VIDEO: We view the weakness in equities since Dec 24th as largely due to profit taking and arguably the drop in market breadth is somewhat constructive for early 2025

Please click below to view our Macro Minute (duration: 5:00)

Equities are down -1.2% over the past week (since Dec 24) and look to be limping into year-end, a contrast to what should be a seasonally strong period — the Santa Claus rally typically sees stocks strong into year-end.

- Several headwinds have emerged in recent days with the two most notable being:

– first, the rise in long-term yields as the US 10-year exceeded 4.6% in the past week

– and not too far from the 2024 (April) highs of 4.73%

– second, market breadth has deteriorated, as noted by Mark Newton, Head of Technical Strategy

– notably on Friday (Jason Goepfert of Sentiment Trader flagged), only 18% of NYSE stocks advanced

– lowest ever reading for the final 3 days of the year in last 65 years - Did market fundamentals and the case for equities inflect in the past week? In our view, nothing has fundamentally changed. The change in character of markets (towards caution) started with the Dec FOMC rate decision and the Fed forecasting fewer cuts in 2025 from 4 to 2. (We noted that fewer cuts in 2025 is arguably a better scenario ultimately). And incrementally, there has not been any real change.

- So the weakness in the past week is probably simple profit taking. After all, the S&P 500 is up 25% in 2024 and investors are taking tax losses now. To us, this explains a lot of this weakness. But this also does not mean stocks have to be weak for the foreseeable future.

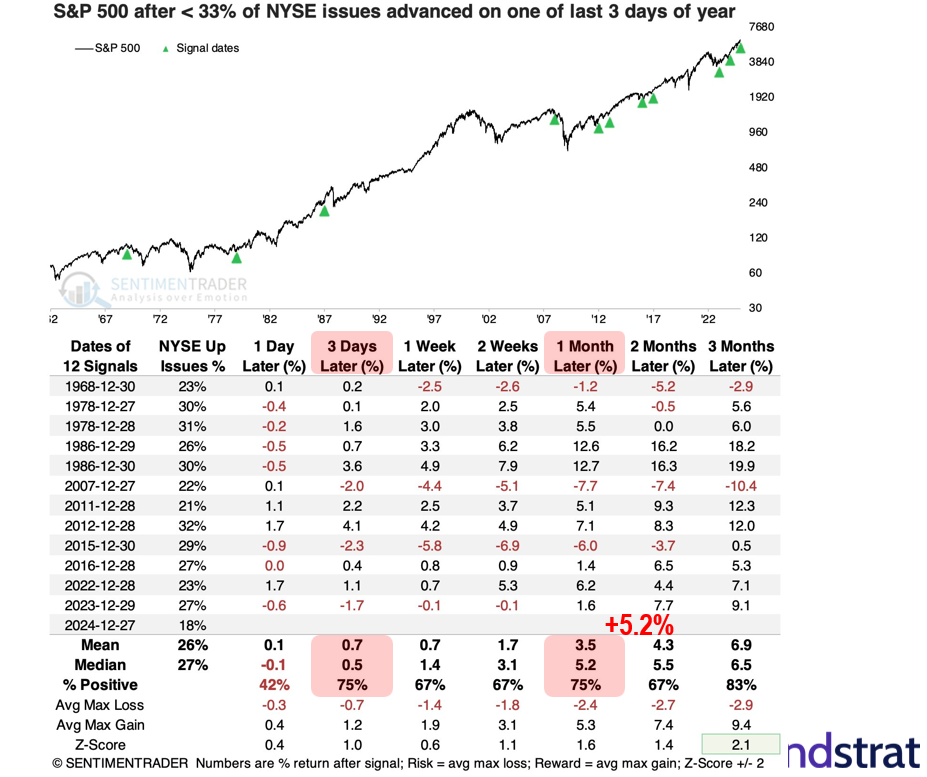

- As Sentiment Trader notes, when we see such weak market breadth at the end of a calendar year, it often signals market gains in the near term:

– of the 12 worst readings of market breadth at year-end since 1962

– next 3 days gain 75% of the time, +0.5% median gain

– next month gain 75% of the time, +5.2% median gain - The 1-month forward return is particularly impressive and implies a pretty solid gain in January.

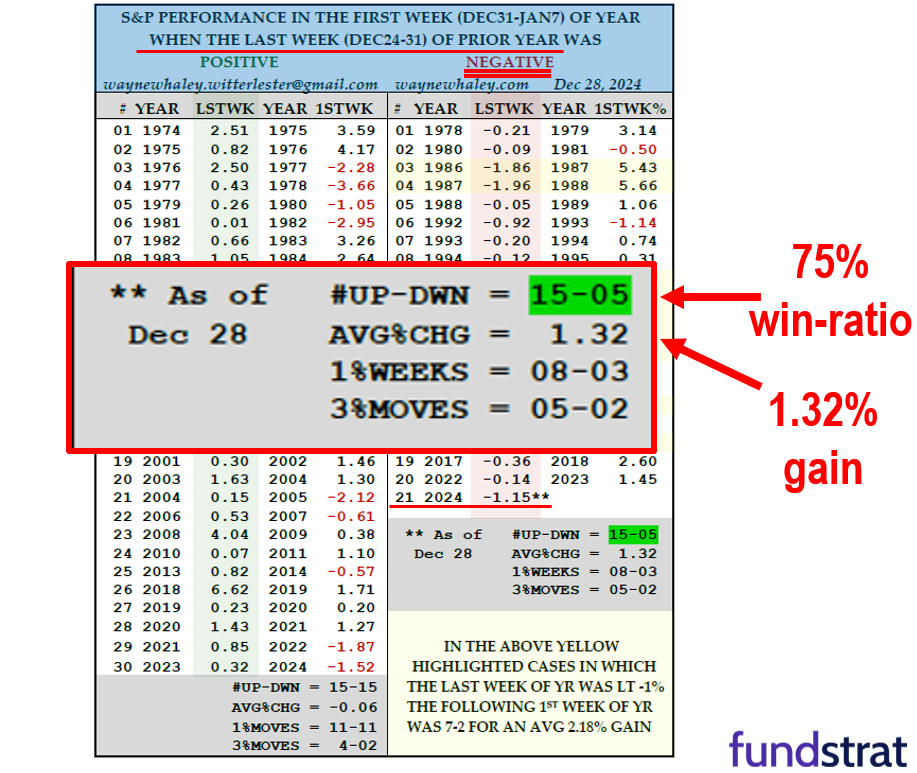

- Similarly, Wayne Whaley notes that when stocks are down in the last week of December, this often signals gains in the first week of January:

– last week of 2024 so far -1.2%

– last 50 years

– when down last week of December

– January 1st week gains 15 of 20 instances, 75% win-ratio

– median gain +1.32% - So again, the weakness of the last few days does not point to sustained weakness ahead.

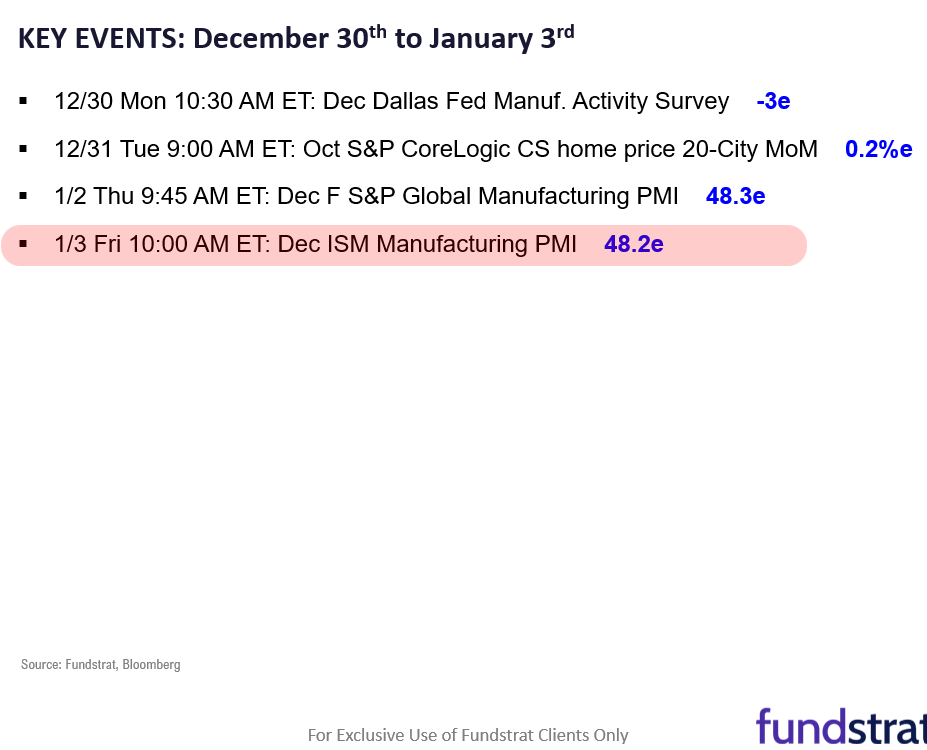

- The coming week is not that macro intensive:

– 12/30 Mon 10:30 AM ET: Dec Dallas Fed Manuf. Activity Survey -3e

– 12/31 Tue 9:00 AM ET: Oct S&P CoreLogic CS home price 20-City MoM 0.2%e

– 1/2 Thu 9:45 AM ET: Dec F S&P Global Manufacturing PMI 48.3e

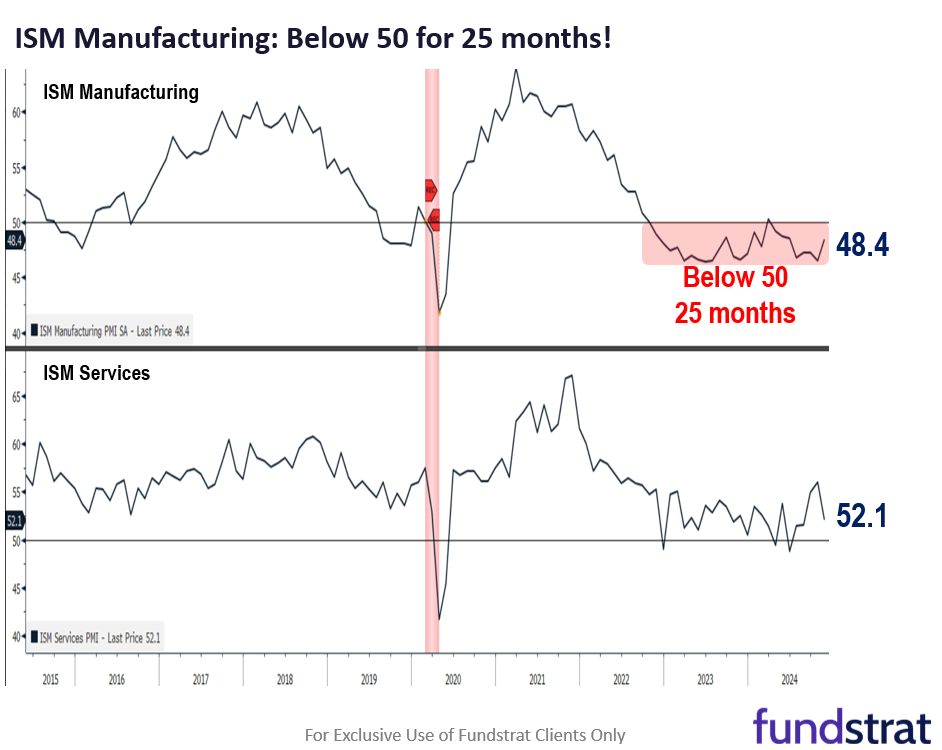

– 1/3 Fri 10:00 AM ET: Dec ISM Manufacturing PMI 48.2e - Of these, the most important is the Dec ISM manufacturing. ISM manufacturing has been below 50 for 25 months (since Oct 2022) and we think is set to rise above 50 in 2025. There are multiple tailwinds including a Fed easing rates and an incoming White House that is seen as business friendly.

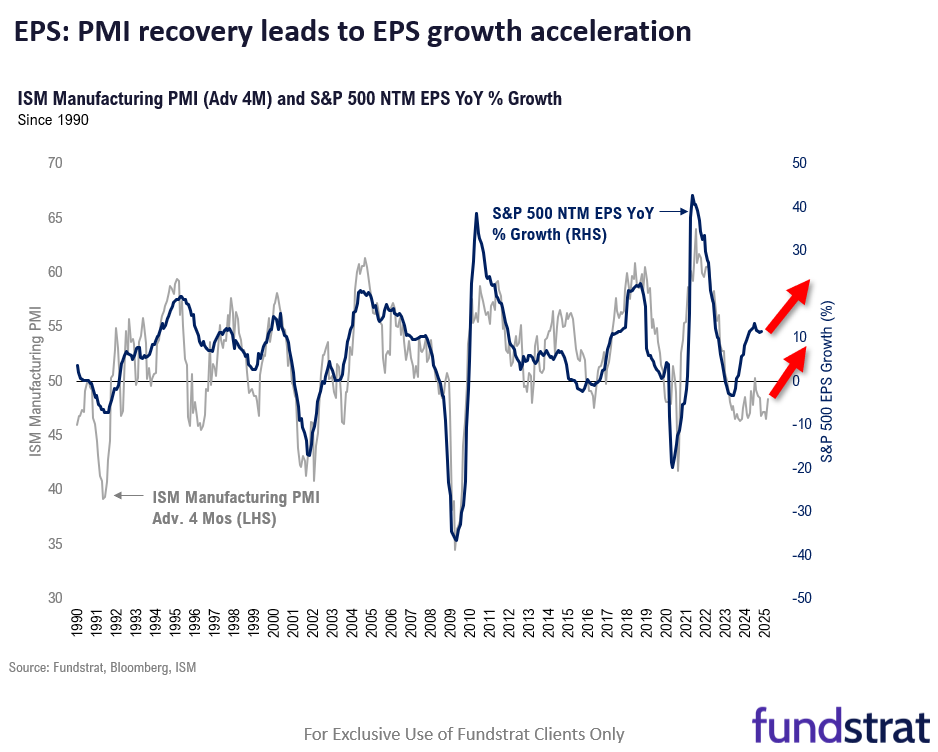

- We have written in the past highlighting ISM manufacturing tends to lead S&P 500 EPS growth rates by 4 months roughly (see below). And thus, a recovery in ISM to >50 signals improving EPS growth next year.

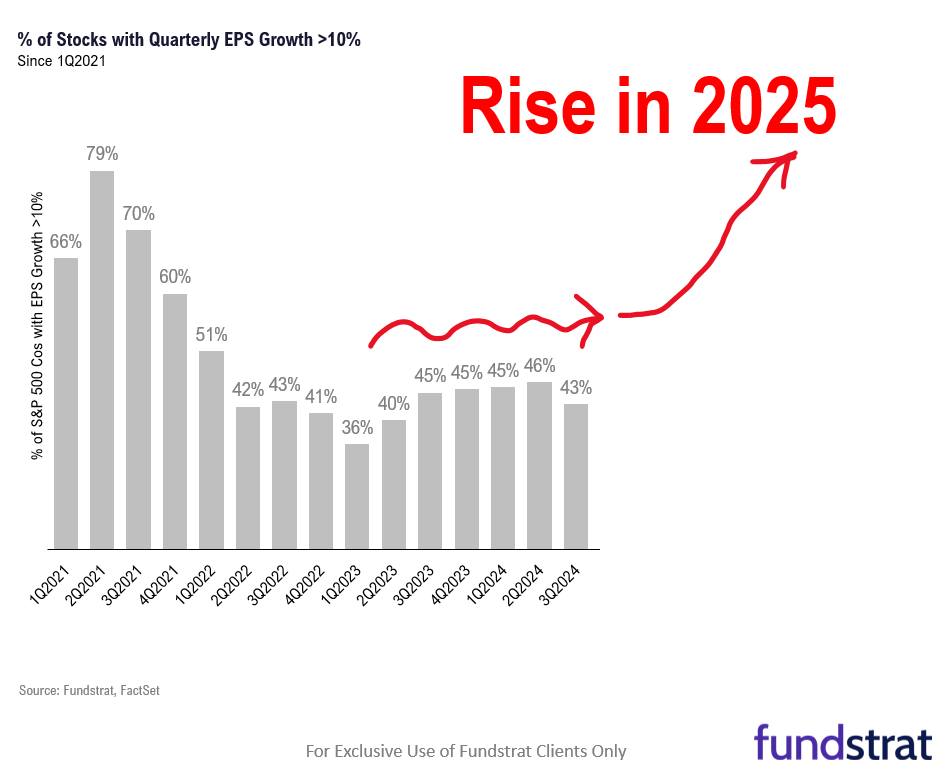

- Since the ISM fell below 50 in Oct 2022, the diffusion of S&P 500 EPS has been rangebound:

– % S&P 500 cos EPS growth >10%

– rangebound at roughly 43% for 10 quarters now - If the ISM moves above 50 in 2025, this is a sign of business expansion (purchasing managers) and thus, suggests that EPS growth diffusion should improve in 2025. Again, this is a byproduct of rising “animal spirits” — and we would be skeptical that the ISM stays below 50 in 2025.

Bottom line: 2024 has shown markets have eluded prolonged periods of weakness

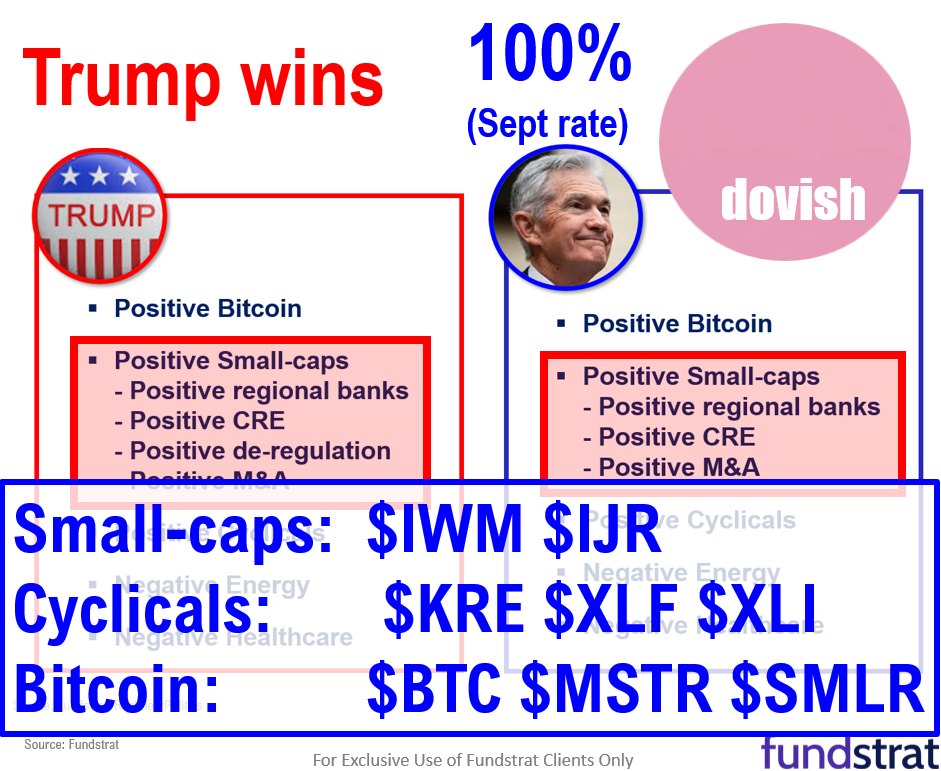

Finally, keep in mind that 2024 has shown an equity market that has eluded prolonged periods of weakness. While December has been disappointing, we do not think this is a sudden change of market character. And “buying dips” has been profitable for all of 2024. The fundamental tailwinds from the Fed and White House remain intact:

- de-regulation

- drop in cost of capital for businesses

- general “animal spirits” given Republican White House and Senate

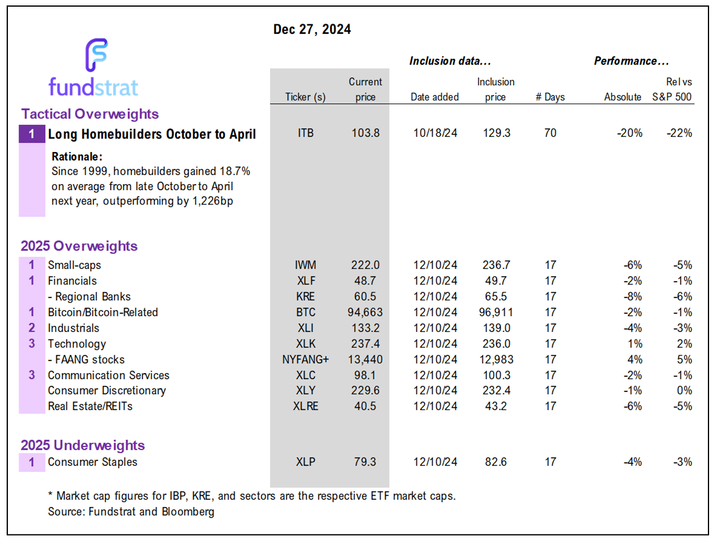

This favors the following groups:

- Small-caps: IWM 2.20% IJR 2.58%

- Cyclicals: XLF 1.29% KRE 2.85% XLI 1.28%

- Bitcoin: BTC MSTR -3.18% SMLR -0.50%

_____________________________

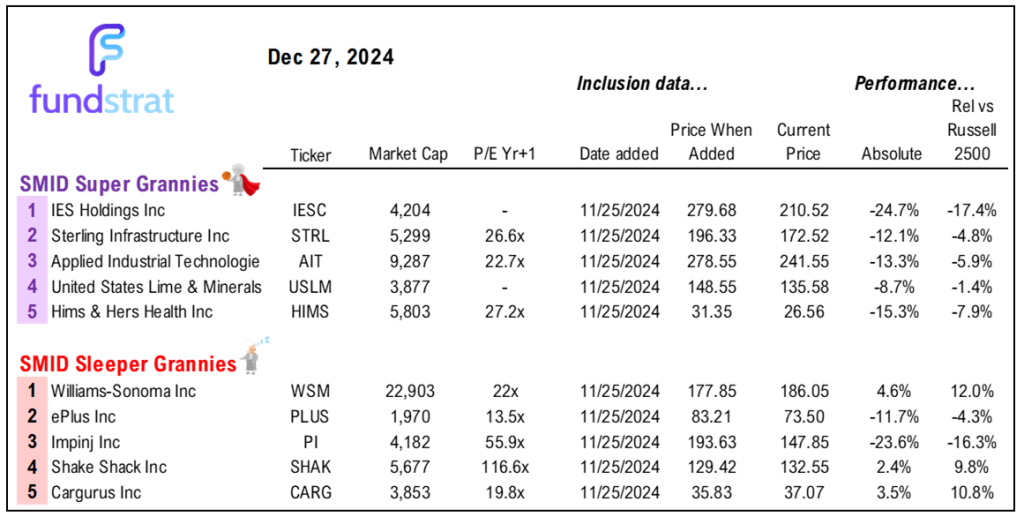

44 SMID Granny Shot Ideas: We performed our quarterly rebalance on 11/25. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

___________________________

Key incoming data December:

12/2 9:45 AM ET: Nov F S&P Global Manufacturing PMITame12/2 10:00 AM ET: Nov ISM Manufacturing PMITame12/3 10:00 AM ET: Oct JOLTS Job OpeningsTame12/4 9:45 AM ET: Nov F S&P Global Services PMITame12/4 10:00 AM ET: Nov ISM Services PMITame12/4 10:00 AM ET: Oct F Durable Goods OrdersTame12/4 2:00 PM ET: Fed Releases Beige BookDovish12/5 8:30 AM ET: Oct Trade BalanceTame12/6 8:30 AM ET: Nov Non-Farm PayrollsTame12/6 9:00 AM ET: Nov F Manheim Used vehicle indexMixed12/6 10:00 AM ET: Dec P U. Mich. Sentiment and Inflation ExpectationTame12/9 11:00 AM ET: Nov NY Fed 1yr Inf ExpTame12/10 6:00 AM ET: Nov Small Business Optimism SurveyTame12/10 8:30 AM ET: 3Q F Non-Farm ProductivityTame12/10 8:30 AM ET: 3Q F Unit Labor CostsTame12/11 8:30 AM ET: Nov CPITame12/12 8:30 AM ET: Nov PPIMixed12/16 8:30 AM ET: Dec Empire Manufacturing SurveyTame12/16 9:45 AM ET: Dec P S&P Global Manufacturing PMITame12/16 9:45 AM ET: Dec p S&P Global Services PMITame12/17 8:30 AM ET: Nov Retail Sales DataTame12/17 9:00 AM ET: Dec P Manheim Used vehicle indexTame12/17 10:00 AM ET: Dec NAHB Housing Market IndexTame12/18 2:00 PM ET: Dec FOMC DecisionHawkish12/19 8:30 AM ET: 3Q T 2024 GDPTame12/19 8:30 AM ET: Dec Philly Fed Business OutlookTame12/19 10:00 AM ET: Nov Existing Home SalesTame12/19 4:00 PM ET: Oct Net TIC FlowsTame12/20 8:30 AM ET: Nov PCE DeflatorTame12/20 10:00 AM ET: Dec F U. Mich. Sentiment and Inflation ExpectationTame12/23 8:30 AM ET: Nov Chicago Fed Nat Activity IndexTame12/23 10:00 AM ET: Dec Conference Board Consumer ConfidenceTame12/24 10:00 AM ET: Nov New Home SalesTame12/24 10:00 AM ET: Nov P Durable Goods OrdersTame- 12/30 10:30 AM ET: Dec Dallas Fed Manuf. Activity Survey

- 12/31 9:00 AM ET: Oct S&P CoreLogic CS home price

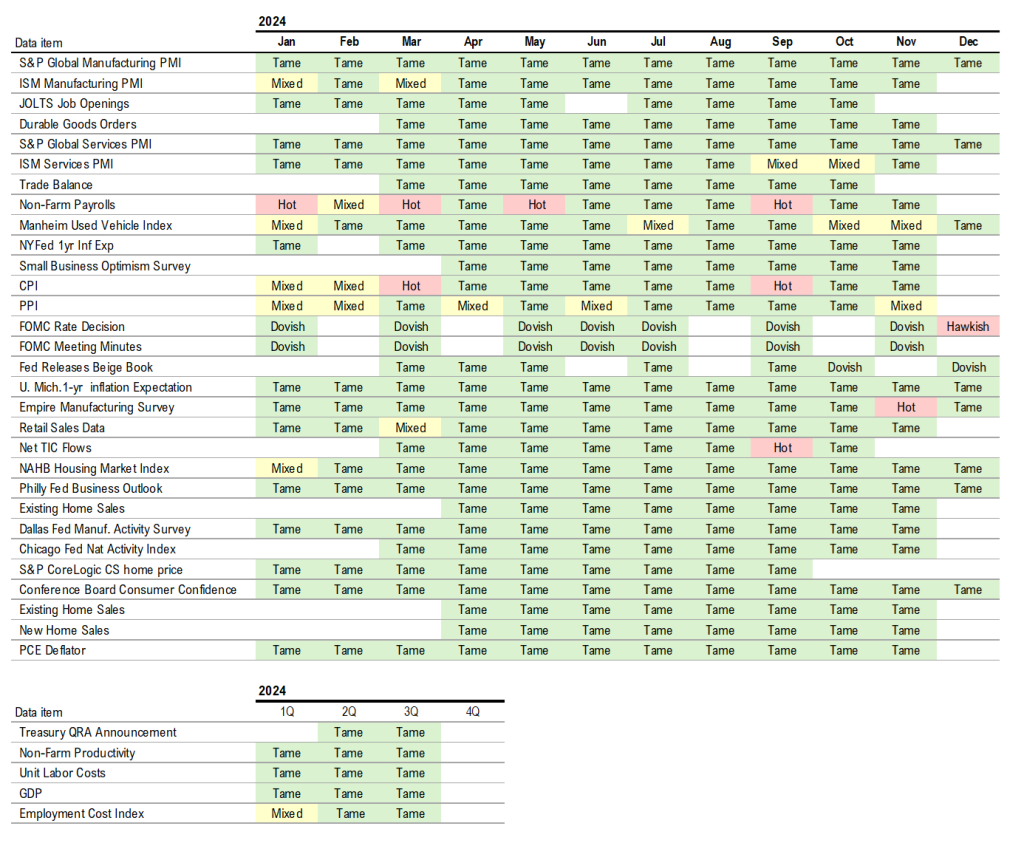

Economic Data Performance Tracker 2024:

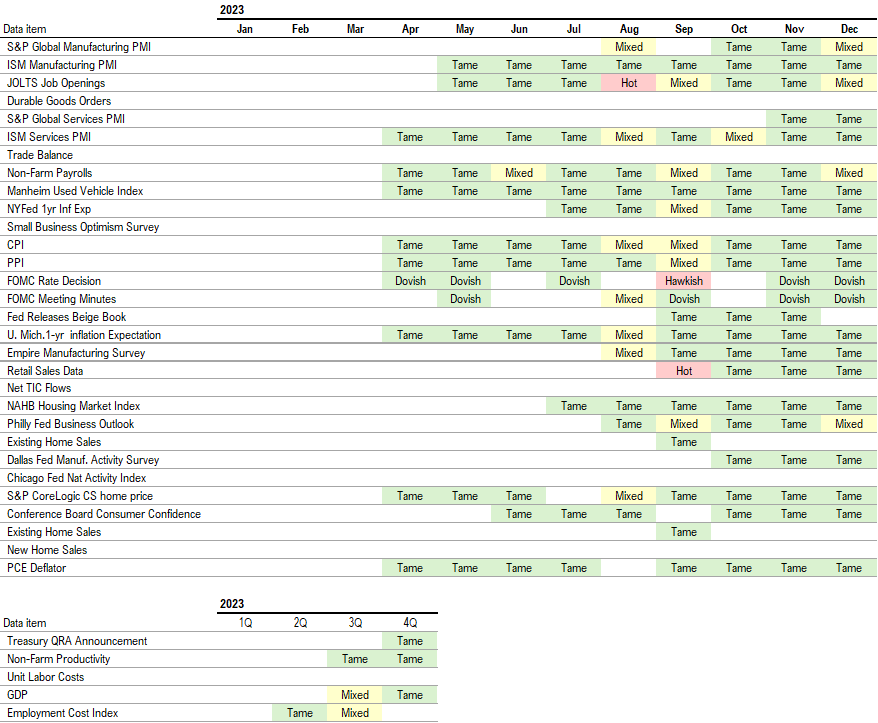

Economic Data Performance Tracker 2023: