“I take a vitamin every day. It’s called steak.” – Robert Duvall

Chart of the Day

Good morning!

Like many on Wall Street, we typically follow the “core” versions of inflation metrics (CPI, PPI, PCE) – metrics that strip out the more volatile food and energy components. However, the average American household measures inflation not by looking at macroeconomic data releases, but by monitoring their weekly grocery bills (and gas-pump charges). Thus, grocery prices affect consumer sentiment and confidence.

President Trump asserts that food costs and inflation have generally gone down, but he also notes that beef prices have not. (The latest government data, from September, shows beef prices up more than 12% YoY.) That explains his Nov. 7 claim that meatpacking companies like Cargill, Tyson Foods, JBS, and National Beef “are driving up the price of beef” through collusion and price-fixing. It also explains his about-face on tariffs imposed on beef (along with coffee, bananas, as well as Treasury Secretary Scott Bessent’s unusual assertion that undocumented migrants smuggling diseased cows (along with themselves) across the border are also to blame.

Regardless, the undeniably high prices for beef make Trump’s efforts to expand beef exports to countries such as Australia and the United Kingdom a bit curious. Even if American beef can overcome resistance over sustainability and health concerns (U.S. beef tends to be industrially farmed and hormone-treated, both of which consumers and regulators abroad sometimes find undesirable), increased global demand for American beef would arguably put upward pressure on beef prices for Americans.

Still, the president might have a point when it comes to price-fixing. The White House’s allegations are not exactly unheard of. In fact, Tyson and Cargill on Oct. 11 agreed to pay $55 million and $32.5 million, respectively to settle their parts of a civil lawsuit making substantively similar allegations of misconduct between 2014-2019. (The portions of the suit against JBS and National Beef remained pending as of this writing.) In the last decade, Tyson and JBS are also among the companies that have settled lawsuits alleging price-fixing to drive up the prices of pork and chicken. (The companies have denied all wrongdoing despite agreeing to the settlements.)

One would think that the companies alleged to have participated in the price-fixing schemes have been doing well, but that’s not necessarily so. For example, JBS (JBS -0.18% ), which went public in June, has seen a general rise in revenues since 2022 (though its shares are roughly flat from where they began on their June 13 IPO). However, Tyson (TSN 0.75% ) revenue has been more or less flat since 2022, while its margins (and share price) have largely declined since then. In its most recent earnings report on Nov. 10, Tyson reported operating losses for its beef division widening YoY and weighing down the rest of the company, expressing little optimism for a reversal anytime soon.

The difference is mostly due to the U.S. JBS has benefited from its geographically diversified operations, particularly in Europe and Australia. Meatpackers primarily focused in the U.S., however, have found little escape from an array of challenges since the pandemic ended.

U.S. cattle ranchers shrank their herd sizes in response to the pandemic lockdown, which reduced both restaurant demand and meatpacker capacity. Drought and elevated costs (feed, fuel, labor) made it economically unfeasible to return to pre-COVID herd sizes. The aggregate U.S. cattle supply is thus at lows not seen since the 1950s.

That’s kept cattle prices high for meatpackers even as they struggle with a labor shortage due to a federal tightening in immigration policy. (As in many other dangerous and grueling occupations, meat packers are largely dependent on immigrants, even undocumented ones, as Americans are typically unwilling to fill open positions.)

Price fixing is illegal, and rightly so. Trump’s claim that meatpacker price-fixing has come “at the expense of farmers [and] ranchers,” however, is an oversimplification with which at least some ranchers disagree. If we want our steaks and burgers to become more affordable (and our pork chops and fried chicken, while we’re at it), there are arguably larger problems behind today’s higher prices.

Share your thoughts

What’s to blame for surging beef prices? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Q: Do you have any memories to share from the past recessions?

A: You used the term “scarred for life”. That is me from the 2000 crash. I never really recovered mentally from that crash. It changes the way you invest, the risks you take, and your life completely. The mental damage cost me more money in future years than I actually lost in the crash.

Catch up with FS Insight

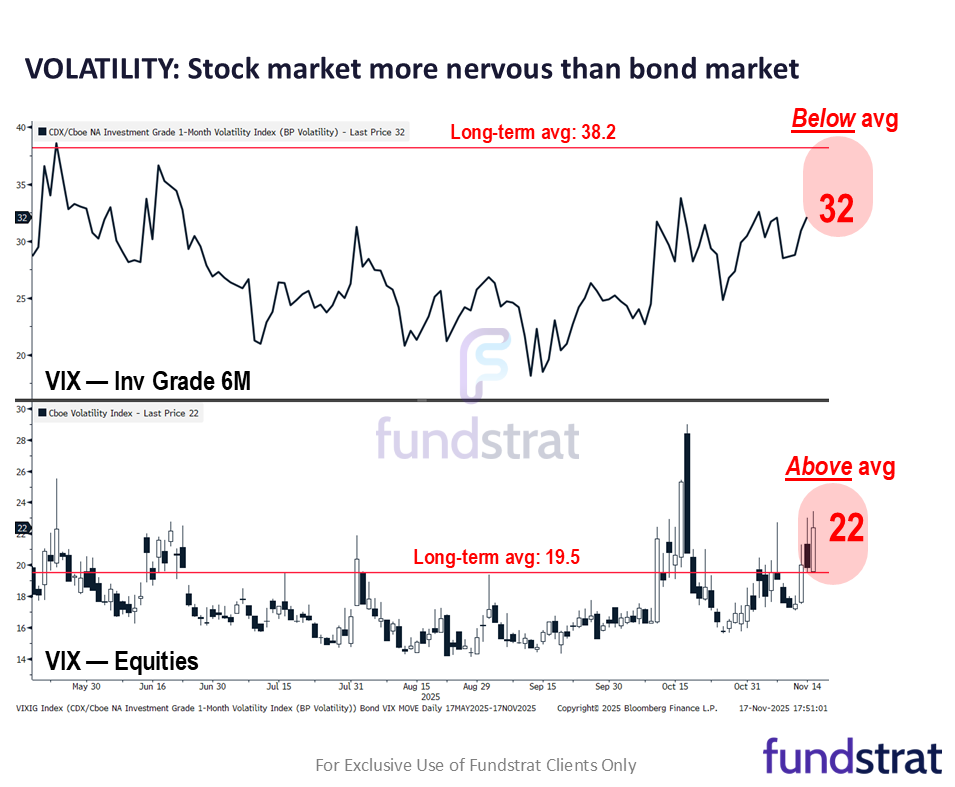

Equity markets are again nervous and the wall of worry is growing. The VIX surged today to 22, above the long-term avg of 19.5, but investment grade VIX (bond VIX) sits at 32, well below its long-term average of 38. In our view, this shows equity markets could be over-reacting to the recent private credit headlines.

Technical

Despite Small-caps and Financials being under pressure, both have appeal on weakness this week, and their underperformance is thought to be temporary. Until/unless October lows are violated, it’s right to be bullish and simply use this recent consolidation as a chance to buy dips.

Crypto

My bigger concern is the continued complacency and build-up of bullish leverage in BTC perps. Overall, while the risk-reward has improved sharply since last week, I still prefer staying patient here.

News We’re Following

Breaking News

- Lawrence Summers to step back from public roles over ties to Epstein FT

- ChatGPT and X hit by outage at online security group Cloudflare FT

Markets and economy

- Fed Governor Lisa Cook Offers First Defense of Mortgage Records WSJ

- More than half of US homes lost value in the past year, Zillow data show YF

- US regulator will permit companies to exclude shareholder proposals from proxies FT

- The Most Joyless Tech Revolution Ever: AI Is Making Us Rich and Unhappy WSJ

- The ‘JPMorgan Boys’ Behind the U.S. Bailout for Argentina WSJ

Business

- US probes firms that borrowed $400mn from BlackRock private credit giant HPS FT

- DeepMind’s Latest AI Weather Model Targets Energy Traders BBG

- iPhone release schedule set to change forever in 2026/2027, confirms Apple insider TG

- J&J buys cancer drugmaker Halda for $3bn in latest biotech deal FT

- Netflix is finally leaning into a key piece of the media playbook: Merchandising CNBC

Politics

- Too Powerful to Ignore, Saudi Prince Returns to Washington’s Embrace NYT

- FEMA Chief Resigns, Sources Say WSJ

- Trump’s Grip on Republicans Shows First Signs of Slipping WSJ

Overseas

- Poland Says Rail Explosion Was ‘Unprecedented Act of Sabotage’ WSJ

- Security Council Expected to Back Trump’s Plan for Postwar Gaza WSJ

Of Interest

- UK to ban resale of tickets above face value for live events FT

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 11/18 | 10:00 AM | Nov Oct Homebuilder Sentiment | 37 | 37 |

| 11/18 | 10:00 AM | Aug F Sep P Durable Gds Orders | 2.9 | 2.9 |

| 11/18 | 4:00 PM | Sep Aug Net TIC Flows | n/a | 2.078 |

| 11/19 | 8:30 AM | Aug Trade Balance | -60.65 | -78.311 |

| 11/19 | 2:00 PM | Oct 29 Sep 17 FOMC Minutes | n/a | 0 |

| 11/20 | 8:30 AM | Sep Oct AHE m/m | 0.3 | 0.3 |

| 11/20 | 8:30 AM | Sep Oct Unemployment Rate | 4.3 | 4.3 |

| 11/20 | 8:30 AM | Sep Oct Non-farm Payrolls | 55 | 22 |

| 11/20 | 10:00 AM | Oct Sep Existing Home Sales | 4.09 | 4.06 |

| 11/20 | 10:00 AM | Oct Sep Existing Home Sales m/m | 0.62 | 1.5 |

| 11/21 | 9:45 AM | Nov P Sep F S&P Srvcs PMI | 54.6 | 54.8 |

| 11/21 | 9:45 AM | Nov P Oct S&P Manu PMI | 52 | 52.5 |

| 11/21 | 10:00 AM | Nov F Oct P UMich 1yr Inf Exp | n/a | 4.7 |

| 11/21 | 10:00 AM | Nov F Oct P UMich Sentiment | 50.6 | 50.3 |