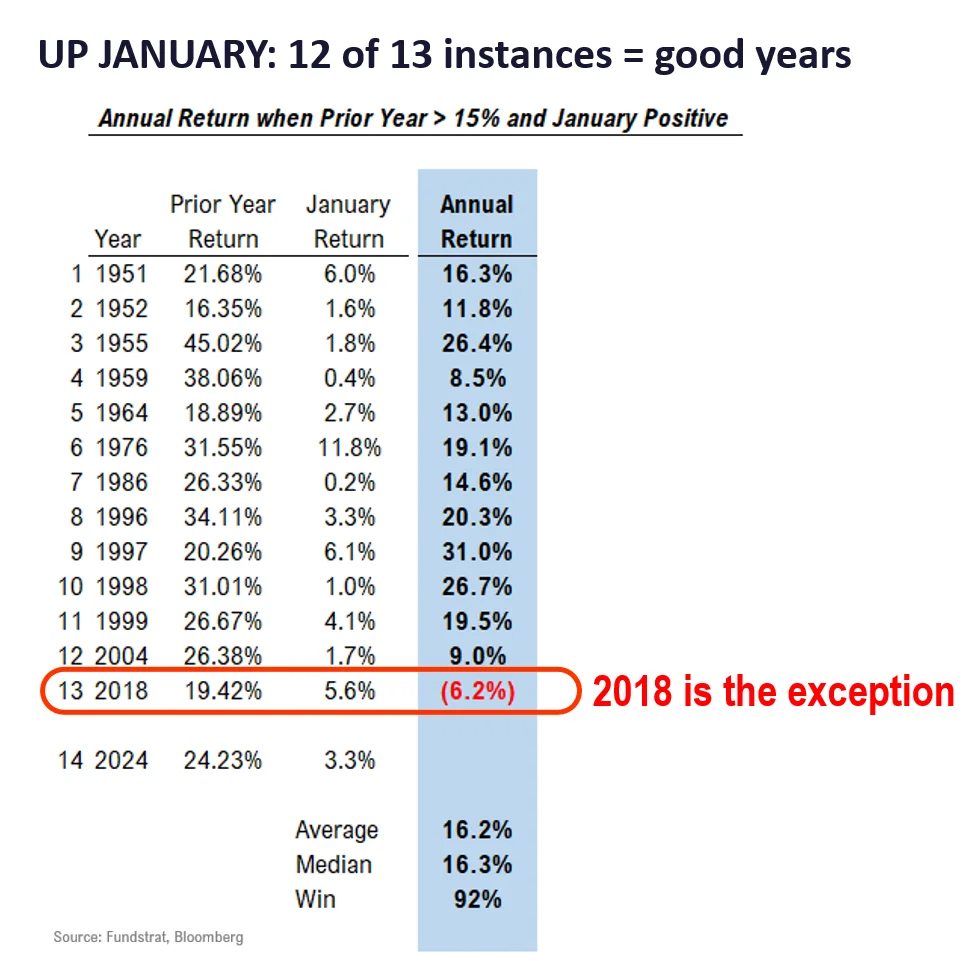

The S&P 500 ended up 1.59% for the month of January. Lee and his team examined data from the past 74 years, finding 28 instances in which the prior year saw gains of 15% or more, as we just did. January was a positive month in 13 out of those 28 instances. In these 13 historic analogs, the full-year return was positive 12 out of 13 times (92%), and the median full-year return was 16.3%. Remarked Lee, “This suggests that our 5,200 [year-end] target might be low. Based on this January barometer, the possible upside to our S&P 500 target could be as high as 5,500 or more.” (See our Chart of the Week below for details on this.)

Head of Technical Strategy Mark Newton had similar thoughts about his year-end target for the S&P 500. In his 2024 outlook, Newton forecast a year-end target of 5,175, but this week, he admitted that “like Tom, I suspect my original target might prove low.” He added, “Unfortunately for the bears, I don’t suspect much will come of any correction at present, and any pullback likely does not undercut former early January highs near 4802.” Looking further out, he said, “My work suggests that Treasury yields likely start a larger period of decline from March into August which should coincide with a more broad-based stock market rally.”

Arguably the most important and most closely watched of last week’s catalysts was the Federal Open Market Committee (FOMC) meeting on January 31. Though the FOMC kept rates unchanged, Federal Reserve Chair Jerome Powell threw cold water on hopes for a March cut during the post-meeting press conference. Stocks sank immediately afterwards but rebounded on Thursday in an apparent sign of market strength.

Lee believes that the odds of a March cut are higher than the immediate post-FOMC market reaction suggests. Powell acknowledged declining inflation and spoke of trying to identify when to “begin the process of dialing back the restrictive level.” “In my view,” Lee said, “this means that the Fed is getting ready to cut, and this is a good thing. But Wednesday’s FOMC statement also tells us that the Fed and markets will continue to struggle with what that framework is.”

Chart of the Week

We found 13 instances over the last 74 years in which a positive January followed a year of gains of 15% or more. Following that positive January, markets saw up years 92% of the time, with a median gain of 16.3%. This suggests that markets might close significantly higher than Tom Lee’s year-end S&P 500 target of 5200.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Sector Allocation Update

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton, part of the February 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Key incoming data

1/29 9:30am ET Dallas Fed January Manufacturing Activity SurveyTame1/30 9am ET January S&P CoreLogic CS home priceTame1/30 10am ET January Conference Board Consumer ConfidenceTame1/30 10am ET JOLTS Job Openings DecemberMixed1/31 2pm ET FOMC Rate DecisionTame2/01 8:30am ET 4QP 2023 Nonfarm ProductivityMixed2/01 9:45am ET S&P Global Manufacturing PMI January FinalTame2/01 10am ET January ISM ManufacturingMixed2/02 8:30am ET January Jobs ReportHot2/02 10am ET: U. Mich. Sentiment and Inflation Expectation January FinalTame- 2/05 9:45am ET S&P Global Services & Composite PMI January Final

- 2/05 10am ET January ISM Services

- 2/07 9am ET Manheim Used Vehicle Index January Final

- 2/09 CPI Revisions

Stock List Performance

In the News

[fsi-in-the-news]