A daily market update from FS Insight — what you need to know ahead of opening bell

“I should like to know which is worse: to undergo all the miseries we have each of us suffered – or simply to sit here and do nothing?” ― Voltaire, Candide

First news

- Through her mere existence, Taylor Swift, who has moved and shaken the U.S. economy to the tune of $4+ billion so far, is creating a reality-distortion field that is wreaking havoc on the minds of those on the side of a certain former president

- Inflation numbers say one thing; the size of a can of Pringles – something else. Is it an illusion?

Overnight

- U.S. Promises More Mideast Strikes While Trying to Avert Wider War. link

- Senate Negotiators Unveil Bipartisan Border Bill; Speaker Johnson Calls It “DOA”. link

- National Security Adviser Jake Sullivan Declines to Rule out Hitting Targets in Iran. link

- More Than 800,000 without Power in California in Atmospheric River Event. link

- Case Against Australian Claiming to Be Bitcoin Inventor Satoshi Nakamoto Begins in U.K. Court Today. link

- El Salvador’s Bukele Declares Victory in Presidential Poll; No Official Results Yet. link

- Putin to Visit Turkey in First Trip to NATO Country Since Start of War in Ukraine. link

- World Cup 2026 Final Goes to NYC in Victory Over Dallas, LA. link

- KoBold Metals, Backed by Bill Gates, Jeff Bezos, Discovers Zambia’s Largest Copper Deposit in a Century. link

- Wildfires in Chile Kill at Least 112; Hundreds Remain Missing. link

- Taylor Swift Wins Fourth Album of the Year Grammy, More than Any Artist, for 2023’s Midnights. link

- US Eco Brief: CPI Revisions to Reveal a Key Rate-Cut Hurdle. link

MARKET LEVELS

| Overnight |

| S&P Futures -7

point(s) (-0.1%

) overnight range: -16 to +0 point(s) |

| APAC |

| Nikkei +0.54%

Topix +0.67% China SHCOMP -1.02% Hang Seng -0.15% Korea -0.92% Singapore -1.43% Australia -0.96% India -0.38% Taiwan +0.2% |

| Europe |

| Stoxx 50 +0.12%

Stoxx 600 +0.18% FTSE 100 +0.37% DAX +0.11% CAC 40 +0.04% Italy +0.99% IBEX -0.18% |

| FX |

| Dollar Index (DXY) +0.36%

to 104.3 EUR/USD -0.34% to 1.0751 GBP/USD -0.29% to 1.2594 USD/JPY +0.05% to 148.45 USD/CNY +0.06% to 7.198 USD/CNH +0.06% to 7.219 USD/CHF +0.31% to 0.8695 USD/CAD +0.18% to 1.3487 AUD/USD -0.18% to 0.65 |

| Crypto |

| BTC +0.87%

to 43131.94 ETH +1.03% to 2323.14 XRP -0.22% to 0.5066 Cardano +0.62% to 0.5045 Solana +2.61% to 97.88 Avalanche +2.35% to 35.65 Dogecoin flat at 0.079 Chainlink +4.51% to 19.36 |

| Commodities and Others |

| VIX +3.54%

to 14.34 WTI Crude -0.58% to 71.86 Brent Crude -0.44% to 76.99 Nat Gas +0.77% to 2.1 RBOB Gas +0.01% to 2.148 Heating Oil +0.24% to 2.666 Gold -0.72% to 2025.09 Silver -1.01% to 22.46 Copper -0.46% to 3.804 |

| US Treasuries |

| 1M -0.1bps

to 5.3466% 3M -1.1bps to 5.3506% 6M -0.9bps to 5.2301% 12M +1.3bps to 4.8053% 2Y +7.1bps to 4.4346% 5Y +7.0bps to 4.0523% 7Y +7.0bps to 4.0725% 10Y +6.1bps to 4.0809% 20Y +4.4bps to 4.3739% 30Y +3.8bps to 4.259% |

| UST Term Structure |

| 2Y-3

M Spread widened 6.1bps to -95.8

bps 10Y-2 Y Spread narrowed 0.8bps to -35.6 bps 30Y-10 Y Spread narrowed 2.2bps to 17.6 bps |

| Yesterday's Recap |

| SPX +1.07%

SPX Eq Wt -0.09% NASDAQ 100 +1.72% NASDAQ Comp +1.74% Russell Midcap +0.15% R2k -0.59% R1k Value -0.14% R1k Growth +1.97% R2k Value -0.82% R2k Growth -0.35% FANG+ +4.85% Semis +1.95% Software +0.74% Biotech -1.12% Regional Banks +0.46% SPX GICS1 Sorted: Comm Srvcs +4.69% Cons Disc +2.5% Tech +1.32% SPX +1.07% Indu +0.65% Fin +0.45% Energy +0.16% Healthcare -0.12% Cons Staples -0.25% Materials -0.57% REITs -1.26% Utes -1.81% |

| USD HY OaS |

| All Sectors -3.1bp

to 382bp All Sectors ex-Energy -2.7bp to 365bp Cons Disc -6.0bp to 320bp Indu -1.8bp to 291bp Tech +1.2bp to 483bp Comm Srvcs -1.8bp to 588bp Materials -4.8bp to 343bp Energy -3.9bp to 320bp Fin Snr -5.6bp to 356bp Fin Sub flat at 262bp Cons Staples -7.7bp to 306bp Healthcare -0.1bp to 465bp Utes -0.0bp to 233bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 2/5 | 9:45AM | Jan F S&P Srvcs PMI | 52.9 | 52.9 |

| 2/5 | 10AM | Jan ISM Srvcs PMI | 52.0 | 50.5 |

| 2/7 | 8:30AM | Dec Trade Balance | -62.15 | -63.207 |

MORNING INSIGHT

Good morning!

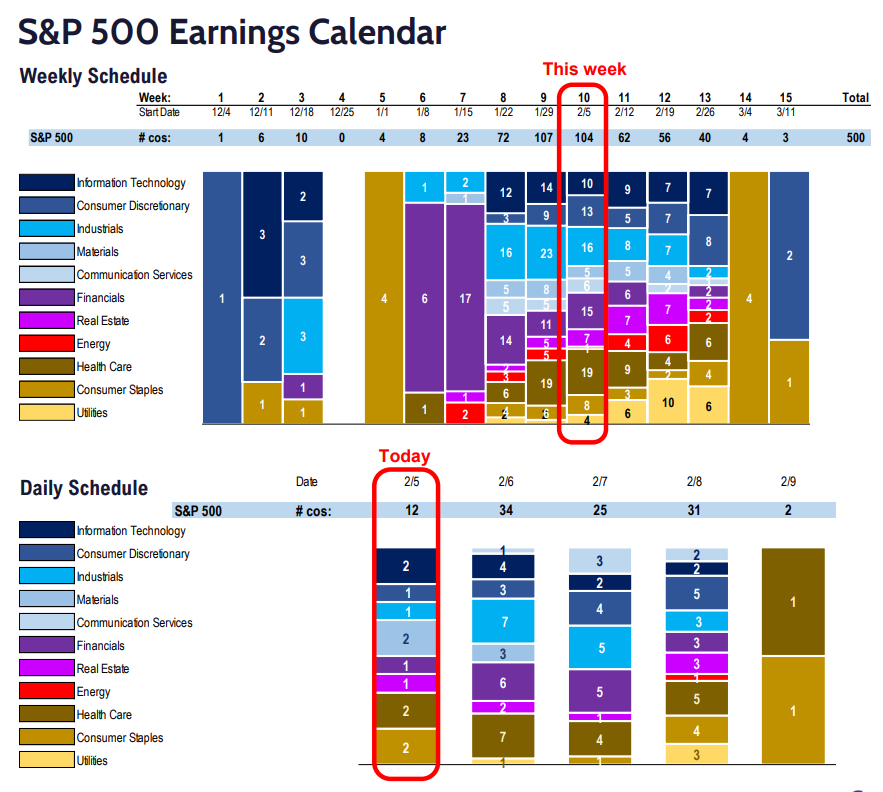

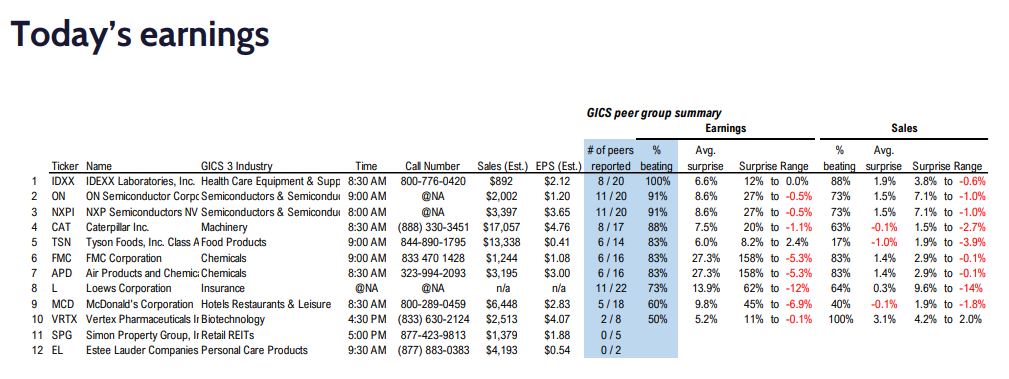

One hundred and four companies are reporting this week. Of the 231 companies that have reported so far (46% of the S&P 500):

- Overall, 81% are beating estimates, and those that “beat” are beating by a median of 7%.

- Of the 19% missing, those are missing by a median of –4%.

- On the top line, overall results are beating estimates by a median of 2% and missing by a median of –3%, and 65% of those reporting are beating estimates.

TECHNICAL

Divergence between the top-performing stocks within Technology and the broader market grew even more extreme this past week. However, this doesn’t necessarily imply that a large selloff is imminent. A broadening out in performance can also happen to allow sectors to play catchup to recent large-cap Technology performance, and this seems to have started with Healthcare and Financials in recent weeks. Near-term, some negative breadth and momentum divergences likely could prove problematic in mid-February. Yet, there’s been no evidence of any price weakness in the larger indices to warrant concern just yet. As discussed a few days ago, the extent of the decoupling of Treasuries and Equities looks to be continuing. Overall, keeping a close eye on market internals will continue to be important in the seasonally difficult month of February.

Click HERE for more.

CRYPTO

Weekly Recap

Total funding fell 23% week-over-week from $159 million to $123 million, while the deal count remained constant at 29. This is the fourth week of triple-digit funding and over 20 deals, and the second in a row with nearly 30 deals, confirming private markets activity is trending higher. DeFi and Infrastructure were the leading sectors for funding, accounting for almost one-third of all deal activity each. Investors are focused on teams addressing common user pain points such as self-custody and interoperability between chains. Deals were concentrated in seed-stage companies, which received $87 million while representing 12 of the 29 deals announced. Metaverse and Gaming are seeing renewed interest, with 24% of deal activity and $25 million raised, a significant jump from the one deal and $3m raised two weeks ago. As the bull market trend solidifies for liquid token markets, investors are beginning to get comfortable betting farther out on the risk curve on speculative, unproven models, hoping to be early to the next potential trend.

Selected Deals

Binance Labs, the venture capital and incubation division of cryptocurrency exchange Binance, has invested in Puffer Finance, a protocol for liquid restaking on Ethereum, built upon EigenLayer. Puffer has attracted investment from notable entities such as Brevan Howard Digital, Jump Crypto, and Lightspeed Faction. While the amount of Binance Labs’ investment was not disclosed, the funds are earmarked to develop Puffer’s Layer 2 network, which will function as an EigenLayer Actively Validated Service. The investment will also support the launch of Puffer’s liquid restaking token, pufETH, on the BNB Chain, offering users opportunities for staking and restaking rewards. This move by Binance Labs aligns with the growing interest and momentum in the Ethereum restaking sector, particularly following the introduction of EigenLayer last June.

Squid, a cross-chain platform known as a do-anything router, has secured $4 million in funding to enhance its cross-chain functionalities, improving user interactions with cross-chain transactions like swaps and Web3 application onboarding. Polychain Capital spearheaded the funding round and saw contributions from various investors, including Nomad Capital, North Island Ventures, and others, with continued support from existing investors. Squid stands out by offering a quick, seamless, and secure method for token swaps across over 60 blockchain networks, benefiting a vast user base.

Click HERE for more.

FIRST NEWS

Swift Quick in a Tight Spot. Taylor Swift’s Eras tour, which runs Fri, Mar 17, 2023 through Sun, Dec 8, 2024, has broken attendance and – more importantly for all those Americans who are not Taylor Swift – income records across the country. The economic boost it has generated has transformed the economy of every city she visits. The U.S. Travel Association reported last fall that people attending Swift’s concerts have engaged in quite literally Super-Bowl-level spending on 53 nights in 20 locations over the course of 5 months.

When Swift played LA for six sold-out nights last August, she brought a reported $320 million local windfall with her, including 3,300 jobs and a $160 million increase in local earnings. Straits Research says the tour is “an economic phenomenon that is totally altering the rules of entertainment economics.” She is clearly giving her audiences what they want, and in getting what they need from her, people tend to part with a tremendous amount of money, which, naturally she gets. Yet she also knows how to give a lot of it back to the people who’ve helped her give and get so much.

As the tour started demolishing all known records, Swift was quick to give everyone on her crew – dressers, set movers, backup dancers, sound techs – a combined $55 million in bonuses. The truck drivers alone received $100,000 each. Bloomberg Economics reports that U.S. gross domestic product went up an estimated $4.3 billion as a result of her first 53 concerts.

Foreign leaders, eager for a quick economic boost, have begged Swift to come. One said, “Thailand is back on track to be fully democratic after you had to cancel last time due to the coup.” Swift does tour Asia, of course, and this past Friday, on what must have been a slow day – what with bellicose China and missile-launching North Korea apparently not a real problem – the Japanese embassy in D.C. geeked out on their own fandom by posting on its social-media feed that Swift will be able to perform her show at the Tokyo Dome on Feb. 10 and still make it to Las Vegas to see boyfriend Travis Kelce’s Kansas City Chiefs play the San Francisco 49ers in the Super Bowl. In the spirit of lighthearted ridiculousness, we include an image of said post below, in Spanish, because – why not?

Swift’s influence is apparently not just economic, but political. Some of Trump’s wingmen are saying he might lose the 2024 election because of Swift, who endorsed Biden in 2020 and is, as the Japanese Embassy just mentioned, dating Travis Kelce, the tight end for the Kansas City Chiefs. Why is that important?

Congenital arguer Vivek Ramaswamy, once Trump’s foe and now a potential running mate, wrote recently on social media. “I wonder if there’s a major presidential endorsement coming from an artificially culturally propped-up couple this fall.” The theory du jour is that the Super Bowl will be rigged for the Chiefs to win in dramatic fashion. Then, Swift and Kelce get engaged (perhaps in Disneyland) in order to be at peak influence to support candidate Biden.

Of course, the argument that a very popular pop star and very popular football star have come together for publicity and the influencing of U.S. elections is a bit of a non-starter, as they have more popularity and publicity now than anyone could hope for. There is an unspoken truth here, which is that Trump and his denizens are well known for bodying about and deploying 1. fragile egos, and 2. conspiracy theories (see 1).

Anything could be, of course. And as long as we’re entertaining alternative facts, what could also be is that what was described above is… a false-flag operation to distract from the real psyop: Swift and Kelce endorsing… Nikki Haley – to give her the most realistic chance of still being in the running for the nomination; but mostly to stab Trump, her former boss from the time when she was U.S. ambassador to the U.N., in the heart – which could ostensibly allow Haley to run against and beat Biden, giving Swift the chance to figuratively score the soundtrack of the American people breaking up with both Biden and Trump.

Their aim achieved, Swift and Kelce get into a Getaway Car and drive away in Style, belting You Belong with Me as they ride off into the AI-generated sunset. Men in black take down the green screen as little green men watch the proceedings with what to us would be a smirk from behind nuclear-bomb-proof one-way glass. WSJ Hat tip to Fundstrat’s own Tom Block.

Wrap Head around Shrinking Offerings for Same Money. Stock prices are up. Jobs numbers are up. Inflation is down. So are mortgage rates. All is well?

Not so fast.

An insidious phenomenon some are calling ‘shrinkflation’ is on the rise. Cereal, paper towels, detergent, canned tomatoes, cat food, potato chips by weight, body wash, salad dressing, canned coffee, ice cream, cookies by weight, air freshener, and myriad other items are more and more often coming in smaller packages while costing the same or more as before.

Attractive airline fares, which the Labor Department’s consumer-price index shows fell 9.4% during 2023, are being offered by budget airlines requiring that flyers pay increasingly more to bring a carry-on, select a seat in basic economy – or get a bottle of water – than in 2023.

Lower fares attract customers, but what you get for that fare today is less than what you received yesterday, when you got it as part of the ticket cost. The trend only promises to worsen, as airline labor costs climb on the back of recently renegotiated pilot union contracts and many airlines continue to languish in the red, as they have since the beginning of the pandemic.

Who else has been losing money in flowing fashion? Streaming services. As they can’t run losses forever, some of them increased prices last fall by ~20%. Disney+’s ad-free service rose from $11 a month to $14 (a 27% increase) and Netflix’s ad-free plan went from $10 to $12. Yet the CPI shows that prices for video subscription services rose 5.6% over the last year. What explains the discrepancy? Shrinkflation.

Another thing rising much faster than CPI? Recurring bills. We regularly pay premiums for health, auto and home insurance – and all are rising rapidly. Indeed, Fundstrat has pointed out before the outsize role auto insurance plays in CPI. In our macro strategy note from January 11, we drew our subscribers’ attention to the fact that auto insurance, while 3.6% of weight, was 20% of Core CPI inflation.

Healthcare providers are renegotiating contracts with insurers, which are starting to pass on their increasing costs to the consumer. Employer health-plan premiums are expected to rise this year by about 6% on average, compared to ~3%-4% over the last decade. Why, then, does the CPI show that health-insurance prices dropped 27.1% since December 2022? Because the Labor Department calculates health-insurance inflation using an abstruse method that relies on retained insurer earnings as a proxy for prices.

Inflation numbers alone fail to relate the full story. As another example, the Federal Reserve’s preferred inflation gauge – the personal consumption expenditures index, or PCE – takes into account so-called substitution effects. Yet when you are forced to substitute a usual-sized chicken for a smaller one (or to settle for Perdue instead of enjoying your regular D’Artagnan) you are precisely suffering from the deleterious effects of shrinkflation.

The famous teacher Pangloss and his pupil Candide, in Voltaire’s eponymous satire, insist on persisting in their belief that “we live in the best of all possible worlds” despite the brutal fact that, so that all may live, a certain part of their party members’ bodies had to be removed – and are thus less than they had been in the beginning. Just because you don’t notice it under their clothes, it is a fact that they are no longer as callipygian as they once were. In other words – shrinkflation. WSJ, Fundstrat