A daily market update from FS Insight — what you need to know ahead of opening bell

“The combustion engine is our core product, and that will remain so for the coming future.” — Riley Nelson, Head of Sustainability, NASCAR

Over the Weekend

Left wing on track to win French election in stunning turn of events Semafor

Boeing has agreed to plead guilty to one charge of conspiracy to defraud the U.S. CNN

Wall Street’s upbeat earnings expectations set high bar for U.S. companies FT

Futures flat with inflation data, earnings in focus RT

A key part of America’s economy has shifted into reverse CNN

Power outages climb rapidly across Texas as Hurricane Beryl moves inland CNN

Climate change is hitting food supplies Semafor

Six Flags completed an $8 billion merger with rival Cedar Fair to create the largest amusement park operator in the U.S. CNN

Ellison’s Skydance gets closer to Paramount deal TI

Founder of U.K. fintech Revolut will sell millions of dollars’ worth of stock in an upcoming secondary offering, part of a $500 million share offering organized by Morgan Stanley, at a $40 billion target valuation TI

AI-powered super soldiers are more than just a pipe dream Wired

NASCAR unveils electric SUV, but the race series isn’t giving gasoline the boot CNN

John Deere will lay off roughly 600 employees from three U.S. factories CNN

Indian PM Modi will visit Moscow today in his first visit to Russia since the country invaded Ukraine CNN

Thailand is doing away with duty-free shopping at its international airports to boost tourism spending within the country Semafor

Chart of the Day

MARKET LEVELS

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crypto | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commodities and Others | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Treasuries | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 7/8 | 11AM | Jun NYFed 1yr Inf Exp | n/a | 3.17 |

| 7/9 | 6AM | Jun Small Biz Optimisum | 90.2 | 90.5 |

| 7/11 | 8:30AM | Jun CPI m/m | 0.1 | 0.0 |

| 7/11 | 8:30AM | Jun Core CPI m/m | 0.2 | 0.2 |

| 7/11 | 8:30AM | Jun CPI y/y | 3.1 | 3.3 |

| 7/11 | 8:30AM | Jun Core CPI y/y | 3.4 | 3.4 |

| 7/12 | 8:30AM | Jun PPI m/m | 0.1 | -0.2 |

| 7/12 | 8:30AM | Jun Core PPI m/m | 0.2 | 0.0 |

| 7/12 | 10AM | Jul P UMich 1yr Inf Exp | 3.0 | 3.0 |

| 7/12 | 10AM | Jul P UMich Sentiment | 68.2 | 68.2 |

MORNING INSIGHT

Good morning!

Interest rates are down.

The Fed has more reasons to be dovish compared to their stance after the June FOMC meeting

The Fed has a playbook for dealing with a softer jobs market = turn dovish

We are near-term dip buyers.

Our strategy recommendations remain to stick with what is working:

- AI NVDA 0.53% CDNS -0.05% ARM -3.66% AMD -1.56% AIQ -0.82%

- Ozempic-related LLY -1.60% NVO -1.85%

- Financials and Industrials XLI 0.47% XLF 0.80%

- Bitcoin & Proxies: BTC MARA -0.50% PYPL -0.05% COIN 4.40% MSTR 1.98% SMLR -0.26%

- Feb Stealth: Small-caps IWM 0.63% IJR 0.86%

Click HERE for more.

TECHNICAL

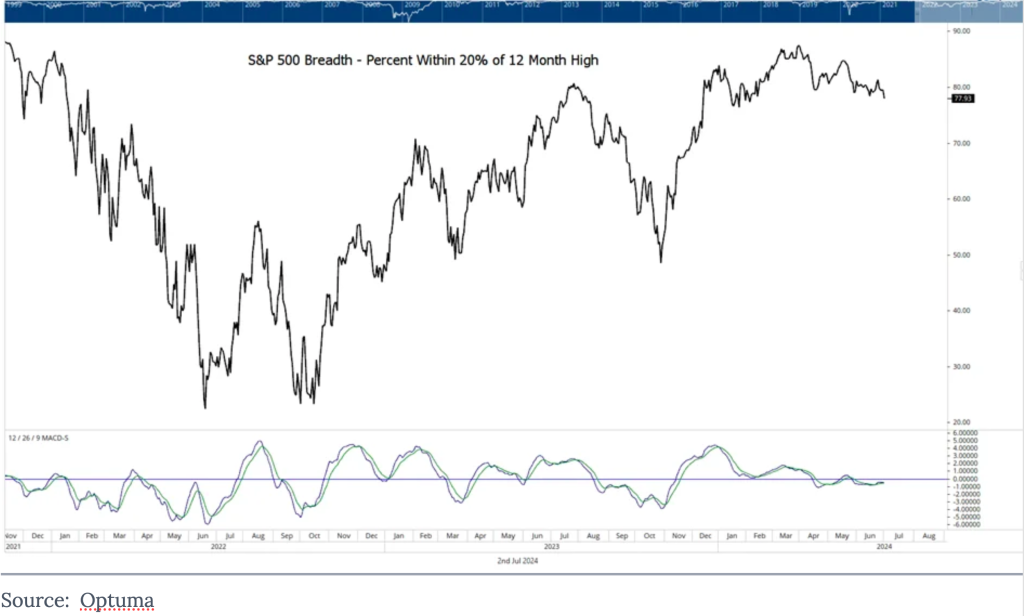

S&P breadth indicators like “Percentage of Stocks within 20% of their 52-week (12-month) highs” still lies near 80%, despite many investors complaining that Technology seems to be the only sector working. This is clearly not the case, but it’s expected that this gauge will start to lift as more sectors begin to follow suit.

As can be seen on the left-hand side of the chart below, this breadth gauge began to plummet back in 2021 ahead of the bull market peak for SPX on 1/3/22 as well as well ahead of the November 2021 peak for NASDAQ and DJ Transports along with most European indices. This is a worthwhile chart to keep handy for those worried that markets might begin a bear turn based on lack of participation.

At present, with nearly 80% of all stocks within 20% of their 12-month highs, a relatively high reading above 70% does not present much worry.

However, evidence of this dropping below 50% would certainly make for a more cautious view; we would then begin to study uptrends for signs of the larger benchmark indices giving way.

Overall, this doesn’t look to be of much concern at the present time, and despite some minor breadth waning in recent months, the intermediate-term gauges remain in good shape.

S&P 500 Breadth – Percent Within 20% of 12 Month High

Click HERE for more.

First News

The Federal Reserve Bank of New York will release consumer inflation expectations at 11 a.m. ET. today.

Fed Chair Jerome Powell will appear on Capitol Hill on Tuesday and Wednesday, testifying before the Senate Banking Committee and the House Financial Services Committee, respectively, with both Republicans and Democrats expected to question him on the potential for interest-rate cuts amid falling consumer demand. Powell’s testimony is likely to cover the Fed’s outlook on inflation, employment, and economic growth.

The Consumer Price Index (CPI) report will be released Thursday at 8:30 AM EST. The Fed says more data is needed to confirm whether low inflation is a true trend. The CPI report will be key in deciding if there will be a rate cut.

On Friday, big banks, including JPMorgan Chase & Co., Wells Fargo, Citigroup, The Bank Of New York Mellon Corporation, and Unity Bancorp, will release earnings reports. Q2 earnings outpaced expectations, boosting the stock market. Naturally, investors want this trend to continue, as strong earnings could signal economic resilience and buoy market optimism. Still, financials as a sector make up roughly 12% of the S&P, while Consumer Staples and Consumer Discretionary jointly make up roughly 1 ½ times that – and consumer demand is down.

TSLA.gov.cn For the first time, Tesla cars are on a Chinese government procurement list, as reported by state-owned media outlet Paper.cn.

The Jiangsu provincial government in eastern China has published a purchase catalog featuring Tesla as the sole foreign-owned electric vehicle brand. Other listed brands include Geely-owned Volvo and state-owned SAIC. This inclusion allows government agencies and public organizations in Jiangsu to acquire Tesla vehicles for official use, pointing to a favorable state of affairs in the relationship between China and the ostensibly American company.

The news has sparked discussions on Chinese social media platforms, with some users debating the appropriateness of considering foreign cars for government use.

In response to these concerns, as reported in state-owned National Business Daily, a Jiangsu government employee clarified that the Tesla model in question is “a domestic car, not imported”. It’s all in the definition, one supposes.

Tesla’s Shanghai gigafactory produced ~947,000 vehicles in 2023, with the majority intended for the local market. CNN

Rash Containment. Driven by increased longevity and smaller families, global aging is an “irreversible trend”, as described by the UN. By 2050, the global population aged 65 and older is projected to more than double to 1.6 billion.

Japan exemplifies this demographic shift, with its aging population posing challenges to its economy. In 2023, Japan reported a record low of 727,277 births, continuing an eight-year decline. Japan is now officially the world’s oldest country, with one in ten people aged 80 or older and nearly 30% of the population over 65.

To address this demographic crisis, Prime Minister Fumio Kishida introduced a multi-billion dollar package in June 2023 to encourage childbearing. Similar packages exist in other countries with ultra-low birth rates, such as South Korea, Italy, Hungary, and Russia. Japan faces potential issues with pension funding and healthcare as its workforce shrinks and demand from the elderly increases.

This demographic shift is also impacting consumer markets. The global adult diaper market, valued at $12.8 billion in 2023, is expected to reach $15.5 billion by 2026, while Japan’s share of this market is projected to grow from $1.7 billion to $1.9 billion in the same period.

As a way of responding to these changes – while leaving babies o muddle through somehow – Japanese manufacturer Oji Holdings announced plans to cease domestic baby diaper production and focus on adult incontinence products. In 2023, Oji Holdings sold 7.3% more adult diapers than baby diapers in Japan.

It’s not clear whether this is a case of concentrating resources on a growing market at the calculated expense (savings, really) of abandoning a contracting one, or a vote of no confidence in the country’s future. As the company plans to maintain its overseas baby diaper business, which has seen growth in China, Indonesia, and Malaysia, it’s likely the latter option. CNN