VIDEO: The most notable change in betting markets is now the surge in the possibility of a Republican sweep. Our analysis shows that several sectors have been highly correlated with this change and thus, if one feels this is wrong, one can bet against these groups (Duration: 4:33).

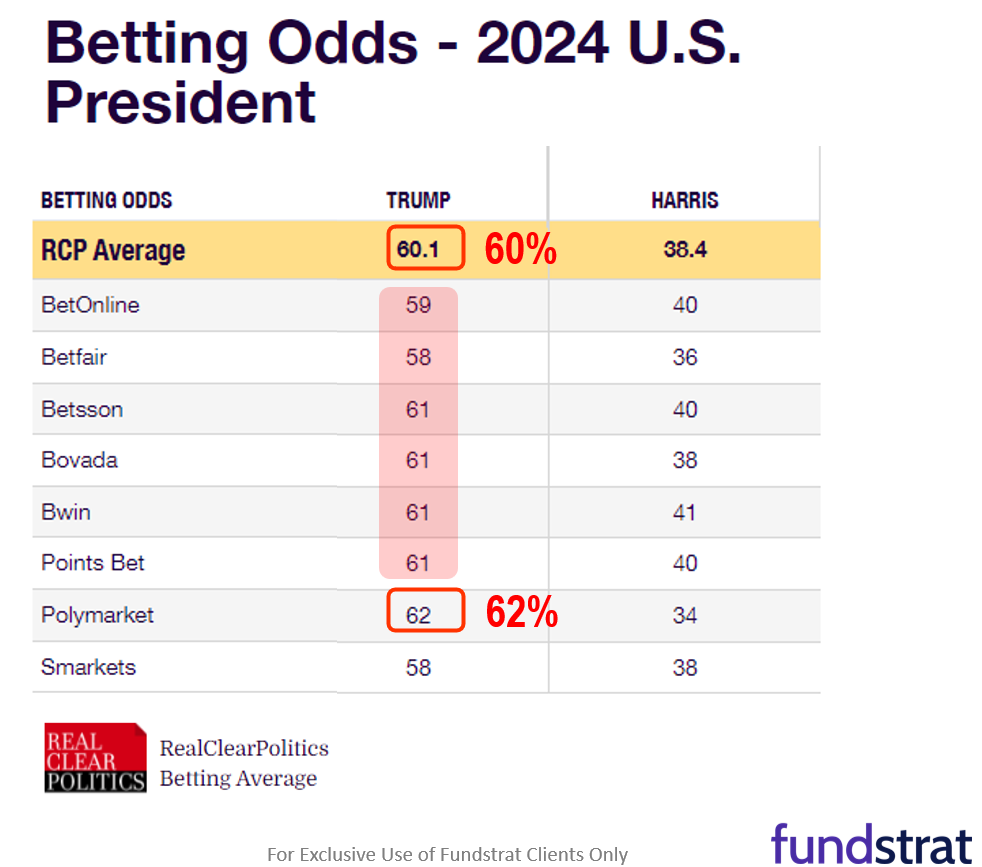

There are 12 days until the 2024 Presidential election. To us, this race remains too close to call when looking at political models (Nate Silver is our preferred) or betting markets (RealClearPolling.com has 8 markets tracked). But the incremental changes, or momentum of models, is notable. And as we discuss below, seem to have influence on sector performance, evidenced by that fact several sectors have positive or negative correlation to these movements.

- The S&P 500 remains resilient. This was evident yesterday as equities faced early weakness and closed essentially flat. The fact the Fed is dovish, coupled with solid 3Q24 earnings (so far) act as supports. But we are also in the tricky seasonal period ahead of the election.

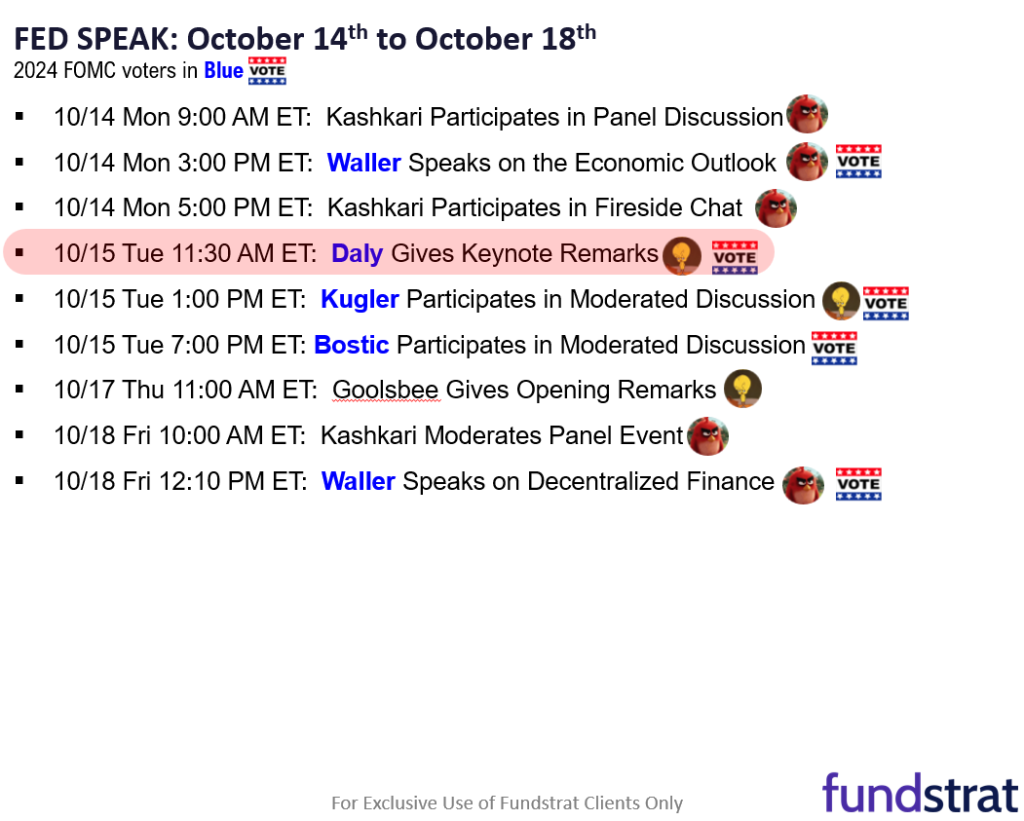

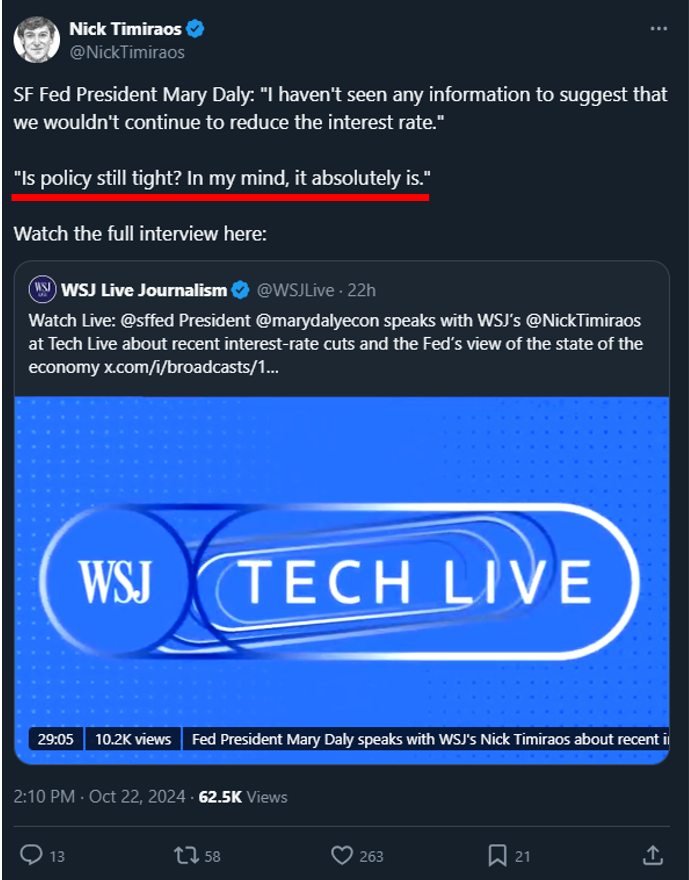

- SF Fed President, Mary Daly, reminded us of the dovish Fed stance in her keynote yesterday at the WSJ forum. The most cogent quote:

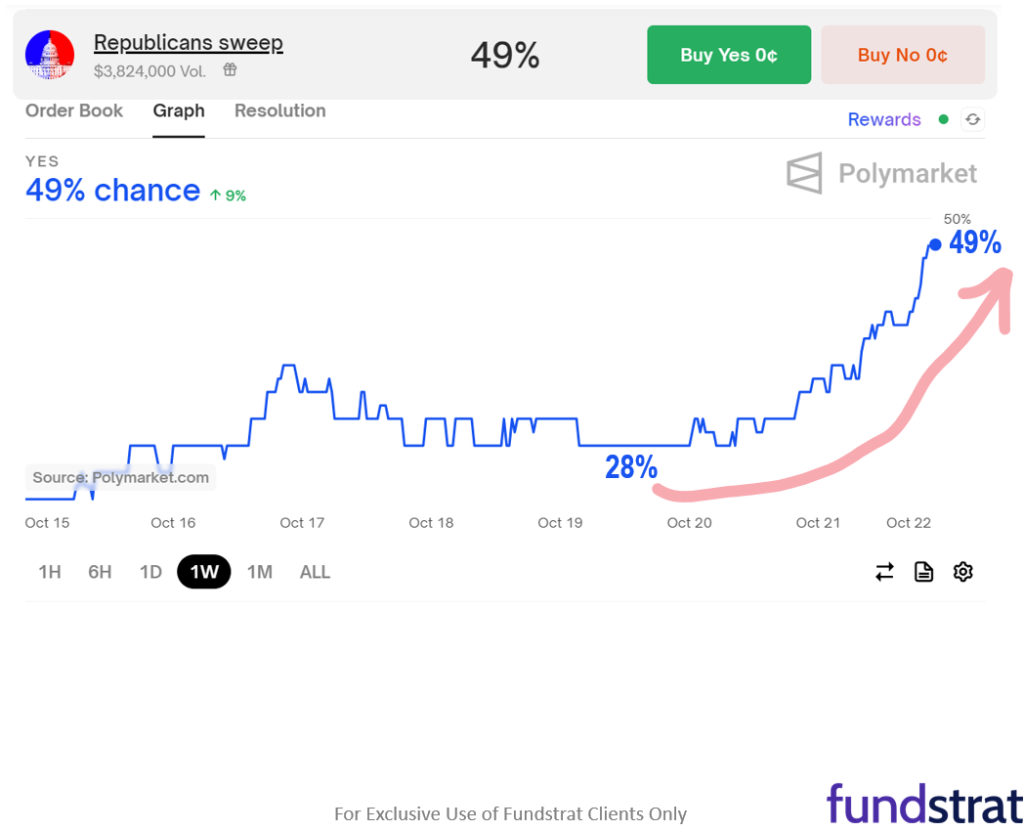

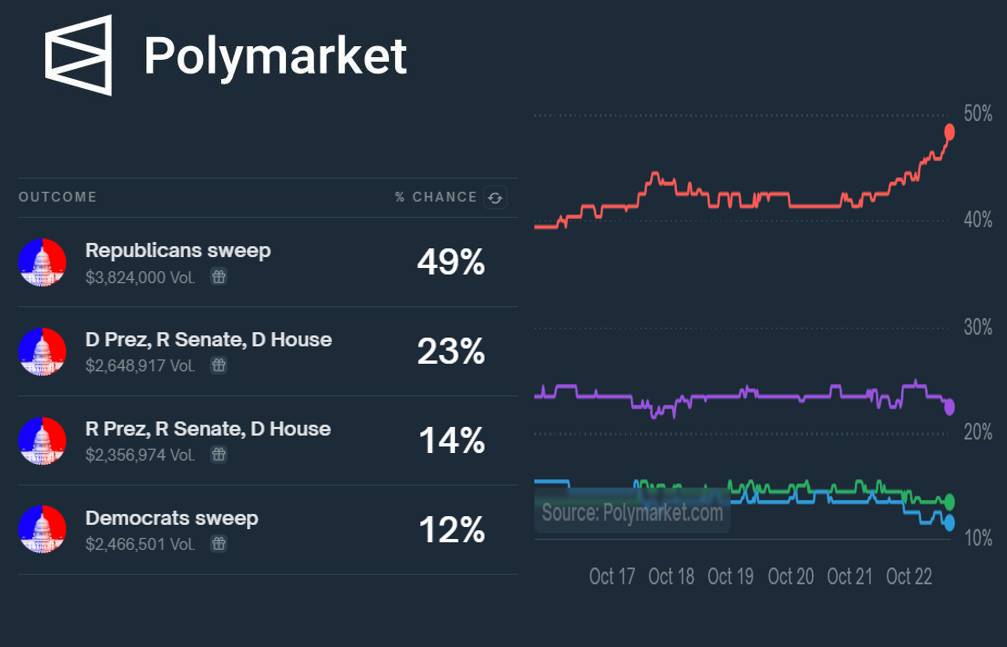

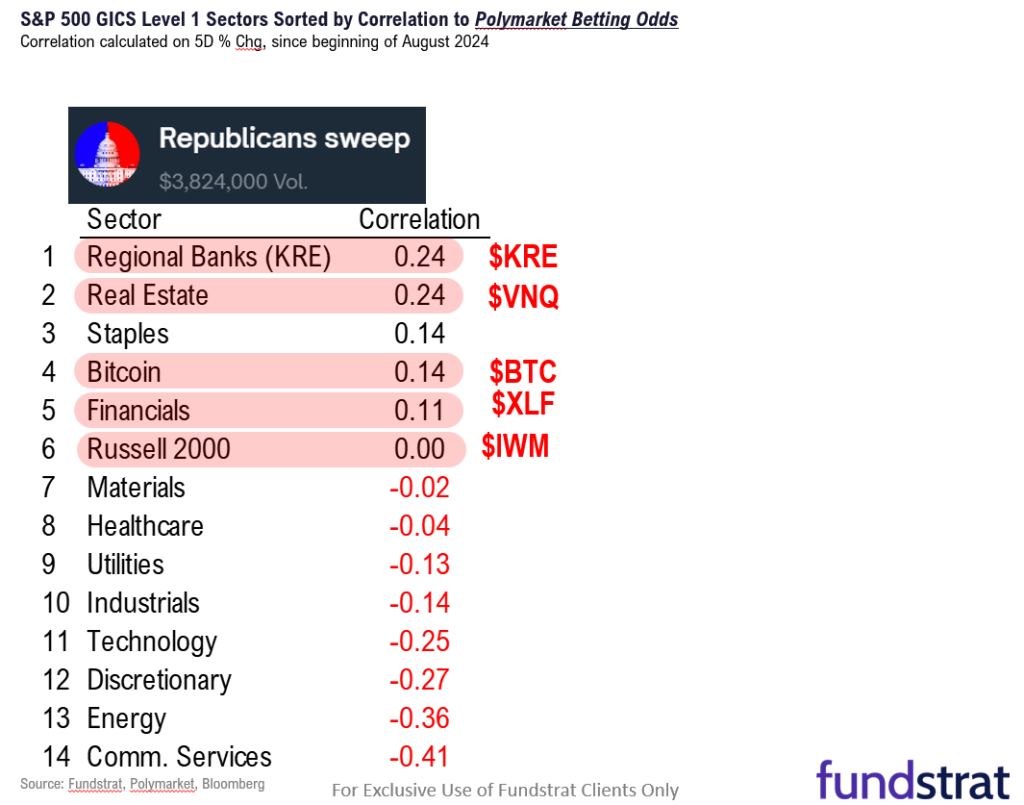

– “Is policy still tight? In my mind, it absolutely is.” - The most incremental development on betting markets, is the surge in the probability of a Republican sweep (Pres-R, Senate-R, House-R). In polymarket, these odds now stand at:

– Pres-Senate-House

– R-R-R (sweep) 49%

– D-R-D 23%

– R-R-D 14%

– D-D-D 12% - The odds of a Republican Sweep were only 28% just 2 days ago, so the probability has essentially doubled in two days. This is a sizable change in our view. And this is having an impact on sector performance.

- Based upon analysis done by our data science team, led by “tireless Ken,” below are the rank of correlations to a Republican Sweep:

– 1. Regional banks KRE 1.45%

– 2. Real Estate VNQ 1.41%

– 3. Staples

– 4. Bitcoin BTC

– 5. Financials XLF 0.80%

– 6. Small-caps IWM 0.63%

– 7. Materials (negative)

– 8. Healthcare (negative)

– 9. Utilities (negative)

– 10. Industrials (negative)

– 11. Technology (negative)

– 12. Discretionary (negative)

– 13. Energy (negative)

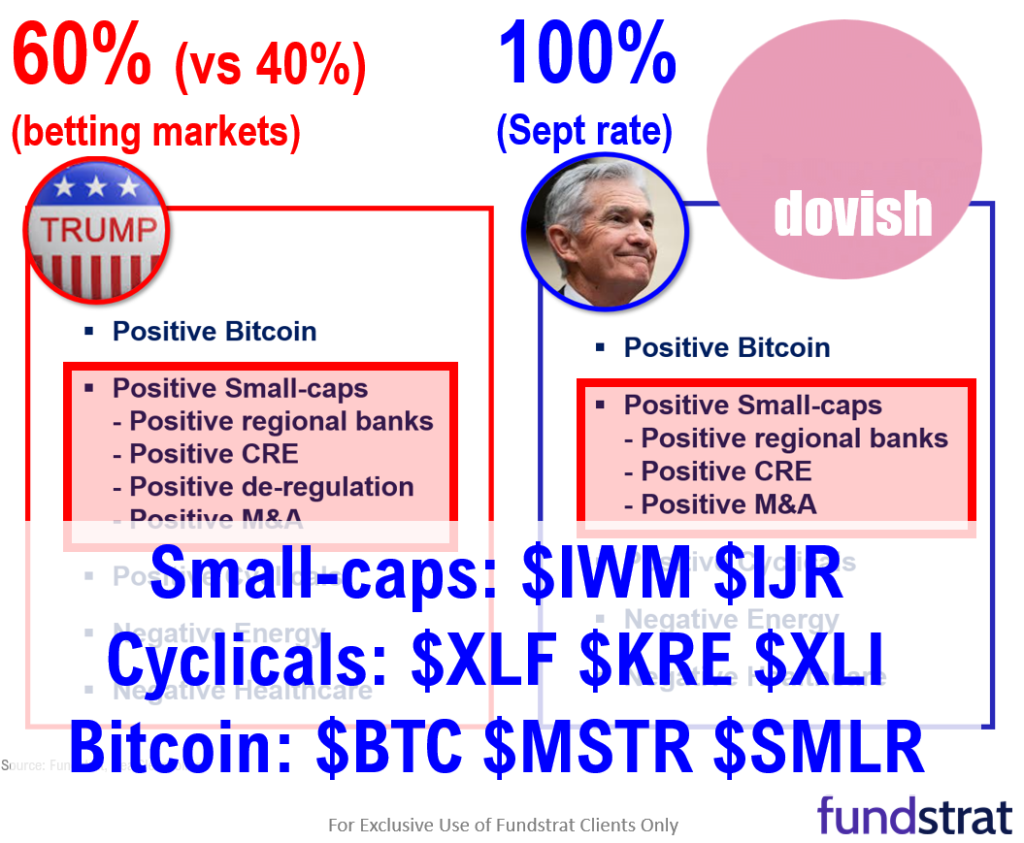

– 14. Comm. Services (negative) - This should be a way to monitor election probabilities. Just watch the above groups. The top 5 of 6 are exactly the groups we have suggested would outperform if a Republican wins the White House (see below). And by the way, are the groups that should outperform when the Fed starts cutting.

- So whether one believes the betting markets represent true election signal, it seems like the betting market movements are impacting equity markets. And in this sense, it probably makes sense for investors to pay heed on this.

- Many investors want to dismiss betting markets, citing biases such as:

– betting markets operate outside US

– betting markets are mostly male - This could be true, and as such, if one believes this is the case, then one can simply bet the opposite whether in equity markets, or on the betting markets themselves.

- By the way, we continue to receive a lot of criticism for our commentary around elections. We are not rooting for one candidate or the other. But we are highlighting the changing probabilities and the related impact on sectors.

- This is not partisan analysis. And if one feels this way, this reminds me of the adage:

– amateurs want to be right

– professionals want to make money - Our focus is on identifying the key drivers and pivots impacting not only the market, but also sector relative performance.

Bottom line: We are still in the “tricky” period, but in the context of a very strong market

2024 has proven the S&P 500 to be very strong. Thus, we expect dip buyers to emerge if we get any pullback. 3Q24 EPS season is supportive of fundamentals.

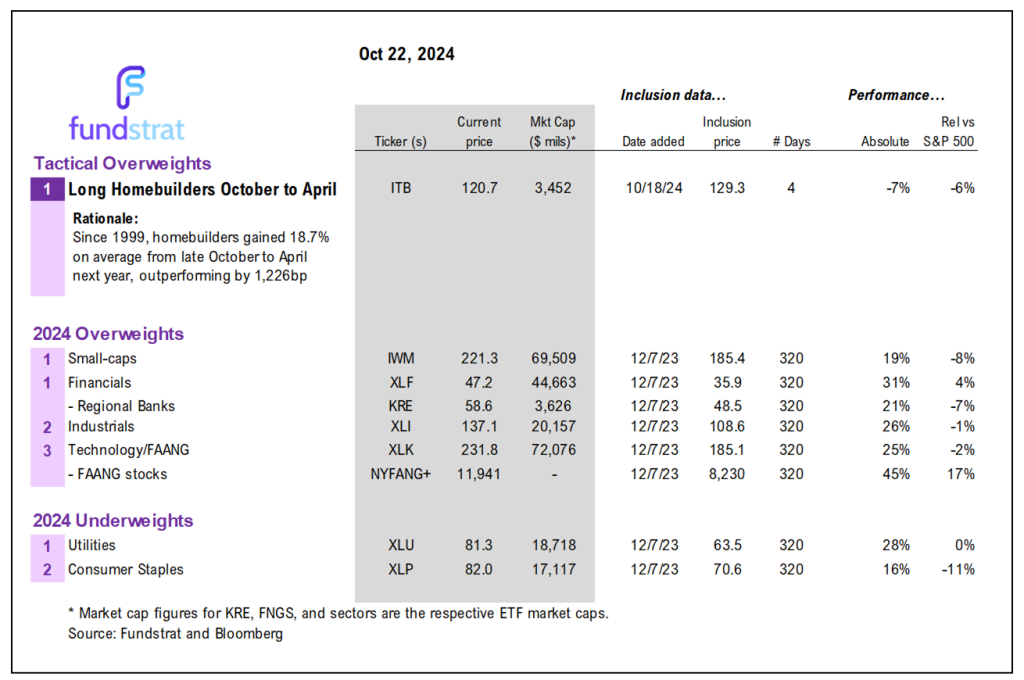

- the new tactical idea

- Buy homebuilders

- Homebuilder ETF: XHB 0.99% ITB 0.93% PKB -0.15%

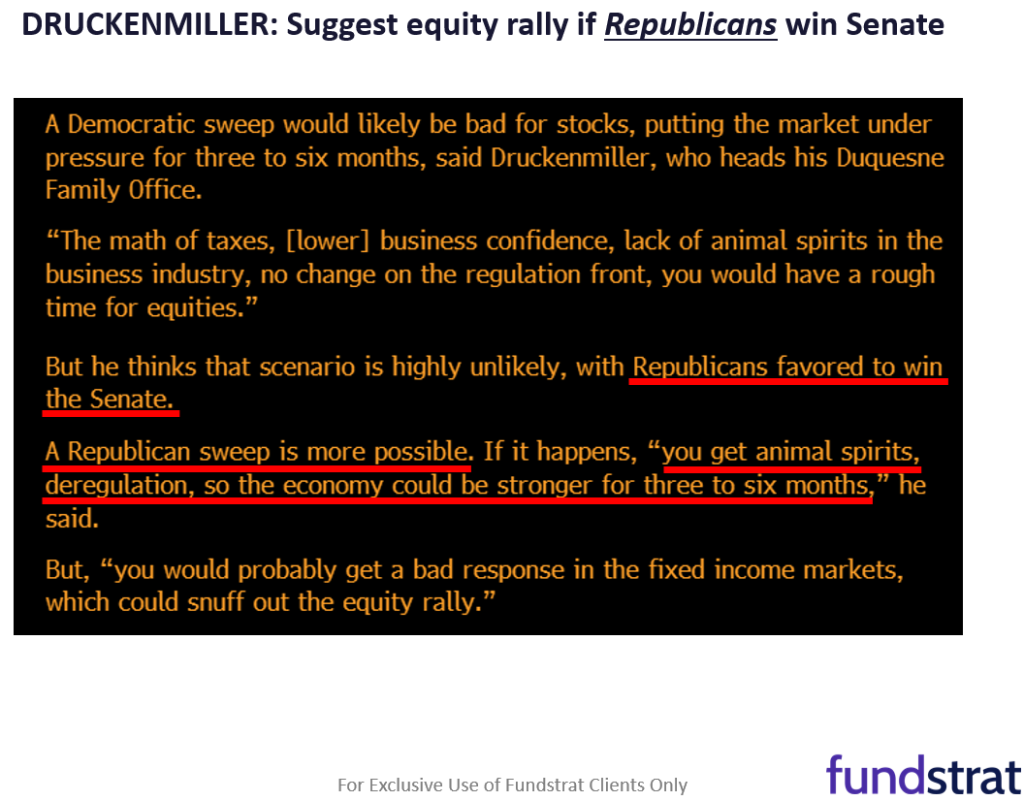

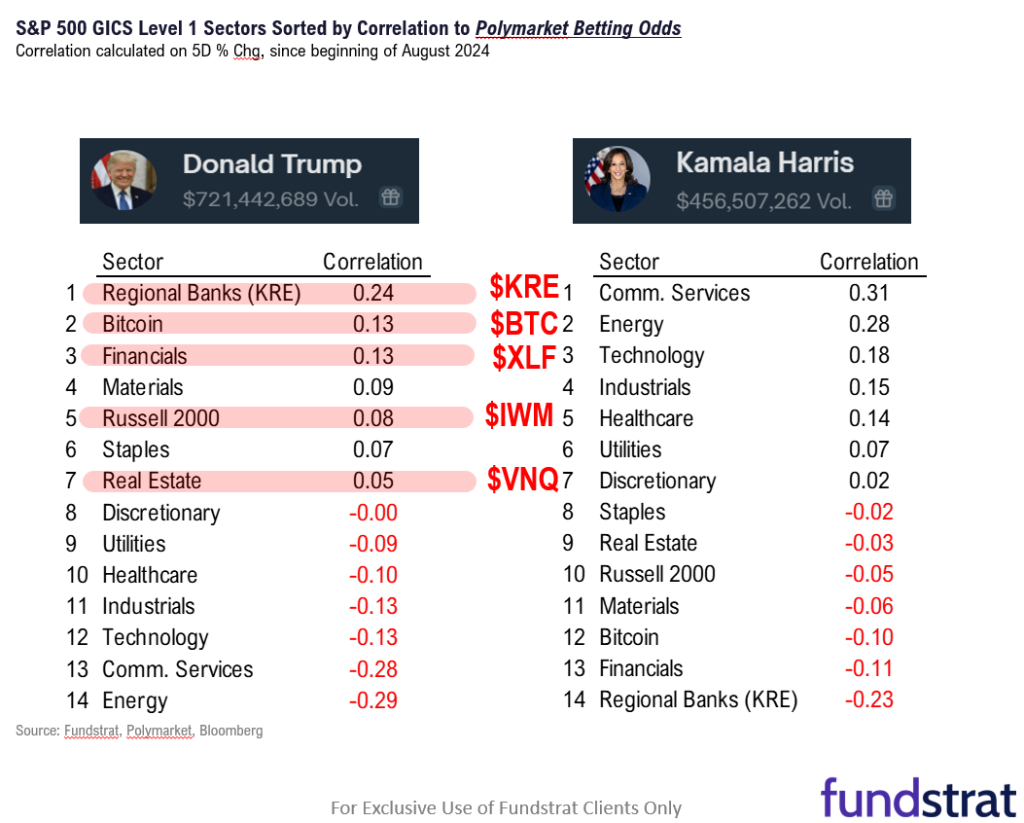

Given the movement in polls, there are sectoral implications. And as we noted, the following are positively leveraged to a Trump victory:

– Small-caps: IWM 0.63% IJR 0.86%

– Cyclicals: XLF 0.80% KRE 1.45% XLI 0.47%

– Bitcoin: BTC MSTR 1.98% SMLR -0.26%

_____________________________

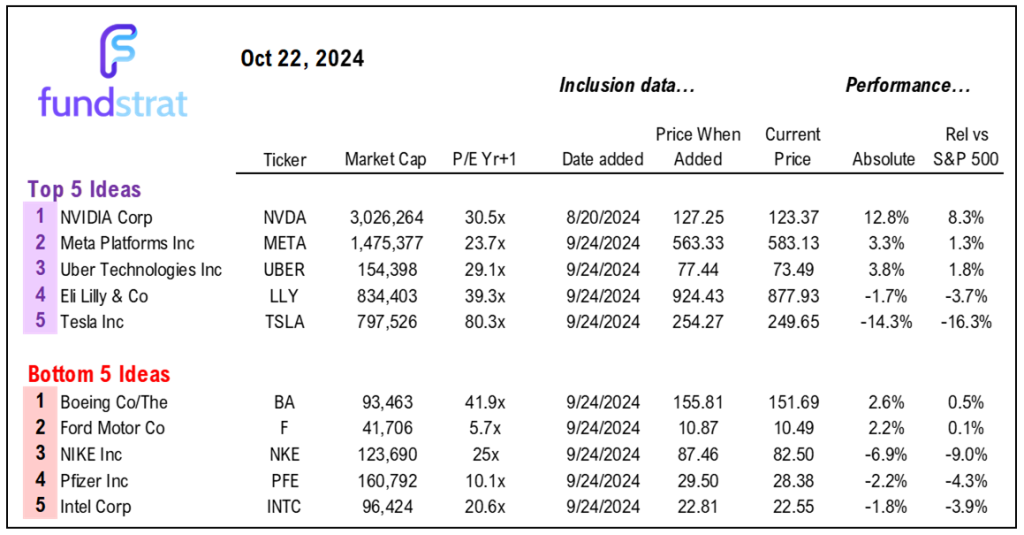

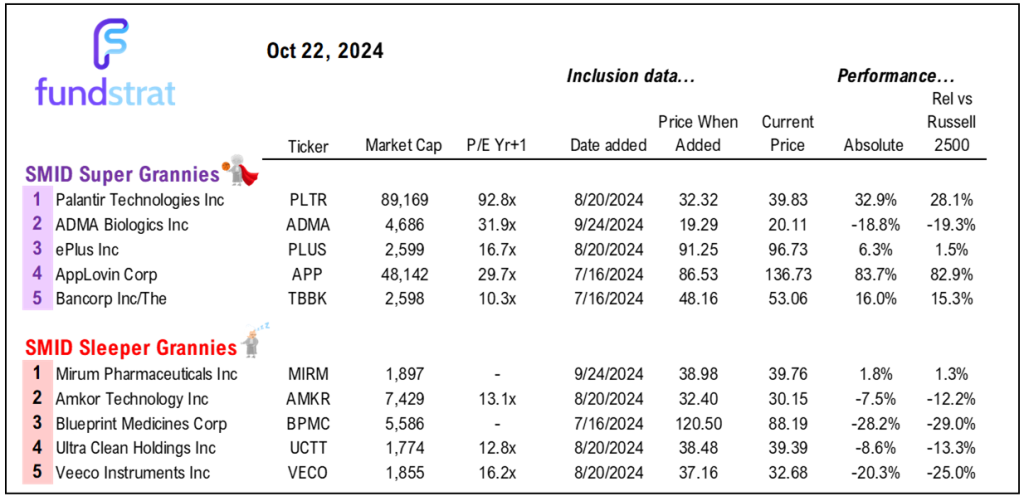

42 SMID Granny Shot Ideas: We performed our quarterly rebalance on 7/16. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

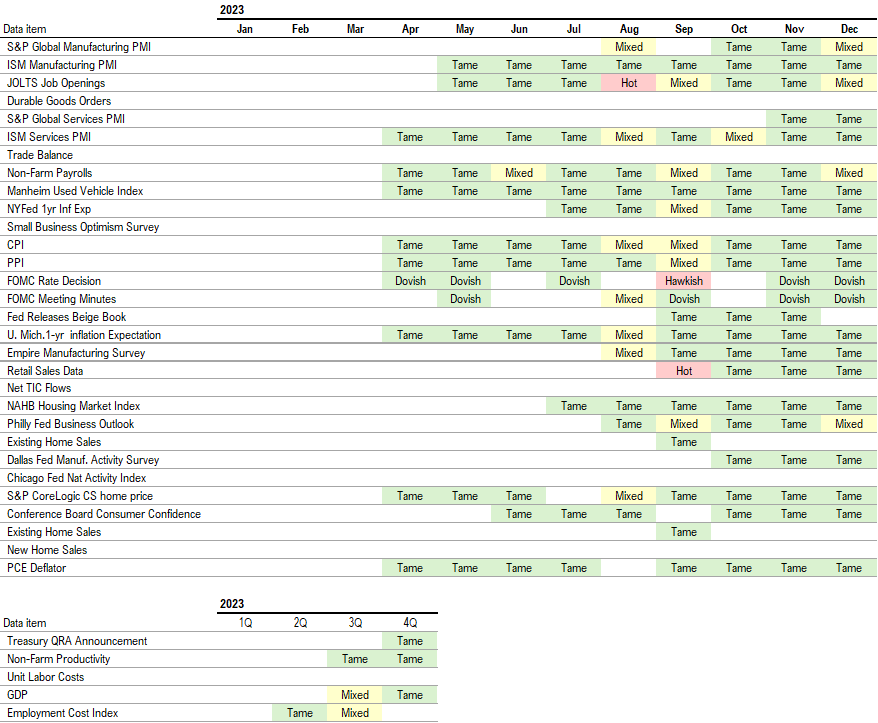

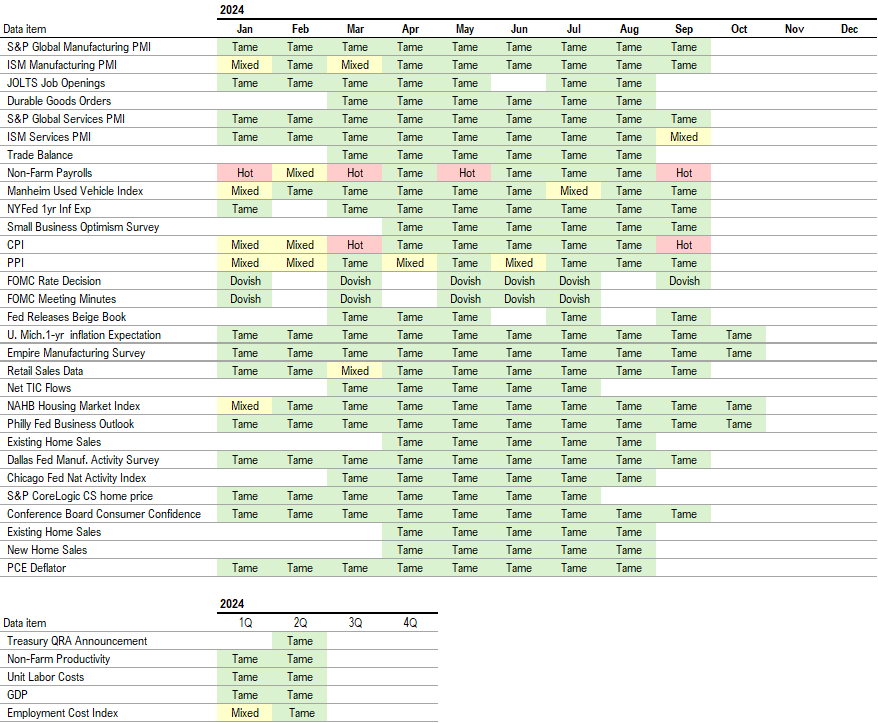

Key incoming data October:

10/1 9:45 AM ET: Sep F S&P Global Manufacturing PMITame10/1 10:00 AM ET: Sep ISM Manufacturing PMITame10/1 10:00 AM ET: Aug JOLTS Job OpeningsTame10/3 9:45 AM ET: Sep F S&P Global Services PMITame10/3 10:00 AM ET: Sep ISM Services PMIMixed10/3 10:00 AM ET: Aug F Durable Goods OrdersTame10/4 8:30 AM ET: Sep Non-Farm PayrollsHot10/7 9:00 AM ET: Aug F Manheim Used Vehicle IndexTame10/8 6:00 AM ET: Sep Small Business Optimism SurveyTame10/8 8:30 AM ET: Aug Trade BalanceTame10/9 2:00 PM ET: Sep 18 FOMC Meeting MinutesDovish10/10 8:30 AM ET: Sep CPIHot10/11 8:30 AM ET: Sep PPITame10/11 10:00 AM ET: Oct P U. Mich. Sentiment and Inflation ExpectationTame10/15 8:30 AM ET: Oct Empire Manufacturing SurveyTame10/15 11:00 AM ET: Sep NY Fed 1yr Inf ExpTame10/17 8:30 AM ET: Sep Retail Sales DataTame10/17 8:30 AM ET: Oct Philly Fed Business OutlookTame10/17 9:00 AM ET: Sep M Manheim Used Vehicle IndexTame10/17 10:00 AM ET: Oct NAHB Housing Market IndexTame10/17 4:00 PM ET: Aug Net TIC FlowsTame- 10/23 10:00 AM ET: Sep Existing Home Sales

- 10/23 2:00 PM ET: Oct Fed Releases Beige Book

- 10/24 8:30 AM ET: Sep Chicago Fed Nat Activity Index

- 10/24 9:45 AM ET: Oct P S&P Global Manufacturing PMI

- 10/24 9:45 AM ET: Oct P S&P Global Services PMI

- 10/24 10:00 AM ET: Sep New Home Sales

- 10/25 10:00 AM ET: Oct F U. Mich. Sentiment and Inflation Expectation

- 10/25 10:00 AM ET: Aug F Durable Goods Orders

- 10/28 10:30 AM ET: Oct Dallas Fed Manuf. Activity Survey

- 10/29 9:00 AM ET: Aug S&P CoreLogic CS home price

- 10/29 10:00 AM ET: Oct Conference Board Consumer Confidence

- 10/29 10:00 AM ET: Sep JOLTS Job Openings

- 10/30 8:30 AM ET: 3Q A 2024 GDP

- 10/30 10:00 AM ET: 3Q24 Treasury Quarterly Refunding Press Conference

- 10/31 8:30 AM ET: Sep PCE Deflator

- 10/31 8:30 AM ET: 3Q Employment Cost Index

Economic Data Performance Tracker 2024:

Economic Data Performance Tracker 2023: