Much of this week was somewhat range-bound, at least compared to the wild ride that Nvidia (NVDA) sparked the week before. Nevertheless, stocks continued their advance. The Nasdaq hit an all-time high close, breaking a record set in 2021. The S&P 500 also notched fresh new highs, and on Thursday it celebrated Leap Day by extending its monthly win streak to four.

With the bulk of earnings season having passed, investors resumed focusing on inflation data and what the Federal Reserve’s response might be. Two weeks ago, markets sank on a higher-than-expected January CPI reading, even though January seasonal surges in inflation readings are not unusual. CPI tends to foreshadow PCE, so although Core PCE MoM came in on Thursday at 0.4% – the biggest monthly jump since January 2023, the reading was roughly in line with Street expectations, and the S&P 500 and Nasdaq both rose afterward. “There were no major revelations in the PCE numbers, but the market’s reaction tells me there is still gas in the tank,” Lee remarked on Thursday.

Head of Technical Strategy Mark Newton has a similar opinion. In his view, “equity trends show no evidence of wavering. Until or unless last week’s lows are challenged (4946 for ^SPX), SPX very well can continue its rise into mid-March without much trouble, technically.”

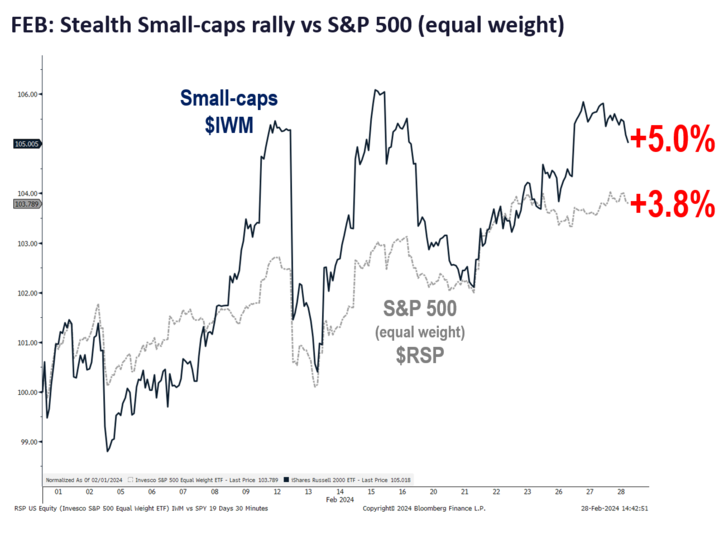

The week’s market action also suggests that the rally is broadening. As Newton pointed out, “RSP, the equal-weighted S&P 500, logged a new all-time high monthly and weekly close.” In fact, the equal-weighted S&P 500 outperformed the S&P 500 index this week.

Chart of the Week

This week, Fundstrat Head of Research Tom Lee pointed out “kind of a ‘stealth rally’” taking place with small-caps, as shown in our Chart of the Week. “If you compare the Russell 200 and compare it to the RSP (S&P 500 equal-weighted index), you can see that small caps have outperformed the broader market,” he pointed out. “We still see 50% upside for small caps, based on their valuation levels.”

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

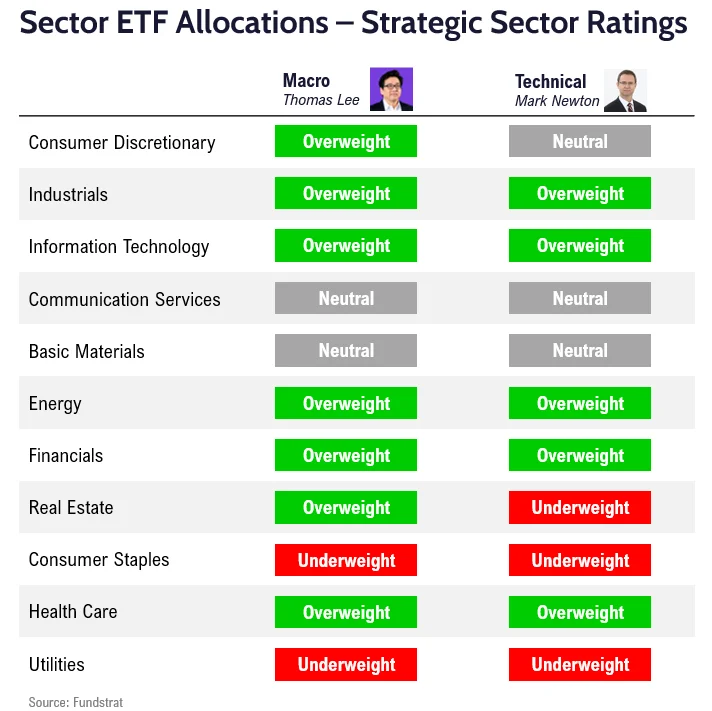

Sector Allocation Update

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton, part of the March 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Key incoming data

2/26 10:30am ET February Dallas Fed Manufacturing Activity SurveyTame2/27 9am ET February S&P CoreLogic CS home priceTame2/27 10am ET February Conference Board Consumer ConfidenceTame- 2/

28 8:30am ET 4QS 2023 GDPTame 2/29 8:30am ET January PCETame3/01 9:45 am ET: Feb F S&P Global Manufacturing PMITame3/01 10:00 am ET: Feb ISM ManufacturingTame3/01 10:00 am ET: Feb F U. Mich. Sentiment and Inflation ExpectationTame- 3/05 9:45 am ET: Feb F S&P Global Services & Composite PMI

- 3/05 10:00 am ET: Feb ISM Services

- 3/06 10:00 am ET: Jan JOLTS Job Openings

- 3/06 2:00 pm ET: Fed Releases Beige Book

- 3/07 8:30 am ET: 4QF 2023 Nonfarm Productivity

- 3/07 9:00 am ET: Feb F Manheim Used Vehicle Index

- 3/08 8:30 am ET: Feb Jobs Report

Stock List Performance

In the News

[fsi-in-the-news]