“If pocketbooks are being stretched and consumers are being choice full, and value seeking, it stands to reason if there’s more pressure on the consumer, they’re only going to become more so.” — Walmart Chief Financial Officer John David Rainey during the third quarter earnings call.

Chart of the Day

Good morning!

Walmart shares ended up as the star yesterday over Nvidia’s blowout quarter in a surprising twist of market luck.

Shares of America’s largest retailer jumped 6.5%, its best day since April 9. It reported third quarter sales that came in better than expectations and raised its financial outlook for the full year.

Its standout performance was a rare bright spot amidst a broader market rout that saw the S&P 500 slide 1.6%.

Nvidia might be to blame for that. It rose as high as 5.1% in the morning, but then for no specific reason, just gave up the gains and ended down almost 3%. Short coverings, AI bubble concerns, worries about a potential pause from the Federal Reserve all seem like lazy answers for why the shares slipped.

I know more of our readers care about Nvidia over Walmart so I’ll briefly say this: I can’t identify a single reason for Nvidia’s sudden reversal. That’s why it’s key for long-term investors to focus on AI fundamentals, which haven’t really changed just because shares fell a little.

Now let’s go back to regularly scheduled programming. I learned something new about the K-shaped economy from Walmart’s earnings yesterday, and it’s that Walmart is uniquely positioned to benefit from a split consumer base.

The K-shaped economy refers to how higher-income consumers are doing significantly better in this challenging economy compared to the lower ones.

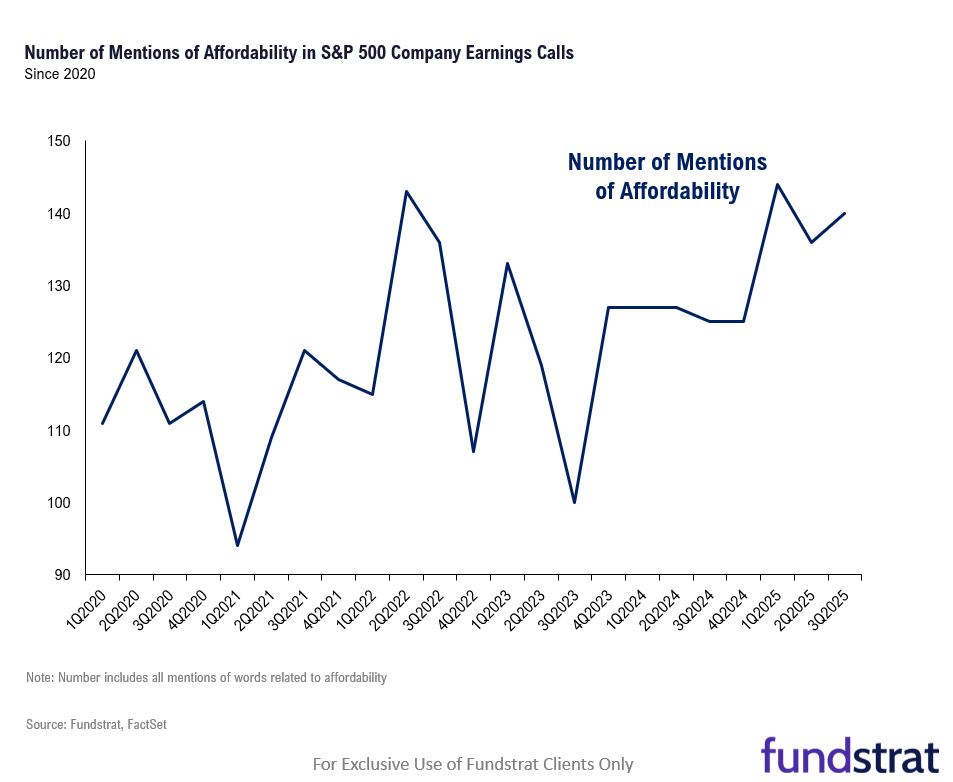

Terms closely related to affordability were cited on the S&P 500 earnings calls of 140 companies in the third quarter. This is the highest number since the first quarter this year when fears of upcoming tariffs caused panic amongst consumers. If we ignore that period, then it’s the highest number since the second quarter in 2022 when higher interest rates first started causing the split, according to an analysis of FactSet data by our macro data scientist Alex Wang.

You’d think that since Walmart mostly caters to lower income consumers, it’d be feeling the pinch right now. And to add some more context there, executives said they’re indeed noticing “moderation in spending in the low-income cohort.”

But here’s the thing: Any spending shortfall by lower-income customers is being easily filled by spending from higher-income consumers, which is a perfect illustration of how money-conscious even those at the top are feeling right now. Even they’re attracted to Walmart for its bargain prices.

Of course, that’s not a great sign for the state of the economy, but on the other hand, it’s bullish for Walmart and shows that it can be more than just a defensive play.

“I think Walmart is better insulated than just about anybody given the value proposition that we have,” said Walmart chief financial officer John David Rainey during the earnings call.

Speaking from experience, it’s rare to find a retailer that sells just about every kind of product for as low as Walmart does. As has long been the case, Walmart’s size and scale enables highly competitive prices.

“We’re leaning into price rollbacks, and making both everyday essentials, and seasonal celebrations more affordable for customers, and members. Walmart’s Thanksgiving Meal basket is a great example. It will feed a group of 10 people for less than $40,” Rainey added.

As a side note, yesterday’s reversal is what ticks people like me about markets. You can never predict what’s going to happen, making it all the more important for investors to maintain a long-term view.

Share your thoughts

What is your plan to be money-conscious this Thanksgiving? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Do you think we’re saved because of Nvidia?

A: A major one day reversal occurred. The next day after earnings release. It does not feel like NVDA can save the day! It seems majority view of AI bubble is taking the lead. I think the one day reversal will be the start of a major decline well into 2026.

Catch up with FS Insight

We discuss the 5 possible factors that triggered the disappointing reversal for equity markets.

Nvidia posted strong results and equities should have had a strong day. But we still expect markets to soon find their footing.

Technical

Thursday’s decline was not encouraging and will likely result in fear starting to creep back into the market. Overall, the next 3-5 days certainly have the potential to show more volatility.

Crypto

Bitcoin’s rolling 30-day return is in the 6th percentile since 2020, the 7-day return is in the 3rd percentile, and its deviation from the 50-day moving average has reached a z-score of roughly -2.8.

News We’re Following

Breaking News

- The Middle Class Is Buckling Under Almost Five Years of Persistent Inflation WSJ

- President and Mamdani to Meet for First Time NYT

Markets and economy

- Nvidia’s Best Wasn’t Enough to Prop Up a Wobbly Stock Market WSJ

- Bitcoin falls below $84,000 Friday. Here’s why stock-market investors are keeping close watch. MW

- The Race to Refinance Makes Mortgages More Expensive for Everyone Else WSJ

- New York Fed President Williams sees room for ‘further adjustment’ to rates CNBC

Business

- The Chip CEO Staring Down Nvidia and Talk of an AI Bubble WSJ

- U.S. Manufacturers to Benefit as GE Appliances Shifts Production NYT

- Strategy Isn’t in S&P 500. Now It Could Get Kicked Out of Other Indexes. BR

- As holidays approach, value players Walmart and T.J. Maxx are drawing the cash-strapped and the wealthy CNBC

Politics

- Why Democrats are warning about Trump giving illegal orders CNN

- Congressional Republicans Begin to Look Beyond Trump NYT

Overseas

- Japan’s Leader Gets Off to Rocky Start With China NYT

- Exclusive: US threatens to cut intel, weapons to press Ukraine into peace deal, sources say RT

Of Interest

- Air-Traffic Controllers With Perfect Shutdown Attendance to Get $10,000 Bonuses WSJ

- Mexico’s bullied pageant contestant gets payback by capturing Miss Universe crown AP

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 11/21 | 9:45 AM | Nov P Sep F S&P Srvcs PMI | 54.6 | 54.8 |

| 11/21 | 9:45 AM | Nov P Oct S&P Manu PMI | 52 | 52.5 |

| 11/21 | 10:00 AM | Nov F Oct P UMich 1yr Inf Exp | 4.7 | 4.7 |

| 11/21 | 10:00 AM | Nov F Oct P UMich Sentiment | 50.6 | 50.3 |

| 11/25 | 8:30 AM | Sep PPI m/m | n/a | -0.1 |

| 11/25 | 8:30 AM | Sep Core PPI m/m | n/a | -0.1 |

| 11/25 | 9:00 AM | Sep Aug Case Shiller 20-City m/m | n/a | 0.19 |

| 11/25 | 10:00 AM | Nov Oct Conf Board Sentiment | 93.3 | 94.6 |

| 11/26 | 8:30 AM | Sep P Durable Gds Orders | n/a | 2.9 |