A daily market update from FS Insight — what you need to know ahead of opening bell

“Worry is the interest paid by those who borrow trouble.” — George Washington

Overnight

Putin warns NATO of risk of nuclear confrontation over Ukraine

Mitch McConnell will step down as Senate GOP leader in November

Pro-EU Moldova dismisses breakaway region’s request for Russian help

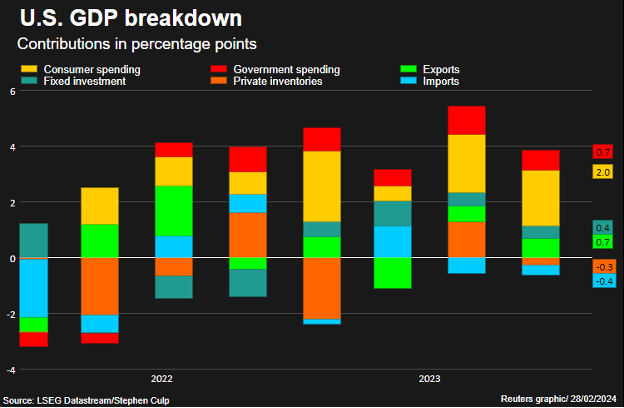

U.S. GDP revised slightly lower as inventories subtracted

Uber CEO unlocks $136M in shares after hitting $120B valuation

Universal Music escalates fight with TikTok, removes entire catalog from platform

New Canaan, Connecticut, is selling $27 million in GOs next week

First news

- Non-banks have been piling – one could say, leaping – into lending for years, and the consequences could be building up into an externality.

Chart of the Day

MARKET LEVELS

| Overnight |

| S&P Futures -14

point(s) (-0.3%

) overnight range: -21 to +4 point(s) |

| APAC |

| Nikkei -0.11%

Topix +0.03% China SHCOMP +1.94% Hang Seng -0.15% Korea -0.37% Singapore +0.09% Australia +0.5% India +0.14% Taiwan +0.6% |

| Europe |

| Stoxx 50 +0.01%

Stoxx 600 +0.12% FTSE 100 +0.19% DAX +0.44% CAC 40 +0.06% Italy +0.37% IBEX -0.07% |

| FX |

| Dollar Index (DXY) -0.12%

to 103.85 EUR/USD +0.06% to 1.0844 GBP/USD flat at 1.2662 USD/JPY -0.43% to 150.04 USD/CNY -0.03% to 7.196 USD/CNH -0.04% to 7.2109 USD/CHF +0.13% to 0.8799 USD/CAD +0.1% to 1.3591 AUD/USD +0.02% to 0.6497 |

| Crypto |

| BTC +3.4%

to 62610.51 ETH +4.56% to 3474.78 XRP +4.47% to 0.5983 Cardano +10.92% to 0.6945 Solana +8.35% to 128.93 Avalanche +8.14% to 43.67 Dogecoin +13.01% to 0.1286 Chainlink +5.92% to 20.29 |

| Commodities and Others |

| VIX +1.3%

to 14.02 WTI Crude +0.11% to 78.63 Brent Crude -0.05% to 83.64 Nat Gas -0.48% to 1.88 RBOB Gas -0.48% to 2.26 Heating Oil -0.85% to 2.636 Gold -0.17% to 2031.05 Silver -0.38% to 22.37 Copper +0.18% to 3.834 |

| US Treasuries |

| 1M -1.9bps

to 5.3647% 3M -2.2bps to 5.3693% 6M -0.6bps to 5.3188% 12M -0.3bps to 4.9954% 2Y +5.2bps to 4.6891% 5Y +5.3bps to 4.3131% 7Y +5.0bps to 4.3336% 10Y +4.3bps to 4.3073% 20Y +3.3bps to 4.5696% 30Y +2.9bps to 4.4337% |

| UST Term Structure |

| 2Y-3

M Spread widened 5.0bps to -71.7

bps 10Y-2 Y Spread narrowed 1.0bps to -38.6 bps 30Y-10 Y Spread narrowed 1.7bps to 12.2 bps |

| Yesterday's Recap |

| SPX -0.17%

SPX Eq Wt +0.04% NASDAQ 100 -0.54% NASDAQ Comp -0.55% Russell Midcap +0.05% R2k -0.77% R1k Value +0.06% R1k Growth -0.34% R2k Value -0.8% R2k Growth -0.74% FANG+ -0.72% Semis -1.11% Software -0.17% Biotech -1.32% Regional Banks -1.08% SPX GICS1 Sorted: REITs +1.28% Fin +0.35% Cons Disc +0.32% Utes +0.3% Indu +0.3% Materials +0.22% Cons Staples +0.09% SPX -0.17% Energy -0.2% Healthcare -0.51% Tech -0.55% Comm Srvcs -0.92% |

| USD HY OaS |

| All Sectors +5.5bp

to 368bp All Sectors ex-Energy +5.9bp to 354bp Cons Disc +4.2bp to 302bp Indu +5.9bp to 284bp Tech +5.9bp to 448bp Comm Srvcs +4.7bp to 582bp Materials +6.6bp to 327bp Energy +6.0bp to 306bp Fin Snr +5.7bp to 338bp Fin Sub +4.5bp to 255bp Cons Staples +6.8bp to 313bp Healthcare +6.1bp to 459bp Utes +8.4bp to 235bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 2/29 | 8:30AM | Jan PCE m/m | 0.3 | 0.2 |

| 2/29 | 8:30AM | Jan Core PCE m/m | 0.4 | 0.17 |

| 2/29 | 8:30AM | Jan PCE y/y | 2.4 | 2.6 |

| 2/29 | 8:30AM | Jan Core PCE y/y | 2.8 | 2.93151 |

| 3/1 | 9:45AM | Feb F S&P Manu PMI | 51.5 | 51.5 |

| 3/1 | 10AM | Feb ISM Manu PMI | 49.5 | 49.1 |

| 3/1 | 10AM | Feb F UMich 1yr Inf Exp | 3.0 | 3.0 |

| 3/1 | 10AM | Feb F UMich Sentiment | 79.6 | 79.6 |

| 3/5 | 9:45AM | Feb F S&P Srvcs PMI | 51.4 | 51.3 |

| 3/5 | 10AM | Feb ISM Srvcs PMI | 53.0 | 53.4 |

| 3/5 | 10AM | Jan F Durable Gds Orders | n/a | -6.1 |

| 3/6 | 10AM | Jan JOLTS | n/a | 9026.0 |

MORNING INSIGHT

Good morning!

We discuss the four themes working in 2024.

Jan. PCE released Thu. am.

Recall, “stubborn” inflation is Auto insurance + Shelter.

NYSE margin debt barely rose in Jan., including the stealth rally in small-caps. That is a surprise, given the Fed odds of a cut have diminished. A sign that the stock market is stronger in 2024 vs 2023.

Click HERE for more.

TECHNICAL

Equity trends show no evidence of wavering. Despite this week’s mild consolidation in Equity indices, the Cyclicals have managed to kick into gear to provide support to Equities, and little evidence of any trend break has occurred in uptrends of QQQ or SPX. Technically speaking, this mild consolidation should represent a buying opportunity for a push higher into mid-March before any consolidation sets in. However, as charts below will show, it’s very possible that QQQ could lead markets higher out of this mild consolidation, despite this week’s underperformance. SPX requires a break of last week’s lows (SPX-4946) to cause even minor concern about additional weakness.

Below is a closeup of the daily chart of SPX, intended to show some of the key areas that will represent importance for near-term trends. As this two-hour chart shows, following the gap back higher to new highs into late last week, the last few days have produced a mild consolidation. This won’t really be a concern until/unless 4946 is broken, and, technically, we feel the opposite occurs into end of week.

SPX should begin a push back higher to exceed 5111 into the month of March. We’ll discuss upside targets in price and time next week, but another 2-3 weeks of gains look quite possible technically, despite many market participants feeling SPX has grown elevated.

S&P 500 Index

Click HERE for more.

CRYPTO

- Ark Invest and 21Shares have integrated Chainlink’s Proof of Reserve product to increase the transparency of their Bitcoin ETF holdings (ARKB). ARKB has accumulated approximately $1.6 billion in Bitcoin since launching in January, making it the fourth-largest Bitcoin ETF by AUM. Ark and 21Shares are the first Bitcoin ETF issuer to leverage Chainlink’s technology and set a new standard for digital asset security and transparency. Chainlink (LINK 4.18%) is the leading oracle provider across the industry and has secured over $9 trillion in on-chain value across over 11.8 billion data points. Its Proof of Reserves product will give investors further transparency into ETF reserves by pulling data directly from Coinbase via an up-to-date decentralized reference contract. Investors will be able to monitor ARKB’s holdings in real-time with full confidence in the data’s accuracy with no singular point of failure. LINK 4.18% has gained 5.92% today following the integration announcement.

- Riot Platforms (RIOT) has entered into a new purchase agreement with MicroBT to buy 31,500 next-generation M60S miners for a total consideration of $97.4 million, reflecting a rate of $16.50 per terahash (TH). All the miners will be deployed at Riot’s Rockdale Facility, with 14,500 utilizing available capacity and the remaining ones replacing underperforming machines. Replacing old miners with newer models should increase Riot’s hash rate capacity and efficiency, reducing Riot’s bitcoin cost of production. M60S miners are MicroBT’s newest air-cooled machines, which boast an efficiency rating of 18.5 J/TH and produce approximately 186 TH/S per machine. The order should bring the Rockdale Facility’s self-mining hash rate capacity to 15.1 exahashes per second (EH/S) by the end of July. The miners are expected to be shipped between May and June 2024.

FIRST NEWS

Private Credit, Public Headache? Michael Hsu believes a great blurring between banks, payment firms,* and firms that do bank-like lending is afoot.

Hsu, the acting comptroller of the currency – aka the head of the OCC, which charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks – remarked recently that “since PE firms are not subject to consolidated supervision, it is not possible for regulators and other outsiders to assess how risky and interdependent these activities are.

The idea is that, with more and more financial firms increasingly acting like banks, the private equity industry’s rapid advance into private credit poses potential threats to global financial stability. PE firms are originating more loans and nudging their way into other functions typically performed by banks. Buyout firms are also increasingly active in insurance and creative funding structures.

Hsu adds that the introduction of new evergreen funds, which provide investors with opportunities to exit, can introduce new risks, “including redemption risks similar to those faced by open-end bond funds”, which have previously been cited as a financial stability concern by other regulators.

He also highlighted private equity firms’ push into insurance, noting that “since PE firms are not subject to consolidated supervision, it is not possible for regulators and other outsiders to assess how risky and interdependent these activities are”. His comments come at a time when private credit has grown ever more popular among asset managers and investors. The private credit market exceeded $1.5tn (£1.2tn) in assets globally as of 2022, per Preqin. At the same time, private credit fundraising dropped to $123.1bn in 2023 (from $150.8 billion the year before) amid investor concerns over high interest rates and potential defaults, while the average time to close to new investors (i.e. to raise the targeted amount of funds) has shot up to 39 months in 2024, from 25 months last year.

Elsewhere, Hsu said that, with the digitization of banking, coupled with non-banks offering payments services (not to mention further changes expected over the next decade in the space), regulators should focus on ensuring that “bank safety and soundness is maintained, consumers are protected and the playing field is level”.

In November of last year, U.S. senators Sherrod Brown and Jack Reed wrote a letter to leaders at the Federal Reserve, the FDIC, and the OCC, asking them to assess the systemic risks presented by the fast-growing private credit market, and specifically seeking to understand whether private credit could threaten the safety of the banking system.

Fearing defaults and the impact of rising rates on borrower repayments, major investors, such as pension funds, are reducing allocations to private credit, and yet, despite challenges and a tougher fundraising environment, some pension plans remain attracted to private credit’s potential for double-digit returns. Still, all in all, most public pensions funds are making smaller commitments to private credit or spending more time searching for managers to invest with.

The dramatic rise of private-credit funds has been powered by a simple pitch to insurers and pension managers: invest in our loans and avoid the price gyrations of other types of corporate finance. The private debt will trade so rarely; in many cases, never; that its value will stay steady, letting backers enjoy bountiful, (better than private-equity) stress-free returns. This difficult-to-resist proposition has powered a boring-to-billions transformation of the sector from a Wall Street backwater into a $1.7 trillion market. Hence the increased scrutiny.

Despite the sector’s history of high returns, investors are increasingly cautious as interest rates rise, potentially leading to more companies struggling to meet debt interest payments. To some industry insiders, a high-interest-rate environment is, not illogically, synonymous with more defaults on the horizon.

On the other side of the pond, they say there’s trouble brewing. In late-January, a Bank of England official warned of stormy seas ahead for the private-credit markets. In a recent speech, Lee Foulger, director of financial stability, strategy, and risk at the BOE, said rising interest rates could create issues for private credit lenders in the future – admitting that private credit firms have maintained low default rates to date, but pointing to the serious decline in interest-coverage ratios for highly leveraged borrowers over the past year. This could lead many of them to enter into refinancing agreements at a higher rate.

Foulger added that refinancing deals could delay or mask borrower vulnerabilities instead of addressing the underlying issues. He also said that some of the tools used by private credit lenders to smooth out the impact of fiscal tightening could add to the risk of rising defaults. For example: issuing payment-in-kind notes, which allow the borrower to make interest payments with additional debt, or amend and extends, in which lenders push back the maturity of a loan – while individually rational – could put a premium on certain risk-management approaches, collectively upping the risk of defaults down the road.

Closer to home, despite the risks, some U.S. pension plans continue to invest heavily in private credit. Steven Meier, CIO of the $264 billion NYC Employees Retirement Systems, emphasized the double-digit returns offered by private credit, making it an attractive asset despite dislocations in the market, saying, “It’s the right time to be putting more money to work”. Bloomberg, Alternative Credit Investor, Wall Street Now, BOE, Bloomberg

* Square, for instance, has a banking charter. Not many people know that.