A daily market update from Fundstrat – what you need to know ahead of opening bell

“Sometime it’s hell getting to heaven.” — The Undertaker

First news

- Investors sour on Chinese markets, expect miracles of India’s

- Desperate Chinese developers sweeten cheap housing with expensive gifts

- Netflix wrestles its way into live events via landmark WWE deal

- With a wink from Washington, Ankara gives Stockholm the nod for NATO membership, but Budapest may be a pest.

Overnight

- Trump wins New Hampshire primary; rematch with Biden increasingly likely. link

- North Korea fires cruise missiles to ratchet up regional pressure. link

- Russian military plane with 74 on board crashes near Ukraine. link

- Alibaba rallies after Jack Ma, Tsai buy $200 million of stock. link

- The two-day Asian Financial Forum begins in Hong Kong today. link

- An Israeli company is granted the first provisional license to sell lab-cultivated beef steaks. link

MARKET LEVELS

| Overnight |

| S&P Futures +20

point(s) (+0.4%

) overnight range: +5 to +23 point(s) |

| APAC |

| Nikkei -0.8%

Topix -0.51% China SHCOMP +1.8% Hang Seng +3.56% Korea -0.36% Singapore +0.58% Australia +0.06% India +1.01% Taiwan +0.01% |

| Europe |

| Stoxx 50 +1.47%

Stoxx 600 +0.87% FTSE 100 +0.3% DAX +1.05% CAC 40 +0.68% Italy +0.5% IBEX +0.78% |

| FX |

| Dollar Index (DXY) -0.46%

to 103.14 EUR/USD +0.42% to 1.09 GBP/USD +0.54% to 1.2755 USD/JPY -0.55% to 147.54 USD/CNY -0.14% to 7.162 USD/CNH -0.1% to 7.1602 USD/CHF -0.63% to 0.8647 USD/CAD -0.06% to 1.3454 AUD/USD +0.23% to 0.6595 |

| Crypto |

| BTC +3.18%

to 40446.65 ETH +2.61% to 2259.38 XRP +1.81% to 0.5186 Cardano +2.65% to 0.4795 Solana +4.9% to 88.43 Avalanche +3.45% to 31.67 Dogecoin +4.82% to 0.0805 Chainlink +3.5% to 14.4 |

| Commodities and Others |

| VIX +0.24%

to 12.58 WTI Crude +0.3% to 74.59 Brent Crude +0.18% to 79.69 Nat Gas +3.27% to 2.53 RBOB Gas +0.04% to 2.211 Heating Oil +0.1% to 2.694 Gold +0.09% to 2031.2 Silver +1.23% to 22.72 Copper +2.43% to 3.885 |

| US Treasuries |

| 1M -1.9bps

to 5.345% 3M -2.2bps to 5.3258% 6M -1.9bps to 5.2071% 12M -5.0bps to 4.7809% 2Y -4.2bps to 4.3262% 5Y -1.8bps to 4.0209% 7Y -2.1bps to 4.0733% 10Y -1.9bps to 4.1089% 20Y -1.6bps to 4.4589% 30Y -1.3bps to 4.349% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 4.9bps to -105.7

bps 10Y-2 Y Spread widened 2.6bps to -22.0 bps 30Y-10 Y Spread widened 0.7bps to 23.7 bps |

| Yesterday's Recap |

| SPX +0.29%

SPX Eq Wt +0.05% NASDAQ 100 +0.43% NASDAQ Comp +0.43% Russell Midcap -0.15% R2k -0.36% R1k Value +0.21% R1k Growth +0.27% R2k Value -0.6% R2k Growth -0.11% FANG+ +0.92% Semis +0.51% Software +0.19% Biotech +0.25% Regional Banks -0.96% SPX GICS1 Sorted: Cons Staples +1.08% Comm Srvcs +1.0% Tech +0.45% Energy +0.34% Materials +0.32% SPX +0.29% Utes +0.23% Fin +0.14% Healthcare -0.05% Indu -0.06% Cons Disc -0.14% REITs -0.51% |

| USD HY OaS |

| All Sectors +2.6bp

to 389bp All Sectors ex-Energy +3.0bp to 371bp Cons Disc +2.2bp to 335bp Indu +1.9bp to 299bp Tech +1.9bp to 488bp Comm Srvcs +3.5bp to 587bp Materials +4.1bp to 345bp Energy -1.4bp to 326bp Fin Snr +7.0bp to 364bp Fin Sub +1.9bp to 266bp Cons Staples +1.4bp to 312bp Healthcare +1.9bp to 474bp Utes +4.2bp to 241bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 1/24 | 9:45AM | Jan P S&P Manu PMI | 47.6 | 47.9 |

| 1/24 | 9:45AM | Jan P S&P Srvcs PMI | 51.5 | 51.4 |

| 1/25 | 8:30AM | 4Q A GDP QoQ | 2.0 | 4.9 |

| 1/25 | 8:30AM | Dec P Durable Gds Orders | 1.5 | 5.4 |

| 1/25 | 10AM | Dec New Home Sales | 649.0 | 590.0 |

| 1/25 | 10AM | Dec New Home Sales m/m | 10.0 | -12.2 |

| 1/26 | 8:30AM | Dec PCE m/m | 0.2 | -0.1 |

| 1/26 | 8:30AM | Dec Core PCE m/m | 0.2 | 0.06 |

| 1/26 | 8:30AM | Dec PCE y/y | 2.6 | 2.6 |

| 1/26 | 8:30AM | Dec Core PCE y/y | 3.0 | 3.15503 |

| 1/30 | 9AM | Nov Case Shiller 20-City m/m | n/a | 0.64 |

| 1/30 | 10AM | Jan Conf Board Sentiment | 111.55 | 110.7 |

| 1/30 | 10AM | Dec JOLTS | n/a | 8790.0 |

MORNING INSIGHT

Good morning!

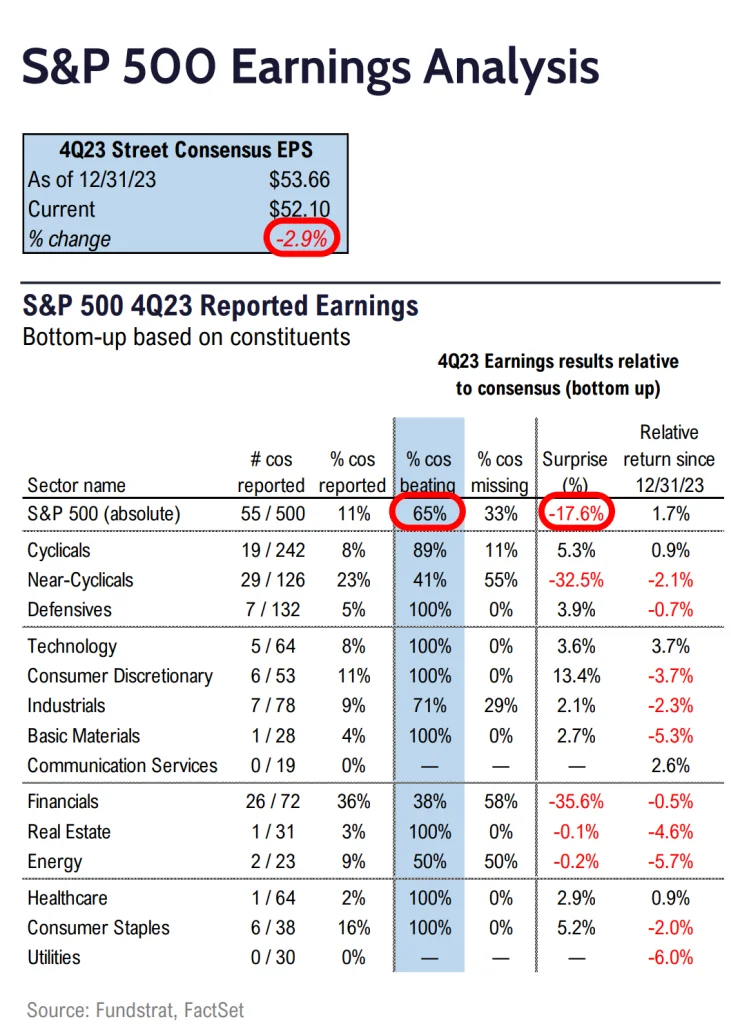

Seventy-five companies are reporting earnings this week. Of the 55 companies that have reported so far (11% of the S&P 500):

Overall, 65% are beating estimates, and those that are, are doing so by a median of 6%.

Of the 33% missing, they are missing by a median of -18%.

On the top line, overall results are beating estimates by a median of 2% and missing by a median of -2%, and 60% of those reporting are beating estimates.

TECHNICAL

As this daily SPX chart shows below, one cannot rule out a move to SPX-4950, but we feel like 5000 should be truly difficult to exceed in the next month without consolidation. SPX lies outside the upper Bollinger band on daily charts, while Russell 3K remains below all-time highs from November 2021.

The first real area of downside support lies near 1/12/24 intra-day peaks of 4802.40. Until/unless this is violated, it’s going to be difficult to be too negative on US indices. The next 2-3 days still look positive given a lack of intra-day DeMark-based signals from indicators such as TD Sequential and/or TD Combo.

Furthermore, the key timeframe in question at this point lies near 1/27-29. This aligns with a 3-month anniversary of the October 2023 lows, along with a 6-month anniversary of last July’s (2023) peaks. I expect that, by the end of this week, US Equities will have arrived at the next important window. At present, SPX being stretched does not equate with an immediate opportunity to pare back longs.

Click HERE for more.

CRYPTO

- Rabby Wallet, a popular crypto wallet provider, announced the launch of Rabby Points, a scoring methodology that will likely be convertible for Rabby tokens when they complete their airdrop. Rabby has distributed initial points to every Rabby EVM address, awarding additional points to any users who have switched from MetaMask to Rabby.

- Rollbit, a leading crypto gambling and trading platform, has announced a multi-million dollar esports sponsorship deal with Faze Holdings, one of the most popular gaming organizations in the world. Under the terms of the partnership, Rollbit will become a partner of Faze’s Counter-Strike team, which is currently ranked number one in the world.

FIRST NEWS

“I’ll Have What She’s Having”. India, beneficiary of investors being driven away by political and economic headwinds in China, has overtaken Hong Kong as the world’s fourth-largest stock market. Demographic advantages (a growing rather than a declining population) and a strong local investor base have buoyed the combined value of shares on Indian exchanges. Last year brought an IPO boom to India just as Hong Kong found itself in a historic stock slump. The shift brings hefty pressures, with investors expecting “the same kind of returns that China delivered in the first decade of 2000.” Semafor

Love for Sale. Chinese real estate developers and local government officials, desperate to lure buyers as the country’s property crisis worsens, are resorting to increasingly unconventional marketing tactics. One firm advertised, “buy a house, get a wife for free,”* while another promised buyers a 10-gram (0.35 oz.) gold bar. The desperation reflects growing concern over the fate of China’s property market. Fifty-plus developers have defaulted on their debt during the crisis, millions of buyers are stuck with unfinished homes, yet Beijing has taken no serious steps to buttress its real estate sector, opting for incremental measures instead. Semafor, WSJ

* One famous science-fiction author said, “TAANSTAFL”; one Chinese sage echoed him, “Either way, you pay”.

It’s Good to Be the King. Netflix posted Q4 earnings Tuesday evening, showing a better-than-projected (12.5% higher) revenue of $8.8 billion, driven by 13% growth in subscribers. Against a background of older TV companies burning through hundreds of millions of dollars on their streaming services like stereotypical startups desperately grabbing for market share, incumbent Netflix generated $1.6 billion in free cash flow in the quarter. That number must have landed with the thud of a massive smackdown, whose finality resounds in the C-suite of NBCUniversal’s USA Network, from whom Netflix has pilfered the WWE weekly show Monday Night Raw. Raw, WWE’s flagship show, which broadcasts live weekly and has been a staple of linear cable for over 30 years, is leaving traditional linear television for the first time in its generation-spanning history to stream on Netflix.

Here’s another shocking fact: production will cost Netflix nothing. WWE produces its shows in-house; all Big N will have to do is stream whatever feed WWE sends its way. Can they be trusted? Well, after decades on the air, Raw must be polished to a finish more impressive than the oiled tans of the performers.

Harsh reality

On the off chance that some readers may hail from a faraway land, have never heard of Hulk Hogan, Randy Savage, or The Rock, and are thus laboring under the impression that, flush with cash and drunk on success, Netflix is making an eccentric bet on edifying broadcasts of Greco-Roman, i.e. classic wrestling – you know, the one that hails from ancient times, is practiced worldwide, was included in the first modern Olympic Games in 1896, and has been a staple of every edition of the summer Olympics held since 1904 – allow us to disabuse you of that naïve notion. The very professional wrestling that Netflix will be streaming into millions of homes 52 weeks a year is proto-reality-TV, a form of athletic theater combining mock combat with drama and the premise that the performers are competitive wrestlers.

Kicking off next year, the 10-year, $5+ billion deal to become the new home of the wildly popular wrestling show is Netflix’s most serious foray yet into live streaming. The company had dabbled in live broadcasts over the last year or so and is even more ambitious outside the U.S., where it’s also obtaining the rights to WWE shows like SmackDown and NXT, plus monthly premium live events like WrestleMania, SummerSlam, and the Royal Rumble.

Netflix stock is up 36% from a year ago, while Disney shares have slipped 10%, and Warner Bros. Discovery is down 22% over the same period. Once an upstart disruptor that almost didn’t make it, Netflix is now firmly ensconced on its throne as the victorious king of the streaming wars. All hail, or The Undertaker will make sure you “rest in peace”! The Verge, WSJ

Turkey Gets to Fly, Budapest Still Hungary. A month ago, we wrote about a preliminary/partial approval of Sweden’s NATO bid by Turkey’s legislators (Lox, Now a Staple at the Thanksgiving Table). Earlier today, Turkey’s entire parliament voted to make the motion a full-throated one. Sweetening the deal is a big deal waiting in the wings – approval by U.S. Congress of a Turkish request to purchase 40 new F-16s and kits to modernize the country’s existing fighter fleet. Approving the request for planes has been unofficially contingent on rubber-stamping Sweden’s membership.

NATO expansion requires a unanimous yes from all existing members, and the dragging of feet by Turkey and Hungary over the last two years has frustrated NATO allies pressing for Sweden and Finland’s swift accession.

Concerned that the Kremlin was using Hungary’s Viktor Orbán and Turkey’s Recep Erdogan to seed and grow divisions in the West, NATO’s commanders had presented the bloc’s expansion as a show of Western resolve in the face of Russian aggression. Turkey now having cast its vote, leaves Hungary to give approval, while Orbán demands “respect” from the Nordic country, denouncing its “openly hostile attitude”, and accusing Swedish representatives of being “repeatedly keen to bash Hungary” on rule-of-law issues. Budapest could use its veto power over Stockholm’s membership to extract concessions from the European Union, which has frozen billions in funds to Hungary over concerns about minority rights and the rule of law.

For its part, Hungary has worked to freeze progress on Sweden’s approval as much as possible, supplementing its active inaction with a soundtrack of, by turns, inflammatory and dismissive rhetoric. “To put it in a nutshell: they are asking us for a blood pact without being willing to make any gestures in return,” wrote Matyas Kohan from Hungary’s pro-government Mandiner magazine. Separately, a junior member of Orbán’s administration obliquely cast aspersions on Sweden, a fellow EU member, which supposedly “has not done anything to boost confidence in its suitability for NATO membership and has given the impression that joining the alliance is not a priority”.

Despite prior promises not to be the last to approve Sweden’s accession, Hungary has placed itself in precisely the predicament it had pledged to avoid, its purposefully slowpoke strategy now poking it in the side with a stick of its own making. AP, Barron’s