VIDEO: This weekend tweet by Elon Musk highlights that X.com will likely play a prominent role in the next 4 years. Also, Probabilities favor a rally into Thanksgiving, as markets bounce off support and several uncertainties clear.

Please click below to view our Macro Minute (duration: 5:26).

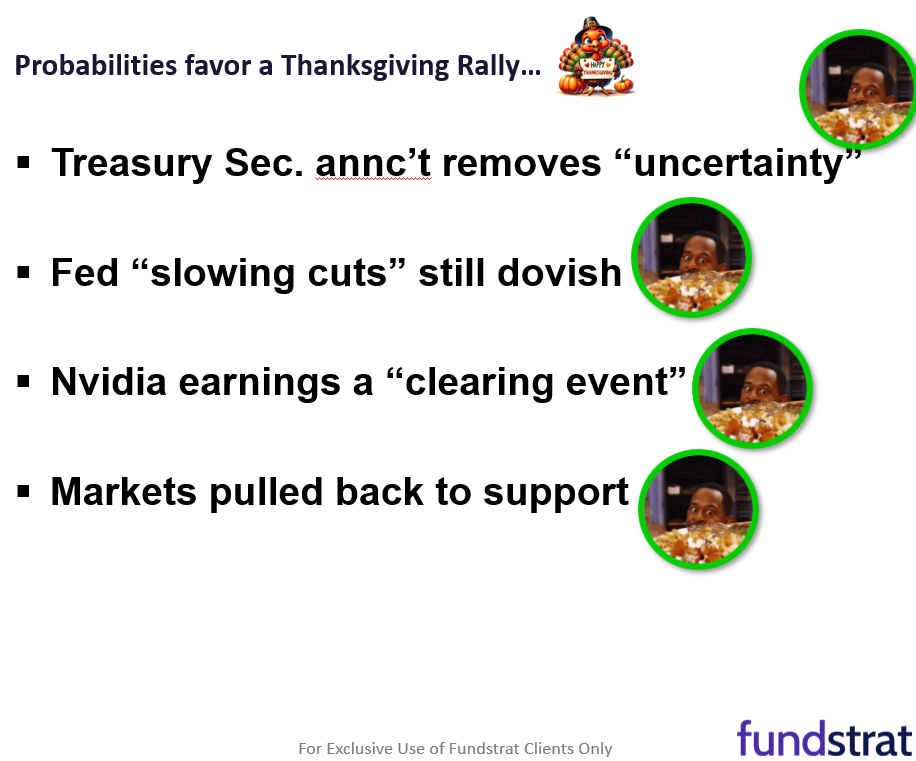

We believe probabilities favor a rally into Thanksgiving, reversing the “slow bleed” lower seen in the past week. There are multiple factors, but the primary driver, in our view, is the clearing of several uncertainties that have acted as overhang:

- The 4 drivers for this “Thanksgiving rally” are:

– Treasury Sec. annc’t removes “uncertainty”

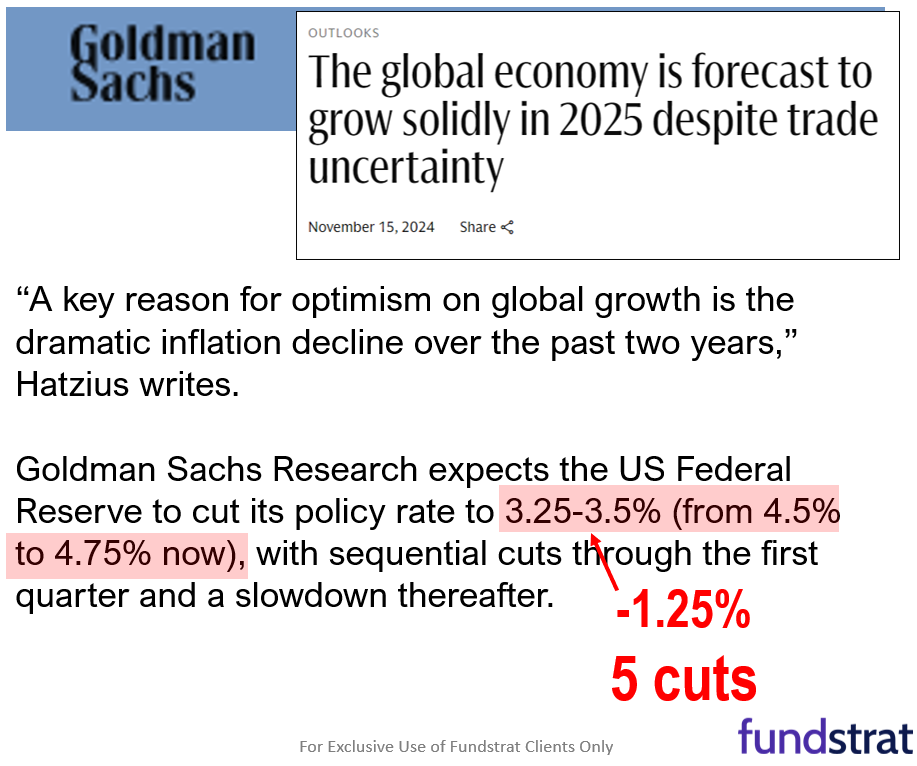

– Fed “slowing cuts” still dovish

– Nvidia earnings a “clearing event”

– Markets pulled back to technical support (per Newton) - Foremost, the Trump trade, in our view, remains intact, as the tailwinds of de-regulation, pro-business stance, possibility of extended tax cuts and general risk aversion into the election act as tailwinds. But we expect markets to be relieved when Trump’s Treasury Secretary pick is announced. This remains a tight race between Scott Bessent and Howard Lutnick.

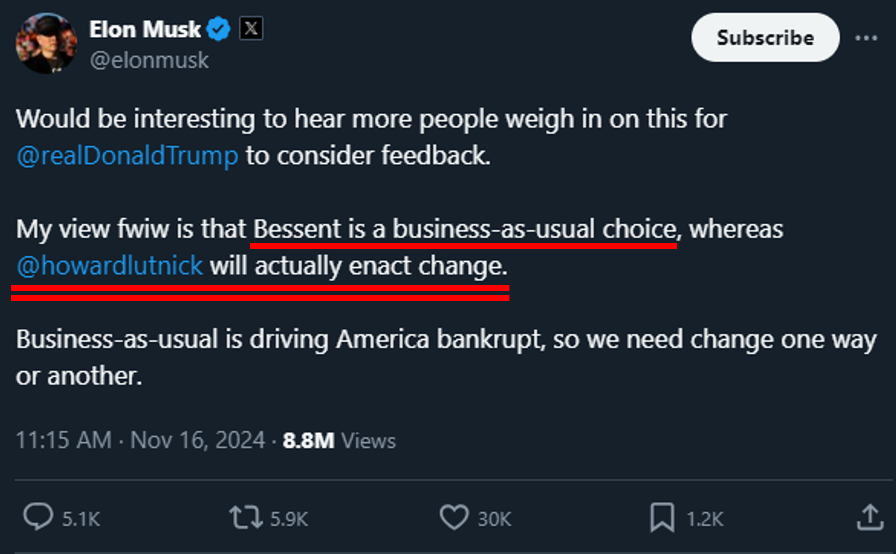

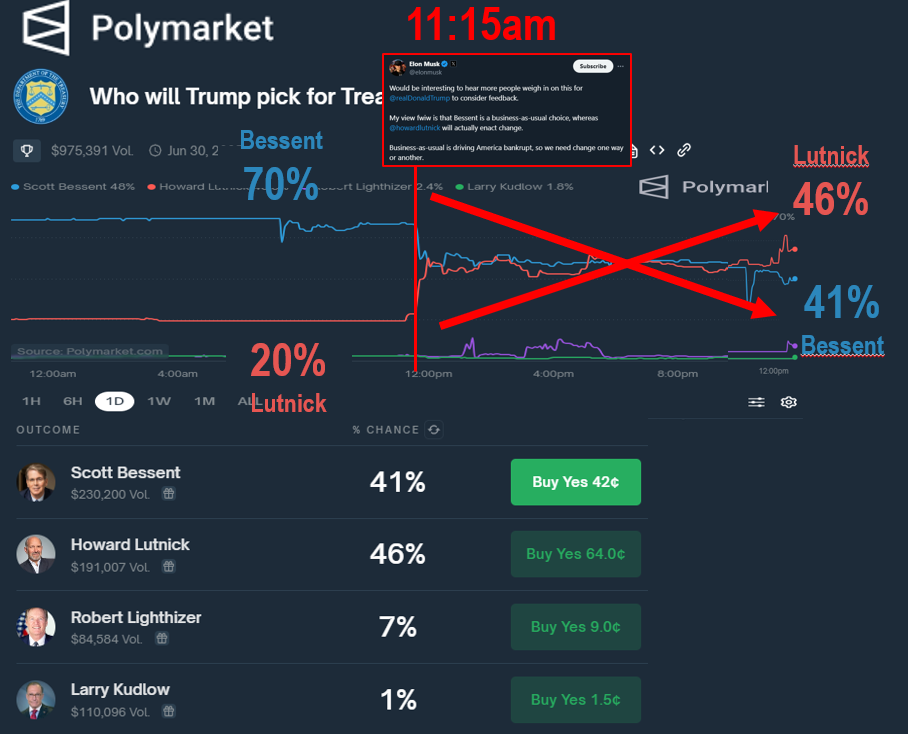

- Elon Musk tweeted at 11:15am Saturday about this nomination, noting he viewed Lutnick more favorably as someone to “enact change.” This altered the probabilities of nomination per Polymarket.com

– on Polymarket

– into weekend, Bessent favored +70%

– Elon tweets 11:15am Sat

– as of Sunday, Lutnick now favored 46% - While I am not entirely clear exactly the reasons for Musk to support Lutnick, but it is possibly due to Lutnick being pro-Bitcoin. Lutnick has been a vocal advocate of Bitcoin and claims to personally own hundreds of millions of dollars of Bitcoin.

- There are two takeaways for me from this:

– first, Bitcoin role in next adminstration clear

– second, X.com prominence and centrality likely grows next 4 years

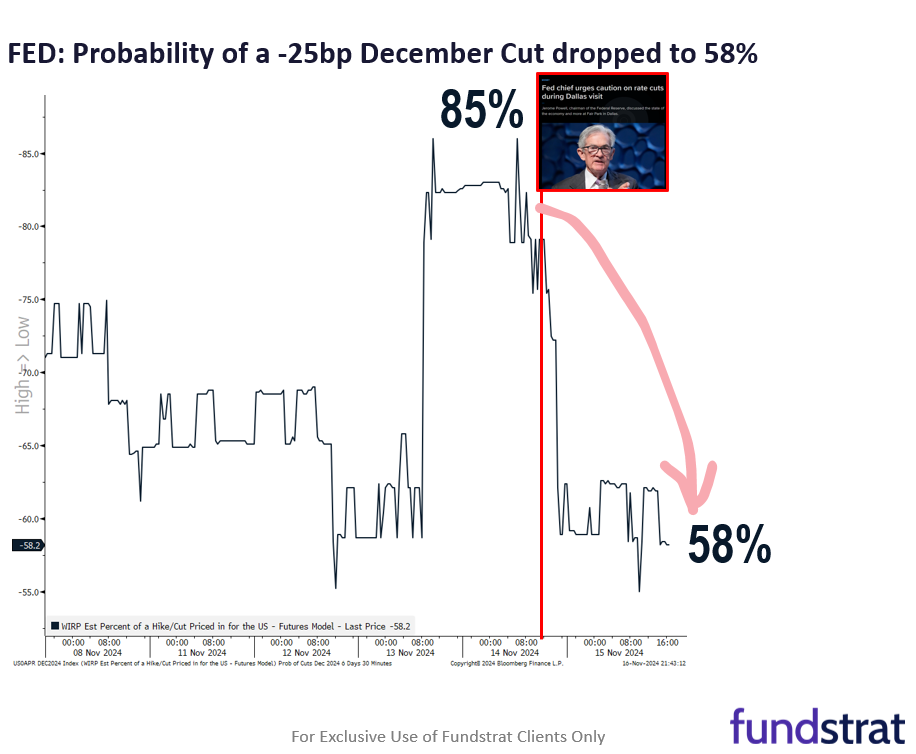

– so, it might pay heed to pay more attention to X.com if you don’t already - As we noted last week, Fed Chair Powell’s comments at the Dallas Fed, talking of slowing rate cuts has “hawkishly” hurt equities. Stocks fell in part to his comments. And Fed fund probabilities shifted:

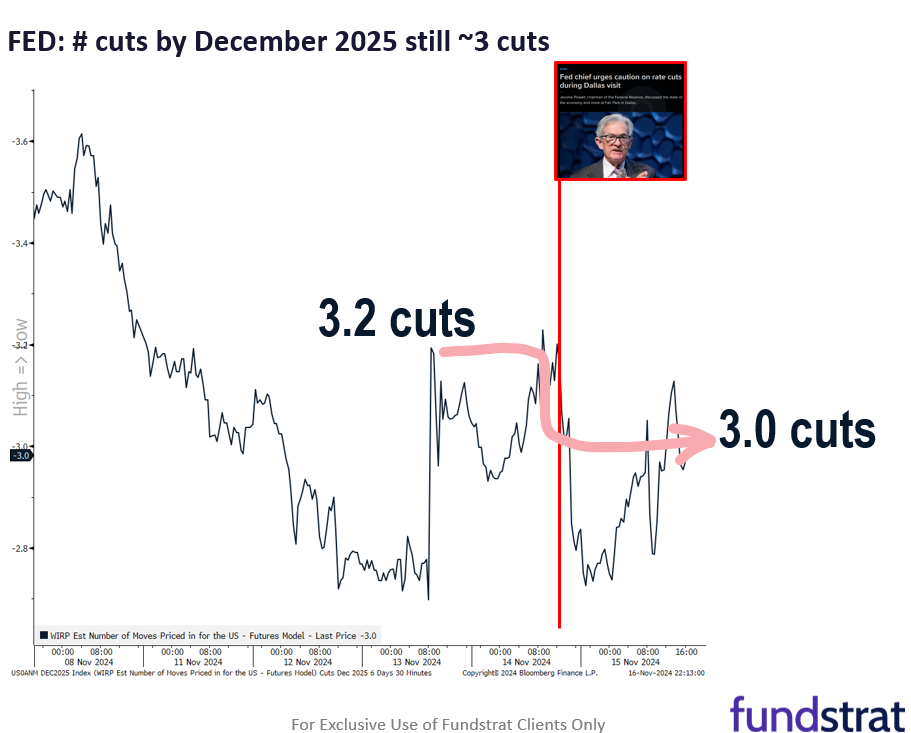

– odds of a Dec 2024 cut fell from 85% to 58% - But the markets might have taken an overly hawkish response. Several reasons:

– first, the number of cuts expected by Dec 2025 (13 mos) remains

– remains at 3.0 cuts from 3.2 prior to comments

– essentially, markets pricing in cuts “pushed out” into 2025

– that is not hawkish - Equity markets are also now at support. Stocks have fallen sharply in the past week, and per Mark Newton:

– Nasdaq 100 QQQ is at important support (below)

– this is bullish

– Small-caps have held above prior highs (below)

– that is bullish

– he sees probabilities favoring both to rally into Thanksgiving - So you see, there are multiple supports for stocks in the next two weeks into Thanksgiving.

- As far as the macro calendar, the most closely watched will be NVDA earnings on Wed:

– 11/18 Mon 10:00 AM ET: Nov NAHB Housing Market Index 42e

– 11/18 Mon 4:00 PM ET: Sep Net TIC Flows

– 11/19 Tue 9:00 AM ET: Nov M Manheim Used Vehicle Index

– 11/20 Wed 4:20 PM ET: NVDA Reports Q3 ‘25 Earnings

– 11/21 Thu 8:30 AM ET: Nov Philly Fed Business Outlook 7.0e

– 11/21 Thu 10:00 AM ET: Oct Existing Home Sales 3.9me

– 11/22 Fri 9:45 AM ET: Nov P S&P Global Manufacturing PMI 48.8e

– 11/22 Fri 9:45 AM ET: Nov P S&P Global Services PMI 55.3e

– 11/22 Fri 10:00 AM ET: Nov F U. Mich. 1yr Inf Exp - There is Fed speak as well, but not Powell:

– 11/18 Mon 10:00 AM ET: Goolsbee Gives Welcome Remarks

– 11/19 Tue 1:10 PM ET: Schmid Speaks on Economic Outlook, Policy

– 11/20 Wed 11:00 AM ET: Cook Speaks on Economic Outlook, Policy

– 11/20 Wed 12:15 PM ET: Bowman Speaks on Agency Policymaking

– 11/21 Thu 8:45 AM ET: Hammack Gives Welcome Remarks

– 11/21 Thu 12:25 PM ET: Goolsbee Participates in Moderated Q&A

– 11/21 Thu 12:30 PM ET: Hammack Moderates Conversation

– 11/21 Thu 4:40 PM ET: Barr Discusses Banks and AI

– 11/22 Fri 6:15 PM ET: Bowman Speaks on AI

Bottom line: Stay on target into year-end

Thus, we see positive supports for equities into year-end. As we noted earlier this week:

- the median gain post-election AND

- given no recession AND markets declined

- is 7%, implying S&P 500 6,300 or so

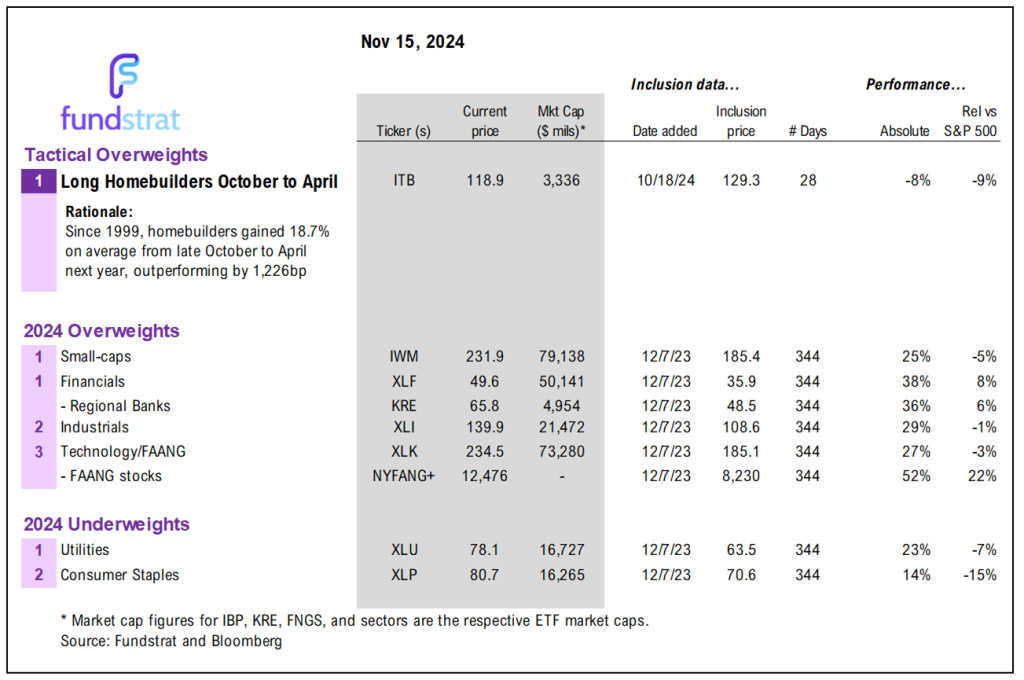

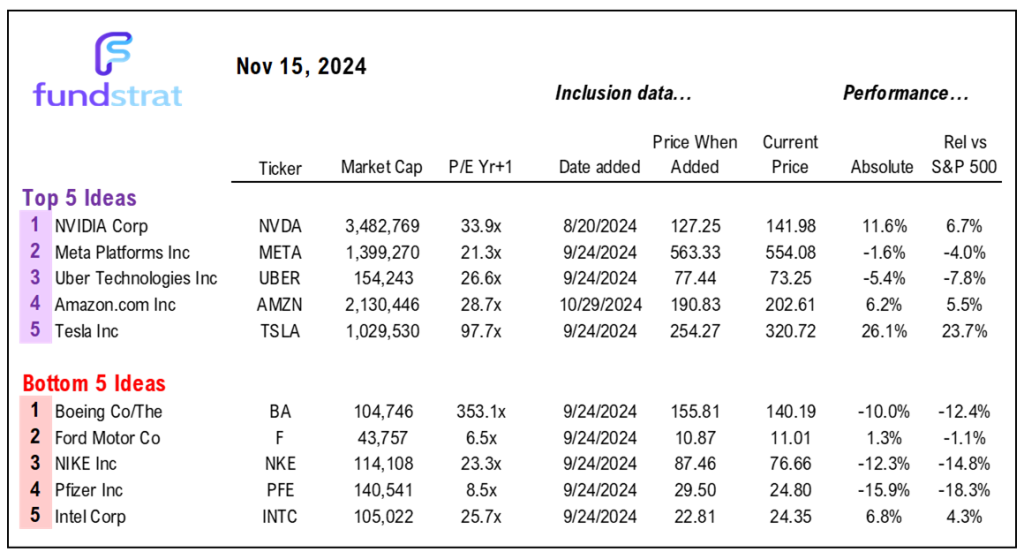

That said, we see more upside for other groups. This holds whether looking at 2016, or whether thinking of a dovish Fed. The drivers are:

- de-regulation

- drop in cost of capital for businesses

- general “animal spirits” given Republican White House and Senate

This favors the following groups:

_____________________________

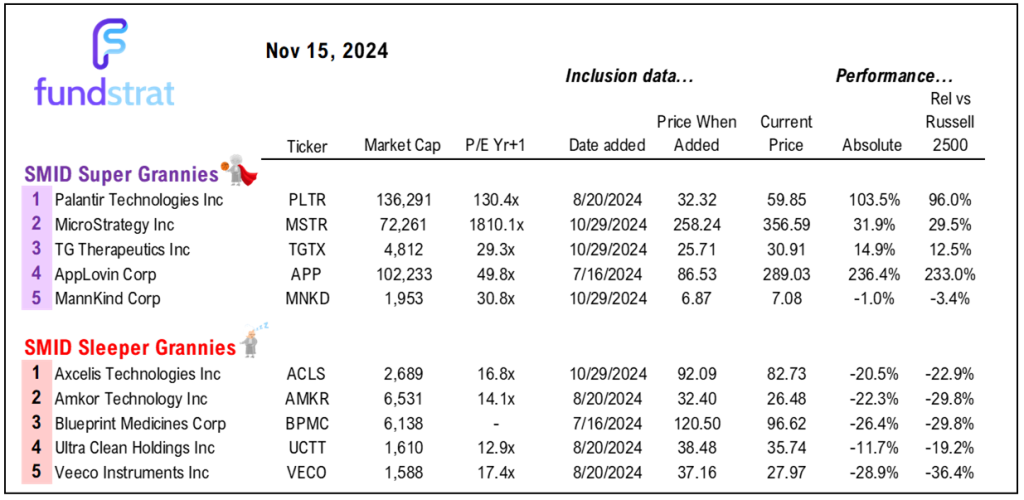

42 SMID Granny Shot Ideas: We performed our quarterly rebalance on 7/16. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

___________________________

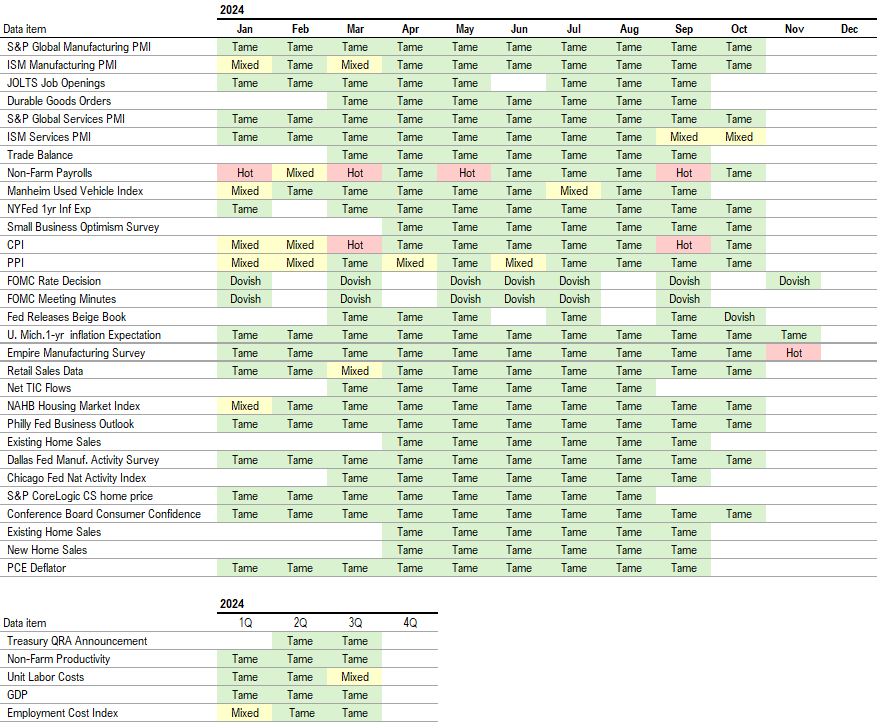

Key incoming data November:

11/1 8:30 AM ET: Oct Non-Farm PayrollsTame11/1 9:45 AM ET: Oct F S&P Global Manufacturing PMITame11/1 10:00 AM ET: Oct ISM Manufacturing PMITame11/4 10:00 AM ET: Sep F Durable Goods OrdersTame- 11/5: US Presidential Election 2024

11/5 8:30 AM ET: Sep Trade BalanceTame11/5 9:45 AM ET: Oct F S&P Global Services PMITame11/5 10:00 AM ET: Oct ISM Services PMIMixed11/7 8:30 AM ET: 3Q P Non-Farm ProductivityTame11/7 8:30 AM ET: 3Q P Unit Labor CostsMixed11/7 9:00 AM ET: Sep F Manheim Used vehicle indexTame11/7 2:00 PM ET: Nov FOMC DecisionDovish11/8 10:00 AM ET: Nov P U. Mich. Sentiment and Inflation ExpectationTame11/12 6:00 AM ET: Oct Small Business Optimism SurveyTame11/12 11:00 AM ET: Oct NY Fed 1yr Inf ExpTame11/13 8:30 AM ET: Oct CPITame11/14 8:30 AM ET: Oct PPITame11/15 8:30 AM ET: Oct Retail Sales DataTame11/15 8:30 AM ET: Nov Empire Manufacturing SurveyHot- 11/18 10:00 AM ET: Nov NAHB Housing Market Index

- 11/18 4:00 PM ET: Sep Net TIC Flows

- 11/19 9:00 AM ET: Oct M Manheim Used vehicle index

- 11/21 8:30 AM ET: Nov Philly Fed Business Outlook

- 11/21 10:00 AM ET: Oct Existing Home Sales

- 11/22 9:45 AM ET: Nov P S&P Global Manufacturing PMI

- 11/22 9:45 AM ET: Nov P S&P Global Services PMI

- 11/22 10:00 AM ET: Nov F U. Mich. Sentiment and Inflation Expectation

- 11/25 8:30 AM ET: Oct Chicago Fed Nat Activity Index

- 11/25 10:30 AM ET: Nov Dallas Fed Manuf. Activity Survey

- 11/26 9:00 AM ET: Sep S&P CoreLogic CS home price

- 11/26 10:00 AM ET: Nov Conference Board Consumer Confidence

- 11/26 10:00 AM ET: Oct New Home Sales

- 11/26 2:00 PM ET: Nov FOMC Meeting Minutes

- 11/27 8:30 AM ET: Oct PCE Deflator

- 11/27 8:30 AM ET: 3Q S 2024 GDP

- 11/27 10:00 AM ET: Oct P Durable Goods Orders

Economic Data Performance Tracker 2024:

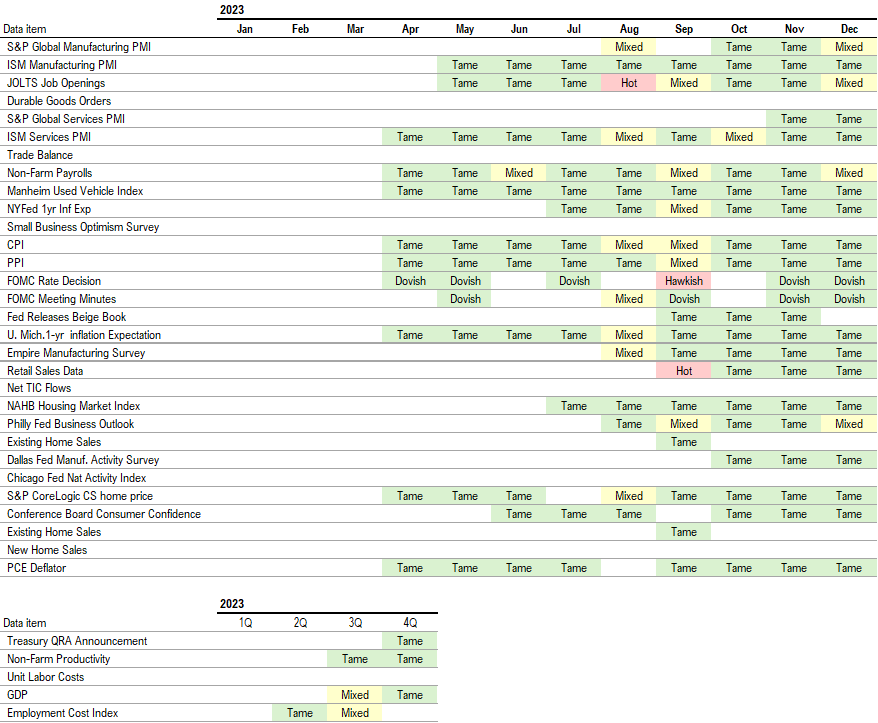

Economic Data Performance Tracker 2023: