A daily market update from FS Insight — what you need to know ahead of opening bell

“All boundaries are conventions waiting to be transcended.” — Cloud Atlas

First news

- No longer hedging their adoption of AI, hedge funds, other financial firms dive in, as Bloomberg transcends its offering

- Deepfakes are officially good enough to do deep financial damage

- Hydrogen may finally be good enough to start being taken seriously.

Overnight

- China Jan. consumer prices fall at fastest pace since Sept. 2009. link

- Global gold ETF outflows continued in January. link

- For first time in 20 years, U.S. imports more goods from Mexico than from China. link

- Uber posts first full-year profit since its 2019 IPO. link

- Target mulls paid membership program like ones from rivals Amazon Prime and Walmart+. link

- Blockbuster payout by U.S. oil majors is largest ever. link

- SoftBank to report earnings after AI demand allows its portfolio star, UK chip designer Arm, to handily beat Wall Street’s expectations. link

- OpenAI shifts AI battleground to software that operates devices, automates tasks. link

MARKET LEVELS

| Overnight |

| S&P Futures -4

point(s) (-0.1%

) overnight range: -5 to +1 point(s) |

| APAC |

| Nikkei +2.06%

Topix +0.5% China SHCOMP +1.28% Hang Seng -1.27% Korea +0.41% Singapore -0.42% Australia +0.31% India -0.97% Taiwan flat |

| Europe |

| Stoxx 50 +0.44%

Stoxx 600 +0.2% FTSE 100 +0.23% DAX +0.1% CAC 40 +0.54% Italy +0.08% IBEX +0.32% |

| FX |

| Dollar Index (DXY) +0.04%

to 104.09 EUR/USD +0.02% to 1.0774 GBP/USD -0.04% to 1.2621 USD/JPY +0.57% to 149.03 USD/CNY +0.02% to 7.1965 USD/CNH +0.01% to 7.2138 USD/CHF -0.15% to 0.8731 USD/CAD +0.04% to 1.3469 AUD/USD -0.21% to 0.6506 |

| Crypto |

| BTC +1.42%

to 44816.95 ETH -0.22% to 2424.77 XRP +0.43% to 0.5152 Cardano +6.99% to 0.5339 Solana +0.85% to 101.96 Avalanche +0.45% to 35.45 Dogecoin flat at 0.0801 Chainlink +0.33% to 18.83 |

| Commodities and Others |

| VIX +1.17%

to 12.98 WTI Crude +0.64% to 74.33 Brent Crude +0.71% to 79.77 Nat Gas +0.76% to 1.98 RBOB Gas +0.99% to 2.285 Heating Oil +0.52% to 2.83 Gold +0.05% to 2036.39 Silver +0.89% to 22.42 Copper +0.17% to 3.742 |

| US Treasuries |

| 1M -1.4bps

to 5.357% 3M -2.4bps to 5.3537% 6M -3.8bps to 5.1957% 12M -0.0bps to 4.8066% 2Y -0.6bps to 4.4226% 5Y -0.2bps to 4.0681% 7Y +0.3bps to 4.1038% 10Y -0.8bps to 4.1134% 20Y +0.7bps to 4.4305% 30Y +0.8bps to 4.3326% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 1.6bps to -97.3

bps 10Y-2 Y Spread narrowed 0.2bps to -31.1 bps 30Y-10 Y Spread widened 1.6bps to 21.7 bps |

| Yesterday's Recap |

| SPX +0.82%

SPX Eq Wt +0.39% NASDAQ 100 +1.04% NASDAQ Comp +0.95% Russell Midcap +0.56% R2k -0.17% R1k Value +0.26% R1k Growth +1.29% R2k Value -0.35% R2k Growth +0.02% FANG+ +1.78% Semis +2.02% Software +1.6% Biotech -1.88% Regional Banks -0.26% SPX GICS1 Sorted: Tech +1.43% Cons Disc +1.12% Comm Srvcs +0.93% SPX +0.82% Materials +0.81% Fin +0.69% Indu +0.64% Healthcare +0.26% Energy +0.17% Utes +0.05% REITs -0.06% Cons Staples -0.08% |

| USD HY OaS |

| All Sectors -6.7bp

to 380bp All Sectors ex-Energy -6.5bp to 362bp Cons Disc -8.2bp to 319bp Indu -7.8bp to 284bp Tech -13.1bp to 468bp Comm Srvcs +2.2bp to 601bp Materials -10.1bp to 340bp Energy -9.0bp to 316bp Fin Snr -6.6bp to 354bp Fin Sub -1.4bp to 261bp Cons Staples -5.9bp to 312bp Healthcare -7.5bp to 453bp Utes -7.1bp to 228bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 2/12 | 11AM | Jan NYFed 1yr Inf Exp | n/a | 3.01 |

| 2/13 | 6AM | Jan Small Biz Optimisum | n/a | 91.9 |

| 2/13 | 8:30AM | Jan CPI m/m | 0.2 | 0.3 |

| 2/13 | 8:30AM | Jan Core CPI m/m | 0.3 | 0.3 |

| 2/13 | 8:30AM | Jan CPI y/y | 2.9 | 3.4 |

| 2/13 | 8:30AM | Jan Core CPI y/y | 3.7 | 3.9 |

MORNING INSIGHT

Good morning!

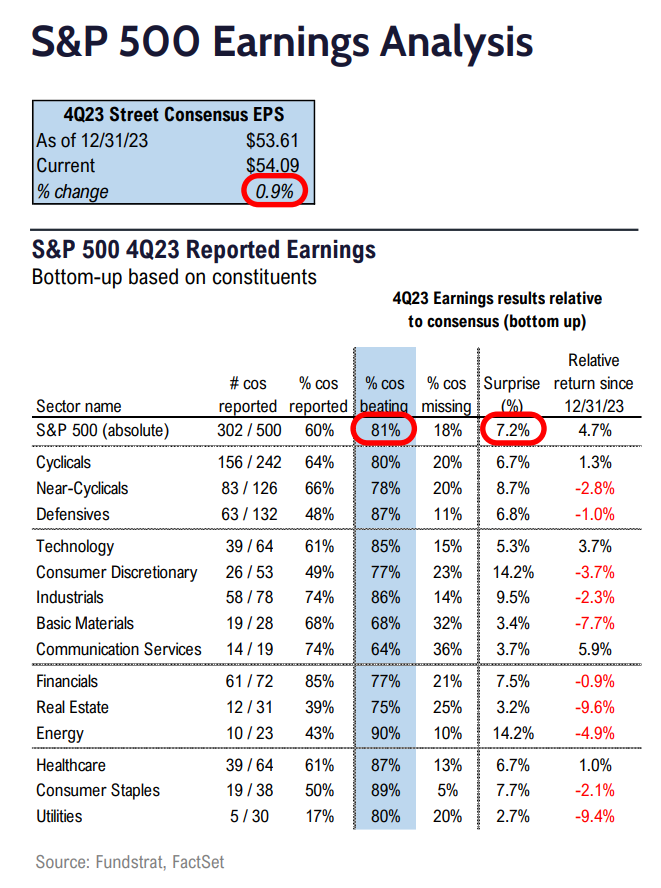

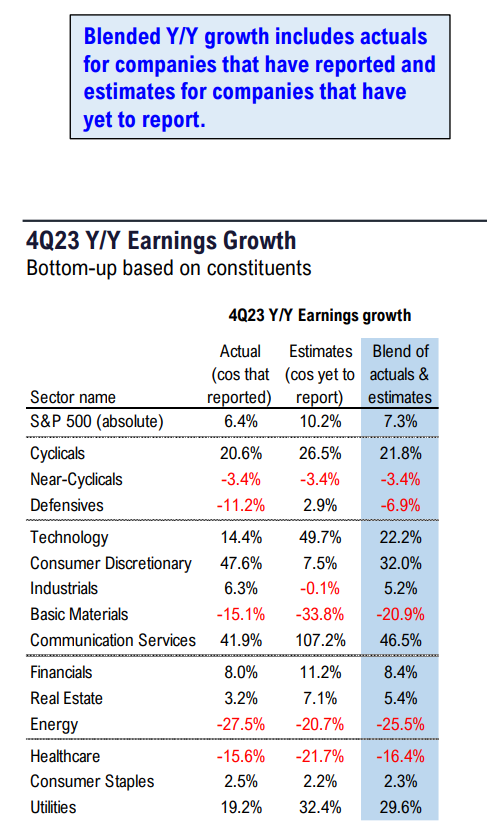

One hundred and five companies are reporting this week. Of the 302 companies that have reported so far (60% of the S&P 500):

- Overall, 81% are beating estimates, and those that “beat” are beating by a median of 7%.

- Of the 18% missing, those are missing by a median of –4%.

- On the top line, overall results are beating estimates by a median of 2% and missing by a median of –3%, and 66% of those reporting are beating estimates.

Click HERE for more.

TECHNICAL

The MSCI World index has moved back to new all-time highs.

The divergence between the top-performing stocks within Technology and the broader market could eventually lead stock indices to consolidate. Currently, we’re seeing the opposite, however, as groups such as Industrials and Healthcare have both pushed back to new all-time highs. A minor broadening out in sector performance has happened, and this week has brought about a rally back to new all-time highs for the MSCI World index, along with a breakout in Equal-weighted SPX to the highest levels in nearly two years. While many have avoided chasing some of the high flyers that have dominated performance, there’s been precious little sign of these stocks turning down. Conversely, the broader market has now begun to show signs of mean reversion higher after a weak January.

Equal-Weighted S&P 500 ETF

Click HERE for more.

CRYPTO

Market Update

- The Ethereum network has progressed with the deployment of the Dencun upgrade on the Holesky test network, marking the final test phase before its anticipated mainnet launch in March, featuring proto-danksharding via EIP-4844. Activated on Holesky early today and quickly achieving finality, this development follows its implementation on the Goerli and Sepolia testnets in January. The upcoming Ethereum All Core Developers call is expected to finalize the mainnet deployment date, which is projected for early to mid-March. The Dencun upgrade aims to enhance both the execution and consensus layers. It introduces “blobs” for off-chain data storage, aiming to significantly reduce storage demands and transaction costs for dApps, especially benefiting Layer 2 rollup chains through more efficient, scalable data management. This represents significant progress on a key milestone we’ve been monitoring for this year.

- The Solana network experienced an outage yesterday, leading to nearly five hours of downtime before a patch was developed and deployed. A comprehensive postmortem is still pending, but initial theories indicate that the outage was due to a bug related to recent changes in a Solana Improvement Proposal, which interrupted block progression. Although the adverse effects of a blockchain outage are significant, it is crucial to differentiate between this incident, attributed to untested software, and prior outages triggered by an overload of transactions causing validator issues. SOL 6.35% seems undeterred by the outage, having climbed from $94 yesterday, now above $97.

- Bitcoin spot ETF flows have maintained their positive momentum, marking eight consecutive trading days of positive flows. This trend coincides with a deceleration in GBTC outflows. However, it’s important to note that the net inflows have shown a decreasing trend in recent days. The total USD net inflows across all spot BTC ETF products now exceed $1.5 billion.

Click HERE for more.

FIRST NEWS

Trader’s Little Helper. The Alternative Investment Management Association, which launched a report recently on how hedge funds are using AI, began it with a heavy but true statement: “The very mention of the term ‘AI’ sparks excitement and anxiety in equal measure”.

Of course, AI is, ideally, something meant to stay invisible, but effective. It saves time, aggravation, thinking. How is it being adopted by the financial services industry?

Per the report, 86% of 157 hedge fund managers globally permit their staff to use some form of generative AI tools for work, to “enhance marketing materials, support their coding efforts, and (use) for general research purposes”.

Bloomberg has been more goal-oriented, not just reporting on the rise of AI, but actually rolling out a new tool for terminal users that generates instant summaries and analyses of company performance, including context on a company’s guidance, capital allocation, hiring and labor plans, the macro environment, new products, supply chain issues, and consumer demand.

Andrew Skala, who spent nearly 10 years as a sell-side researcher before joining Bloomberg, says, “It’s been an iteration to the point where we got comfortable that this makes a difference, this is unique, this is differentiated.” That actually sounds like more of an offering than most consumer-facing AI today provides. Fund Marketer

Mens sana in corpore sano. Let’s say you work in the accounting department of a multinational firm. A digitally recreated version of the company’s chief financial officer, along with other employees, appears in a video conference call instructing you to transfer funds. It’s a sophisticated scam involving deepfake technology, and it causes your multinational company’s Hong Kong office, where you sit, a significant financial loss amounting to HK$200 million (USD25.6 million). Naturally, when you make the transfer, you know nothing about deepfakes or scams. We are pretty sure of this.

The part in italics, above, is important. Because of local cultural norms, you would not be likely to question what your boss said because it would cause the boss to lose face. If the boss says ‘transfer the money’, you do it. You wouldn’t necessarily check whether the face on your screen is actually human, because if it turns out to be DNA instead of AI, you’ve just questioned your boss’s decision – and that’s simply not done.

In terms of both the serious sum stolen and the use of deepfake technology to simulate a multi-person video conference where all the participants (except for you) were fabricated images of real individuals, this is unprecedented. The detective from the Major Crimes unit of the Hong Kong Police, even now making his or her way to your office, just may be adding insult to injury by identifying you as the prime suspect, just in case. Case is, since you were the only real person on the call, you also could very well be the mastermind of the con. After all, what do all the very different people in the dinner-table scene in The Nutty Professor (except for the chubby tween, but we’ll ignore him for the moment) all of them played by Eddie Murphy, have in common?

The answer is Eddie Murphy, who created the characters and brought them to life.

In the end, the seasoned detective may figure out that you were not involved. You’re just a working stiff and a victim of this crime – just like your employer, only worse: because, although some courts see corporations as people, barring newsworthy advances in the as-yet-nonexistent field of legal-to-human entity transplantation, people are not yet corporations (single-person corporations notwithstanding).

Still, the high-tech theft underscores the growing concern over new uses of AI, which have been in the spotlight recently in incidents like the spread of fake images of pop superstar Taylor Swift. Over the past year, scammers have also used deepfake audio technology to scam people out of money by impersonating loved ones in trouble. Ars Tecnica

Vapor Coalescing. Thanks to unprecedented federal support and increased private investment, after decades of having a reputation for quixotic experiments and unfulfilled hype, hydrogen-powered vehicles may finally be looking like a future reality instead of something really futuristic but unrealistic.

Hydrogen fuel cells generate electricity to power a motor by mixing hydrogen and air, producing only water vapor as waste. That would have made them the climate solution — especially given their longer driving range and faster refueling than EVs – if not for the fact that the hydrogen is currently made mostly with the involvement of natural gas (which negates the environmental benefits), is expensive to produce, and has a nationwide distribution network.

The early players, including Toyota, Hyundai and BMW, have stuck with the technology, quietly experimenting with fuel-cell-powered cars for decades. Despite their efforts, fuel-cell passenger cars remain a tiny niche. Fewer than 18,000 have been sold stateside since 2012, and a mere 55 publicly available hydrogen fueling stations exist in the U.S. – all in California, which sports the strictest zero-emissions rules.

At the moment, however, recent U.S. policy moves to get behind hydrogen are driving optimism for fuel-cell vehicles. In October 2023, the Biden administration set aside $7 billion from the 2021 infrastructure law to establish seven regional hydrogen-production hubs. Two months later, the U.S. Treasury Department proposed rules for companies to claim lucrative tax credits for clean hydrogen production under 2022’s Inflation Reduction Act (IRA), which also includes tax incentives for fuel cell vehicles, hydrogen infrastructure, and energy storage.

Go heavy or go home

Will all that government spending generate tens of billions more in private hydrogen investment? Well, General Motors and Honda have started producing fuel cells at a Detroit-area factory for plug-in hybrid fuel-cell versions of Honda’s CR-V crossover utility arriving this spring. The cells will also go into a line of heavy-duty trucks that GM is developing with Autocar Industries. GM additionally has a new joint venture with Komatsu to develop fuel cell-powered mining trucks. Also bringing fuel cell trucks to market are Toyota, Hyundai, and perennially underwater truck startup Nikola, which, despite its corporate-governance and other troubles, did manage to open a hydrogen refueling station earlier this week with a capacity of 40 Class 8 trucks daily.

Not to be outdone, ostensibly dinosaur-like heavy-duty diesel-engine specialist Cummins has come out with a potentially far-going twist: hydrogen combustion engines that burn hydrogen instead of diesel fuel. Then there are rivals Daimler Truck and Volvo Group, who’ve teamed up on a new fuel-cell venture called Cellcentric that aims for large-scale production by next year. The reason for such suddenly large-scale commitments by multiple players? Hydrogen makes a lot of sense for emissions-conscious long-haul trucking and round-the-clock freight logistics operations, where time (otherwise spent charging) is money.

The bottom line is that, infrastructure- and cost-wise, fuel cell vehicles may have a long way to go – but they may finally be getting the energy to get there. “Up until two years ago, I knew we were in an uphill battle and I didn’t see a wave that would change anything,” says Bill Elrick, executive director of the Hydrogen Fuel Cell Partnership, a government-and-industry venture to expand the fuel-cell vehicle market. “I think something has shifted.” Axios