Fundstrat Head of Research Tom Lee has repeatedly told clients that we are in a “buy the dip” regime, and last week the market presented investors with the opportunity to act on his suggestion. Equities were weighed down this week as the market digested the inflationary implications of the relatively hot “prices paid” component that went into calculating the March ISM Manufacturing index, and of the rise in oil prices.

Some hawkish Fedspeak did its part to pressure stocks as well. During an interview on Thursday, Neel Kashkiri, President of the Minneapolis Fed, floated the possibility of zero rate cuts from the Federal Reserve this year. (Note that Kashkiri is not currently a voting member of the FOMC.)

Still, heading into the next CPI release, Lee sees a high probability that the numbers will come in below Street expectations. In part this is due to the dissipation of the residual seasonality that artificially swelled January and February CPI numbers. We have already seen a preview of this in Europe, where March inflation numbers came in super-soft after hot numbers in January and February.

“If March CPI comes in below consensus, as we expect, then this would reinforce the predominant trend of inflation falling like a rock,” Lee told us. “This, in turn, would likely reverse much of the hawkishness that has crept into the bond market recently; we would expect yields to fall and the implied odds of a June cut to climb.”

In the meantime, Head of Technical Strategy Mark Newton is seeing an extraordinarily resilient market. This is only the fifth down week in the past five months,” he pointed out during our weekly research huddle. Newton’s constructive outlook comes in part from the broadening he’s seen in the current market rally. “Even though Technology is 28% of the S&P 500, and Technology has been down in the last month, the S&P has still managed to show gains,” he said. “Energy, Materials, Utilities, and Financials have really kicked in.” In the near-term, “I expect to see 5350 or 5400, and then, potentially, you might get a little bit more consolidation, or backing and filling. As we head into earnings season, a lot of my cycle work shows the potential for late-month weakness.”

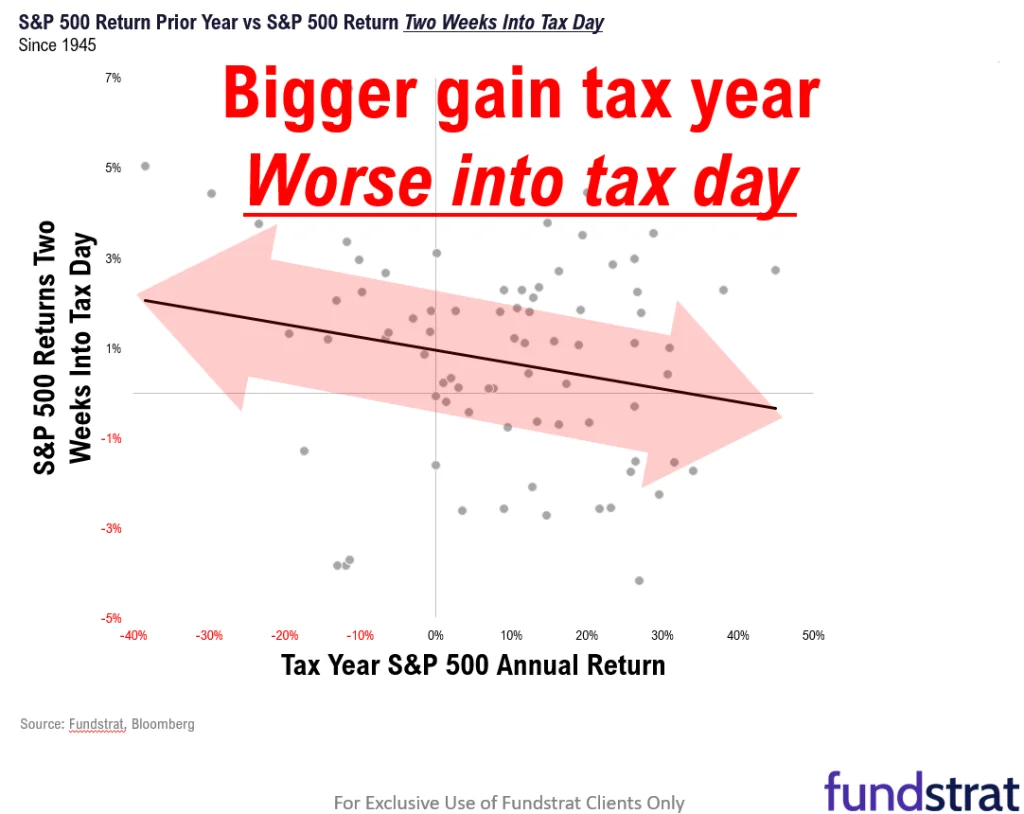

Chart of the Week

We could see some artificial, temporary headwinds affecting stocks until the approaching April 15 tax-filing deadline. Stocks notched strong gains in 2023, and some investors will need to raise cash to pay the capital-gains tax. An analysis by Fundstrat Head of Data Science Ken Xuan shows that weakness heading into tax day is correlated to the strength of the prior calendar year’s stock-market performance, and this is illustrated by our Chart of the Week.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Sector Allocation Update

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the April 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Key incoming data

4/01 9:45 am ET: Mar F S&P Global Manufacturing PMITame4/01 10:00 am ET: Mar ISM ManufacturingMixed4/02 10:00 am ET: Feb JOLTS Job OpeningsTame4/03 9:45 am ET: Mar F S&P Global Services PMITame4/03 10:00 am ET: Mar ISM ServicesTame4/05 8:30 am ET: Mar Jobs ReportHot4/05 9:00 am ET: Mar F Manheim Used Vehicle IndexTame- 4/10 8:30 am ET: Mar CPI

- 4/10 2pm ET: Mar FOMC Meeting Minutes

- 4/11 8:30 am ET: Mar PPI

- 4/12 10:00 am ET: Apr P U. Mich. Sentiment and Inflation Expectation

Stock List Performance

In the News

[fsi-in-the-news]