Markets were apprehensive ahead of last week’s FOMC meeting, and Fundstrat Head of Research Tom Lee told clients that, based on the conversations he was having, many investors remained skeptical about equities as an asset class and expected the Fed to turn hawkish on Wednesday.

However, despite recent hotter-than-expected data, Lee argued that the Fed would acknowledge that inflation was still clearly on a downward trajectory, thus remaining dovish. He asserted that the market would rally on this news, as it became clear that consensus pre-meeting sentiment and expectations were incorrect.

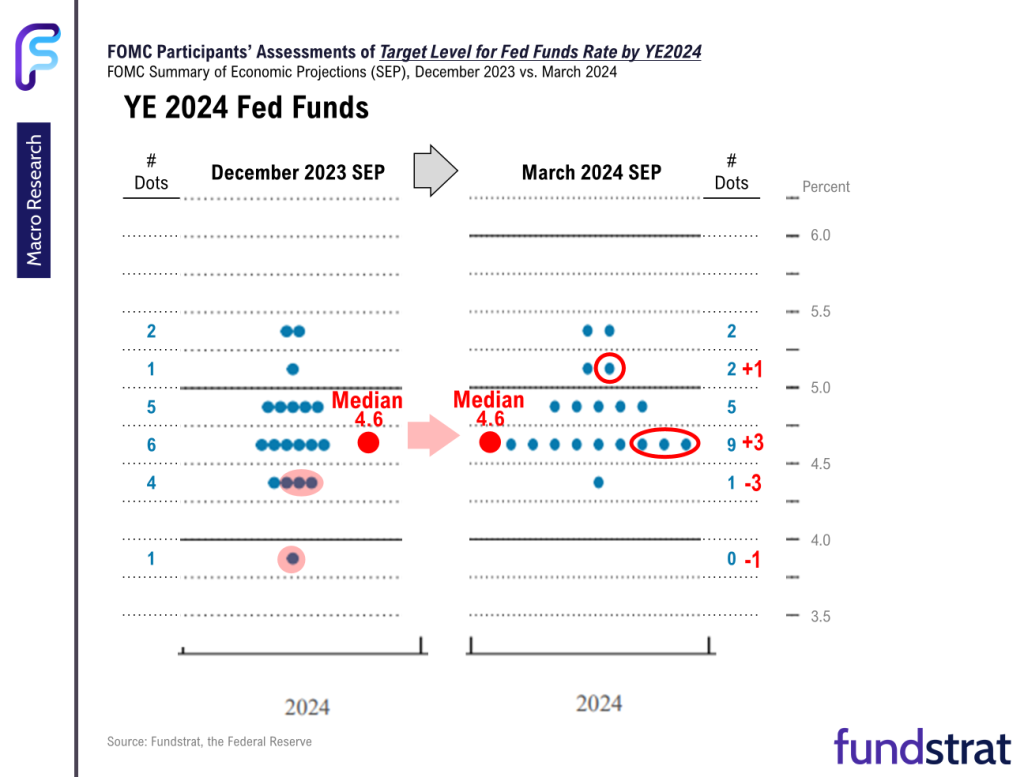

This is exactly what happened. The latest SEP showed that members still expect three rate cuts for 2024 (as shown in our Chart of the Week). Markets immediately rallied in response, with the S&P 500 breaking the 5,200 mark for the first time and closing at a new all-time high Wednesday and again on Thursday. Can this continue?

Lee thinks it’s possible, suggesting that the March 20 FOMC meeting will ultimately convince the market that the Fed remains dovish. Looking forward, he suggested that “once this happens, a lot of things can happen – all of them arguably good for stocks.” In his view, perceptions of a dovish Fed will result in easing financial conditions, expansion of market breadth, and improved CEO confidence.

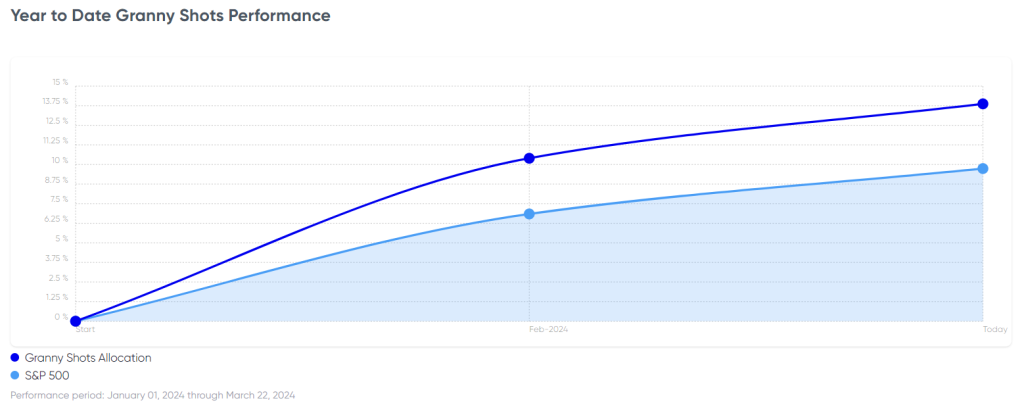

Lee also pointed out that the technicals appear to be in place for markets to continue rallying, citing the work of Fundstrat Head of Technical Strategy Mark Newton. At our weekly research huddle, Newton elaborated on this: “I hear a lot of people who are saying, ‘the market’s overextended,’ or ‘the market’s overbought’. And it’s true that the S&P 500 has made an extraordinary move, up over 26% since October, but much of that has been large-cap Tech.”

He continued, “I think many of those skeptics would be surprised to learn that, on an equal-weighted basis, a breakout has literally just started. We’re seeing a broadening out in the market that is actually quite healthy – rotation out of Technology, which has underperformed the last month, into Energy and Materials, and we’ve already seen Financial and Industrials performing well. This is actually very constructive for the market. That’s why, in my view, we have to be in the market and not be concerned about how overbought the S&P and QQQ have gotten of late.”

Chart of the Week

The Summary Economic Projections (SEP) illustrates where each FOMC voting member currently expects the Fed Funds rate to end the the year. The latest SEP showed FOMC members are coalescing around a median forecast that implies three rate cuts for 2024. Fundstrat’s Tom Lee had argued ahead of the meeting that Fed economists would not use one – or two – months of unexpected inflation readings to pivot from the dovish course that the central bank had already signaled in previous meetings, and in our view, the Chart of the Week confirms his expectation.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

3/18 8:30 am ET: Mar New York Fed Business Activity SurveyTame3/18 10:00 am ET: Mar NAHB Housing Market IndexTame3/19 9:00 am ET: Mar Mid-Month Manheim Used Vehicle IndexTame3/20 2:00 pm ET: Mar FOMC Rate DecisionDovish3/21 8:30 am ET: Mar Philly Fed Business Outlook SurveyTame3/21 9:45 am ET: Mar P S&P Global PMITame- 3/25 10:30 am ET: Mar Dallas Fed Manufacturing Activity Survey

- 3/26 9:00 am ET: Mar S&P CoreLogic CS home price

- 3/26 10:00 am ET: Mar Conference Board Consumer Confidence

- 3/28 8:30 am ET: 4QT 2023 GDP

- 3/28 10:00 am ET: Mar F U. Mich. Sentiment and Inflation Expectation

- 3/29 8:30 am ET: Feb PCE

Stock List Performance

In the News

[fsi-in-the-news]