As the summer solstice approaches and 2019 closes in on the halfway mark, investors have already witnessed two opposing market regimes: equity gains reminiscent of the mid-90s (double-digit gains January to May) and a “tower of terror” decline (May to early June).

Multiple factors contributed to the roughly 8% decline from May highs to the early June lows,. Among them was a loss of visibility (hence, higher risk premia) as trade tensions escalated during a period in which the market was overbought (on many measures). Trade tensions continue to linger, and it is apparent that investors have become overly negative. That’s evident in several measures discussed below.

Coupled with what, in my view, remain resilient U.S. fundamentals and a supportive Federal Reserve, there is a backdrop for equity markets to build on gains into year end.

Tariff wars are scary, but investors are overstating the impact on the U.S. consumer, given volatility in consumer price index and the likelihood of substitution. The S&P 500 lost ~$2 trillion—that’s right $2 trillion—in market capitalization over the past 6 weeks on the heels of $64 billion tariff. That shows the tariff war hurt the S&P 500 index more than it hurt China (30 times the impact on equity vs China).

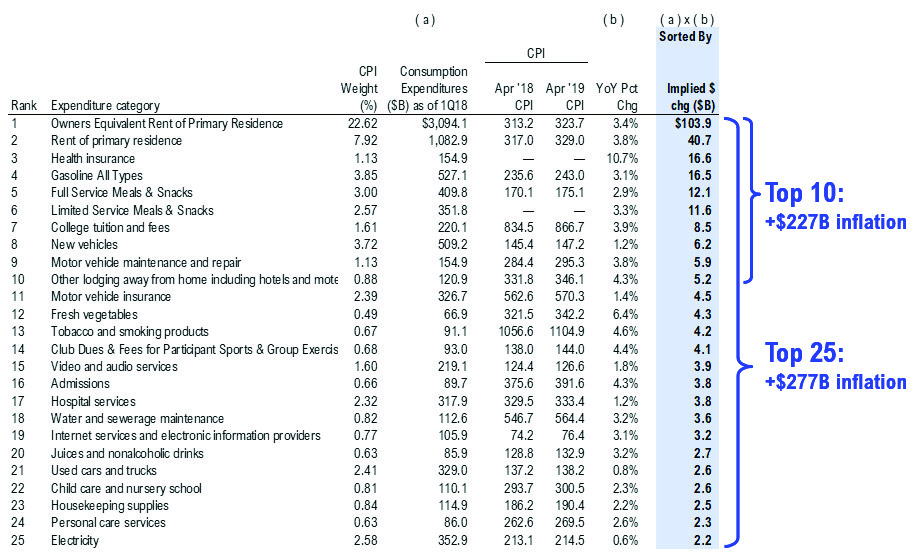

While loss of visibility is worrying, volatility in CPI is much greater than any $64 billion in increased tariffs. As shown in the table below, over the past year just the top 10 changes in CPI (past year) were $227 billion in increased costs for US households and top 25 were $277 billion (topping lists are rent, health insurance, gasoline, higher snacking costs). And even CPI declines offset tariffs to an extent—the top 10 drops in CPI components resulted in $32 billion in saving, including apparel, toys, eggs, etc.

The point of this is to highlight the complexity of a giant $20 trillion US economy means tariff impacts are much more muted in the grand scheme of things. Moreover, one has to remember the consumer is likely to substitute spending—of the $257 billion in goods impacted by Trump tariffs, the majority of substitutable purchases, not staples.

What is FS Insight?

FS Insight is a market-leading, independent research boutique. We are experts in U.S. macro market strategy research and have leveraged those fundamental market insights to become leading pioneers of digital assets and blockchain research.

Tom Lee's View

Proprietary roadmap and tools to navigate and outperform the equity market.

Macro and Technical Strategy

Our approach helps investors identify inflection points and changes in equity leadership.

Deep Research

Our pioneering research provides an understanding of fundamental valuations and risks, and critical benchmarking tools.

Videos

Our macro and crypto videos give subscribers a quick and easy-to-understand audiovisual updates on our latest research and views.

US Policy Analysis

Our 40-year D.C. veteran strategist cuts through the rhetoric to give investors the insight they need.