When Tom Lee said a year ago that the S&P would end 2023 at 4750, many were inclined to dismiss the prediction as the view of a permabull who had contrarianed himself into a corner. As it turns out, not only did Lee come closer than any strategist out there to predicting the market’s trajectory; he actually came within one-half of one percentage point – less than the allowance for statistical error – to the actual close at 4 PM on the last trading day of the year.

Lee is already focused on the future. He sees the beginning of 2024 as a launching point for further gains. The median max gain over the next 18 months is +22%. There is only one instance, May 2007, when the max further gain was nominal (<5%), while the other 10 instances saw significant further gains. “Reaching an all-time high is a significant market milestone, and stocks do not suddenly reverse from there,” Lee pointed out.

Is there a wrinkle? There is, actually. Seven out of 11 times, markets first consolidated with a modest drawdown, with overall declines at 2% to 5% – in the current context, that means S&P 500 could pull back to 4,400-4,500 once we make all-time highs. This is consistent with Lee’s 2024 Market Outlook, in which his base case is that the S&P 500 makes most of its gains in 2H2024. Here are some potential reasons for this:

- The markets could get ‘itchy’ waiting for the Fed to cut interest rates, while the Fed itself dithers

- The AI timeline could be pushed out due to a ‘systematic hack’ by malevolent AI

- The equity markets will need to consolidate the parabolic gains from late-2023.

Lee also pointed out that “a drawdown in Feb/March would be consistent with election year seasonal returns. We see a pronounced downturn historically around the Feb/March timeframe, although it is not entirely clear why this happens.”

Chart of the Week

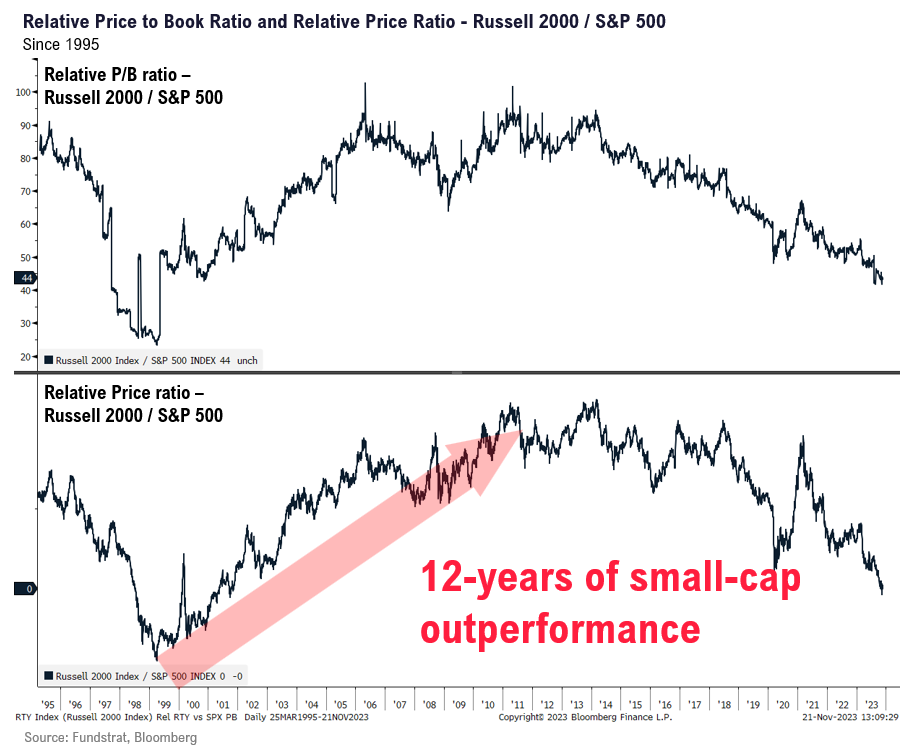

We favor small-caps to outperform in 2024. One reason why is that, as shown above, small-caps on a price-to-book ratio are at 1999 lows, and this should serve as the launch point for a 12-year outperformance cycle.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

12/26 9am ET December S&P CoreLogic CS home priceTame12/26 10:30am ET Dallas Fed December Manufacturing Activity SurveyTame12/29 9:45am ET December Chicago PMITame- 1/02 9:45am ET S&P Global Manufacturing PMI December Final

- 1/03 10am ET December ISM Manufacturing

- 1/03 10am ET JOLTS Job Openings November

- 1/03 2pm ET December FOMC Meeting Minutes

- 1/04 9:45am ET S&P Global Services & Composite PMI December Final

- 1/05 8:30am ET December Jobs Report

- 1/05 10am ET December ISM Services

Stock List Performance

In the News

[fsi-in-the-news]