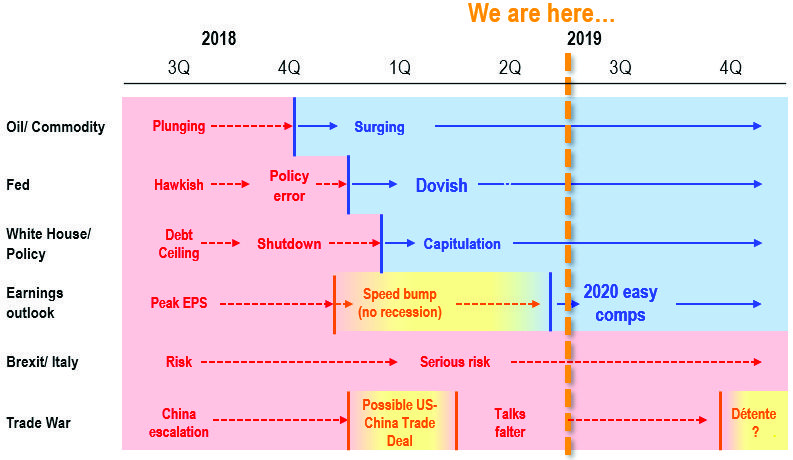

It seems these days the markets are a broken record. The latest, confusing Fed cut (was it dovish? hawkish? we think somewhere in between), coupled with Trump’s latest tariff announcement and a 2.4% drop in the S&P 500 over two days is a scenario that should no longer surprise markets. But yet again we have seen a resulting surge in bearish sentiment and confidence levels appropriate for an economy in late-cycle (which it’s not).

There are three macro factors that belie this reborn market bearishness and support further upside for equities.

i. Falling 10-year yield

ii. Weakening USD

iii. Odds of a rate cut in September have risen to 100%

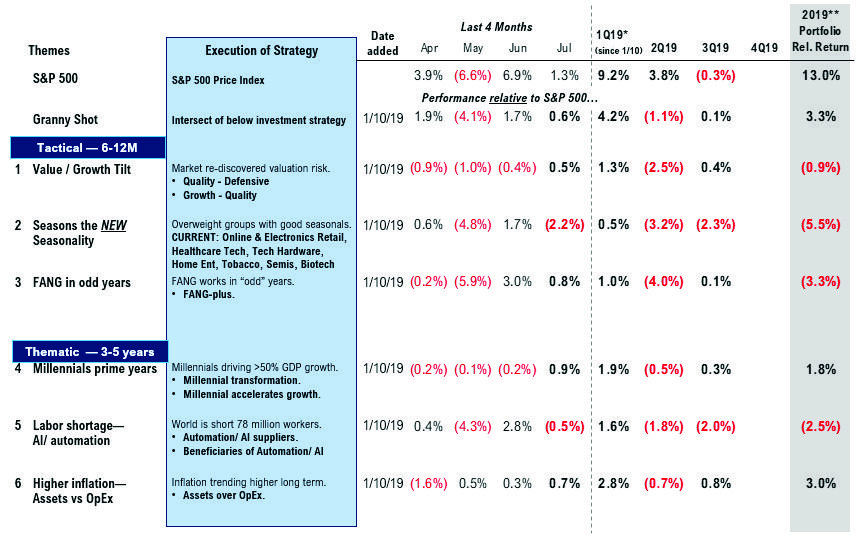

Remember folks, since 2009, with rare exceptions, pullbacks NEED TO BE BOUGHT. What to buy? Here are the four trades that this Fed cut supports: i) Overweight US vs. rest of world; ii) asset-light stocks over asset-heavy stocks; iii) large caps; iv) cyclicals over defensives.

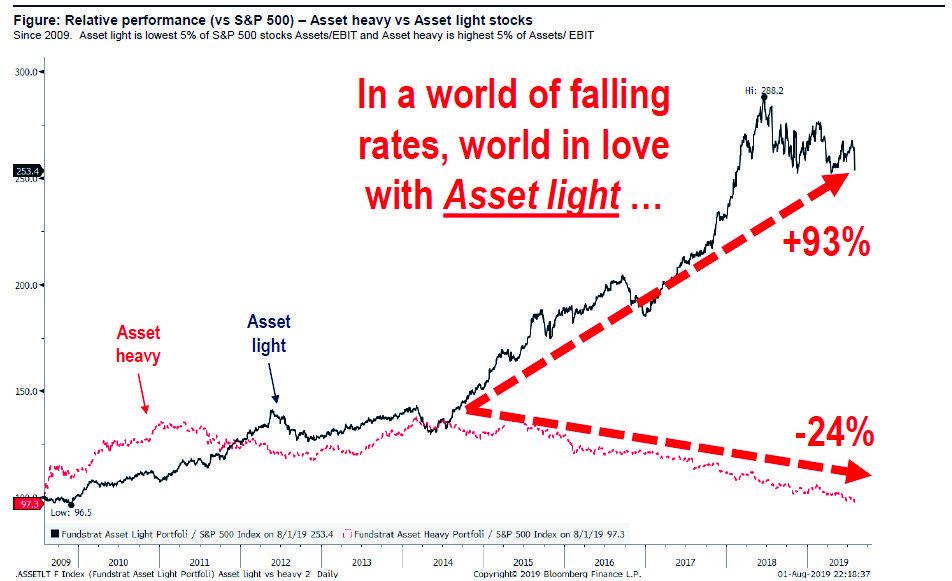

The Fed cut is especially adding gasoline to asset-light stocks because it is further cementing the market belief that interest rates can only fall lower, which makes asset heavy businesses less attractive to investors. And by the way, we define asset-light stocks as those with low assets to EBIT (earnings before interest and tax expenses).

Need proof? Since 2015 our asset-light index, composed of 5% of stocks from the S&P 500 with the lowest assets to EBIT ratio outperformed our asset-heavy index (5% of stocks from S&P 500 with highest assets to EBIT ratio) by 11,070 basis points! See chart below.

The question to consider though is how much longer this trade can continue. We believe the asset-light trade will jump the shark when the market is convinced interest rates will stay low forever. But here’s the secret. “Forever” is a dangerous word in markets and we believe reflationary conditions will resurface in 2020 for two reasons.

First, we’ve witnessed the recent steepening of the long-term yield curve (30Y-10Y) and this has led the ISM Manufacturing Index by 16 months. So, expect ISM to bottom sometime in late 2019 at 48 (was 51.2 in July). Second, we expect labor markets to tighten in 2020. Hence, asset-heavy stocks should start working again in 2020.

What could go wrong? Markets do not like trade wars and China could escalate tensions.

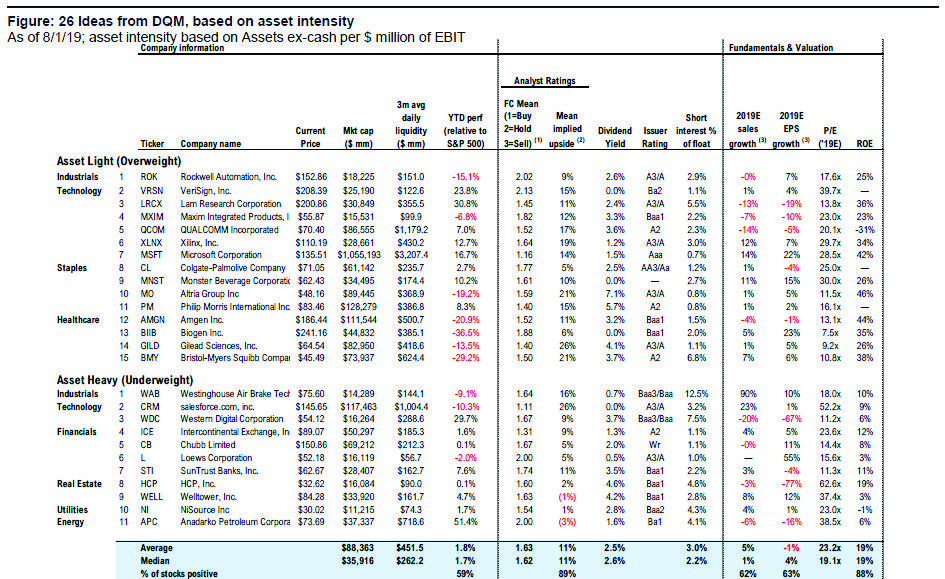

Bottom line: We remind investors that 2019 is the strongest YTD gains for markets since BEFORE 2009. And we see falling 10-yr and weakening USD and higher odds of a September cut as VERY BULLISH—hence, we strongly urge investors to take advantage of this weakness. For now, we believe Fed is adding gasoline to support the trades that are working in 2019 (now new regime) and especially asset light stocks. We have identified 15 “asset light” stocks which are top decile of asset light + DQM ranked 1 and 11 underweights which are “asset heavy” and DQM ranked 5. The OW tickers are ROK, VRSN, LRCX, MXIM, QCOM, XLNX, MSFT, CL, MNST, MO, PM, AMGN, BIIB, GILD, BMY, while the UW tickers are WAB, CRM, WDC, JPM, ICE, CB, L, STI, HCP, WELL, NI.